Trade agreements are reshaping the landscape of Middle East shipping, creating new opportunities and challenges for businesses across the region. As global commerce evolves, understanding these agreements has become essential for anyone involved in international trade through this strategic maritime hub.

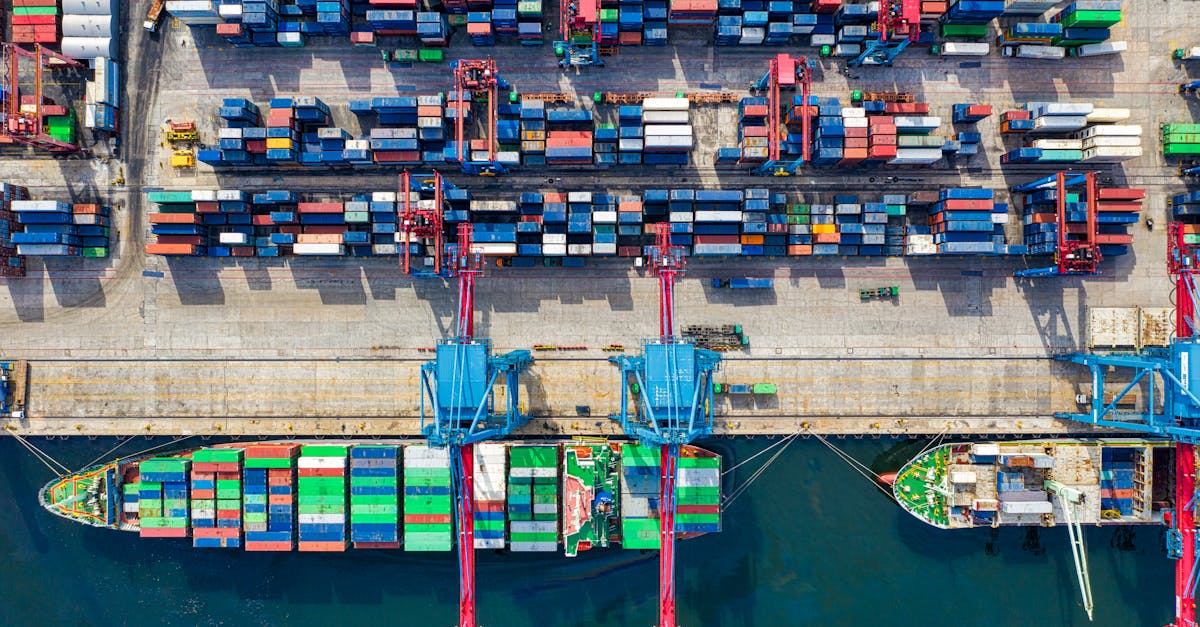

The Middle East's position at the crossroads of Europe, Asia, and Africa makes its shipping lanes critical to worldwide supply chains. Recent trade pacts have significantly altered tariff structures, customs procedures, and market access conditions. You'll find that these changes impact everything from shipping costs to delivery timeframes, potentially affecting your bottom line if you're operating in or through the region.

Understanding Trade Agreements in the Middle East Maritime Sector

Trade agreements in the Middle East maritime sector form a complex network of bilateral and multilateral arrangements that directly impact shipping operations. These agreements establish the rules and regulations governing the movement of goods across borders, affecting everything from tariff rates to customs procedures.

The Middle East's maritime sector is governed by several types of trade agreements, including free trade agreements (FTAs), preferential trade agreements (PTAs), and economic cooperation frameworks. Each agreement type serves different purposes while collectively shaping the regional shipping environment.

Key trade agreements include the Greater Arab Free Trade Area (GAFTA), which eliminates customs duties among 17 Arab countries, and the Gulf Cooperation Council (GCC) Customs Union, which standardizes external tariffs across member states. Additionally, agreements like the EU-GCC Trade and Cooperation Agreement facilitate trade between Europe and Gulf nations.

