In the world of international shipping, FOB (Free On Board) is a term you'll hear constantly. So, what does it actually mean?

Think of it as a clearly defined handover point in a relay race. The seller is the first runner, carrying the baton (your goods) all the way to the starting line of the main race—the ship. The moment the goods are safely loaded on board that vessel, the baton is passed. You, the buyer, are the next runner, and the race is now yours to finish.

What FOB Really Means for Your Shipment

FOB is one of the official Incoterms—a set of globally recognised rules that prevent misunderstandings between buyers and sellers. It’s all about creating a single, universally understood point where responsibility for the shipment transfers. This point dictates who pays for each part of the journey and, crucially, who is on the hook financially if the cargo gets lost or damaged along the way.

The phrase "on board the vessel" is the key. Everything that happens before that moment is the seller’s problem. They're responsible for getting your products from their warehouse to the port, clearing them for export, and paying all the local port fees to get them loaded onto the ship.

But the second your cargo is loaded, the tables turn. A complete switch happens. Suddenly, you, the buyer, take over. All subsequent costs—the main ocean freight, marine insurance, and any charges at the destination port like customs duties and final delivery—are now your responsibility.

This clean split is precisely why FOB is so common, especially for goods coming out of major manufacturing countries. The meaning of 'FOB' in international trade, particularly in the context of China, is fundamental. In fact, estimates suggest that around 70% of China's exports are handled on FOB terms. If you want to dive deeper into this, you can find more insights about FOB shipping from China on modaknits.com.

Key Takeaway: FOB establishes a clean line in the sand. The seller handles everything before the goods are on the ship, and the buyer takes over for everything after. This clarity is invaluable for avoiding costly disputes down the road.

To make this handover crystal clear, let's look at who does what.

FOB At a Glance: Buyer vs. Seller Responsibilities

The table below gives you a quick summary of how the key tasks are divided between the buyer and seller under standard FOB Incoterms. It's a great cheat sheet for understanding who is accountable for each stage of the shipping process.

| Responsibility | Seller (Exporter) | Buyer (Importer) |

|---|---|---|

| Goods & Packaging | ✓ Prepares and packages goods for export | ✗ |

| Inland Transport to Port | ✓ Arranges and pays for transport to the port of loading | ✗ |

| Export Customs | ✓ Handles all export documentation and fees | ✗ |

| Port Handling (Origin) | ✓ Covers charges for loading goods onto the vessel | ✗ |

| Main Freight | ✗ | ✓ Arranges and pays for ocean or sea freight |

| Cargo Insurance | ✗ | ✓ Secures insurance for the main journey |

| Port Handling (Destination) | ✗ | ✓ Pays for unloading and handling at the arrival port |

| Import Customs | ✗ | ✓ Manages all import clearance, duties, and taxes |

| Final Delivery | ✗ | ✓ Arranges and pays for transport to the final destination |

As you can see, the seller’s duties end once the cargo is loaded, and the buyer’s begin at that exact same point. It’s a straightforward division that makes managing international shipments much more predictable.

When Does the Responsibility Actually Shift?

The entire concept of FOB boils down to three simple yet powerful words: "on board the vessel." This isn't just shipping lingo; it's the precise, legally defined moment when your shipment officially stops being the seller's headache and becomes yours. Getting this timing right is everything when it comes to managing risk and money in global trade.

Picture this: your container of brand-new electronics is sitting on the quay at the Port of Shanghai. Your supplier has done their part – they've manufactured the goods, packed them, trucked them to the port, and cleared them for export. Now, a giant gantry crane lifts the container high into the air, swinging it out over the water toward the ship. This is the moment of truth.

This handover point is often described as crossing the "ship's rail." It's helpful to think of it as an invisible line drawn along the edge of the vessel. Before your container crosses that line, the seller is 100% responsible for anything that happens to it. If the crane cable snaps and the container smashes onto the dock, that loss is entirely on them.

