Delivered Duty Paid (DDP) is a shipping agreement that places maximum responsibility squarely on the seller's shoulders. Imagine ordering something online; you click 'buy', and it shows up at your door a few days later. You don't worry about customs, taxes, or logistics – that's the DDP experience for an importer.

The seller arranges and pays for everything to get the goods from their warehouse to your specified location, including all the tricky bits like import duties and taxes.

What Delivered Duty Paid Actually Means for Your Shipments

Let’s go beyond the official definition. Think of DDP as the white-glove, all-inclusive package of international shipping. It's the difference between a fully catered meal brought to your table versus a box of ingredients left on your doorstep for you to figure out.

With DDP, the seller handles every single step of the journey. They book the transport, clear the goods for export, manage the import process in your country, and—crucially—pay all the import duties and taxes. Your only job? Be there to receive the shipment.

The Core Principle of DDP

The whole point of DDP is to give the buyer total clarity on cost and a hassle-free experience. The price you're quoted is the final price you pay. Period. No unexpected bills from customs or last-minute calls from a freight forwarder to sort out a problem.

This all-in-one approach makes it a fantastic option for:

- E-commerce sellers aiming to provide a smooth, borderless shopping experience for their international customers.

- Businesses new to importing who aren’t yet comfortable with the maze of customs regulations.

- Buyers purchasing high-value items who want a predictable, low-risk delivery process.

Of course, this puts immense pressure on the seller. They need to be experts not just in shipping, but in the specific import rules of the destination country. One misstep can lead to costly delays and wipe out their profit on the sale.

Under the Incoterms 2020 rules, DDP represents the highest level of responsibility a seller can undertake. The risk and ownership of the goods only transfer to the buyer once the shipment has arrived at the named destination, cleared customs, and is ready for unloading.

To really see how the workload is split, it's helpful to break down the specific tasks. This quick overview shows exactly why the delivered duty paid meaning is all about seller accountability.

DDP at a Glance: Who Is Responsible for What

The table below gives a clear breakdown of who handles each step in a DDP shipment.

| Task | Seller Responsibility | Buyer Responsibility |

|---|---|---|

| Export Packaging | ✔️ Yes | ❌ No |

| Export Customs Clearance | ✔️ Yes | ❌ No |

| Transportation to Port | ✔️ Yes | ❌ No |

| Main Carriage (Freight) | ✔️ Yes | ❌ No |

| Shipping Insurance | ✔️ Yes | ❌ No |

| Destination Port Charges | ✔️ Yes | ❌ No |

| Import Customs Clearance | ✔️ Yes | ❌ No |

| Import Duties & Taxes (VAT/GST) | ✔️ Yes | ❌ No |

| Final Mile Delivery | ✔️ Yes | ❌ No |

| Unloading at Destination | ❌ No (Unless agreed) | ✔️ Yes |

As you can see, the seller manages nearly everything. The only task typically left for the buyer is unloading the goods once they arrive, unless you've negotiated otherwise.

The Seller’s Journey: What DDP Really Means for You

When a seller agrees to DDP (Delivered Duty Paid) terms, they’re essentially signing up for the whole nine yards. Think of it as a white-glove, door-to-door delivery service on an international scale. This Incoterm places the maximum responsibility squarely on the seller's shoulders, making them the project manager for the entire shipping journey, from their own factory floor right up to the buyer's specified destination.

The work starts the second the deal is done. First up is getting the goods ready for what could be a long and bumpy ride. This isn’t just about putting items in a box; it's about making sure the packaging can handle the rigours of an ocean voyage or air freight and is labelled perfectly for export.

Next, the seller lines up and pays for all transportation. This isn't a single payment but a cascade of costs: getting the goods to the port, loading them onto the vessel, the main sea or air freight journey, fees at the destination port, and finally, the last leg of the journey to the buyer's location.

Getting Through Customs: Export and Import

Before the goods can even think about leaving their home country, the seller has to manage all the export paperwork. This means filing the right documents with their local customs, proving the shipment is above board, and paying any export taxes that might apply. For seasoned exporters, this part is usually business as usual.