These agreements impact shipping in tangible ways, such as reducing tariffs on certain goods by 5-25%, streamlining customs documentation requirements, and opening previously restricted shipping routes. For instance, the Jordan-UAE trade agreement has reduced processing times at ports by 30%, significantly improving supply chain efficiency.

The regulatory framework established by these agreements includes standardized customs documentation, harmonized product classification systems, and unified procedures for inspections and clearances. These standards are critical for shipping companies operating across multiple Middle Eastern jurisdictions, allowing for more predictable operations and compliance requirements.

Key Regional Trade Agreements Impacting Middle Eastern Shipping

Regional trade agreements in the Middle East have dramatically reshaped shipping routes, customs procedures, and logistics operations across this strategic maritime nexus. These agreements collectively form the regulatory foundation for cargo movement through the region's vital waterways and port facilities.

Gulf Cooperation Council Unified Customs Agreement

The GCC Unified Customs Agreement, implemented in 2003, created a customs union among Saudi Arabia, Kuwait, Bahrain, Qatar, UAE, and Oman, establishing a common 5% external tariff on most imported goods. This agreement eliminates customs duties between member states and allows goods to move freely once cleared at the first point of entry. For shipping companies, this means cargo destined for multiple GCC countries requires only a single customs clearance, reducing documentation by approximately 70% and cutting transit times by up to 3-4 days at major ports like Jebel Ali and Dammam. The agreement also introduced standardized customs valuation methods and harmonized product classification systems, creating a more predictable operating environment for maritime logistics providers.

Euro-Mediterranean Partnership Agreements

The Euro-Mediterranean Partnership Agreements (EMPA), also known as the Barcelona Process, connect Middle Eastern nations with the European Union through preferential trade arrangements. Countries including Egypt, Jordan, Lebanon, Morocco, and Tunisia have established bilateral agreements with the EU under this framework. These agreements have created specialized shipping lanes between Mediterranean ports, with dedicated fast-track customs channels reducing processing times by up to 60% compared to standard procedures. For shipping companies, the EMPA offers significant benefits including reduced tariffs (often zero for industrial goods), simplified rules of origin documentation, and technical assistance for customs modernization. At Egypt's Port Said, for example, EU-bound containers receive expedited processing through digital pre-clearance systems implemented as part of EMPA's trade facilitation measures.

The Impact of Global Trade Agreements on Middle East Shipping Routes

Global trade agreements create a complex framework that directly shapes shipping patterns and logistics operations throughout the Middle East. These international pacts extend beyond regional arrangements like GAFTA and the GCC Customs Union to establish broader rules and market access that transform how cargo moves through Middle Eastern ports and waterways.

World Trade Organization Frameworks

The WTO's trade frameworks establish foundational rules that govern Middle Eastern shipping operations across international waters. Middle Eastern countries that are WTO members, including Saudi Arabia, the UAE, Qatar, and Egypt, must align their maritime regulations with global standards outlined in the Trade Facilitation Agreement (TFA). This agreement has reduced documentation requirements by approximately 25% at major ports like Jebel Ali and Dammam, cutting clearance times from 7-10 days to 3-5 days. The WTO's Information Technology Agreement (ITA) has eliminated tariffs on products like navigation equipment, vessel tracking systems, and port management software, lowering operational costs for shipping companies by 15-20% since implementation. Middle Eastern ports adhering to WTO standards attract greater shipping volume, as demonstrated by DP World terminals which have seen a 30% increase in container throughput following compliance upgrades.

Free Trade Agreements with Asian Economic Powers

Free trade agreements with Asian economic giants have redirected shipping traffic and established new maritime corridors across the Middle East. The China-GCC Free Trade Agreement negotiations have already prompted the expansion of dedicated terminals at ports like Khalifa Port in Abu Dhabi and Hamad Port in Qatar, specifically designed to handle Chinese cargo volumes. South Korean trade agreements with the UAE have created specialized logistics zones at Jebel Ali, reducing processing times for Korean electronics and automotive shipments by 40%. The Japan-GCC Economic Partnership discussions have led to the development of specialized petrochemical shipping facilities at Saudi Arabia's King Fahd Industrial Port, featuring dedicated berths and accelerated customs channels. These Asian agreements have shifted traditional shipping routes, with 65% of vessels now making direct calls at Middle Eastern hub ports rather than transshipping through European terminals, cutting transit times by 7-10 days for Asian imports and exports.