The Instant the Liability Flips

The very second that container is safely placed onto the ship's deck, the responsibility flips. Instantly. If something happens a moment later—say, another container is loaded improperly by the crew and damages yours—it's now your problem to solve.

This critical moment dictates who pays for what and who takes action from that point forward. Let's stick with our Shanghai electronics shipment to see how this plays out.

- Before the Rail: The seller is on the hook for all costs at the origin port, including the labour and equipment needed to get that container lifted. They carry all the risk if something goes wrong during the loading process.

- At the Rail: This is the transfer. In a split second, responsibility for the goods and their safety moves from the seller to you, the buyer.

- After the Rail: Now, it's your turn. You are responsible for paying the main sea freight, arranging cargo insurance for the journey, and covering all the costs at the destination.

This clear division is what makes FOB so useful in international trade. It gets rid of the "who's to blame?" arguments if something goes wrong, making it clear who needs to file the insurance claim or cover the costs of a disaster.

The "ship's rail" isn't just a physical location; it's a financial and legal line in the sand. Knowing exactly when your goods cross it is your cue to ensure your insurance is active and you're ready to take control.

What This Means for You, the Importer

Grasping this transfer point has a direct impact on your budget and your to-do list. The seller has officially fulfilled their obligation the moment the goods are confirmed as "on board." That's the starting gun for several key actions on your part.

Once those goods are loaded, you need to be ready to:

- Pay for the Ocean Freight: The main transport cost from the origin port to your destination port is now your bill to pay.

- Arrange Cargo Insurance: This isn't optional, it's essential. Since the risk is now yours, you need a solid insurance policy to cover any loss or damage during the long sea voyage.

- Handle All Destination Charges: Every cost that comes up on arrival is your responsibility. This includes terminal handling fees, customs clearance, import duties and taxes, and the final delivery to your warehouse.

This is exactly why a good freight forwarder becomes your most valuable partner when shipping on FOB terms. They act as your representative, taking over the moment the seller's job is done. The "on board" confirmation is their signal to manage the ocean freight booking, coordinate logistics, and ensure your cargo makes a smooth journey from the port all the way to your door.

Navigating FOB Origin vs. FOB Destination

This is where things can get a bit tricky. While the official Incoterms definition for FOB is recognised around the globe, you’ll often see similar-sounding terms pop up, especially in North America. Phrases like FOB Origin and FOB Destination are commonplace for domestic shipments in the US and Canada, but they don't follow Incoterms rules. Instead, they operate under a local framework known as the Uniform Commercial Code (UCC).

Getting this distinction right is absolutely essential. If you mistake a domestic UCC term for the international standard, you could find yourself in a world of hurt—think contractual arguments, surprise costs, and major confusion over who's responsible for your cargo. The legal and financial consequences are poles apart.

The main difference boils down to a simple question: where exactly does the responsibility shift from seller to buyer? For an international FOB Incoterm, it’s a very specific moment—the second the goods are loaded "on board the vessel" at the port. Domestic UCC terms, on the other hand, are all about the final destination.

What Is FOB Origin?

Under the UCC, FOB Origin (sometimes called FOB Shipping Point) hands over responsibility to the buyer much, much earlier. Here, the seller’s job is considered complete as soon as they hand the goods over to the first carrier. That could be a truck pulling up to their factory, long before your shipment ever sees a seaport.

From that point on, you, the buyer, are in the driver's seat. You own the goods and are responsible for everything that happens next.

This includes:

- Arranging and paying for every leg of the journey to your final destination.

- Bearing all the risk if the goods are lost or damaged in transit.

- Filing any insurance claims if something goes wrong.

With FOB Origin, you effectively take control the moment the goods leave the seller's doorstep.

How FOB Destination Works

In contrast, FOB Destination keeps the seller responsible for a lot longer. Under this term, the seller retains full ownership and liability for the cargo until it is safely delivered to the buyer's specified location. They manage the entire shipping process, pay for it, and carry all the risk until the goods are at your door.

