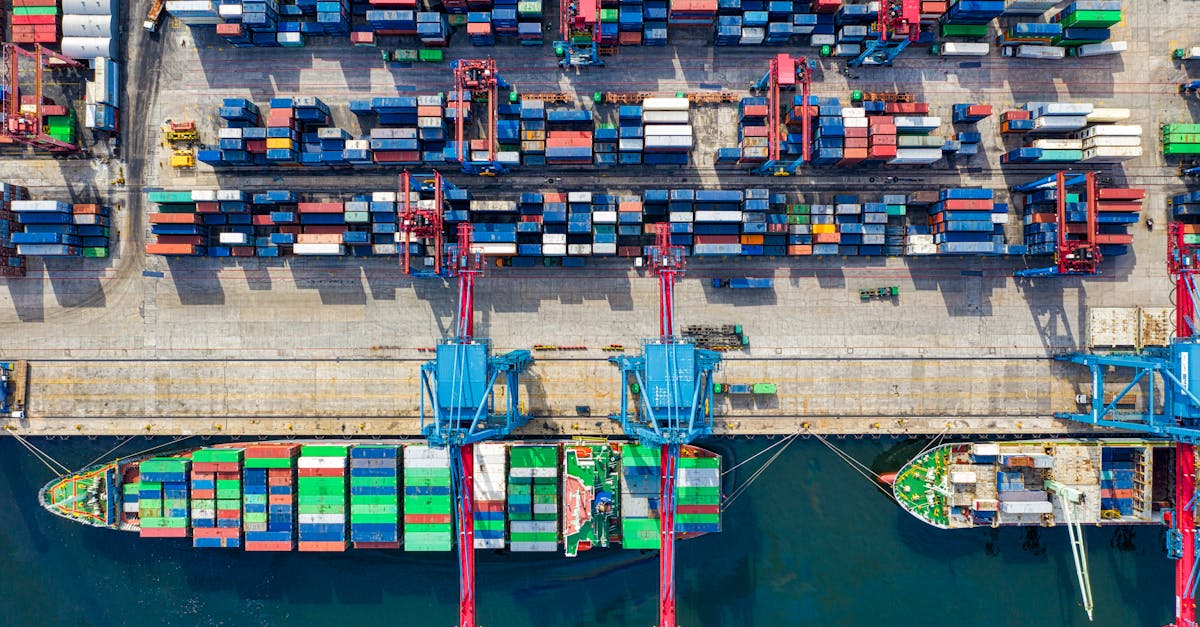

Navigating the complex network of sea freight routes from Asia to the UAE can significantly impact your shipping costs and delivery timelines. As a major trade corridor connecting the manufacturing powerhouses of Asia with the strategic business hub of the UAE, these maritime pathways serve as vital arteries for global commerce.

The sea routes between these regions have evolved substantially over the years, with several key ports in China, Singapore, Malaysia, and India serving as crucial departure points for cargo destined for Jebel Ali, Khalifa Port, and other UAE maritime facilities. Understanding these established shipping lanes and their operational characteristics will help you optimize your supply chain and make informed logistics decisions for your business.

Understanding Sea Freight Routes From Asia to UAE

Sea freight routes connecting Asia to the UAE form critical maritime highways for international trade. These established shipping lanes link major Asian manufacturing centers with the UAE's strategic ports, creating efficient pathways for cargo movement across the Indian Ocean and Arabian Sea.

Asian ports like Shanghai, Singapore, and Mumbai serve as primary departure points, while UAE destinations such as Jebel Ali and Khalifa Port function as regional distribution hubs. Each route offers distinct advantages in terms of transit times, shipping frequency, and cost structures.

Most cargo vessels follow standardized shipping lanes that navigate through the South China Sea, Strait of Malacca, and across the Indian Ocean before entering the Arabian Gulf. These routes vary in distance, with shipments from Eastern China typically traveling 6,500-7,500 nautical miles to reach UAE ports, while those from Western India cover approximately 1,200-1,500 nautical miles.