Challenges and Obstacles in Regional Trade Integration

Despite promising trade agreements across the Middle East, significant barriers continue to impede full regional integration. These obstacles range from deep-seated political conflicts to infrastructure inadequacies that limit the effectiveness of trade pacts and their impact on shipping operations.

Political Tensions and Their Effect on Maritime Commerce

Political tensions create tangible disruptions in maritime trade across the Middle East shipping landscape. Ongoing diplomatic rifts between Qatar and several neighboring countries have fractured shipping networks, forcing vessels to reroute around blockaded ports and adding 5-7 days to typical transit times. These detours increase fuel consumption by approximately 25% and raise operational costs by thousands of dollars per voyage.

Regional conflicts in Yemen and Syria have established maritime security zones that restrict vessel movements, creating unpredictable shipping schedules and insurance surcharges. Maritime insurance premiums for vessels traversing the Persian Gulf have increased 15-30% since 2019 due to heightened geopolitical risks, directly affecting shipping costs and cargo rates.

The fragmented implementation of trade agreements reflects these tensions, with customs authorities occasionally imposing additional inspections on shipments from politically sensitive origins. For example, documentation processing for containers at certain ports can take up to 72 hours longer when originating from countries involved in diplomatic disputes, compared to politically neutral trading partners.

Infrastructure Limitations and Development Needs

The Middle East faces critical infrastructure gaps that undermine the potential benefits of trade agreements. Port capacity constraints represent a primary bottleneck, with major regional ports like Jeddah Islamic Port and Khalifa Port operating at 85-90% capacity during peak seasons, resulting in berthing delays averaging 36-48 hours.

Digital infrastructure lags behind physical development, with only 60% of regional ports having fully implemented electronic documentation systems compatible with international standards. This technological gap causes documentation processing delays of 2-3 days compared to fully digitized ports in Asia and Europe.

Inland connectivity remains insufficient, with limited rail networks connecting ports to industrial centers. Currently, less than 30% of container traffic moves by rail in the region, compared to 40-50% in more developed markets. This dependency on road transport increases last-mile delivery costs by approximately 20-25% and extends delivery times by 1-2 days for shipments to inland destinations.

Investment needs for addressing these gaps total approximately $100-120 billion over the next decade, according to World Bank estimates. Key projects include:

| Infrastructure Project | Estimated Cost | Expected Impact |

|---|---|---|

| GCC Railway Network | $30 billion | Reduce transit times by 40% |

| Saudi Port Expansion Program | $8.5 billion | Increase capacity by 70% |

| Egypt's Suez Canal Economic Zone | $15 billion | Create integrated logistics hubs |

| UAE's ETIHAD Rail | $11 billion | Connect all major UAE ports to Saudi border |

These infrastructure constraints create a two-tiered shipping reality where advanced ports like Jebel Ali and King Abdullah Economic City operate efficiently while secondary ports struggle with congestion and processing delays, undermining the uniform application of trade agreement benefits.

Recent Developments in Middle East Shipping Trade Policy

Middle Eastern shipping trade policy has undergone significant transformations in recent years. These changes reflect both regional priorities and responses to global economic shifts, creating new operational frameworks for maritime commerce.

Post-Pandemic Trade Recovery Initiatives

Post-pandemic recovery initiatives have reshaped Middle East shipping protocols since 2021. The GCC countries introduced the Regional Supply Chain Resilience Program, establishing priority lanes at major ports like Jebel Ali and Dammam for essential goods and medical supplies. This program reduced processing times by 45% for qualifying shipments and created standardized emergency protocols across participating ports.

