Picking the right Incoterm is one of the most important decisions you'll make in international trade. It's not just about who pays for what; it's about control, risk, and ultimately, your bottom line. The choice often boils down to two main options: CIF (Cost, Insurance, and Freight) or FOB (Free On Board).

Think of it this way: with CIF, the seller handles almost everything until the goods reach your country's port. With FOB, you, the buyer, take the reins much earlier in the process. This decision creates a fundamental trade-off between hands-off convenience and direct control over your supply chain.

Understanding CIF vs FOB at a Glance

So, what exactly are these terms? They're part of the Incoterms, a set of globally recognised rules from the International Chamber of Commerce (ICC). These rules spell out exactly who is responsible for what during a shipment, preventing misunderstandings between buyers and sellers. For sea freight, CIF and FOB are two of the most frequently used terms, and they define very different points where cost and risk are handed over.

As an importer, an FOB agreement puts you in the driver's seat. You get to choose your own freight forwarder, negotiate the shipping rates you want, and secure an insurance policy that actually covers your cargo's full value. This control often translates into lower overall costs and much better visibility into where your shipment is at any given moment.

On the other hand, a CIF agreement is all about simplicity. Your supplier deals with the hassle of booking the main sea freight and buying the insurance. While this is certainly convenient—especially if you're new to importing—it's a hands-off approach that can lead to hidden costs and bare-minimum insurance coverage that might not be enough if something goes wrong. Getting these differences straight is the first, most critical step.

Quick Comparison of Seller and Buyer Responsibilities

To get a clear, high-level view of how these terms stack up, it helps to see the obligations side-by-side. This table breaks down the core duties, showing who pays for and manages each part of the journey.

| Responsibility | FOB (Free On Board) | CIF (Cost, Insurance, and Freight) |

|---|---|---|

| Main Sea Freight | Buyer Arranges and Pays | Seller Arranges and Pays |

| Marine Insurance | Buyer Arranges and Pays | Seller Arranges and Pays |

| Export Customs | Seller Responsibility | Seller Responsibility |

| Risk Transfer Point | When goods are on board the vessel | When goods are on board the vessel |

| Supply Chain Control | High for the Buyer | Low for the Buyer |

The takeaway here is that while both terms transfer risk at the same point (once goods are loaded onto the vessel), the control over the main, most expensive leg of the journey is completely different. FOB gives control to the buyer, while CIF leaves it with the seller.

A Look at the Seller's Obligations

When you get down to the brass tacks of CIF vs. FOB, the seller's responsibilities are where the real differences lie. These duties aren't just about who pays for what; they shape the entire operational flow and determine where liability sits at each stage of the journey. The Incoterm you choose hands the seller a very specific to-do list they must complete to honour the deal.

What a Seller Does Under FOB

With a Free On Board (FOB) agreement, the seller’s job is straightforward and geographically contained. Their work is done once the goods are safely loaded "on board" the ship that the buyer has arranged. It's a clean hand-off at the port of origin.

Here’s a breakdown of the seller’s key tasks in an FOB deal:

- Export-Ready Packaging: Making sure the cargo is packed properly to withstand a long sea voyage.

- Inland Transport: Moving the goods from their factory or warehouse to the designated port.

- Export Customs Formalities: Handling all the export paperwork and paying any associated duties or taxes to get the goods cleared to leave the country.

- Loading Costs: Paying the terminal handling charges to get the cargo physically loaded onto the vessel.

Think of it this way: a electronics supplier in Shenzhen using FOB terms is on the hook for everything until their container of gadgets is sitting securely on the deck of the ship at the Port of Shenzhen. The moment the goods are on board, their job is finished, and the risk is no longer theirs. To really get into the weeds on this, check out the complete meaning of FOB in our detailed guide.

What a Seller Does Under CIF

A Cost, Insurance, and Freight (CIF) agreement stretches the seller's duties well beyond the home port. This is where a lot of confusion can creep in because while the seller pays for a lot more, the point where risk transfers to the buyer remains exactly the same as FOB.

Under CIF, the seller's to-do list grows to include arranging and paying for:

- Main Ocean Freight: Booking the vessel and paying the freight charges to get the goods all the way to the buyer's destination port.

- Basic Insurance Cover: Taking out a marine insurance policy for the main leg of the journey.

Here's the crucial detail to grasp: With CIF, the seller pays for the freight and insurance, but the risk of something happening to the goods passes to the buyer as soon as they are loaded at the origin port. If the ship hits a storm and the cargo is damaged, it’s the buyer who has to file the insurance claim, using the policy the seller provided.