The real test comes when the shipment lands in the buyer's country. With DDP, the seller is also on the hook for the entire import customs clearance process. This is where things can get tricky, as it requires a solid grasp of the destination country's laws and import rules. For a deeper dive, check out our guide on the ins and outs of customs clearance.

A critical point to understand about DDP is that the seller must act as the Importer of Record (IOR) in the destination country. This can be a hurdle, as some countries require the IOR to be a local company, often forcing sellers to hire specialised agents to handle it.

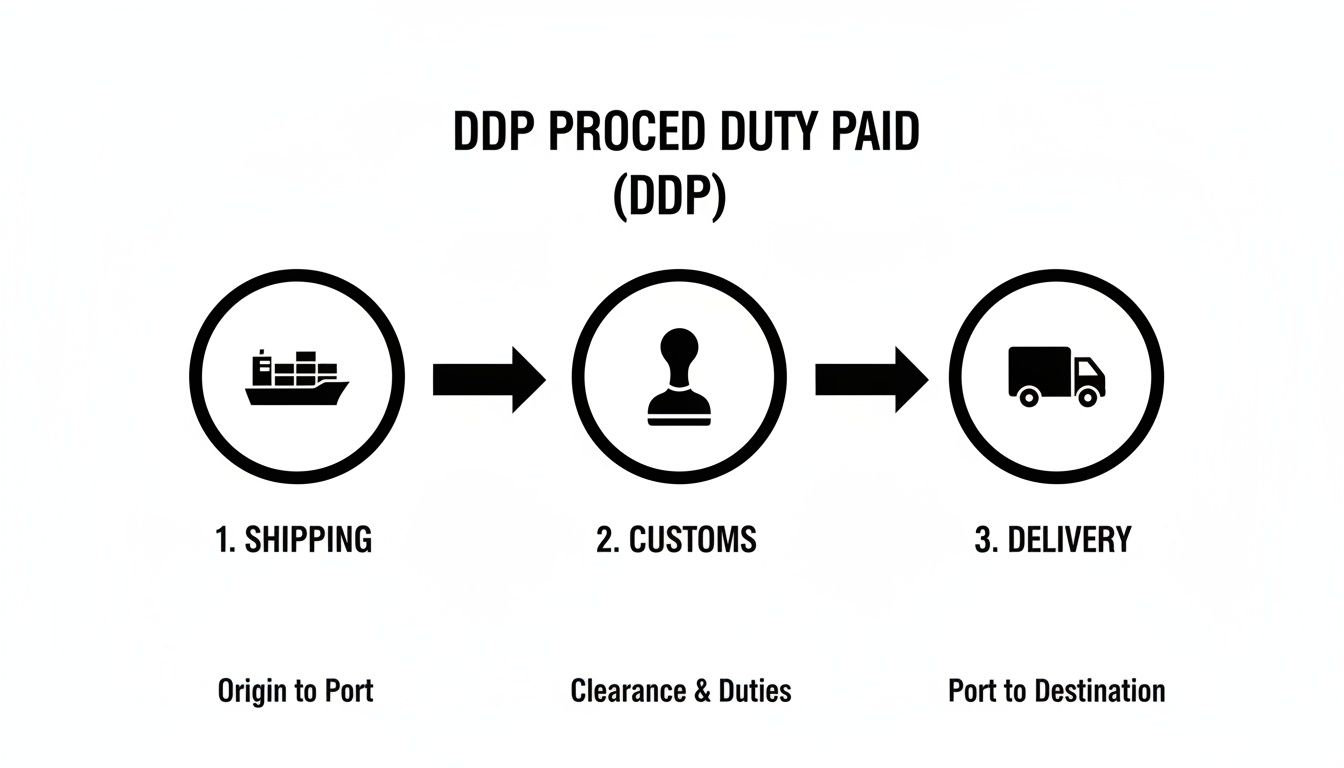

This flowchart maps out the key stages a seller navigates in a DDP shipment.