Saudi Arabia's Vision 2030-aligned Maritime Recovery Framework has allocated $4.3 billion to port modernization projects, including the expansion of King Abdullah Port and the development of automated customs clearance systems. These improvements have increased container handling capacity by 28% since 2022 and cut average vessel turnaround times from 36 to 22 hours.

UAE's Trade Corridor Initiative has established specialized economic zones at Abu Dhabi and Dubai ports, offering tax incentives and simplified customs procedures for companies establishing regional distribution centers. Companies operating in these zones experience 60% faster customs clearance and benefit from integrated logistics services that connect sea, air, and land transportation networks.

Digital Trade Provisions in New Agreements

Digital trade provisions have become central components in recent Middle Eastern shipping agreements. The UAE-Israel Abraham Accords Digital Trade Protocol implemented in 2022 established the region's first comprehensive framework for e-documentation in cross-border shipping, enabling electronic bills of lading and digital customs declarations that reduced documentation processing from 3 days to 4 hours.

The Saudi-led Digital Maritime Corridor initiative connects GCC ports through a unified blockchain platform for shipping documentation. Five major shipping lines and seven port operators participate in this system, processing over 15,000 TEUs monthly through completely paperless transactions and cutting administrative costs by 35%.

Egypt's Digital Trade Gateway program, launched in partnership with the World Bank, has modernized the Suez Canal's documentation systems. The implementation of AI-powered customs risk assessment tools at Port Said and Alexandria has reduced physical inspections by 62% while maintaining compliance rates above 95%, allowing containers to move through these ports with minimal delays.

Recent trade agreements between Middle Eastern countries and Asian partners increasingly include dedicated provisions for e-commerce shipping channels. The Qatar-Singapore Digital Economy Agreement created specialized customs procedures for e-commerce shipments under $3,000, reducing processing times from days to hours and supporting a 73% growth in small parcel shipments between these markets since its implementation.

Economic Benefits of Trade Agreements for Middle Eastern Ports

Trade agreements generate substantial economic advantages for Middle Eastern ports, transforming these maritime gateways into powerful economic engines for their respective countries. These benefits extend beyond simple tariff reductions to create comprehensive economic ecosystems that support regional growth and development.

Increased Cargo Volumes and Revenue Streams

Trade agreements directly boost cargo throughput at Middle Eastern ports by eliminating trade barriers. The UAE-India Comprehensive Economic Partnership Agreement (CEPA) implemented in 2022 increased container traffic at Jebel Ali Port by 13.5% for India-origin cargo in just the first six months. This volume growth translates to higher port revenues through increased docking fees, handling charges, and storage services.

Major ports like Jebel Ali in Dubai and Khalifa Port in Abu Dhabi have diversified their revenue models beyond basic handling services. They've developed value-added logistics offerings such as specialized warehousing, cargo consolidation, and distribution services that generate 25-30% higher margins than standard port operations. These enhanced service portfolios attract shipping lines seeking comprehensive logistics solutions rather than mere transit points.

Job Creation and Skills Development

The economic ripple effects of port expansion create significant employment opportunities throughout Middle Eastern economies. Direct port operations at major regional facilities like King Abdullah Port in Saudi Arabia and Hamad Port in Qatar employ thousands of workers in logistics, administration, and technical roles. For every direct port job created, approximately 3-4 indirect positions emerge in related sectors such as transportation, warehousing, and professional services.

Trade agreements have also driven investments in specialized training facilities at key ports. Sohar Port in Oman established the Maritime Training Centre that provides certification programs for port equipment operators, logistics managers, and customs specialists. These programs enhance workforce capabilities and support the development of high-value maritime services that command premium rates in global markets.

Foreign Direct Investment in Port Infrastructure

Trade agreements serve as powerful catalysts for foreign direct investment (FDI) in port infrastructure and facilities. Following the implementation of the China-GCC Strategic Dialogue, Chinese investments in Middle Eastern ports exceeded $25 billion between 2018-2022. These investments funded terminal expansions, automation systems, and specialized cargo handling equipment that significantly enhanced operational capacities.