Your responsibility only kicks in once the delivery is complete. While this offers maximum protection for a buyer, it also means you have virtually no say over the logistics. It's not a common choice for international trade, where importers usually prefer to manage their own freight to keep a tight grip on costs and timelines.

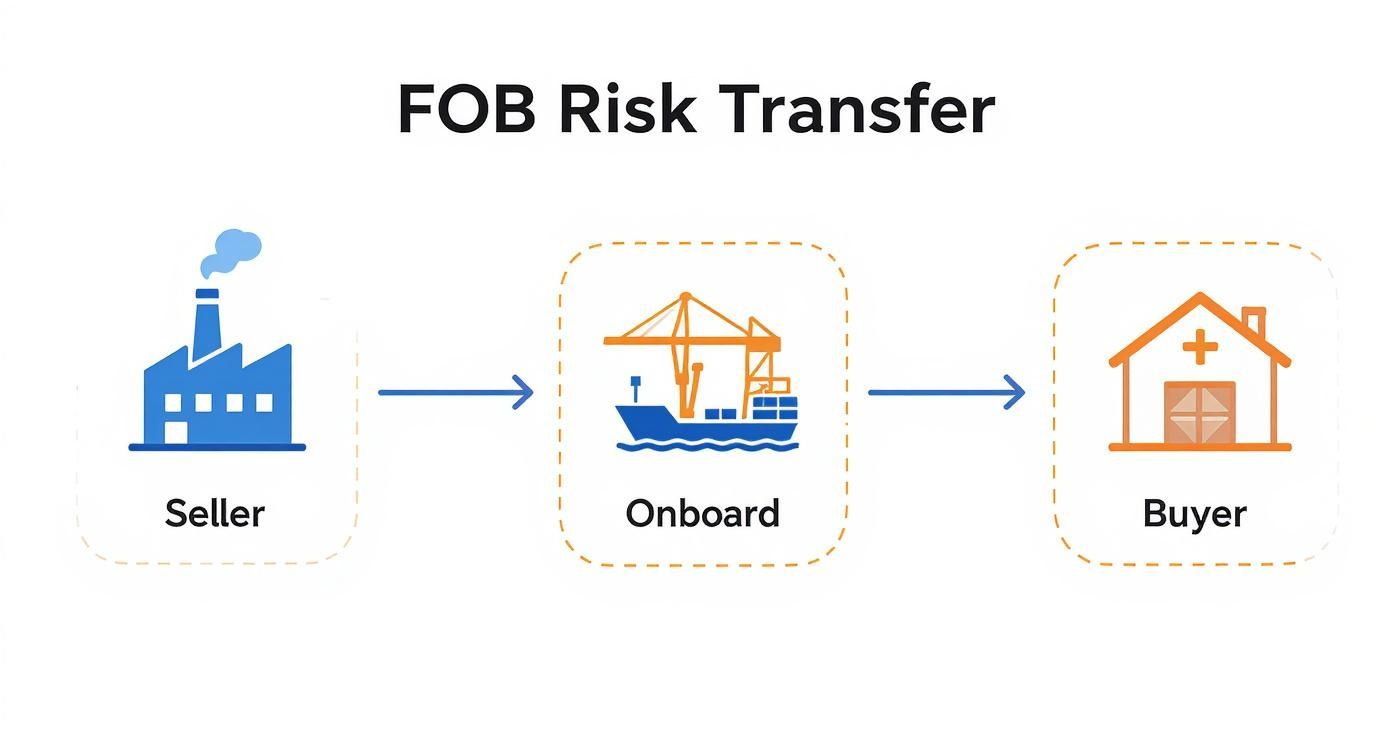

The image below gives a great visual of that crucial handover point in a standard international FOB shipment.

As you can see, the risk passes from the seller to the buyer only after the goods are safely loaded onto the ship—that’s the heart of the international FOB Incoterm.

