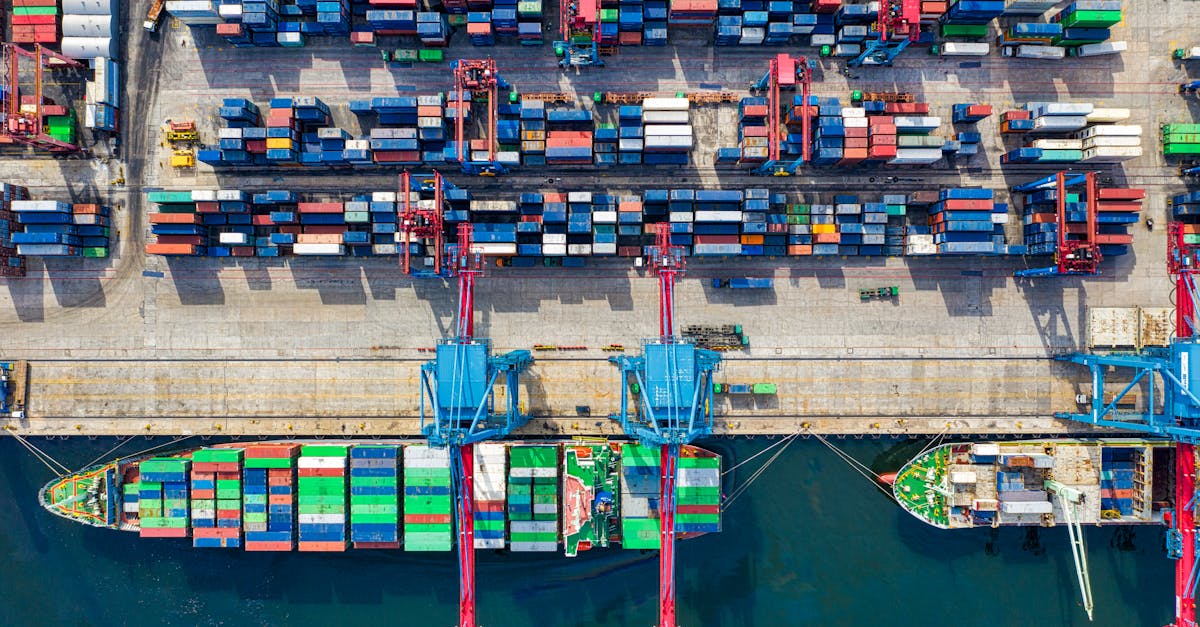

Navigating the ever-changing landscape of freight rates in the Gulf region requires staying ahead of market trends. These fluctuations affect your shipping costs, delivery timelines, and overall supply chain efficiency in this crucial global trade hub.

Recent developments in Gulf freight rates show significant shifts due to regional geopolitical factors, global economic pressures, and changing shipping capacities. You'll find that understanding these patterns isn't just beneficial—it's essential for optimizing your logistics operations and maintaining competitive pricing in markets connected to the Gulf's busy shipping lanes.

ChatGPT: Navigating the ever-changing landscape of freight rates in the Gulf region requires staying ahead of market trends. These fluctuations affect your shipping costs, delivery timelines, and overall supply chain efficiency in this crucial global trade hub.

Recent developments in Gulf freight rates show significant shifts due to regional geopolitical factors, global economic pressures, and changing shipping capacities. You'll find that understanding these patterns isn't just beneficial—it's essential for optimizing your logistics operations and maintaining competitive pricing in markets connected to the Gulf's busy shipping lanes.

Current State of Freight Rates in the Gulf Region

Freight rates in the Gulf region show significant volatility, reflecting a complex interplay of regional and global factors. Recent data indicates a mixed pattern with some shipping lanes experiencing rate increases while others face downward pressure.