As you can see, the seller’s responsibility is a continuous line covering shipping, customs, and final delivery, which really drives home how comprehensive this term is.

Carrying All the Costs and Risks

Until the moment the goods are ready for unloading at the buyer’s premises, the seller carries all the risk of loss or damage. If a container falls overboard, goods are damaged in transit, or a shipment is stolen, the financial hit is entirely on the seller. This makes good shipping insurance an absolute must-have, not a nice-to-have.

On top of that, the seller pays for all import duties, taxes, and other charges. This typically includes:

- Import Duties: Tariffs based on the type and value of the goods.

- VAT/GST: This can be a hefty sum, often around 15-20% of the shipment's value.

- Customs Brokerage Fees: The cost of hiring an agent to handle the import declaration.

- Surprise Costs: Any fees for storage or inspections if customs decides to take a closer look.

The unpredictable nature of global trade really highlights why this matters. Take the ongoing tariff changes in China-US trade. These shifts made DDP a go-to strategy for many Chinese exporters. When the US changed the rules for small-value shipments from China, suddenly every package needed formal clearance and duty payments. By offering DDP, Chinese sellers absorbed these new costs and hassles, protecting their US buyers from nasty surprises. This was a smart move, especially when manufacturing exports accounted for a massive 98.9% of China's total goods exports in 2024.

The Buyer’s View: Why DDP Offers Peace of Mind

For any buyer, especially someone just dipping their toes into international trade, Delivered Duty Paid (DDP) is a breath of fresh air. It stands for one thing above all else: simplicity. Once you understand the seller's mountain of responsibilities under this term, it's easy to see why importers find it so attractive.

Let's say you run an e-commerce store and you've found the perfect product from a supplier in China. Your day is already packed with marketing, talking to customers, and managing your website. The last thing you want is to become an overnight expert in tariff codes and customs brokerage. This is exactly where DDP shines.

With DDP, the seller handles pretty much everything. Your main responsibility? Just be there to accept the delivery when it shows up at your door. You've effectively handed off the entire logistical headache.

The Power of Total Cost Certainty

One of the biggest fears for any importer is the dreaded "cost creep." You agree on a product price, but then the bills start rolling in—freight charges, port fees, unexpected duties, surprise taxes. These hidden costs can absolutely wreck your profit margins before your products even hit the shelves.

DDP wipes that worry off the table. The price you get is the final, all-in price to get the goods to your specified location.

This kind of crystal-clear pricing gives you a few major advantages:

- Accurate Budgeting: You can nail down your cost of goods sold (COGS) right from the start, which makes your financial planning solid.

- Stable Product Pricing: You can set your retail prices confidently, knowing your own costs won’t suddenly jump up.

- Less Admin Overload: Your accounts department isn't stuck trying to piece together a dozen different invoices from freight companies, brokers, and hauliers.

Think of it this way: DDP is all about risk management for the buyer. By making the seller responsible for all transport and customs risks, you shield your business from shipping delays, regulatory fines, and surprise expenses.

Convenience and Minimal Effort

Beyond the financial security, DDP is just incredibly convenient. As the buyer, you don't have to find a freight forwarder, haggle with shipping lines, hire a customs broker, or wade through the sea of paperwork needed for an import.

Your seller manages every single step of the journey, from their factory floor to your warehouse door. This frees you up to focus on what you do best—growing your business, not untangling supply chain knots. For a small or medium-sized business (SME), this can be a massive advantage.

Potential Downsides for the Buyer

Of course, this complete peace of mind can come at a price. While DDP is undeniably easy, it might not always be the cheapest way to get things done.

Sellers often bake a bit of a buffer into their DDP pricing to cover themselves against any unexpected costs or risks. That means the all-in price you pay could be higher than what you’d pay if you arranged your own shipping and customs clearance, especially if you have some experience. You also give up control over which shipping company is used and the exact timing of the delivery.

In the end, it boils down to one simple question: Is the premium you might pay for DDP worth eliminating all the risk, hassle, and uncertainty? For many businesses, the answer is a definite yes.