The Buyer's Role: Taking the Reins of Your Shipment

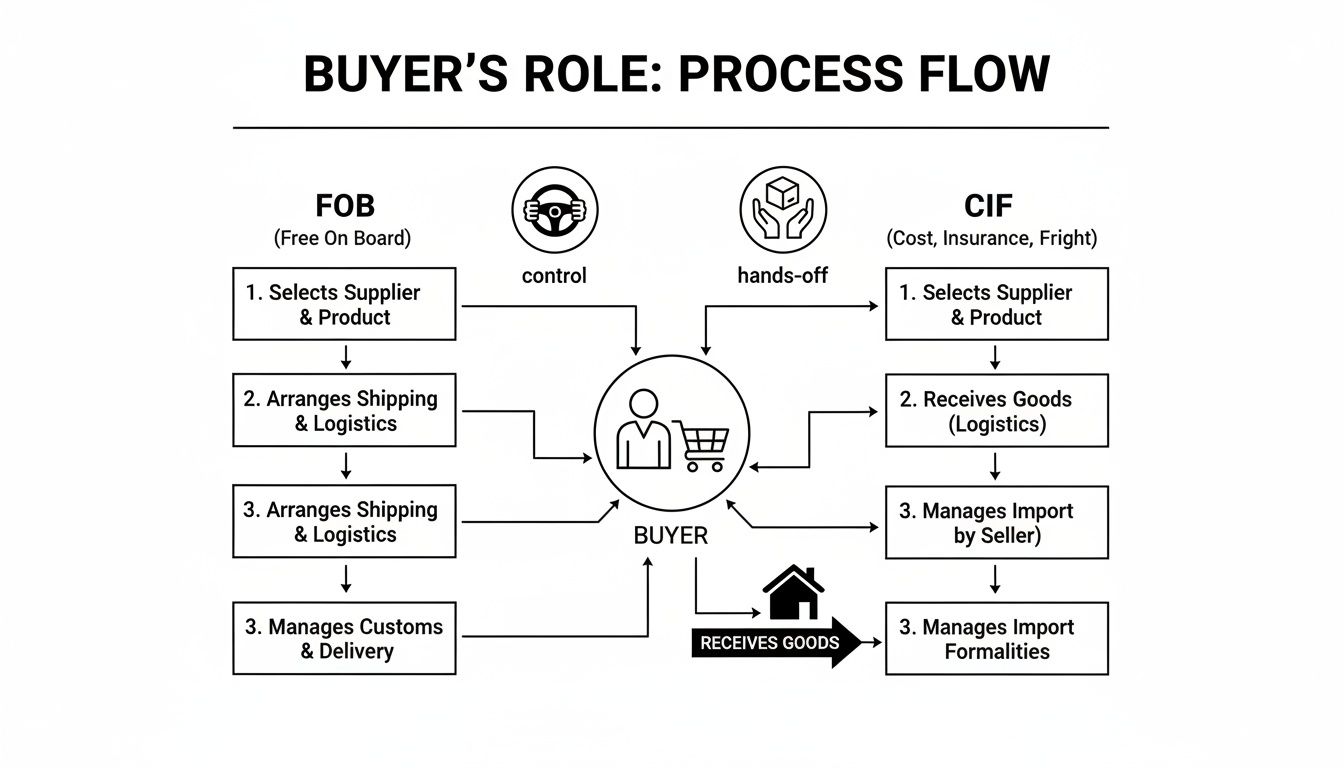

When you're weighing up CIF vs FOB, you're not just picking a term; you're deciding how involved you want to be in your own supply chain. This choice defines your responsibilities, your control, and ultimately, how much you really pay to land your goods.

Under a Free On Board (FOB) agreement, you, the buyer, take the helm as soon as the cargo is loaded onto the ship at the origin port. For any experienced importer, this is a massive advantage. It means you get to choose your own freight forwarder.

Why does that matter? Because you can negotiate your own shipping rates, select a carrier known for reliability, and track your shipment with a partner you trust. You're in the driver's seat.

This control also applies to cargo insurance. With FOB, you arrange your own policy. Instead of settling for the seller's generic, minimal coverage, you can get a policy that protects the full value of your goods against the risks that actually concern you. For any business focused on cost-efficiency and tight logistical control, FOB is almost always the smarter play.

Convenience Comes at a Price: CIF vs. Control

On the other hand, Cost, Insurance, and Freight (CIF) looks tempting, especially if you're new to importing. The seller handles the main shipping leg and the insurance, so it feels like a simple, hands-off solution.

But that convenience can be deceptive and often hides extra costs. The seller’s forwarder might hit you with inflated destination fees (like terminal handling charges) that you have no choice but to pay. Since you didn't hire them, you have zero leverage to negotiate, and those surprise bills can eat into your profits fast.

