When you bring goods in from China, you'll encounter a crucial tax known as Value Added Tax (VAT). Think of it as a sales tax, but instead of being collected at a shop counter, it's charged right at the border when your shipment arrives.

This tax isn't just applied to the price you paid for your products. It’s calculated on the total value of your shipment, which includes the cost of the goods, the shipping fees, and any insurance you've paid. This is a key detail for accurately calculating your final landed cost and avoiding any nasty surprises.

What Exactly Is Import VAT from China

Picture import VAT as a toll booth for your goods as they enter a new country. It’s not a tax levied by China; it’s a consumption tax charged by the government of the country you're importing into. The whole point is to level the playing field, making sure a product you import from China is taxed just like one made and sold down the street.

This is a critical distinction to grasp. You pay your supplier in China for the products themselves, but the VAT is a completely separate payment that goes directly to your own country's customs authority. And the responsibility for paying it? That almost always lands squarely on the importer's shoulders—which is you.

Who Is Responsible for the Payment

Legally, the person or company listed as the "importer of record" on the customs declaration is the one who has to pay the import VAT. This is where your shipping terms, the famous Incoterms, really come into play.

For example, if you've agreed to DDU (Delivered Duty Unpaid) terms, you, the buyer, are on the hook for all import taxes and duties when the goods land. Getting your head around the differences between shipping agreements like DDU and DDP is absolutely vital for managing these costs effectively. You can learn more about these differences in our detailed guide on DDU and DDP Incoterms.

At its heart, import VAT is designed to create tax neutrality. It prevents foreign goods from having an unfair price advantage over domestic products simply because they haven't had local sales tax applied yet.

Why Getting It Right Matters

Getting your VAT calculation wrong or failing to pay it on time can throw a serious wrench in your operations. Your shipment could get stuck at customs, racking up expensive storage fees and causing major delays that disrupt your entire supply chain.

Worse still, you could be hit with hefty financial penalties for non-compliance. Correctly accounting for the VAT from China right from the start isn't just good practice; it's a cornerstone of running a profitable and sustainable importing business. The process requires precise declarations, and for anyone bringing goods into the UK, guides on paying for imports declared via the Customs Declaration Service are an invaluable resource.

Import VAT from China At a Glance

To make this a bit clearer, here’s a quick breakdown of what these concepts mean for your business in a practical sense.

| Concept | What It Means for Your Business |

|---|---|

| What is VAT? | A consumption tax on the total value of your imported goods (product cost + shipping + insurance), charged by your home country. |

| Who Pays? | You, the importer of record. This is determined by the Incoterms you agree upon with your supplier. |

| Why is it Charged? | To ensure imported goods are taxed fairly compared to locally produced goods, creating a level playing field. |

| Risks of Non-Payment | Shipment delays, storage fees at the port, and potential financial penalties from customs authorities. |

| Key to Success | Accurately calculate and budget for VAT as part of your total landed cost to protect your profit margins and maintain compliance. |

Ultimately, treating VAT as an integral part of your financial planning from day one will save you a world of headaches and keep your supply chain running smoothly.

How to Calculate Your VAT Payment Correctly

Figuring out your VAT bill isn't as simple as slapping a percentage on the price you paid your supplier in China. Customs officials have a specific way of adding things up to get to what they call the taxable amount, and getting your head around this is the secret to accurately predicting your total landed costs.

Think of it this way: the price you paid for your products is just the starting point. To get the final value that customs will tax, you need to add a few more crucial costs into the mix. This includes what you paid for shipping, any transit insurance, and—this is the important part—any customs duties that are also due.

Your final VAT bill is then calculated on this all-inclusive, final value.

The whole process, from the initial factory price to the final tax payment, is laid out in the graphic below.

As you can see, import VAT isn't a single event. It's the final step after all the other costs have piled up as your goods journey from the factory floor to your warehouse door.

The VAT Calculation Formula Explained

So, how does this actually work with numbers? The formula customs authorities use is pretty simple once you see all the pieces laid out.

(Cost of Goods + Shipping & Insurance + Customs Duty) x VAT Rate = Total VAT Payable

Let's break that down:

- Cost of Goods: This is the price right there on the commercial invoice your Chinese supplier gave you.

- Shipping & Insurance: This lumps together all the costs needed to get your shipment to the border of the destination country.