Crucial Distinction: Always, always clarify in your contracts whether "FOB" refers to the Incoterms 2020 rules (e.g., "FOB Shanghai") or a domestic UCC term. A single line of clarification can save you from thousands of pounds in potential losses and legal headaches.

Incoterms FOB vs Domestic FOB Variations

The confusion between these terms really comes down to three things: when the risk transfers, who pays for the freight, and when the legal ownership of the goods changes hands. To clear things up, let's break down the differences side-by-side.

| Aspect | Incoterms FOB (Port of Loading) | FOB Origin (UCC) | FOB Destination (UCC) |

|---|---|---|---|

| Risk Transfer Point | When goods are loaded "on board" the vessel at the named port of origin. | When goods are passed to the first carrier at the seller's location. | When goods are delivered to the buyer's specified final destination. |

| Freight Payment | Buyer pays for the main international freight from the port of origin. | Buyer pays for all freight charges from the point of origin. | Seller pays for all freight charges to the final destination. |

| Title Ownership | Title generally transfers to the buyer once goods are loaded on the vessel. | Title transfers to the buyer at the point of shipment (origin). | Title transfers to the buyer upon delivery at the destination. |

For anyone importing internationally, especially from manufacturing hubs like China, the standard you’ll almost always encounter is the Incoterms version of FOB. Still, knowing these domestic variations exist is your best defence against ambiguous contracts. Ensuring everyone is on the same page is the bedrock of a smooth, predictable supply chain.

Why FOB Dominates in Global Trade

Ever wonder why so many suppliers, especially in manufacturing powerhouses like China, lean so heavily on FOB terms? It's not a coincidence. It's a smart, calculated move based on control, cost, and even national policy. Getting inside their heads on this gives you, the importer, a real edge when it's time to talk terms.

The biggest driver is control over local logistics. Under FOB, the seller handles everything on their home turf. Think about it: inland trucking, port fees, and getting the goods cleared for export. Your supplier likely has solid, long-standing relationships with local logistics providers.

By managing these pieces themselves, they tap into their negotiated rates and work with people they know and trust. It drastically cuts their risk of surprise delays or costs on their end, making sure they can get your cargo "on board the vessel" without a hitch and on budget.

Seller's Comfort and Expertise

For a factory manager in Shenzhen, dealing with local port authorities and customs is just another Tuesday. They know the system, speak the language, and have their processes dialled in. Asking them to suddenly start managing international sea freight and navigating UK import laws throws a wrench in the works.

FOB lets sellers stick to what they're good at: making your product and getting it to the port. Once the crane lifts that container onto the ship, their job is done. They can invoice you and get paid without sweating potential shipping delays or customs hold-ups on the other side of the world. This makes their own financial forecasting far simpler.

The Supplier's Perspective: FOB creates a clear, clean handover point. It keeps them operating in their comfort zone, shielding them from the often-unpredictable world of global shipping and foreign customs rules.

But this preference isn't just about what's easiest for one company; it has a ripple effect on how we see global trade as a whole.

Impact on National Trade Statistics

The Incoterm you choose actually influences a country's economic report card. For example, China’s official customs and trade data is typically recorded on an FOB basis. This means the value of an export is captured the moment it's loaded on the ship—before the cost of international freight and insurance gets tacked on.

On the flip side, many importing nations record their data on a CIF (Cost, Insurance, and Freight) basis, which includes those extra costs. This mismatch is why China's officially reported export figures are often lower than what their trading partners report as imports. If you want to dive deeper into this statistical quirk, you can find more insights on how trade data is reported on federalreserve.gov.

This might seem like a detail for economists, but for an importer, it highlights why the meaning of FOB is so vital. Your supplier's preference is a mix of practical business sense and deep-rooted economic practices. When you understand their position, you can anticipate their needs and negotiate a much better deal. For a closer look at how these rules shape global commerce, see our guide on what to expect from Incoterms 2025.