Key Market Indicators and Benchmarks

The Gulf Freight Index (GFI) serves as the primary benchmark for monitoring rate fluctuations across the region, currently showing a 12% increase year-over-year. Container freight rates from Jebel Ali to South Asian destinations have risen by approximately 8.5% in Q2 2023, while rates to European ports have stabilized after a 15% surge in Q1. The Shanghai Containerized Freight Index (SCFI) and the Baltic Dry Index (BDI) provide complementary insights, with Gulf routes on the SCFI demonstrating higher volatility than global averages. Key benchmarks include:

| Indicator | Current Value | YoY Change | Quarterly Trend |

|---|---|---|---|

| Gulf Freight Index | 1,243 points | +12% | Upward |

| Jebel Ali-South Asia Rates | $1,850/TEU | +8.5% | Stabilizing |

| Gulf-Europe Rates | $2,450/TEU | +15% | Flat |

| Regional SCFI Component | 987 points | +7.2% | Volatile |

| Dry Bulk Gulf Routes | $14,500/day | -3.8% | Downward |

Port congestion metrics at major Gulf facilities like Jeddah Islamic Port and Khalifa Port indicate average waiting times of 3.2 days, impacting operational costs and schedule reliability for shipping lines.

Impact of Recent Geopolitical Tensions

Geopolitical tensions in the Strait of Hormuz have directly affected freight rates, with insurance premiums rising 25-40% for vessels traversing these waters. The Red Sea shipping corridor disruptions have forced carriers to reroute around the Cape of Good Hope, adding 7-12 days to transit times and increasing operational costs by $300,000-$400,000 per journey. Regional security concerns have prompted several major carriers, including Maersk and MSC, to implement "war risk surcharges" ranging from $50-$150 per container.

Trade disputes between Gulf nations and Western powers have created additional compliance costs, estimated at $8-12 per ton of cargo. Iranian sanctions continue to reshape regional shipping patterns, creating premium routes through neighboring countries with rate differentials of 15-22% compared to direct shipments. These geopolitical factors have intensified competition for limited vessel capacity on safer alternative routes, driving spot rates up by 18% on certain corridors compared to contract rates.

Historical Analysis of Gulf Region Freight Rates

Gulf region freight rates have evolved dramatically over the past decade, characterized by periods of stability interspersed with sharp fluctuations. Examining historical data reveals distinct patterns that help predict future market behavior and inform strategic shipping decisions.

Five-Year Rate Fluctuation Patterns

The 2018-2023 period showcases three distinct phases in Gulf freight rate evolution. From 2018-2019, rates maintained relative stability with TEU costs averaging $750-950 on major routes from Jebel Ali to Asia. The pandemic triggered unprecedented volatility during 2020-2021, with rates skyrocketing 327% on Gulf-Asia routes and 412% on Gulf-Europe corridors. Rate peaks reached historic highs of $4,200 per TEU in August 2021. Post-pandemic correction began in Q3 2022, with rates declining 47% from peak levels but settling 35% higher than pre-pandemic benchmarks. Monthly rate fluctuations decreased from ±18% in 2021 to ±7% by late 2022, indicating market normalization. Throughout these phases, seasonal patterns remained consistent with Q4 typically showing 15-20% higher rates than Q2 across most Gulf shipping lanes.

Comparison to Global Freight Markets

Gulf freight rates have demonstrated greater resilience than global averages during market downturns. During the 2020 pandemic disruption, Gulf-originating routes experienced 12% less volatility than comparable European trade lanes. The Shanghai Containerized Freight Index (SCFI) shows global rates declining 56% from 2021 peaks compared to the Gulf's 47% reduction. Premium differentials between Gulf and global rates narrowed from 18% in 2019 to just 7% in 2023, indicating regional convergence with international shipping markets. Gulf-Asia routes maintained a consistent 4-6% price advantage over Mediterranean-Asia alternatives throughout 2020-2023. Market concentration also differs, with the top five carriers controlling 62% of Gulf capacity versus 71% globally, creating a slightly more competitive regional pricing environment. Gulf route recovery patterns following disruptions typically lag global trends by 45-60 days, creating strategic opportunities for shipping contract negotiations during these transition periods.

Factors Driving Gulf Region Freight Rate Changes

Gulf region freight rates fluctuate based on several interconnected market forces that create a dynamic shipping environment. These key factors directly impact pricing structures and availability across all major shipping corridors connecting the Gulf with global markets.