Transit times range from 7-10 days for shipments from India to 18-24 days for cargo departing from East Asian ports like Hong Kong or Shanghai. These timeframes factor in port congestion, weather conditions, and canal transits that influence overall delivery schedules.

Maritime traffic density affects shipping efficiency, with high-volume routes like the Singapore-UAE corridor experiencing consistent vessel availability but occasional congestion during peak seasons. Less-traveled routes might offer more competitive rates but with reduced sailing frequency.

Understanding these established sea freight corridors helps businesses optimize their supply chain planning and select the most appropriate shipping options for their specific cargo requirements.

Major Shipping Lanes Connecting Asia and the UAE

Major shipping lanes between Asia and the UAE function as maritime highways that facilitate the movement of goods across vast oceanic distances. These established routes have developed over decades of international trade and represent the most efficient paths for vessels traveling between Asian manufacturing hubs and the UAE's strategic ports.

The Malacca Strait-Gulf Route

The Malacca Strait-Gulf Route stands as the primary shipping corridor connecting East Asia to the UAE. This vital route begins in manufacturing centers like Shanghai, Hong Kong, and Singapore, passes through the Strait of Malacca—one of the world's busiest maritime chokepoints—and continues across the Indian Ocean before entering the Gulf of Oman and eventually reaching UAE ports. Approximately 70,000 vessels traverse the Malacca Strait annually, carrying 25% of global traded goods. The route's significance stems from its relatively direct path, reducing transit distances by 3,000+ nautical miles compared to alternative routes around Indonesia. For UAE-bound cargo, this translates to average sailing times of 12-16 days from Singapore and 18-22 days from Chinese ports like Shanghai, depending on vessel speed and stopping patterns.

The South China Sea-Indian Ocean Route

The South China Sea-Indian Ocean Route creates an essential connection between Southeast Asian production centers and the UAE's importing hubs. This maritime corridor begins in ports like Ho Chi Minh City (Vietnam), Bangkok (Thailand), and Jakarta (Indonesia), crosses the South China Sea, passes through the Strait of Malacca, and continues through the Indian Ocean toward the Arabian Gulf. The route spans approximately 5,500-6,500 nautical miles, with transit times averaging 15-21 days depending on the originating port. Vessels navigating this route typically transport containerized consumer goods, electronics, and textiles from Southeast Asia's manufacturing zones. Key advantages include high service frequency—with 8-10 weekly departures from major ports—and competitive freight rates due to the high volume of trade. The route's capacity expanded 18% between 2018-2022 as shipping lines deployed larger vessels to accommodate growing UAE-Southeast Asia trade, which reached $37 billion in 2022.

Key Asian Ports Serving UAE-Bound Cargo

Asia's major ports serve as crucial gateways for cargo destined for the UAE market. These strategic hubs provide efficient connections to the UAE's expanding port infrastructure, handling millions of TEUs annually and offering specialized facilities for various cargo types.

Chinese Ports: Shanghai, Shenzhen, and Hong Kong

Chinese ports dominate global shipping volumes for UAE-bound cargo, with Shanghai, Shenzhen, and Hong Kong standing as primary export gateways. Shanghai Port, the world's busiest container port, handles over 47 million TEUs annually and features 125+ berths with connections to 40+ weekly services to the UAE. Its Yangshan Deep Water Port section specifically accommodates the largest container vessels with drafts up to 15.5 meters. Shenzhen Port, comprising Yantian, Shekou, and Chiwan terminals, processes 27 million TEUs yearly and specializes in electronics and consumer goods exports to the UAE. Hong Kong's deep-water port offers 24 berths with comprehensive transshipment capabilities and value-added services like consolidated customs clearance for UAE shipments. These ports connect to Jebel Ali and Khalifa ports with transit times ranging from 18-25 days depending on vessel routing and stops.