The biggest issue with CIF is the false sense of security it provides. The insurance policy the seller buys is usually the absolute minimum required. It might only cover a fraction of your cargo’s value and often has major exclusions. If something goes wrong at sea, you’re stuck filing a claim with an overseas insurer you’ve never dealt with—a process that is rarely quick or easy.

This cost difference is even visible in national trade data. China's exports-to-imports ratio, which often compares FOB export values to CIF import values, was 119.08% in October 2023. That CIF import value includes freight and insurance—costs that can add 4-8% to the total—showing just how much extra buyers absorb under this term. For a deeper dive into these trade dynamics, the World Bank offers detailed data specific to the CN region.

Pinpointing the Transfer of Cost and Risk

When you get right down to it, the biggest difference between CIF and FOB comes down to one single moment in the shipping process. This is the exact point where the responsibility for costs—and more importantly, the risk of loss or damage—passes from the seller to you, the buyer. Getting this right isn't just a technical detail; it has real, tangible impacts on your budget and operations.

FOB: A Clean Handover

With a Free On Board (FOB) shipment, the transfer point is clear and happens relatively early. The seller's job is done, and their liability ends, the second your goods are safely loaded onto the ship you've chosen at the port of origin. From that moment on, you own the risk and you're the one paying for the main sea journey.

CIF: The Nuance That Catches People Out

Cost, Insurance, and Freight (CIF) is where things get a bit more complex, and it’s a common point of confusion for importers. While the seller pays for the main freight and arranges an insurance policy for the journey to your destination port, the transfer of risk actually happens at the very same point as FOB—as soon as the goods are on board the vessel at the origin port.

This is hands-down the most misunderstood part of CIF. The seller pays for the freight, but the buyer carries the risk while the ship is at sea. If something happens to your cargo mid-journey, it's up to you, the buyer, to file a claim against the insurance policy the seller took out.

The Journey Step-by-Step

Let's break down how this works in a real-world scenario. Picture a container of goods moving from a factory in Guangzhou, China, to the Port of Rotterdam in the Netherlands.

- Step 1: Factory to Port of Origin: For both CIF & FOB, the seller handles all the costs and risks of getting the goods from their facility to the Port of Guangzhou. This includes handling export customs clearance.

- Step 2: Loading onto the Vessel: The seller also covers the cost of loading the container onto the ship. The instant that container is safely on deck, the risk transfers to the buyer—this is true for both FOB and CIF.

- Step 3: Main Sea Freight: Here’s where the two terms diverge. Under FOB, the buyer pays for the ocean voyage. Under CIF, the seller pays for it.

- Step 4: Insurance During Transit: An FOB buyer is responsible for arranging their own cargo insurance. With CIF, the seller arranges the policy, but don't forget, you're the one who needs to make a claim if anything goes wrong. You can learn more about your coverage options in our guide on insurance for international shipping.

This side-by-side comparison really shows how the buyer's involvement changes, contrasting the hands-on control you get with FOB against the more hands-off nature of CIF.

As the flowchart illustrates, an FOB buyer is actively managing the main leg of the shipment. A CIF buyer, on the other hand, only takes over once the vessel has arrived at their local port.

Detailed Cost and Risk Transfer Points

To make this even clearer, the table below breaks down who is responsible for what at each stage of the shipping journey. It pinpoints the exact moment both financial liability (cost) and the risk of loss or damage shift from the seller to the buyer.

| Stage of Shipment | FOB Responsibility (Buyer/Seller) | CIF Responsibility (Buyer/Seller) |

|---|---|---|

| Export Haulage (Factory to Port) | Seller | Seller |

| Export Customs Clearance | Seller | Seller |

| Origin Terminal Handling Charges | Seller | Seller |

| Loading onto Vessel | Seller | Seller |

| Risk of Damage During Transit | Buyer (from loading) | Buyer (from loading) |

| Main Freight (Sea/Air) | Buyer | Seller |

| Insurance | Buyer | Seller (arranges, but Buyer claims) |

| Destination Terminal Charges | Buyer | Buyer |

| Import Customs Clearance | Buyer | Buyer |

| Import Duties & Taxes | Buyer | Buyer |

| Final Delivery (Port to Door) | Buyer | Buyer |

This detailed view underscores the critical handover point: once the goods are on board the ship. While the seller pays for freight and insurance under CIF, the buyer has shouldered the risk for the entire main transit.

From a macroeconomic perspective, the choice of Incoterm can even tell a story about a country's trade health. For instance, tracking China's FOB export growth shows dramatic fluctuations, from a peak of 136.7% in 1994 to a low of -29.2% during the 2009 global financial crisis. Valuing exports on an FOB basis strips out international freight costs, giving a clearer picture of a nation's raw production and competitiveness.