Choosing Between FOB and Other Incoterms

While Free On Board (FOB) is one of the most common terms you'll hear, it’s far from the only game in town. To really get a feel for what FOB means in practice, it helps to line it up against the other major Incoterms. Picking the right one always comes down to a trade-off between your budget, your appetite for risk, and just how much control you want to have over your shipment.

Think of it this way: when you choose an Incoterm, you're deciding at what point you want to take the wheel. Do you want to take over once the journey is already underway, or do you prefer to manage every single step from the get-go? Each term gives a different answer, shifting costs and responsibilities in some pretty big ways.

FOB vs EXW (Ex Works)

Putting FOB next to EXW (Ex Works) is the quickest way to see how much of the initial legwork FOB actually saves you. With EXW, the seller’s job is basically done the moment the goods are ready for pickup at their own facility—be it a factory or a warehouse. That’s it. They don't even have to load it.

From that point on, the buyer is on the hook for absolutely everything.

- Loading: You have to arrange and pay for the truck to load the cargo at the seller's premises.

- Export Formalities: You’re responsible for navigating all the export customs paperwork and procedures in a country you might not be familiar with.

- The Entire Journey: You manage and fund every single step of the transport, from the factory door right to your own.

Analogy: Think of EXW as buying a sofa "for collection only." The seller has it waiting in their back room, but it's completely up to you to hire a van, get it loaded, and drive it home. FOB, on the other hand, is like the seller agreeing to deliver that sofa to the local port for you, taking care of all the hassle to get it there.

EXW offers a buyer total control, but that comes with maximum risk and responsibility. For anyone not well-versed in the origin country's logistics, it can be a real headache. FOB strikes a much more practical balance for most importers.

FOB vs CIF (Cost, Insurance, and Freight)

The classic debate for sea freight importers is often FOB versus CIF (Cost, Insurance, and Freight). At first glance, CIF looks like the easier option for the buyer. After all, the seller handles and pays for the main sea voyage and even arranges a basic insurance policy. Simple, right?

Not so fast. Here’s the critical detail many people miss: the point where risk transfers from seller to buyer is identical for both FOB and CIF. In both scenarios, you, the buyer, officially assume all risk of loss or damage as soon as the goods are loaded "on board the vessel" at the port of origin.

This means that under a CIF agreement, if your cargo is damaged out on the ocean, it's still your problem to sort out the insurance claim. The catch is that the seller chose the insurance policy, and they likely picked the cheapest, most minimal coverage they could find—which may not be enough to protect your investment. For a detailed breakdown of these differences, our article on FOB and CIF offers further insights.

FOB vs FCA (Free Carrier)

Finally, let's clear up the confusion between FOB and FCA (Free Carrier). People often mix these two up, but the key difference lies in exactly where the handover takes place. With FOB, that handover point is crystal clear: when the goods are loaded "on board the vessel."

FCA is far more flexible. Here, the seller's responsibility ends once they deliver the goods to a carrier you've chosen, at a specific named place. That "named place" could be the seller's own warehouse, a nearby container yard, or even an airport cargo terminal. This flexibility is why FCA is now the officially recommended term for modern containerised sea freight and is the go-to standard for all air freight.

The continued dominance of FOB, particularly in China's export market, is heavily influenced by government policies and long-standing industry habits. Chinese firms have become powerful players across the entire maritime supply chain, thanks in part to massive state backing. Between 2010 and 2018, state support for Chinese shipping and shipbuilding firms was estimated at around $132 billion. This has given them a competitive edge, making it easy for local exporters to stick with the FOB terms they know so well. You can discover more about China's state-backed shipping industry on csis.org.

Ultimately, choosing the right Incoterm isn't just a logistical decision; it's a strategic one. For many importers shipping by sea, FOB continues to offer that sweet spot—a healthy balance of control and manageable responsibility.