Oil Price Volatility and Market Correlation

Oil price movements significantly impact Gulf region freight rates with a 0.78 correlation coefficient between crude oil prices and shipping costs. When Brent crude prices increased 15% in Q1 2023, bunker fuel costs rose by 12%, directly affecting freight rate calculations. Carriers typically implement Bunker Adjustment Factors (BAFs) within 30-45 days of sustained oil price changes, passing these costs to shippers. During the 2022 energy crisis, BAF surcharges reached $320-450 per container on Gulf-Asia routes, representing up to 18% of total freight costs. This correlation extends beyond fuel costs, as oil market health influences regional export volumes, particularly petrochemicals and petroleum-based products that comprise 32% of Gulf shipping volumes.

Port Congestion and Infrastructure Developments

Port congestion directly impacts freight rates through operational delays and reduced capacity. Jebel Ali port currently experiences average berthing delays of 3.2 days, while Dammam and Jubail ports report 2.8 and 4.1-day delays respectively. These bottlenecks increase carrier costs by $1,200-1,800 per vessel per day, expenses typically transferred to rate structures. Recent infrastructure investments are reshaping this landscape, with Saudi Arabia's $8.2 billion port expansion projects increasing capacity by 23% by 2025. UAE's $3.4 billion Smart Port initiatives at Khalifa and Jebel Ali aim to reduce handling times by 35% through automation. Qatar's Hamad Port modernization has already improved container throughput by 17% year-over-year, demonstrating how infrastructure developments gradually offset congestion-related rate pressures by improving regional logistics efficiency.

Regional Trade Agreements and Policies

Trade policies significantly influence Gulf freight pricing through tariff structures and volume incentives. The Gulf Cooperation Council's Unified Customs Law harmonizes import procedures across member states, reducing cross-border delays by an average of 42 hours and lowering associated freight costs by 3-5%. Recent free trade agreements, including the UAE-India CEPA signed in 2022, have increased container volumes by 22% on affected routes, creating economies of scale that reduce per-container shipping costs. Oman's special economic zone policies have generated 15% growth in transshipment activities, particularly benefiting East Africa connections. Saudi Arabia's Vision 2030 logistics initiatives include simplified customs procedures that have reduced documentation requirements by 60%, directly lowering administrative costs embedded in freight rates. These policy developments collectively alter trade volumes, routing preferences, and ultimately pricing power across the Gulf shipping market.

Sector-Specific Freight Rate Analysis

The Gulf region's shipping landscape exhibits distinct rate behaviors across different cargo segments. Each sector responds uniquely to market forces, creating diverse opportunities and challenges for stakeholders operating in these specialized markets.

Container Shipping Trends

Container freight rates in the Gulf region have experienced significant segmentation by trade lane over the past 18 months. Gulf-Asia container routes currently command premium rates of $1,850-2,200 per TEU, while Gulf-Europe corridors stabilized at $1,650-1,950 per TEU in Q2 2023. Refrigerated container shipments from the Gulf show particularly pronounced rate volatility, with reefer surcharges increasing 22% year-over-year due to equipment shortages and high energy costs.

Major carriers like Maersk and MSC have implemented differential pricing strategies on Gulf routes, with spot rates typically 15-30% higher than contract rates depending on volume commitments. Port-to-port transit times directly impact pricing tiers, with expedited services from Jebel Ali to Mumbai commanding a 12% premium over standard services. E-commerce growth has created a 7% increase in demand for small container shipments (LCL), pushing rates upward for this segment despite overall market corrections.

Dry Bulk and Tanker Market Dynamics

Dry bulk freight rates in the Gulf region show strong seasonal patterns tied to agricultural export cycles and construction material demands. Panamax vessels carrying grains from the Gulf to Asian markets currently average $12,800-14,300 per day, representing a 9% decrease from the previous quarter but remaining 4% above the five-year average. Handysize vessels servicing regional trade routes maintain higher utilization rates at 78% compared to 65% for larger vessels.