The introduction of Public-Private Partnership (PPP) frameworks in countries like Egypt and Saudi Arabia has created transparent mechanisms for international port operators to invest in facility modernization. DP World's $1.6 billion investment in Egypt's Sokhna Port exemplifies how trade agreements can attract substantial private capital for infrastructure development that might otherwise strain national budgets.

Development of Special Economic Zones

Many Middle Eastern ports have leveraged trade agreements to establish integrated special economic zones (SEZs) that offer preferential business conditions. Jebel Ali Free Zone houses over 8,000 companies from 140 countries, generating approximately $93 billion in annual trade value. These zones provide tax incentives, streamlined regulations, and specialized infrastructure that attract manufacturing and distribution operations seeking efficient export platforms.

The strategic alignment between trade agreements and SEZ development has created powerful logistics ecosystems around ports like King Abdullah Economic City in Saudi Arabia and KIZAD in Abu Dhabi. Companies operating in these zones benefit from simplified customs procedures, reduced documentation requirements, and integrated transportation networks that significantly lower supply chain costs and enhance regional competitiveness.

Future Outlook: Emerging Trade Partnerships and Maritime Opportunities

The Middle East's maritime trade landscape is transforming through several emerging partnerships that promise to reshape regional shipping dynamics in the coming years. These evolving trade relationships create strategic advantages for stakeholders positioned to leverage these developments while adapting to shifting regulatory frameworks.

The Abraham Accords and New Maritime Corridors

The Abraham Accords have established unprecedented trade channels between Israel and UAE, Bahrain, Morocco, and Sudan. Maritime connections between Haifa Port and Jebel Ali now operate regularly, reducing traditional shipping times by 7-10 days compared to previous routes that avoided direct connections. These new corridors have created a 40% increase in container traffic between participating countries since implementation.

Israeli ports currently process over 300,000 TEUs annually from Abraham Accord partners, with projections indicating this volume will double by 2025. The India-Middle East-Europe Economic Corridor (IMEC), connected to these agreements, proposes linking Gulf ports to European markets through Israel and Mediterranean facilities, potentially reducing Asia-Europe transit times by 8-12 days compared to Suez Canal routes.

China's Belt and Road Investments in Regional Ports

China's Belt and Road Initiative (BRI) investments in Middle Eastern ports are reshaping maritime infrastructure throughout the region. Chinese entities have secured management rights or development contracts at strategic locations including:

- Khalifa Port (UAE): $738 million terminal development with COSCO Shipping

- Duqm Port (Oman): $10.7 billion industrial zone and port expansion

- Haifa Port (Israel): 25-year terminal operation contract valued at $1.7 billion

- Ain Sokhna Port (Egypt): $3 billion expansion project with China Harbor Engineering

These investments integrate Middle Eastern ports into China's maritime trade network, with direct shipping lines connecting them to major Chinese hubs. Port facilities receiving BRI funding have demonstrated 25-35% efficiency improvements through automation and digitalization initiatives, creating competitive advantages for companies utilizing these modernized facilities.

Emerging Free Trade Agreements and Shipping Implications

Several developing trade agreements signal important shifts in regional maritime traffic patterns:

- GCC-UK Free Trade Agreement: Negotiations advanced in 2023, with projected tariff reductions of 5-15% on critical imports and exports. Implementation will likely increase UK-bound container volumes by 18-22% at major Gulf ports.

- GCC-ASEAN Framework Agreement: Preliminary talks established in 2022 aim to boost trade between Gulf states and Southeast Asia. Initial assessments indicate potential 30% growth in maritime cargo volumes between these regions once implemented.

- Egypt-Eastern African Trade Corridor: Formal negotiations launched in 2023 connect Egyptian ports with East African markets, potentially redirecting 15% of regional trade away from traditional routes through enhanced Red Sea connectivity.