Southeast Asian Hubs: Singapore and Port Klang

Singapore and Port Klang function as pivotal transshipment centers for UAE-bound cargo from Southeast Asia. Singapore's PSA terminals handle 37.5 million TEUs annually across 52 berths with automated operations that reduce processing times for UAE shipments by up to 30% compared to conventional ports. Its strategic location reduces transit times to the UAE to 12-14 days and offers 35+ weekly sailings to UAE ports. Port Klang, Malaysia's largest port, processes over 13 million TEUs yearly and serves as both a direct export hub for Malaysian products and a transshipment point for neighboring countries. Its North Port and West Port terminals offer specialized facilities for handling refrigerated cargo, hazardous materials, and oversized equipment bound for UAE construction projects. Both ports provide significant cost advantages for UAE-bound shipments with competitive handling fees and consolidated cargo options that reduce per-unit shipping costs by 15-25% compared to direct shipments from smaller regional ports.

UAE's Strategic Port Infrastructure

The UAE has developed world-class port facilities that serve as pivotal connection points for sea freight routes from Asia. These strategically positioned maritime hubs leverage the country's geographic location between East and West, handling millions of containers annually and offering comprehensive logistics services that facilitate seamless trade flows.

Jebel Ali Port: Gateway to the Middle East

Jebel Ali Port stands as the Middle East's largest and busiest maritime terminal, processing over 14.1 million TEUs annually. Located in Dubai, this deepwater port spans 134 square kilometers with 67 berths and a handling capacity that accommodates the world's largest container vessels. The port features specialized terminals for containers, roll-on/roll-off vessels, and bulk cargo, making it versatile for various shipment types from Asia. Direct connections to 150+ ports worldwide and advanced digital systems like the Dubai Trade Portal streamline cargo processing, reducing documentation time by up to 70% compared to traditional methods.

Khalifa Port: Abu Dhabi's Rising Hub

Khalifa Port has rapidly emerged as Abu Dhabi's premier maritime facility, handling 2.6 million TEUs in 2022 with expansion plans to reach 9.1 million TEUs capacity. Situated on Taweelah Island, this semi-automated port features cutting-edge infrastructure including 42-meter-deep waters accommodating Triple E class vessels and advanced container handling systems that achieve 30+ moves per hour. The port's strategic COSCO Shipping Ports Terminal partnership has established dedicated facilities for Chinese cargo, reducing processing times for Asian shipments by up to 20%. Connected to the Khalifa Industrial Zone Abu Dhabi (KIZAD), the port creates an integrated logistics ecosystem spanning 410 square kilometers that offers significant advantages for businesses utilizing Asia-UAE shipping routes.

Transit Times and Shipping Schedules

Sea freight transit times between Asia and the UAE follow predictable patterns based on departure points, vessel types, and selected routes. Understanding these schedules helps businesses plan inventory management and meet customer delivery expectations effectively.

Seasonal Variations in Shipping Timelines

Shipping timelines from Asia to the UAE fluctuate throughout the year due to seasonal factors. During peak season (August-October), transit times typically extend by 3-5 days beyond standard estimates as vessels operate at maximum capacity. Monsoon season in the Indian Ocean (June-September) creates challenging navigation conditions, adding 1-3 days to normal transit times and occasionally forcing route diversions. Winter months (December-February) often present more reliable schedules with fewer weather disruptions.

Chinese New Year (January-February) significantly impacts shipping operations as factories close for 2-3 weeks, creating pre-holiday congestion and post-holiday backlogs. During this period, booking containers 3-4 weeks in advance becomes essential. Ramadan and Eid holidays affect port operations in the UAE, with reduced working hours potentially adding 1-2 days to cargo clearance times.

Major Asian ports implement congestion surcharges during peak seasons:

| Port | Peak Season | Typical Surcharge |

|---|---|---|

| Shanghai | Aug-Oct | $200-400 per container |

| Singapore | Sep-Nov | $150-300 per container |

| Mumbai | Oct-Dec | $100-250 per container |

Express vs. Standard Shipping Options

Express and standard shipping services offer different transit time and cost trade-offs for Asia-UAE freight. Express services provide expedited transit times with guaranteed delivery windows, reducing shipping time by 25-40% compared to standard options. From Shanghai to Jebel Ali, express services deliver in 12-14 days versus the standard 18-21 days, while Singapore to UAE express routes take 8-10 days compared to standard 14-16 days.