- Customs Duty: This is a completely separate tax based on your product’s specific HS code. You have to figure this out before you can even touch the VAT calculation.

This layered method ensures the tax is based on the full, true value of the goods as they're about to enter the local market. It’s a massive part of international trade finance. To give you some perspective, in just January and February 2025, the revenue from VAT and consumption tax on goods imported into China hit around 262.5 billion yuan. You can find more data on China's import tax revenue over on Statista.com.

A Practical Example of Calculating VAT from China

Alright, let's put the formula to work with a real-world example. Say you're importing £10,000 worth of consumer electronics from Shenzhen into the UK.

- Start with the Goods' Value: The cost of your electronics is £10,000.

- Add Logistics Costs: Your sea freight and insurance for the shipment totals £1,500.

- Calculate Customs Duty: For this type of electronic, the customs duty rate is 3%.

Duty Calculation: (£10,000 + £1,500) x 3% = £345

- Determine the Full Taxable Amount: Now, you add everything together.

Taxable Amount = £10,000 (Goods) + £1,500 (Shipping) + £345 (Duty) = £11,845

- Apply the VAT Rate: The UK’s standard VAT rate is 20%.

VAT Payable = £11,845 x 20% = £2,369

In this scenario, your final VAT payment to UK customs would be £2,369. Once you nail this calculation, you're no longer guessing. You're turning abstract tax rules into a concrete financial planning tool, which means no more nasty surprises when your shipment finally lands.

Navigating the world of import taxes when bringing goods in from China can feel like trying to read a map with different languages for every country. There’s no single, universal rulebook. The tax you pay and the process you follow will look completely different depending on whether your shipment is destined for Rotterdam, London, Los Angeles, or Sydney.

Getting these regional rules right isn’t just about staying compliant; it's about smart financial planning. A strategy that works perfectly for a shipment to the European Union might create a cash-flow headache or a customs nightmare for the exact same goods heading to the UK. Let's break down what you need to know for the major markets.

The European Union: Smoothing Things Over with IOSS

If you're selling directly to consumers in the EU, the Import One-Stop Shop (IOSS) system is your best friend. It was specifically designed to simplify VAT for e-commerce shipments valued at €150 or less.

Before IOSS, your European customer would often get hit with an unexpected VAT bill from the courier upon delivery—not exactly a great customer experience. Now, IOSS lets you, the seller, collect the correct EU VAT right at the checkout. You then handle all that collected tax through a single monthly return in one EU country. It makes customs clearance faster and keeps your customers happy.

- The Big Win: No more surprise tax bills for your customers when their package arrives.

- The Limit: This system is only for shipments with a total value of €150 or less.

- How It Works: You register for an IOSS number, show it to your shipping provider, and charge VAT at the point of sale. Simple as that.

Once your shipment’s value tips over that €150 mark, you’re back to the standard import process where VAT is assessed and paid at the border.

The United Kingdom: A Cash-Flow Lifeline with PVA

The UK has a fantastic tool for VAT-registered businesses called Postponed VAT Accounting (PVA). This system doesn't change if you pay import VAT, but it fundamentally changes when you pay it, which can be a huge boost for your cash flow.

In the old days, you had to pay the import VAT upfront the moment your goods from China cleared customs, tying up your cash. With PVA, you get to skip that upfront payment. Instead, you simply account for the VAT on your next regular VAT return.

Postponed VAT Accounting is a genuine game-changer for working capital. It means UK importers can avoid having large sums of cash locked up in VAT payments at the port, freeing up that money for inventory, marketing, or anything else the business needs.

You effectively declare the import VAT and reclaim it on the same return, making the cash impact at the border zero. It turns a hefty upfront payment into a simple entry on a form.

The United States: No VAT, but Watch Out for Sales Tax

At first glance, the United States seems much simpler. It doesn't have a national VAT system like the UK or the EU, so you won't pay any federal import VAT when your goods arrive from China.

But don't get too comfortable. The tax complexity in the US just shows up at a different stage: the final sale. While there’s no tax at the border, state-level sales and use taxes are a major factor. If your business establishes a connection (known as "nexus") in a particular state, you become responsible for collecting and paying sales tax on every transaction with customers in that state.

It's a common trap to think importing into the US is a tax-free ride. The tax burden is just shifted from the customs checkpoint to the final point of sale, and it varies from state to state. For anyone in e-commerce selling across the country, this is a critical detail to manage.

