When you get down to it, the difference between DDP and DDU boils down to a single, critical question: who is responsible for the import duties and taxes?

With Delivered Duty Paid (DDP), the seller handles everything. They pay all the costs to get the goods to the buyer's doorstep, including any import duties, making it a simple, all-inclusive price for the customer. On the flip side, with Delivered Duty Unpaid (DDU), that responsibility falls to the buyer, who has to settle these fees once the shipment arrives in their country. This can sometimes lead to unexpected costs and hold-ups.

A Quick Comparison of DDP and DDU

Getting a firm grasp on the differences between DDP and DDU shipping terms is essential for anyone serious about managing costs, risk, and customer satisfaction in global trade. These aren't just acronyms; they're Incoterms that define the exact moment when responsibility for a shipment shifts from the seller to the buyer. Getting this choice wrong can lead to stalled shipments, angry customers hit with surprise fees, and ultimately, damaged business relationships.

This decision impacts everything, from the final price a customer sees at checkout to who’s on the hook if something gets stuck in customs. For sellers, offering DDP can be a powerful competitive advantage, as it creates a seamless, predictable buying experience. The trade-off, however, is that the seller takes on the maximum level of risk and has to manage all the logistical complexities.

Meanwhile, DDU (which is now officially known as Delivered at Place or DAP) puts more control into the hands of an experienced buyer. It can sometimes mean lower upfront costs, but that flexibility comes with the very real burden of navigating customs clearance and paying any duties and taxes needed to get the goods released for final delivery.

DDP vs DDU Responsibility Breakdown

To really see how these roles differ, it helps to put them side-by-side. This table breaks down who handles what at each key stage of the shipping journey.

DDP vs DDU Responsibility Breakdown

| Responsibility | Delivered Duty Paid (DDP) | Delivered Duty Unpaid (DDU) | Key Takeaway |

|---|---|---|---|

| Shipping Costs to Destination | Seller | Seller | Both terms make the seller responsible for arranging and paying for transport to the destination country. |

| Import Customs Clearance | Seller | Buyer | This is the main point of difference. The seller handles all import formalities under DDP. |

| Import Duties & Taxes (VAT/GST) | Seller | Buyer | With DDU, the buyer can face surprise costs if duties and taxes aren't accurately estimated beforehand. |

| Risk of Loss/Damage in Transit | Seller (until final delivery) | Seller (until arrival at destination) | The seller's risk period is slightly longer with DDP, as it covers the entire journey to the buyer's door. |

| Final Delivery to Buyer | Seller | Seller (to named place, pre-customs) | Under DDU, the final leg of the journey after customs clearance is effectively the buyer's problem to solve. |

The choice isn't just about cost—it's about the customer experience. DDP offers a frictionless, almost Amazon-like delivery. DDU, on the other hand, places a significant logistical burden on the recipient, making it far more suitable for experienced B2B importers who know the ropes.

This quick comparison just scratches the surface. The right Incoterm for you really depends on your business model, your customer's import experience, and how much control you want to keep over the entire shipping process.

What Delivered Duty Paid Actually Means for Sellers

When you see the term Delivered Duty Paid (DDP), think "maximum responsibility" for the seller. It’s the ultimate all-inclusive shipping arrangement in global trade. Agreeing to DDP terms means you, the seller, are on the hook for every single cost, risk, and logistical step until the goods are sitting at the buyer's doorstep, cleared and ready to be unloaded.

Essentially, your price quote isn't just for the product; it covers the entire journey. You’re providing a true door-to-door service where the buyer's only job is to accept the delivery. It’s a huge selling point, but it also comes with a long list of duties you need to manage perfectly.

Breaking Down the Seller's Extensive Responsibilities

Under DDP, you become the single point of contact and accountability for the shipment’s entire journey. This can be a massive undertaking, particularly if you’re not a seasoned international shipper.

Here’s a look at what falls squarely on your shoulders:

- Export Formalities: You'll handle all the paperwork and customs clearance required to get the goods out of your country.

- International Freight: You're responsible for booking and paying for all transportation—be it by sea, air, or land—to the destination country.