Premium express services include dedicated space allocation, priority berthing at ports, and expedited customs processing. These time-sensitive options typically carry price premiums of 30-50% above standard rates but offer enhanced tracking capabilities and guaranteed loading. Major carriers like Maersk, MSC, and CMA CGM provide tiered service options with varying transit commitments.

Standard services maintain regular weekly departures from major Asian ports to the UAE with consistent, reliable scheduling patterns:

- Shanghai to Jebel Ali: Weekly departures every Wednesday and Saturday

- Hong Kong to Jebel Ali: Sailings every Tuesday and Friday

- Singapore to Khalifa Port: Regular Sunday and Thursday departures

For time-sensitive cargo, express LCL (Less than Container Load) options combine faster transit with lower volumes, offering 15-20% faster delivery than standard LCL services without requiring full container bookings.

Cost Factors in Asia-UAE Sea Freight

Sea freight costs between Asia and the UAE fluctuate based on multiple variables that impact your shipping budget. Understanding these cost elements helps you accurately forecast expenses and identify opportunities for optimization in your supply chain.

Container Types and Pricing Structures

Container selection significantly impacts your shipping costs on Asia-UAE routes. Standard containers come in 20-foot (20GP) and 40-foot (40GP) options, with 20GP units priced at $1,800-$2,500 and 40GP units at $2,500-$3,800 depending on the origin port. High Cube (40HC) containers provide additional vertical space at a 5-15% premium over standard 40-foot units, making them cost-effective for lightweight but voluminous cargo. Specialized containers like refrigerated (reefer) units command substantially higher rates, typically $4,500-$6,000 for Asia-UAE routes, due to power requirements and specialized handling.

Pricing structures follow several models in this trade lane. Freight All Kinds (FAK) rates offer standardized pricing regardless of cargo type, presenting a straightforward option for general merchandise. Commodity-specific rates adjust pricing based on the nature of goods transported, with electronics typically attracting higher rates than textiles. Contract rates provide long-term stability through negotiated agreements with carriers, while spot rates reflect immediate market conditions and can fluctuate 30-40% within a single month during volatile periods. Seasonal factors create predictable rate variations, with peak season (August-October) rates typically 20-30% higher than low season (February-April) for Asia-UAE shipments.

Additional Fees and Surcharges

Beyond base freight rates, numerous additional charges impact your total shipping costs. Terminal Handling Charges (THC) range from $150-$300 per container at Asian export ports and $200-$350 at UAE destination ports. Bunker Adjustment Factors (BAF) fluctuate monthly based on fuel prices, typically adding 10-20% to base rates. Currency Adjustment Factors (CAF) protect carriers from exchange rate volatility, especially relevant for shipments from countries with unstable currencies.

Operational surcharges include documentation fees ($50-$100 per shipment), customs clearance charges ($100-$300 depending on complexity), and equipment imbalance surcharges ($100-$200 during peak periods). Security-related fees like the ISPS (International Ship and Port Facility Security) charge add $10-$20 per container. Peak Season Surcharges (PSS) apply during high-demand periods, adding $200-$500 per container from August through October when Asia-UAE trade volumes spike. Congestion surcharges become applicable when major ports experience delays, occasionally reaching $200-$300 per container at bottleneck ports like Shanghai or Singapore. For special cargo, hazardous material fees ($150-$500) and overweight container charges ($200-$500 for containers exceeding standard weight limits) significantly increase transportation costs.

Navigating Customs and Documentation Requirements

Essential Customs Documentation for Asian Exports

Shipping goods from Asia to the UAE requires specific documentation for smooth customs clearance. Every shipment needs a commercial invoice detailing the goods' value, quantity, and description. You'll also need a certificate of origin that verifies where your products were manufactured, particularly important for items from China, Malaysia, or Singapore. The bill of lading serves as both a receipt and contract between you and the shipping line, containing detailed cargo information and ownership rights.

Packing lists provide customs officers with itemized details of your shipment's contents, dimensions, and weight. For regulated products such as electronics, chemicals, or food items, you'll need product-specific certificates like SGS inspection certificates or health certificates. The UAE requires these documents to be complete and accurate, as errors can result in delays averaging 3-5 business days and potential fines starting at AED 5,000.