Your Action Plan for a Smooth FOB Shipment

Knowing what FOB means is one thing, but actually putting that knowledge into practice is what gets your goods home safely and on budget. A successful FOB shipment hinges on having a clear, organised plan, ready for you to take the reins the moment your seller’s job is done.

Think of this checklist as your playbook, turning theory into a process you can use every time. Following these steps will help you sidestep common traps like surprise fees, gaps in insurance coverage, or customs holdups that can throw a wrench in your entire supply chain.

Step 1 Nominate Your Freight Forwarder Early

Your first and most important move is to pick a reliable freight forwarder. Don't leave this to the last minute. As soon as you've shaken hands on the FOB deal with your supplier, get your forwarder nominated.

A great forwarder is more than just a booking agent; they're your logistics partner on the ground. They need a running start to coordinate with your seller, book space on a vessel, and get all the pre-shipment ducks in a row before your cargo even sees the port. This single proactive step is the bedrock of a seamless handover.

Step 2 Coordinate Port Delivery and Freight Booking

With your forwarder in place, open a clear line of communication between them and your seller. Your forwarder will issue a booking confirmation and, crucially, give the seller a hard deadline for delivering the container to the right terminal at the port.

While your seller handles that initial journey to the port, it's your forwarder who manages the main event: the sea freight booking. This teamwork ensures the cargo shows up on time to be loaded onto the ship, avoiding costly storage fees.

Pro-Tip: Always, always get cargo insurance. The second your goods are "on board," all risk transfers to you. A solid marine insurance policy is a small price to pay for the peace of mind that your investment is protected against loss or damage on its long journey across the ocean.

Step 3 Manage Documentation and Customs Clearance

Once the ship sets sail, your attention needs to pivot to the paperwork. Your freight forwarder will be the one to issue the Bill of Lading (B/L)—the all-important document that serves as a receipt, a contract, and proof of ownership for your goods.

When the vessel arrives, your forwarder will also handle destination port charges and walk you through customs clearance. To make this part of the process truly smooth, it's a good idea to check for any potential shipping restrictions that might affect your products or destination country ahead of time. Having all your documents—like the commercial invoice, packing list, and B/L—in perfect order is the key to getting your goods released without a hitch.

Common Questions About FOB Answered

Even when you feel you've got a good handle on what FOB means, real-world shipping always throws a few curveballs. This is where theory hits the dock, and getting clear answers is vital to sidestepping expensive errors and frustrating delays.

Let's dive into some of the most common questions importers ask when they're actually putting FOB into practice.

Who Handles Customs Clearance with FOB?

This is a big one. The responsibility for customs is split right down the middle, with a very clear handover point.

The seller takes care of everything on their end. That means handling all export customs procedures and footing the bill for any related fees in their country. It’s their job to get the goods legally cleared and ready to leave the port of origin.

Once those goods are safely loaded onto the vessel, the baton passes to you. From that moment on, you, the buyer, are responsible for the entire import customs clearance process at the destination. This covers preparing all the right paperwork, paying import duties and taxes, and dealing with any inspections customs officials might require.

Is Insurance Required for an FOB Shipment?

Technically, no. The official FOB rule doesn't force you to buy insurance. But in the real world? Shipping without it is a huge gamble. Don't forget, all the risk and liability become yours the second your cargo is on that ship.

Think about it: if a storm hits at sea, a fire breaks out, or a container is lost overboard, the financial loss is 100% yours without insurance. Securing a solid marine insurance policy isn't just a "best practice"—it's a fundamental part of protecting your investment.

Can I Use FOB for Air Freight?

This is a critical mistake we see all too often. The official Incoterms rules are very clear: you should not use FOB for air freight.

The term itself is built around the action of loading goods "on board the vessel," a concept that simply doesn't fit with air transport. The right tool for the job here is FCA (Free Carrier). Using FCA provides a clear, appropriate risk transfer point for when goods are handed over to an airline. To get a better grasp of these kinds of distinctions, this freight forwarding terminology is a great resource.