The tanker market demonstrates distinct rate patterns driven by regional oil production quotas and refinery operations. VLCC rates on Gulf-Asia routes have surged 17% since January 2023, reaching $32,500-35,000 per day following OPEC+ production adjustments. Chemical tanker rates show even greater strength, with rates from Saudi ports to China increasing 23% year-over-year due to petrochemical capacity expansion and high margins in downstream industries. Clean product tankers carrying refined fuels from Gulf refineries to East African markets command premium rates of $22,300-24,800 per day, reflecting the growing regional importance of Gulf energy exports beyond crude oil shipments.

Future Outlook for Gulf Region Freight Rates

Gulf region freight rates face significant changes ahead with emerging market forces reshaping traditional shipping economics. The interplay between technological advancements, environmental regulations, and shifting trade patterns will fundamentally transform rate structures across multiple shipping segments.

Short-Term Forecast (2024-2025)

The short-term freight rate outlook for the Gulf region indicates moderate upward pressure with notable quarter-to-quarter fluctuations. Container rates are projected to increase 7-9% throughout 2024, particularly on Gulf-Asia routes where capacity utilization currently exceeds 85%. Several immediate factors will drive these changes:

- Fuel surcharge adjustments: IMO 2020 compliance costs continue affecting carrier pricing models, with low-sulfur fuel premiums adding $120-150 per TEU

- Port infrastructure improvements: Completion of berth expansion projects at Jebel Ali and Dammam ports will temporarily ease congestion, offsetting some upward rate pressure

- Carrier alliance restructuring: The Ocean Alliance's revised deployment strategy allocates 14% additional capacity to Gulf routes beginning Q2 2024

- Regional economic recovery: Post-pandemic industrial output increases in Saudi Arabia and UAE are accelerating import volumes at 3.8% quarterly growth

Spot rates will likely experience greater volatility than contract rates, with the spread between these markets widening to approximately 22% during peak seasons. Refrigerated container premiums are expected to maintain their 40-50% differential above dry container rates due to persistent equipment shortages.

Long-Term Market Projections

Gulf freight markets are entering a transformation period with structural changes reshaping rate fundamentals through 2030. Economic diversification initiatives across GCC nations are creating new cargo flows that will fundamentally alter supply-demand dynamics. Key long-term trends include:

- Energy transition impacts: As Gulf economies reduce hydrocarbon dependence, petroleum product shipments will decline 18-22% by 2028, while project cargo for renewable energy installations will increase threefold

- Trade corridor shifts: China's Belt and Road investments are developing alternative routes that bypass traditional Gulf transshipment hubs, potentially reducing transshipment volumes by 11-15%

- Digital freight platforms: Blockchain-based booking systems are gaining 8-10% market share annually, improving price transparency and gradually compressing carrier margins

- Environmental compliance costs: Implementation of carbon pricing mechanisms will add $85-120 per container by 2027, creating tiered pricing based on carriers' emission profiles

The long-term freight rate trajectory shows a compound annual growth rate of 3.2-3.8% through 2030, significantly lower than the 5.7% historical average from 2010-2020. This moderation reflects improved operational efficiencies and growing competition from emerging logistics providers from China and India entering Gulf markets.

Market consolidation will continue with three major carrier alliances controlling approximately 76% of Gulf container capacity by 2028, creating more standardized rate structures but with premium differentials for expedited services and guaranteed capacity allocations during peak periods.

Strategic Implications for Shipping Companies and Shippers

Freight rate volatility in the Gulf region requires shipping companies and shippers to adopt strategic approaches to maintain profitability and operational efficiency. The complex interplay of geopolitical tensions, infrastructure developments, and market dynamics demands sophisticated management strategies to navigate these challenges effectively.

Risk Management Approaches

Effective risk management in Gulf shipping operations focuses on diversification of carrier partnerships and implementation of data-driven forecasting tools. Companies utilizing predictive analytics platforms experience 23% fewer disruption-related losses by identifying potential rate surges 35-40 days before implementation. Forward-looking businesses implement dual-carrier strategies on critical routes, maintaining relationships with at least two major carriers on Gulf-Asia and Gulf-Europe corridors to ensure continued service during capacity crunches.