UAE Customs Regulations and Compliance

The UAE maintains strict customs regulations that vary by emirate, with Dubai Customs and Abu Dhabi Customs operating under slightly different procedural requirements. All goods entering UAE ports undergo HS code classification, determining applicable duty rates typically ranging from 0-5%. Certain products face higher tariffs, including alcohol (50%) and tobacco (100%).

The UAE enforces prohibited and restricted items lists that align with Islamic principles and national security concerns. Prohibited items include narcotic substances, counterfeit currency, and gambling devices. Restricted goods like pharmaceuticals, communication equipment, and certain food products require special permits from relevant UAE authorities before importation.

The Advance Cargo Information (ACI) system requires you to submit documentation 48 hours before vessel arrival for risk assessment. Non-compliance with this electronic pre-arrival notification system can result in cargo holds and administrative penalties of up to AED 10,000 per shipment.

Electronic Clearance Systems and Pre-Arrival Processing

The UAE has implemented sophisticated electronic clearance platforms that streamline the customs process. Dubai Trade Portal and Abu Dhabi's ADSIC system enable digital submission of all required documents, reducing processing times by up to 60%. These platforms support pre-arrival processing, allowing customs officials to review and approve documentation before your shipment physically arrives.

Pre-arrival processing cuts clearance times from 2-3 days to often under 24 hours when documentation is submitted correctly. The UAE has adopted the World Customs Organization's standards for risk management, using advanced data analytics to determine which shipments require physical inspection. Low-risk consignments with proper documentation typically undergo document verification only, while medium to high-risk shipments face partial or complete physical examination.

You can register for Authorized Economic Operator (AEO) status to gain priority processing and reduced inspection rates. AEO-certified importers experience 70% fewer physical inspections and receive dedicated support from customs liaison officers.

Partnering with Customs Brokers and Freight Forwarders

Customs brokers and freight forwarders provide specialized expertise in navigating UAE import regulations. Licensed customs brokers maintain direct interfaces with Emirati customs authorities and can represent your interests during clearance procedures. They're particularly valuable for complex shipments or when importing specialized goods subject to additional regulatory requirements.

Reputable freight forwarders offering end-to-end services between Asia and the UAE typically provide customs clearance as part of their service packages. These companies maintain offices in both origin ports like Shanghai or Singapore and destination ports such as Jebel Ali, ensuring seamless documentation handling throughout the shipping process.

When selecting a customs partner, consider their specific experience with Asian-UAE trade lanes rather than general customs expertise. Brokers specializing in this corridor demonstrate success rates exceeding 95% for first-time customs clearance, compared to 75-80% for generalists. Their expertise with emirate-specific regulations becomes particularly valuable when your shipments enter through multiple UAE entry points.

Future Developments in Asia-UAE Maritime Trade

Digital Transformation of Shipping Corridors

Maritime trade between Asia and the UAE is undergoing significant digital transformation. Smart port technologies now enhance operational efficiency across major terminals with automated container handling systems reducing load/unload times by up to 30%. Dubai's Jebel Ali Port has implemented blockchain-based documentation processing, cutting paperwork processing from days to hours. Real-time tracking systems provide minute-by-minute cargo location updates, allowing UAE importers to monitor shipments throughout their journey from Asian origins. These digital innovations create more transparent, efficient supply chains while reducing administrative costs for businesses operating along these routes.

New Infrastructure Investments

Massive infrastructure developments are reshaping Asia-UAE shipping connections. China's Belt and Road Initiative has allocated $8.7 billion toward port infrastructure upgrades across the Maritime Silk Road, including improved facilities in Gwadar (Pakistan) and Hambantota (Sri Lanka) that serve as critical waypoints to the UAE. The UAE itself is investing AED 3.8 billion in expanding Khalifa Port's capacity by 50% by 2025. Singapore's Tuas Mega Port project, set to be fully operational by 2040, will handle 65 million TEUs annually—nearly doubling current capacity and strengthening the Singapore-UAE corridor. These developments will create more direct routes, reduce transit times, and increase vessel frequency between Asian manufacturing hubs and UAE ports.