- Insurance: It's up to you to insure the cargo against loss or damage for its entire trip to the final destination.

- Import Clearance: This is a big one. You have to manage the often-tricky customs procedures in the buyer’s country, which usually requires hiring local experts.

- Duties and Taxes: You are responsible for paying all import duties, tariffs, and any local taxes like Value-Added Tax (VAT) or Goods and Services Tax (GST).

This long list of tasks is why getting a firm grasp of the delivered duty paid meaning is so critical before you offer it. It demands a well-established logistics network and the ability to calculate every potential cost down to the last penny.

A Real-World DDP Scenario

Let's picture a Chinese electronics company sending a container of new gadgets to a retail partner in the United States. If they agree on DDP terms, the Chinese manufacturer orchestrates the entire process.

They'll manage the trucking from their factory to the port of Shanghai and clear Chinese export customs. From there, they book and pay for the ocean freight to Los Angeles, making sure the shipment is insured. Once the container lands, an agent they've hired will handle US customs clearance, pay all import duties, and sort out any taxes. The final step is arranging a truck to deliver the container right to the retailer’s warehouse.

For the American retailer, the entire experience is completely hassle-free. The order arrives without them ever needing to speak to a freight forwarder, a customs broker, or worry about an unexpected tax invoice. This simplicity is precisely why DDP is so appealing to buyers.

Offering a transparent, landed-cost price is a major competitive differentiator, especially in B2C e-commerce. It removes the friction and uncertainty of surprise fees, which studies show is a leading cause of international cart abandonment.

But for the seller, this seamless customer experience is loaded with risk. Any unexpected customs inspections, port delays, or miscalculated duties eat directly into your profit margin. Success with DDP really hinges on meticulous planning and partnering with a freight forwarder who can accurately predict costs and navigate cross-border headaches. This is where the DDP vs DDU debate becomes a crucial part of your business strategy.

What Does Delivered At Place Unpaid (DDU) Actually Mean Today?

You'll still see the term Delivered Duty Unpaid (DDU) pop up quite often, even though it was officially struck from the Incoterms rulebook back in 2010. It was replaced by Delivered at Place (DAP), but old habits die hard. DDU persists in freight quotes, long-standing contracts, and everyday industry jargon.

Because it’s still in circulation, it’s crucial for both buyers and sellers to know exactly what it entails. The whole idea behind DDU shipping is a clean split of responsibilities right at the destination country's border. The seller does a lot of the heavy lifting, but their job stops just before the final, often tricky, hurdle of customs clearance.

The Seller's Role vs. The Buyer's Role

Under DDU terms, the seller arranges and pays for the entire journey until the goods get to the final destination point. Think of it as them handling everything from the factory pickup in the origin country right through to the main international ocean or air freight leg.

Essentially, the seller is on the hook for:

- Organising and footing the bill for all transportation to the destination.

- Covering the risk of any loss or damage until the goods are at the named place.

- Providing all the necessary export documents.

But the moment the shipment arrives at the destination country, the responsibility flips entirely. This is where the buyer's work begins, and it's the biggest point of difference when you compare DDP vs DDU. The buyer’s journey is far from over.

The Financial and Logistical Weight on the Buyer

When goods arrive under DDU terms, the buyer instantly becomes the importer of record. This puts them in the driver's seat, legally and financially, for the whole import customs process. Nothing moves an inch further until they’ve sorted everything out.

The buyer needs to be ready to manage:

- Customs Clearance: This means hiring a customs broker and getting all the import paperwork filed correctly.

- Import Duties: Paying whatever tariffs are slapped on the goods.

- Taxes: Settling any local taxes, like VAT or GST.

- Unloading Costs: Arranging and paying for the final unloading of the goods at their warehouse or facility.

This sudden handover can create some real financial headaches. If a buyer hasn't done their homework and budgeted for duties and taxes, they can be hit with a surprise bill that has to be paid on the spot before their cargo is released.

A classic DDU mistake is underestimating the potential for delays. If a buyer isn't prepared for the customs paperwork, or if they want to dispute a duty calculation, their shipment just sits there. Meanwhile, storage fees at the port or warehouse start piling up, turning what looked like a good deal into a very expensive problem.