How DDP Stacks Up Against Other Common Incoterms

To really get a feel for what Delivered Duty Paid means in practice, you have to see how it compares to the other options out there. DDP isn’t just another three-letter acronym in the shipping world; it’s a specific choice that has huge consequences for your costs, risks, and workload.

Think of choosing an Incoterm like picking a tool for a job. Using the wrong one might get the task done, but it’s going to be inefficient, more expensive, and could create a real mess. Let’s put DDP side-by-side with a few other popular terms to see what makes it unique.

DDP vs. DAP: The All-Important Final Step

At first glance, Delivered at Place (DAP) looks almost identical to DDP. With DAP, the seller is also on the hook for arranging and paying for transport all the way to the buyer's specified location. The risk also stays with the seller until the goods are at that destination, ready to be unloaded.

So, what’s the big deal?

The difference comes down to two critical, often complicated, steps: import customs clearance and the payment of duties and taxes.

- Under DDP: The seller handles everything, period. They are responsible for navigating customs in the buyer's country and paying all the import duties, VAT, and any other taxes. The goods show up at your door, clear and ready for you to unload.

- Under DAP: The seller’s job stops right before the goods hit customs. They get your shipment to the destination, but it’s the buyer’s responsibility to handle all the import paperwork and pay the duties and taxes.

This one difference is a game-changer. A DAP shipment leaves the buyer holding the bag for the administrative headache and financial uncertainty of customs. If you've ever bought something online and gotten a surprise bill from the courier for import fees, you've experienced a process that works a lot like DAP. For a deeper dive, check out our guide on the differences between DDU and DDP incoterms, which explores a similar principle.

Here’s a simple way to think about it: DDP is like ordering a pizza. It arrives at your door, fully cooked and ready to eat. DAP is like getting a meal-kit delivery—all the ingredients are there, but you still have to do the cooking and cleaning yourself.

DDP vs. FOB: A World of Difference

Now, let's compare DDP to Free on Board (FOB), which is one of the most common terms used, especially for sea freight. This comparison really shows just how much extra responsibility a seller takes on when they agree to DDP.

With a Free on Board deal, the seller's work is finished as soon as the goods are loaded onto the ship chosen by the buyer at the port of origin. The second those goods are on the vessel, all risk and cost transfer to the buyer.

So, under FOB:

- The buyer books and pays for the main ocean journey.

- The buyer is responsible for insuring the cargo during transit.

- The buyer handles the import customs clearance and pays all duties.

- The buyer arranges transport from the destination port to their warehouse.

The difference couldn't be clearer. FOB places minimal obligation on the seller—basically, just get it on the boat. DDP, on the other hand, puts nearly 100% of the responsibility on the seller until the goods are sitting on the buyer’s doorstep.

Incoterms Responsibility Showdown: DDP vs. DAP vs. FOB

Sometimes, seeing it all laid out is the easiest way to understand the differences. This table breaks down who does what for these three key Incoterms.

| Responsibility | DDP (Delivered Duty Paid) | DAP (Delivered at Place) | FOB (Free on Board) |

|---|---|---|---|

| Export Clearance | Seller | Seller | Seller |

| Main Transportation | Seller | Seller | Buyer |

| Risk Transfer Point | At buyer's named destination | At buyer's named destination | Once goods are on the vessel |

| Import Clearance | Seller | Buyer | Buyer |

| Import Duties & Taxes | Seller | Buyer | Buyer |

| Final Delivery | Seller | Seller | Buyer |

As you can see, DDP truly is an end-to-end service from the seller's perspective. It’s the most hands-off, all-inclusive option a buyer can choose, which is precisely why it’s so appealing.

Calculating DDP Costs: A Real-World Example

Theory is one thing, but seeing how the numbers really add up is where the rubber meets the road. So, let’s walk through a practical example. We'll put ourselves in the shoes of a seller in China calculating the DDP price for a shipment of electronics headed to a buyer's warehouse in Los Angeles, USA.

Imagine a US-based e-commerce business needs to stock up on 1,000 units of a popular new gadget. Their supplier in Shenzhen has to quote an all-inclusive price that covers every single cost until those gadgets are sitting safely in the buyer's L.A. warehouse.