Emerging Alternative Routes

New shipping corridors are emerging as alternatives to traditional Asia-UAE maritime pathways. The International North-South Transport Corridor (INSTC) connects India to the UAE via Iran and Russia, potentially reducing transit times by 40% compared to conventional routes around the Arabian Peninsula. The China-Pakistan Economic Corridor (CPEC) establishes a land-sea connection that bypasses the congested Malacca Strait, with cargo moving through Pakistan's Gwadar Port before a shorter sea journey to the UAE. The Arctic Sea Route, becoming increasingly viable due to climate change, offers a potential alternative during summer months that could cut transit times from Northeast Asia to the UAE by up to 10 days compared to routes through the Suez Canal.

Sustainability Initiatives

Environmental considerations are transforming shipping practices along Asia-UAE routes. Major carriers like Maersk and CMA CGM have introduced carbon-neutral shipping options on this corridor, using biofuels that reduce emissions by up to 85%. The UAE's Maritime Vision 2030 includes requirements for vessels entering its waters to meet stringent emissions standards, with sulfur content caps stricter than global IMO regulations. Asian ports including Singapore and Shanghai now offer shoreside power connections, eliminating the need for ships to run auxiliary engines while docked and reducing port-side emissions by up to 98%. These green shipping initiatives align with the UAE's sustainability goals while meeting growing demand from environmentally conscious consumers and businesses.

Trade Agreement Impacts

Evolving trade agreements are reshaping the commercial landscape of Asia-UAE maritime commerce. The UAE-India Comprehensive Economic Partnership Agreement signed in 2022 has already increased bilateral trade volume by 25%, with particular growth in agricultural products requiring specialized shipping. Similar agreements with South Korea and Indonesia have removed tariffs on 90% of traded goods, creating new cargo flows along established shipping lanes. The Regional Comprehensive Economic Partnership (RCEP), the world's largest trade agreement, includes major Asian exporters to the UAE and promises to standardize customs procedures across member states, potentially reducing documentation processing times by 40%. These agreements create more efficient trade corridors with simplified customs procedures and preferential tariffs.

Key Takeaways

- The primary shipping routes from Asia to UAE include the Malacca Strait-Gulf Route and the South China Sea-Indian Ocean Route, with transit times ranging from 7-10 days (from India) to 18-24 days (from East Asia).

- Major Asian export hubs serving UAE-bound cargo include Chinese ports (Shanghai, Shenzhen, Hong Kong), and Southeast Asian ports (Singapore, Port Klang), each offering specialized facilities and services.

- The UAE's strategic port infrastructure is anchored by Jebel Ali Port (processing 14.1 million TEUs annually) and Khalifa Port (handling 2.6 million TEUs), both offering advanced logistics capabilities for Asian imports.

- Sea freight costs between Asia and UAE are influenced by container types, seasonal variations, and numerous surcharges including Terminal Handling Charges (THC), Bunker Adjustment Factors (BAF), and Peak Season Surcharges (PSS).

- Proper documentation (commercial invoice, certificate of origin, bill of lading) is essential for smooth customs clearance, with the UAE requiring electronic pre-arrival notification 48 hours before vessel arrival.

- Future developments in Asia-UAE maritime trade include digital transformation, infrastructure investments, emerging alternative routes, sustainability initiatives, and new trade agreements that will enhance shipping efficiency.

Conclusion

Sea freight routes from Asia to the UAE represent vital arteries in global trade networks that you can leverage for your business advantage. These established maritime pathways connect major manufacturing hubs with strategic UAE ports while offering predictable schedules and competitive pricing options.

By understanding the nuances of different routes transit times customs requirements and seasonal variations you'll be better positioned to optimize your supply chain operations. Whether shipping from Chinese industrial centers or Southeast Asian manufacturing hubs your choices significantly impact both delivery timelines and bottom-line costs.

As these corridors continue evolving with digital innovations infrastructure investments and sustainability initiatives your awareness of these developments will prove invaluable. The strategic knowledge of these sea freight connections empowers you to make informed logistics decisions tailored to your specific cargo needs.