A Real-World DDU Example

Let’s imagine a European fashion brand is bringing in a container of textiles from a supplier in India. They agree on DDU terms to the brand’s warehouse in France. The Indian supplier takes care of everything to get that container from their factory to the French port and then trucked to the specific warehouse address.

But here’s the catch: the truck can’t actually deliver the container until French customs gives the green light. The fashion brand has to step in, use its own customs broker to handle the import declaration, figure out the right duties for that specific type of textile, and pay the French VAT.

In this scenario, DDU works well for the brand. They're an experienced importer and have direct control over the customs process. They can work with their trusted broker to ensure duties are classified correctly, potentially saving money. For a rookie importer, though, this same situation could easily lead to costly delays and unexpected bills, proving just how vital import experience is when you opt for DDU.

DDP vs. DDU: A Head-to-Head on Cost, Risk, and Control

Deciding between DDP and DDU isn't just about crunching numbers; it's a strategic move that dictates who holds the risk, who has control, and how your customer ultimately feels about their purchase. Your choice hinges on your business model, your customer’s expectations, and how comfortable you are navigating the murky waters of international customs.

At first glance, DDU often looks like the cheaper option. But that initial price tag can be deceptive, hiding variables that can quickly inflate the final cost. DDP, on the other hand, offers an all-inclusive price that can be a fantastic sales tool, but it also means the seller shoulders every ounce of risk until the package is in the buyer’s hands.

How Cost Structures Differ

The financial models for DDP and DDU are worlds apart. With DDP, your buyer sees a single, final, landed cost at checkout. That number includes the product, the shipping, and all import duties and taxes. This kind of transparency is a huge win for consumers—in fact, 69% of shoppers say they would jump to a competitor for more convenient delivery, which absolutely includes dodging surprise fees.

To make this happen, sellers using DDP typically build a small risk premium or service fee into their pricing. This covers the work involved in managing foreign customs and pre-paying duties, which can make the upfront cost look slightly higher than a DDU shipment.

DDU, in contrast, splits the bill. The buyer pays for the product and initial shipping, but customs duties, taxes, and any clearance fees are charged separately when the goods arrive. This can look attractive to price-conscious shoppers initially, but it also creates major financial uncertainty. An unexpected bill for duties can easily sour the entire experience and lead to abandoned packages.

Comparing Risk Allocation and Management

The real dividing line between DDP and DDU is risk. These Incoterms pinpoint the exact moment responsibility transfers from seller to buyer, and that handover has massive consequences when things go sideways.

Under DDP, the seller assumes maximum risk. You're on the hook for the goods until they are safely delivered to the buyer's final address. This responsibility covers:

- Loss or damage during the entire journey.

- Delays from customs inspections, both at origin and destination.

- Fines for incorrect paperwork or duty miscalculations.

- Surprise storage fees if the shipment gets held up.

With DDU, a huge chunk of that risk shifts to the buyer. The seller's responsibility ends the moment the goods arrive at the destination country, before they clear customs. From that point on, the buyer is responsible for all risks tied to the import process. This includes delays, fines, and storage fees if they aren't ready to clear the shipment immediately.

The biggest risk for a buyer with DDU is the unknown. If they aren't familiar with their country's import rules, a simple shipment can turn into a logistical nightmare, with goods stuck in customs until all compliance issues are sorted and fees are paid.

Examining Logistical Control

The final piece of this puzzle is control. DDP gives the seller complete, end-to-end command of the logistics chain. You choose the carriers, you pick the customs brokers, and you manage the entire timeline. For sellers who have solid logistics partners, this is a major advantage, allowing you to deliver a smooth and predictable experience every time.

DDU, however, hands over control of the final, critical step—customs clearance—to the buyer. For a seasoned B2B importer with a trusted local broker, this is ideal. They can ensure accurate tariff classification, potentially lowering their duty bill, and navigate the local bureaucracy far more efficiently than a foreign seller ever could. This is especially true for complex products that demand deep knowledge of a country’s specific import laws. Getting the classification right is crucial, and you can learn more about how to find the correct harmonized tariff code to prevent costly mistakes.