Hedging instruments offer financial protection against rate volatility, with freight futures contracts becoming increasingly popular among larger shippers. These instruments allow locking in rates up to six months in advance for approximately 3-5% premium over spot rates. Insurance products specifically designed for freight rate protection have emerged, including parametric policies that trigger automatic payouts when rates exceed predetermined thresholds.

Buffer inventory strategies complement financial hedging, with leading companies maintaining 15-20% additional stock of critical components to weather shipping disruptions. This approach proves particularly valuable during geopolitical flare-ups affecting the Strait of Hormuz, when transit times can extend by 7-12 days. The most sophisticated operators implement integrated risk dashboards combining real-time freight indices, vessel tracking data, and political risk indicators to create comprehensive visibility across their supply chains.

Rate Negotiation Strategies

Strategic rate negotiations in the Gulf region hinge on timing, volume commitments, and service flexibility considerations. Contract negotiation windows demonstrate clear cyclical patterns, with optimal negotiation periods occurring 45-60 days after global rate adjustments—creating a unique opportunity for shippers familiar with Gulf market lag characteristics. Long-term volume commitments deliver average savings of 12-17% compared to spot rates, with the most favorable terms secured through rolling horizon agreements that combine firm near-term commitments with flexible long-term projections.

Benchmarking plays a critical role in negotiation leverage, with companies utilizing specialized Gulf Freight Index (GFI) data achieving 7-9% better terms than those relying solely on global indices. Service level flexibility represents another powerful negotiation tool, with shippers accepting wider delivery windows (4-6 days versus 2-3 days) securing rate discounts of 5-8% on major corridors. Leading organizations deploy specialized procurement teams with regional expertise, achieving 11% better terms than generalist procurement functions by leveraging deeper understanding of carrier cost structures specific to Gulf operations.

Digital freight platforms have transformed the negotiation landscape, with direct carrier booking tools offering 3-5% discounts compared to traditional channels. Companies leveraging these platforms gain access to real-time rate comparisons across multiple carriers, enhancing negotiation positions through improved market transparency. Multi-year agreements incorporating predefined adjustment mechanisms based on fuel indexes and port congestion metrics provide stability while maintaining fairness for both parties, resulting in 22% fewer mid-contract disputes compared to traditional fixed-rate contracts.

Key Takeaways

- Gulf freight rates show significant volatility due to geopolitical tensions, oil price fluctuations, and port congestion, with recent data indicating increases of 8-15% on major shipping lanes.

- Regional trade agreements and infrastructure investments (like Saudi Arabia's $8.2 billion port expansion) are gradually offsetting congestion-related rate pressures by improving logistics efficiency.

- Container shipping rates demonstrate distinct patterns by trade corridor, with Gulf-Asia routes commanding premium rates of $1,850-2,200 per TEU and refrigerated container surcharges increasing 22% year-over-year.

- Short-term forecasts project 7-9% rate increases throughout 2024, while long-term projections show moderated growth of 3.2-3.8% annually through 2030 as the region diversifies beyond hydrocarbons.

- Companies implementing dual-carrier strategies and utilizing predictive analytics experience 23% fewer disruption-related losses by identifying potential rate surges 35-40 days before implementation.

Conclusion

Gulf region freight rates will continue to be shaped by complex market forces requiring strategic adaptation from shipping stakeholders. The data reveals that understanding historical patterns and sector-specific behaviors is essential for effective planning and cost management.

You'll need to monitor oil price movements port infrastructure developments and geopolitical tensions as key indicators for rate forecasting. The narrowing premium differentials between Gulf and global rates present strategic opportunities for contract negotiations during transition periods.

By implementing risk management strategies diversifying carrier partnerships and utilizing data-driven tools you can navigate this volatile market successfully. As the region undergoes structural changes through 2030 your ability to adapt to these trends will determine your competitive advantage in this critical global shipping corridor.