No hidden fees, no surprise invoices. Just one price.

Breaking Down the Cost Components

The seller can't just pull a number out of thin air. The final DDP price is a careful assembly of many smaller costs, each needing an accurate estimate. Get it wrong, and you either lose the deal by overpricing or lose your shirt by underpricing.

Here’s a step-by-step look at how they'd build that quote:

- Factory Price: This is the starting line. Let's say each gadget costs $25 to produce. For 1,000 units, that's a total product cost of $25,000.

- Export Packaging: These aren't going down the street; they're crossing an ocean. The seller budgets $500 for sturdy, reinforced cartons and palletisation to withstand the journey.

- Inland Transport in China: Next, the goods need to get from the factory in Shenzhen to the Port of Yantian. A truck for that leg of the journey runs about $300.

- Export Customs & Port Fees: At the port, there are handling charges and paperwork for export customs clearance. Let’s peg this at $250.

- Ocean Freight: This is the big one—the cost for a 20-foot container from Yantian to the Port of Los Angeles. Freight rates are notoriously volatile, but for our example, we'll use a figure of $3,000.

- Cargo Insurance: To cover the risk of loss or damage all the way to L.A., the seller adds insurance. This typically costs around 0.5% of the commercial invoice value, which adds $125 to the total.

Navigating US Import Costs

Once the container lands in Los Angeles, a whole new set of costs pop up. Under DDP, these are all on the seller's tab.

- Destination Port Charges: Fees for getting the container off the ship and other terminal handling charges. This adds another $400.

- Customs Brokerage: The seller needs to hire a US customs broker to handle the import declaration. That service usually costs around $200.

- Import Duties & Fees: Here’s where it gets tricky. The duty is calculated based on the product’s specific HS Code and its value. If these electronics have a 4% duty rate, the duty would be $1,000 (4% of the $25,000 product cost). You can learn more about how this works in our guide to the Harmonized Tariff Code system. On top of that, there's a Merchandise Processing Fee (MPF), which adds approximately $87.

The Grand Total: By meticulously adding every single cost, the seller can calculate the total landed cost and set their final DDP price. This is what gives the buyer complete cost certainty and peace of mind.

The turbulence of global trade makes this calculation even more vital. Throughout 2024 and into 2025, shifting tariffs and new regulations reshaped the dynamics of China-US trade. When the US government adjusted certain trade exemptions, many Chinese suppliers quickly pivoted to DDP terms. By prepaying the duties themselves, they protected their American buyers from nasty surprises at the border.

Finally, we have the last leg of the journey.

- Final-Mile Delivery: A truck is needed to move the goods from the Port of Los Angeles to the buyer’s local warehouse. This could easily cost another $500.

To be safe, the seller will likely add a small buffer for unexpected delays or fees before presenting a final, all-inclusive DDP price to the buyer. This ensures that for the buyer, the price they see is the price they pay. Period.

Is DDP the Right Choice for Your Business?

Picking the right Incoterm isn't just about logistics; it's a core part of your business strategy. While Delivered Duty Paid (DDP) is the ultimate red-carpet experience for your buyer, it places a heavy burden of responsibility and risk squarely on your shoulders as the seller. The right choice really boils down to your business model, who you're selling to, and how comfortable you are navigating the often-murky waters of international trade.

For a lot of businesses, especially in e-commerce, the name of the game is creating a seamless, surprise-free customer experience. This is where DDP shines. It gets rid of those nasty, unexpected customs bills that show up at the customer's door—a huge reason why international shoppers abandon their carts. If your entire strategy is built on all-in pricing and protecting your customers from customs headaches, DDP can be your most powerful sales tool.

But let's be clear: DDP is not a silver bullet. For sellers, it represents the absolute maximum level of obligation. If you don't know the ins and outs of the import regulations, tax laws, and customs quirks in your buyer's country, DDP can quickly turn into a costly nightmare filled with unexpected fees and frustrating delays.