Ultimately, there’s no single "better" option. The right choice is situational, depending entirely on your capabilities and your customer’s experience level. It's about taking a hard look at your business and deciding where you want to draw the line on risk and responsibility.

How DDP and DDU Play Out in Today’s Global Trade

In the real world of international shipping, the textbook definitions of DDP and DDU come to life every day on major trade routes. The choice isn't just a line item on a cost sheet; it's a strategic move that shapes customer satisfaction, supply chain stability, and your competitive edge—especially for goods coming out of a manufacturing powerhouse like China. With the e-commerce explosion, the entire game has tilted towards models that deliver a smooth, hassle-free experience for the final buyer.

You can see this shift most clearly on the busy China-to-EU and China-to-US shipping lanes. As shoppers worldwide get comfortable buying across borders, they’ve come to expect a straightforward purchase. No customs drama, no surprise bills. This expectation has turned DDP into a go-to for sellers on platforms like AliExpress and for direct-to-consumer (D2C) brands that need to build a loyal customer base.

The E-commerce Pivot Toward DDP

The move towards DDP has been accelerated by new international regulations. Take the European Union's Import One-Stop Shop (IOSS) system. It’s practically made DDP a standard for B2C sellers shipping into the EU, allowing them to handle VAT at the point of sale. This simple change ensures smaller shipments fly through customs without hitting the buyer with unexpected charges.

By sorting out these details upfront, an exporter in China can make the delivery feel entirely local to a customer in Berlin or Paris. It effectively removes the number one reason for abandoned carts in international sales: the fear of hidden costs.

The modern consumer journey is all about predictability. When a package from China arrives in the UK without a single extra fee or customs form, the seller has successfully removed the biggest point of anxiety in cross-border trade, turning a one-time buyer into a repeat customer.

And this isn't just a European phenomenon. The complexities of U.S.-China tariffs have also raised the stakes. Industry data reveals that around 10% of DDU parcels from China are refused or returned simply because of unexpected customs fees. In stark contrast, Chinese sellers who switched to DDP have boosted their delivery success rates from an average of 80-90% all the way up to 90-98%. For more information on this trend, you can discover more insights about duty-paid shipping on GFSdeliver.com.

When DDU Remains the Strategic Choice

Even with all the momentum behind DDP for e-commerce, DDU (now officially known as DAP) still has its place, particularly in the B2B world. Large, seasoned importers often prefer the hands-on control that DDU provides. Think of a major US retailer bringing in containers of product from China; they almost certainly have their own trusted customs brokers.

By opting for DDU, this kind of importer can:

- Optimise Duty Payments: Their in-house experts or preferred brokers can nail the tariff classifications, often finding ways to lower the total duty bill.

- Manage Cash Flow: They get to pay duties and taxes on their own schedule, which helps with their internal accounting and financial planning.

- Consolidate Shipments: It’s far more efficient for them to manage the customs clearance for multiple inbound shipments from various suppliers all at once.

In scenarios like these, DDU isn’t a hassle—it's a lever for financial and logistical control. It empowers sophisticated buyers to use their own expertise and infrastructure. As you weigh these options, it’s always smart to look ahead at how the rules of trade are evolving. You can learn more by checking out our guide on Incoterms 2025 explained. Ultimately, the right choice comes down to balancing a seamless customer experience with the advantages of direct operational control.

How to Choose Between DDP and DDU

Picking the right Incoterm isn't just a logistics detail; it's a strategic move that shapes your customer experience, profit margins, and how much work lands on your plate. There's no single "best" answer in the DDP vs DDU debate. The real goal is to match your shipping strategy to your business model and, just as importantly, to what your buyer can actually handle.