- Turkey-GCC Trade Expansion: Recent negotiations focus on renewing and expanding existing frameworks, potentially increasing maritime cargo between Turkish and Gulf ports by 28% within three years.

Each emerging agreement introduces specialized customs channels, documentation systems, and tariff structures that require shipping companies to adapt their compliance protocols and route planning strategies.

Digital Maritime Trade Innovations

Technological advancements are revolutionizing Middle Eastern maritime trade through several key initiatives:

- GCC Single Window System: This platform integrates customs processing across member states, reducing documentation requirements by 60% and processing times by 75%.

- Blockchain Trade Documentation: Initiatives like the "TradeTrust" partnership between Singapore and UAE enable digital verification of shipping documents, cutting processing times from 7-10 days to less than 24 hours.

- Port Community Systems: Advanced digital platforms at major ports like Jebel Ali, King Abdullah, and Sohar integrate stakeholder operations, reducing vessel turnaround times by 35-40%.

- AI-Powered Customs Risk Assessment: Implemented at ports including Jebel Ali and Dammam, these systems reduce physical inspections by 65% while maintaining security protocols.

These digital innovations are creating competitive advantages for ports and shipping companies that adopt them early, establishing new efficiency benchmarks across the region.

Environmental Regulations and Sustainable Shipping

Emerging environmental frameworks are reshaping regional maritime operations through several key developments:

- IMO 2023 Carbon Intensity Regulations: New requirements mandate 2% annual carbon reductions for vessels, affecting route planning and vessel deployment in Middle Eastern waters.

- Green Shipping Corridors: UAE, Saudi Arabia, and Egypt have established designated lanes with preferential fees for low-emission vessels, reducing port charges by up to 15% for qualifying ships.

- Alternative Fuel Infrastructure: Major ports including Jebel Ali, Dammam, and Sohar are investing in LNG bunkering facilities, with $3.7 billion allocated for development through 2026.

- Regional Emission Control Areas: Discussions among GCC members propose creating Mediterranean-style emission control zones in the Gulf by 2025, which would require vessels to switch to low-sulfur fuels.

These regulations create both challenges and opportunities, with environmentally compliant shipping operations gaining competitive advantages through reduced fees and preferential processing at major ports.

Key Takeaways

- The Middle East's strategic location at the crossroads of Europe, Asia, and Africa makes its shipping lanes critical to global supply chains, with trade agreements significantly altering tariff structures and market access conditions.

- Key regional frameworks like the GCC Unified Customs Agreement and Euro-Mediterranean Partnership Agreements have streamlined shipping operations, reducing documentation requirements by up to 70% and cutting transit times by 3-4 days at major ports.

- Political tensions remain significant barriers to full regional integration, with conflicts and diplomatic rifts creating shipping detours that increase transit times by 5-7 days and raise operational costs by 25%.

- Infrastructure limitations, including port capacity constraints and limited digital systems, undermine trade agreement benefits, with required investment needs estimated at $100-120 billion over the next decade.

- Recent developments like the Abraham Accords have established unprecedented trade channels, reducing traditional shipping times by 7-10 days, while China's Belt and Road Initiative is reshaping port infrastructure with billions in investment.

- Digital innovations including blockchain documentation and AI-powered customs systems are revolutionizing maritime trade, cutting processing times from 7-10 days to less than 24 hours at modernized facilities.

Conclusion

Trade agreements across the Middle East continue to reshape shipping dynamics with far-reaching effects on global commerce. As you navigate these evolving waters your business strategy must account for both the opportunities and challenges presented by this complex regulatory landscape.

The region's strategic transformation through digital initiatives specialized economic zones and infrastructure development has created a more efficient yet uneven shipping environment. Your competitive edge may depend on leveraging these agreements while preparing for emerging partnerships that will further alter maritime trade patterns.

The path forward requires adapting to new corridors enhanced by the Abraham Accords China's Belt and Road investments and sustainability requirements. By staying informed of these developments you'll be better positioned to optimize your supply chain and capitalize on the Middle East's pivotal role in global shipping.