Before we look at other regions, let's quickly compare these systems side-by-side.

Comparing Import Tax Systems for Chinese Goods

A look at VAT and sales tax differences in key global markets.

| Region | Primary Tax System | Key Compliance Strategy for Importers |

|---|---|---|

| European Union | Value Added Tax (VAT) | Use the IOSS scheme for B2C shipments under €150 to simplify VAT collection and improve customer experience. |

| United Kingdom | Value Added Tax (VAT) | Leverage Postponed VAT Accounting (PVA) to defer VAT payment and protect business cash flow. |

| United States | State Sales & Use Tax | Understand and track your "nexus" obligations in each state to ensure you're correctly collecting and remitting sales tax. |

This table highlights just how different the approach needs to be for each market. Now, let's add Canada and Australia to the mix.

Getting Your VAT Documentation Right

Think of your import paperwork as your shipment's passport. If any detail is off or a page is missing, it's not getting across the border. When you're importing from China, flawless documentation is your golden ticket to a smooth customs experience and, just as importantly, an accurate VAT bill.

The whole process really boils down to a few key documents. Together, they paint a clear picture for customs officials: what’s in your shipment, what it's worth, and where it came from. Getting this right from the start helps you sidestep frustrating delays, unexpected fines, or the ultimate headache—having your goods impounded over a simple paperwork mistake.

The Three Pillars of Import Paperwork

Your documentation is the official proof customs authorities rely on to figure out duties and VAT. For any shipment involving VAT from China, it all rests on three foundational documents.