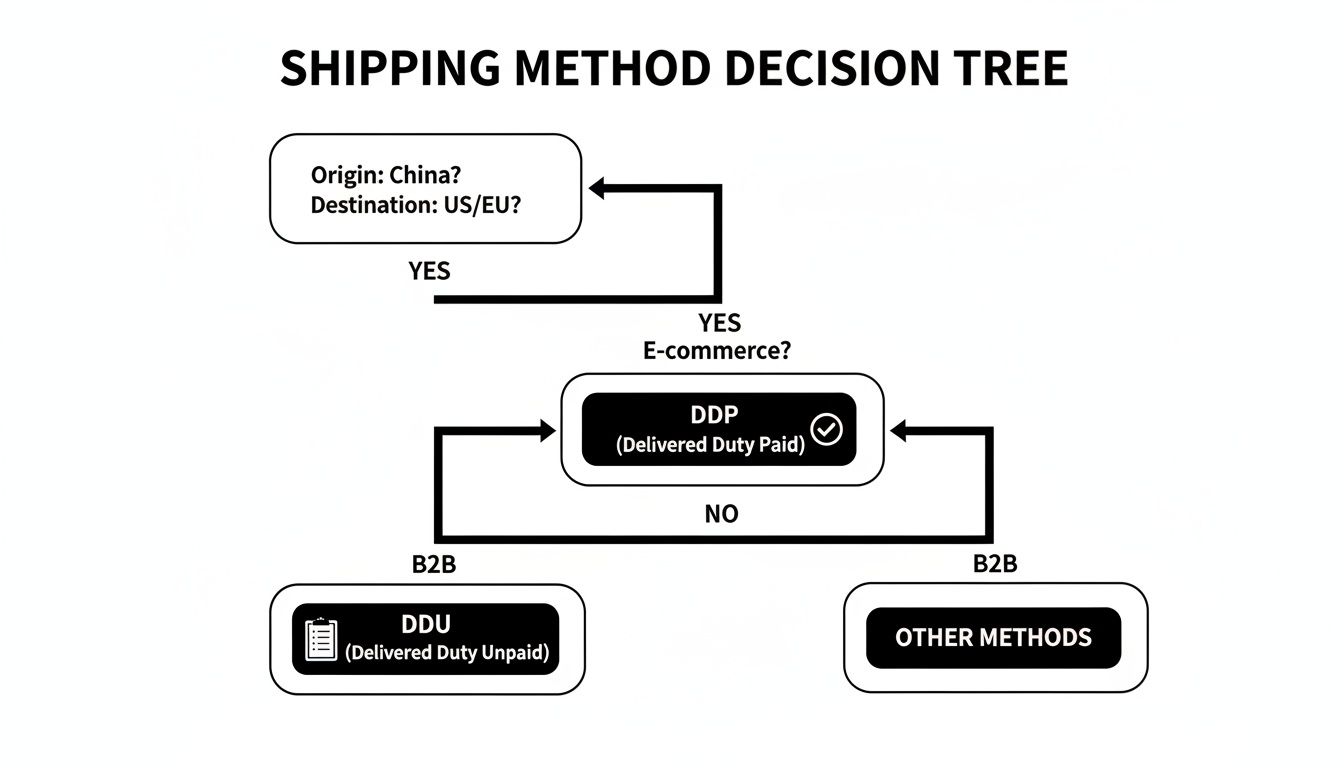

Making the right call starts with asking the right questions. For exporters shipping from China, the path often diverges based on whether you're in e-commerce or traditional B2B trade. This decision tree lays out a common thought process.

As you can see, for high-volume e-commerce shipping into Western markets, DDP often gets the nod. It creates a smooth, predictable experience for the end customer. DDU, on the other hand, usually fits better within established B2B relationships where the importer knows the ropes.

Key Questions to Guide Your Decision

Let's get practical. Run through this checklist to figure out which term aligns with your business. Your answers should point you toward the right choice for your specific situation.

1. Is a Transparent, All-Inclusive Price Central to Your Customer Experience?

If you want to offer a frictionless, Amazon-style checkout with absolutely no surprise fees later on, DDP is the obvious choice. It eliminates the number one cause of frustration in cross-border e-commerce. Presenting one final price builds immense trust and cuts down on abandoned carts because customers know exactly what they're paying upfront. No nasty surprises.

2. Does Your Buyer Actually Know How to Handle Customs?

Think about who you're selling to. If your customers are large companies or seasoned importers with their own customs brokers, then DDU (or DAP) is a perfectly reasonable, and often preferred, option. These buyers can navigate clearance effectively and might even secure a lower duty bill through their expertise.