Choosing the Right Incoterm for Your Business

Picking between CIF and FOB isn't just a tick-box exercise on a contract. It's a strategic move that directly affects your costs, your level of control over the shipment, and how much work lands on your desk. There’s no single right answer here—just the one that fits your company’s experience, resources, and appetite for risk. You have to look past the initial price on the quote to make the smart call.

For someone just starting out in importing, or for a smaller business without a dedicated logistics team, the simplicity of a CIF (Cost, Insurance, and Freight) agreement is a huge draw. The seller takes care of the headaches of booking the vessel and arranging insurance, which means less upfront hassle for you, the buyer. This lets you focus on your actual business, even if it comes at a slightly higher all-in cost.

But as your business scales, so does the need for tighter control and better cost management. This is the point where FOB (Free On Board) almost always becomes the better choice for seasoned importers.

Evaluating Your Business Needs

If you're importing a high volume of goods and have logistics partners you trust, FOB is the way to go. By choosing your own freight forwarder—like Upfreights—you gain the power to negotiate better shipping rates and secure more comprehensive insurance cover. Most importantly, you get full visibility into your supply chain. This direct control is vital for managing inventory, hitting deadlines, and dodging the nasty surprise of hidden destination charges that frequently pop up with CIF shipments.

Flipping the coin, an exporter might offer CIF terms as a strategic move to break into a new market. By quoting a simple, all-inclusive price to the buyer's port, they make their products more appealing and lower the barrier to entry for an importer who might be new to the game. It can be a great sales tactic, even if the buyer ends up paying more than they would have by arranging shipping themselves.

At its core, the decision boils down to convenience versus control. If your priority is a simple, hands-off transaction, you might lean towards CIF. But if you're focused on optimising your supply chain and trimming long-term costs, an FOB agreement will serve you better nine times out of ten.

This isn't just theory; it's reflected in how global trade is measured. For instance, in November 2025, China's merchandise trade showed total exports at 23,456 hundred million yuan on an FOB basis, while imports were 15,531 hundred million yuan on a CIF basis. This standard practice of valuing imports with shipping costs baked in and exports without them perfectly illustrates the fundamental cost difference between the two terms. You can dig into these kinds of trade statistics on CEICdata.com.

The choice also fits into a broader spectrum of Incoterms, each with a different split of responsibilities. To get a feel for the full range of options, our guide on the EX Works price definition offers great context on an Incoterm where the seller has the absolute minimum obligation. In the end, truly understanding why each term exists is what gives you the power to choose the one that best supports your company’s financial and operational goals.

Answering Your Top CIF & FOB Questions

When you're getting down to the nuts and bolts of a shipping contract, a few key questions about CIF and FOB always seem to pop up. Getting these details straight from the start is the key to avoiding nasty surprises with costs or delays down the line. Let's tackle some of the most frequent queries we hear from importers and exporters.

Which One Gives a Buyer a Better Deal?

Nine times out of ten, FOB (Free On Board) gives buyers far more control and usually a much better final price. A CIF quote can look appealing because it's a single, all-in number, but that simplicity often hides inflated freight and insurance costs that the seller has marked up for a bit of extra profit.

When you choose FOB, you bring in your own freight forwarder—someone like Upfreights. This puts you in the driver's seat, letting you shop around and lock in genuinely competitive shipping rates. That direct control almost always leads to a lower total landed cost than you'd get with a bundled CIF price. The transparency alone is worth it for keeping your budget in check.

Who's in Charge of Customs Paperwork?

This is a classic point of confusion, but the rules are actually crystal clear and don't change whether you're using CIF or FOB. The responsibilities are split right down the middle.

- Export Customs: The seller always handles the paperwork, fees, and procedures to get the goods cleared for export from their country.

- Import Customs: The buyer is always responsible for dealing with import clearance, paying duties, and handling taxes once the shipment arrives in the destination country.

This division of labour is a constant for both Incoterms.

The most important thing to remember is that neither CIF nor FOB gets the buyer off the hook at the destination port. You are always going to be managing the import side of things, which is exactly why having a trustworthy partner on your side of the ocean is a game-changer.

Does the CIF Insurance Cover My Cargo All the Way to My Warehouse?

Absolutely not. This is probably the single most costly misunderstanding an importer can make. The insurance policy the seller takes out under a CIF contract is designed to cover one thing only: the main sea journey from the port of loading to the port of destination.

The moment your cargo is lifted off that ship, the seller's insurance policy is no longer in effect. You are completely on your own for any damage or loss that might happen during unloading, while it's sitting in a customs warehouse, or during the final truck journey to your facility. It's a massive gap in coverage that catches a lot of new importers out. To be fully protected, you must arrange your own separate insurance for that last, critical leg of the journey.