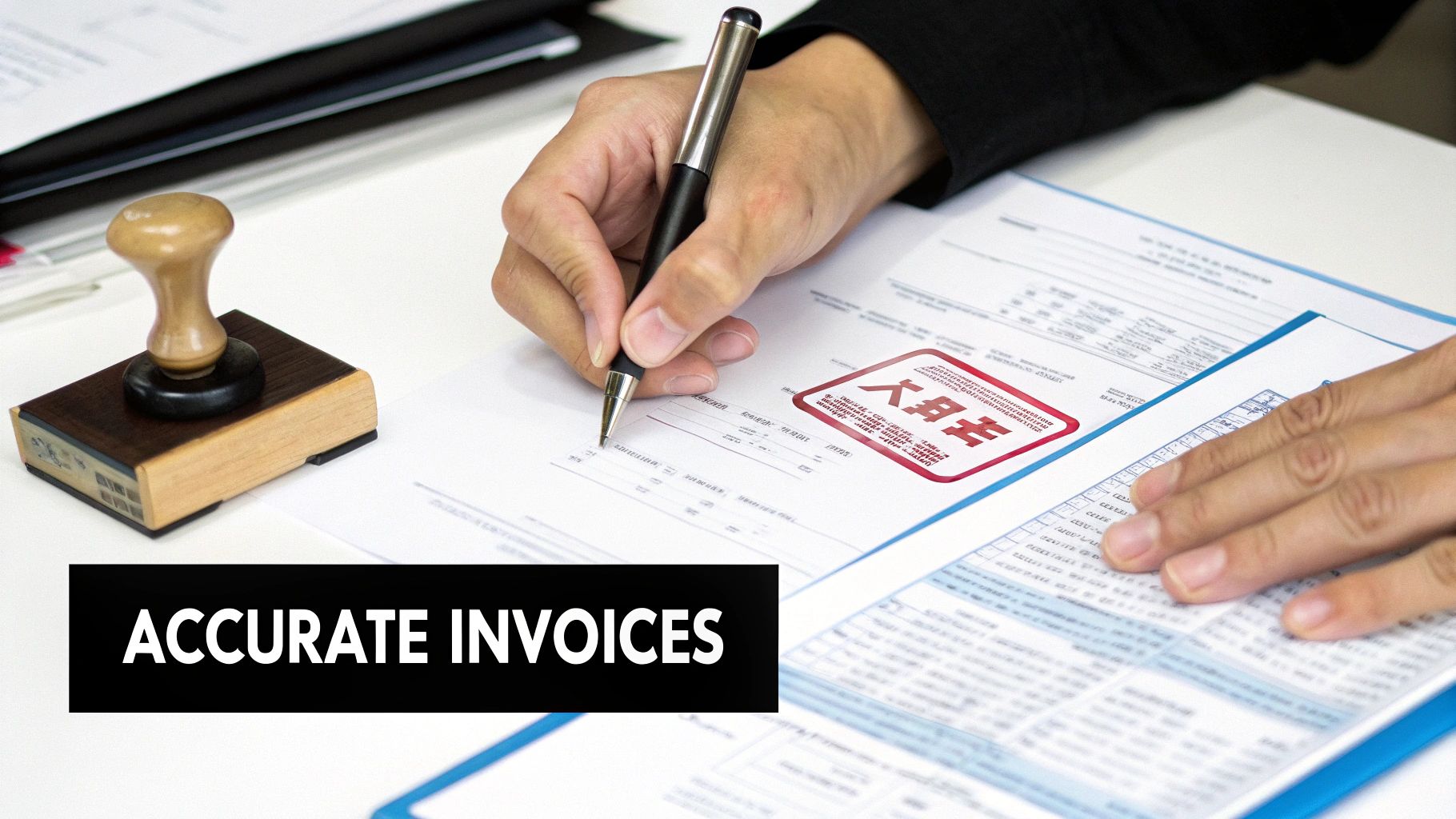

- Commercial Invoice: This is the big one. It's the official bill of sale from your supplier, and it’s the main document customs will use to value your goods.

- Customs Declaration: This is the formal statement you make to customs, laying out all the essential details—what the goods are, their origin, value, and final destination.

- Chinese VAT Invoice (Fapiao): While this is mostly for tax purposes inside China, having a copy on hand can be a great backup to prove the transaction value if questions arise.

Of these three, the commercial invoice has the most influence. In my experience, a vague or incorrect invoice is the single biggest reason for customs holds and surprise tax bills. For e-commerce sellers, mastering the process of downloading AliExpress invoices is a crucial skill, especially if you're sourcing regularly.

Perfecting Your Commercial Invoice

Your commercial invoice needs to be airtight. Every piece of information must be crystal clear, because any ambiguity gives customs officials a reason to second-guess your declared value. That can lead to your shipment being put on hold while they investigate, or they might just decide on a higher value for you.

Your commercial invoice is the story you tell customs about your shipment. If the story has plot holes—like a missing HS code or a vague product description—expect your shipment to be pulled aside for a detailed review.

Make sure your invoice ticks every one of these boxes:

- Full Seller and Buyer Information: Complete and accurate names and addresses are non-negotiable.

- Detailed Product Descriptions: Don't just write "electronics." Be specific: "500 units of Model X Bluetooth speakers."

- Correct HS Codes: Every product needs its own Harmonized System code listed.

- Unit Price and Total Value: Clearly state the price per item and the total value of the sale.

- Incoterms: Specify the shipping terms you agreed on (e.g., FOB, EXW). This defines who pays for what, and when.

- Country of Origin: This is absolutely essential for calculating duties. For a deeper dive, check out our guide on why a Letter of Origin is so important.

When you treat your paperwork with this much attention to detail, it stops being a bureaucratic chore. It becomes your best tool for ensuring your imports are fast, compliant, and predictable.

Smart Ways to Manage Your VAT Cash Flow

That upfront import VAT bill can feel like a punch to your business's working capital. But seasoned importers know a secret: VAT isn’t a final cost. It's a temporary cash flow event. With the right game plan, you can dramatically soften its immediate financial hit when your goods arrive from China.

The first and most fundamental tactic is the VAT reclaim. If your business is VAT-registered in your home country, the import VAT you pay at the border isn't money down the drain. You simply claim it back as input tax on your next VAT return.

While this makes the payment a recoverable expense, it does mean your cash is tied up for a while—at least until your VAT return gets processed and refunded. For many businesses, there are better options.

Powerful Deferment and Accounting Schemes

Beyond just reclaiming what you've paid, many countries offer specific schemes designed to help importers with this exact cash flow problem. These are absolute game-changers, allowing you to account for import VAT without cutting a cheque to customs the moment your shipment lands.

Two of the most valuable tools are:

- VAT Deferment Accounts: Think of this as a direct debit for your import taxes. Instead of paying every single time a shipment arrives, you get to bundle all your import VAT and customs duties into a single, predictable monthly payment. It smooths out your cash flow and massively simplifies your admin.

- Postponed VAT Accounting (PVA): This is even more powerful. Available in the UK and several other regions, PVA lets VAT-registered businesses declare import VAT on their VAT return instead of paying it at the border. You declare the VAT owed and reclaim it on the very same form, which often means there's no cash flow impact at all at the time of import.