But if you're selling to individual consumers or small businesses, the burden of DDU can quickly turn into a nightmare of delays and confusion for them.

Handing off a DDU shipment to an inexperienced buyer is a huge gamble. You’re essentially forcing them to become a project manager for a complex import process they’re not equipped for. If that shipment gets stuck, it’s your brand reputation that takes the hit.

Finalising Your Choice

3. How Much Risk and Paperwork Are You Prepared to Take On?

With DDP, the seller manages everything and shoulders all the risk right up until the package is on the buyer's doorstep. This requires a solid logistics network and the ability to predict every single cost along the way. If you don’t have the resources or expertise to navigate foreign customs, the risk of unexpected expenses makes DDP a potentially costly strategy.

DDU, in contrast, passes the import risk and responsibility to the buyer, which certainly simplifies things on your end.

4. How Critical Is Showing the Lowest Possible Price at Checkout?

A DDU shipment can make your initial product and shipping costs look lower, which might appeal to buyers focused purely on price. The problem is, this advantage can quickly evaporate—and even create resentment—if the final duties and taxes are higher than the customer anticipated. If your sales strategy leans on advertising the lowest upfront price, DDU might seem tempting, but you absolutely must be crystal clear about the costs the buyer will face later.

Ultimately, choosing between DDP and DDU is a balancing act. You're weighing customer convenience against your own operational control and risk. For most modern e-commerce businesses selling directly to consumers, the seamless customer journey offered by DDP makes it the smarter, more strategic choice for building a lasting global brand.

Your Questions on DDP and DDU, Answered

When you're getting into the weeds of DDP vs. DDU, a few practical questions always pop up. Let's tackle some of the most common ones that shippers, both new and seasoned, ask. Getting these straight can make all the difference in crafting your shipping strategy.

Is DDU the Same as DAP?

You'll often hear these terms used as if they're the same thing, but they're not—at least, not anymore. Delivered at Place (DAP) is the official term that replaced DDU in the Incoterms 2010 rules, published by the International Chamber of Commerce.

Functionally, they're very similar: the buyer is responsible for import duties and taxes. The key difference is that DAP provides a much clearer definition of exactly where the delivery point is and when the risk transfers from seller to buyer. To keep your contracts legally sound and avoid any arguments, you should always use the current Incoterms like DAP. That said, don't be surprised if you still see 'DDU' on older paperwork or quotes from some suppliers.

Which Incoterm Puts More Risk on the Seller?

Hands down, DDP is the riskier option for the seller. When you agree to DDP, you’re taking on the entire journey. You're responsible for all costs and risks until those goods are sitting at the buyer's doorstep. This covers everything from potential damage in transit and customs hold-ups to surprise storage fees and wrestling with a foreign country's import rules.

On the flip side, DDU (or more accurately, DAP) is much less of a gamble for the seller. Your job is pretty much done once the goods land in the destination country, just before the customs clearance maze begins. This hand-off shields you from a whole world of potential costs and logistical nightmares that can pop up during import.

When a seller chooses DDP, they're essentially betting they can navigate another country's customs bureaucracy without a hitch. It's a calculated risk for veterans with solid partners on the ground, but for the unprepared, it's an easy way to watch your profit margin evaporate.

Should a First-Time Importer Ever Agree to DDU?

I would strongly advise against it. When a buyer, especially one new to importing, accepts a DDU (DAP) shipment, they become the official "importer of record." Suddenly, you’re on the hook for handling customs clearance, calculating the right duties, paying taxes, and knowing the local import laws inside and out.

Getting this wrong can be a painful and expensive lesson. Common pitfalls include:

- Long Delays: A simple paperwork error can leave your shipment stuck in customs for weeks.

- Hidden Costs: Storage and demurrage fees at the port can pile up frighteningly fast.

- Lost Goods: In a worst-case scenario, customs can seize your entire shipment.

If you don’t have a trusted customs broker or any experience with importing, DDP is by far the safer bet. It puts the weight of all that complex work onto the seller, giving you a much simpler, all-in-one delivery experience.