When DDP Is a Clear Winner

So, how do you know if the delivered duty paid meaning fits your business? It’s often the best move in a few specific situations:

- When Customer Experience is Everything: You're aiming for that smooth, Amazon-like checkout where the price your customer sees is the final price they pay. No surprises, no extra bills for duties or taxes.

- When Your Buyer Is an Import Novice: You're selling to small businesses or directly to consumers who have zero interest (or ability) in figuring out customs clearance on their own.

- When You're Selling High-Value Goods: For premium products, customers expect a premium, hassle-free service. DDP delivers that peace of mind and can help justify a higher price tag.

- When You're Breaking into a New Market: Offering DDP can give you a serious competitive edge. It makes it incredibly easy for new international customers to take a chance on your products.

DDP is fundamentally a customer-first decision. You're taking the entire complex journey—from shipping to customs clearance—off your buyer's plate. This creates a predictable and trustworthy experience that can seriously lift conversion rates for your cross-border sales.

Red Flags: When DDP Could Be a Mistake

On the flip side, there are times when offering DDP can seriously backfire and chew through your profits. You should probably steer clear of this Incoterm if:

- You're Flying Blind on Destination Country Rules: Every country's import laws are different. A simple miscalculation of VAT or duties can completely wipe out your profit on a shipment.

- Your Buyer Is a Seasoned Importer: A large, experienced buyer likely has their own customs broker and better shipping rates. They might be able to handle importation far more efficiently and cheaply than you can. Forcing DDP on them could even lose you the sale.

- Your Profit Margins Are Wafer-Thin: With DDP, the seller is on the hook for any and all unexpected costs—think random customs inspections, storage fees, or sudden tariff changes. If you don't have much wiggle room in your margins, a single problem can turn a profitable order into a loss.

In the end, it’s a balancing act between control, cost, and the customer experience you want to create. Taking a hard look at these factors will tell you whether DDP is a strategic tool for growth or a potential risk you can’t afford to take.

Common Questions About DDP Answered

Even when you've got the basics down, a few tricky questions always pop up when it's time to actually use Delivered Duty Paid shipping. Let's tackle the most common ones head-on, so you can navigate the finer details of this Incoterm like a pro.

We’ll dig into the details that can make or break a DDP agreement, like who's legally responsible for the import and what happens with taxes or if something goes wrong along the way.

Who Acts as the Importer of Record in a DDP Shipment?

This is a big one: under DDP Incoterms, the seller is responsible for acting as the Importer of Record (IOR) in the destination country. It’s a crucial role that goes way beyond just paying fees. The seller (or their agent) must have the legal standing to handle all the import paperwork and formalities.

Frankly, this can be a major hurdle. Many countries require the IOR to be a locally registered business, which means international sellers often can't do it themselves. They end up having to hire a third-party service to act as the IOR, adding another layer of cost and complexity that gets baked into the final price.

Does the DDP Price Include VAT or Other Sales Taxes?

Yes, it absolutely should. The whole point of the delivered duty paid meaning is that the seller hands over the goods completely cleared and ready to go. That includes all import taxes, like Value-Added Tax (VAT) or Goods and Services Tax (GST), which can be a hefty 15-20% of the shipment's value.

It’s incredibly important to spell this out in the sales contract. While standard DDP covers these taxes, you might occasionally see an agreement for "DDP, VAT unpaid." This usually only happens if the buyer has a special arrangement to reclaim the tax themselves, but it's the exception, not the rule.

What Happens if a DDP Shipment Is Damaged in Transit?

With a DDP agreement, the seller is on the hook for all risk of loss or damage right up until the moment the goods arrive at your doorstep, ready for unloading. If a container falls off the ship, a forklift driver gets clumsy, or customs seizes the shipment indefinitely, the financial hit is entirely the seller's problem.

This all-inclusive risk coverage is one of the biggest draws for a buyer. The risk doesn't transfer to you until the goods are physically at the final destination named in your contract, waiting for you to unload them. This is exactly why any seller with sense will have solid cargo insurance for their DDP shipments.