Learning to use these financial tools is key to mastering VAT from China. It turns what feels like a costly roadblock at the border into a straightforward accounting task, keeping your working capital safe and sound.

Looking at the Bigger Picture

It also helps to have a sense of the tax world your suppliers live in. China's own domestic VAT system has gone through plenty of reforms. As of 2025, the standard VAT rate there is 13%, though they have lower rates for certain things. You can find more details on China's tax rates on TradingEconomics.com.

Now, this local Chinese VAT is completely separate from the import VAT you'll pay. But it does affect your supplier's pricing. Your negotiations around the EXW price definition, for instance, are directly tied to the costs they carry before your goods ever leave the factory floor. By getting a handle on these cash flow strategies, you gain the financial breathing room to manage your supply chain from start to finish.

Common VAT Mistakes and How to Sidestep Them

When you're importing from China, even a tiny mistake with VAT can spiral into a massive headache. A simple miscalculation or a misunderstood rule might seem minor, but it can easily lead to frustrating customs delays, surprise fines, or even having your entire shipment seized. The smart move is to learn from the common slip-ups others have made so you can keep your own business protected.

Getting VAT right isn't just about ticking a compliance box; it's about protecting your cash flow. Most of the time, importers get into trouble by either trying to creatively lower their tax bill or by just being careless with the paperwork. Either way, customs officials have seen every trick in the book, and the consequences are never worth the risk.

One of the biggest temptations, especially for newcomers, is under-declaring the value of goods. On the surface, it looks like a quick win—lower the declared value, and you lower the VAT you have to pay. But customs officers are trained valuators with access to enormous databases of product prices. If your declared value looks off, they'll flag it in a heartbeat, triggering a full inspection and a costly re-valuation that you have to pay for.

Getting Your Product Classification Wrong

Another landmine is using the wrong Harmonized System (HS) code. Every single product has a specific code that dictates its duty rate, and that rate is a key part of your final VAT calculation. Using an incorrect code, whether by accident or in a deliberate attempt to find a lower duty, is a serious red flag for customs.

This one mistake can cause a domino effect:

- Wrong Tax Payments: You'll be on the hook for back-payments, plus some hefty financial penalties.

- Held-Up Shipments: Customs can lock down your goods until the classification is sorted out.

- A Black Mark on Your Record: Your business could be flagged, meaning more intense scrutiny on every single shipment you bring in from then on.

At the end of the day, honesty is the best policy. Always declare the real transaction value of your goods and find the correct HS code. Any short-term savings you might get from bending the rules just aren't worth the long-term pain of fines and a bad reputation with customs.

Not Understanding Your Shipping Terms

Finally, a surprisingly common and costly error is misinterpreting Incoterms, especially DDP (Delivered Duty Paid). Many importers hear "DDP" and think the supplier is handling absolutely everything, including the VAT in their own country. While the supplier does cover transport and import duties, the responsibility for reclaiming the VAT often still falls squarely on the importer's shoulders. This mix-up can leave you with a messy paper trail, making it impossible to get back the VAT you’re entitled to.

The sheer scale of global trade shows why these details are so critical. China’s economic engine generates a huge amount of tax income—in January and February 2025 alone, its VAT revenue was around 1.51 trillion yuan. You can discover insights into China's tax revenue on Statista.com to get a better sense of the numbers. By sidestepping these common mistakes, you can ensure your piece of this massive trade flow stays both profitable and compliant.

Got Questions About China VAT? We've Got Answers

Let's clear up some of the most common questions that pop up when dealing with VAT on goods coming in from China.

Does Every Shipment from China Get Hit with VAT?

Pretty much, yes. If you're bringing commercial goods into a country with a VAT system, like the UK or anywhere in the EU, you should expect to pay import VAT.

While there used to be some low-value exemptions, those loopholes have been closing fast. The current reality is that almost every single shipment, no matter its value, is subject to VAT.

Can I Get the VAT I Paid on Imports Back?

Absolutely. If your business is registered for VAT in the country you're importing into, you can—and should—reclaim the import VAT.

Think of it as just another business expense. You'll account for it as "input tax" on your regular VAT return, effectively offsetting the initial cash outlay. This means it's a cash flow consideration, not a permanent hit to your bottom line.