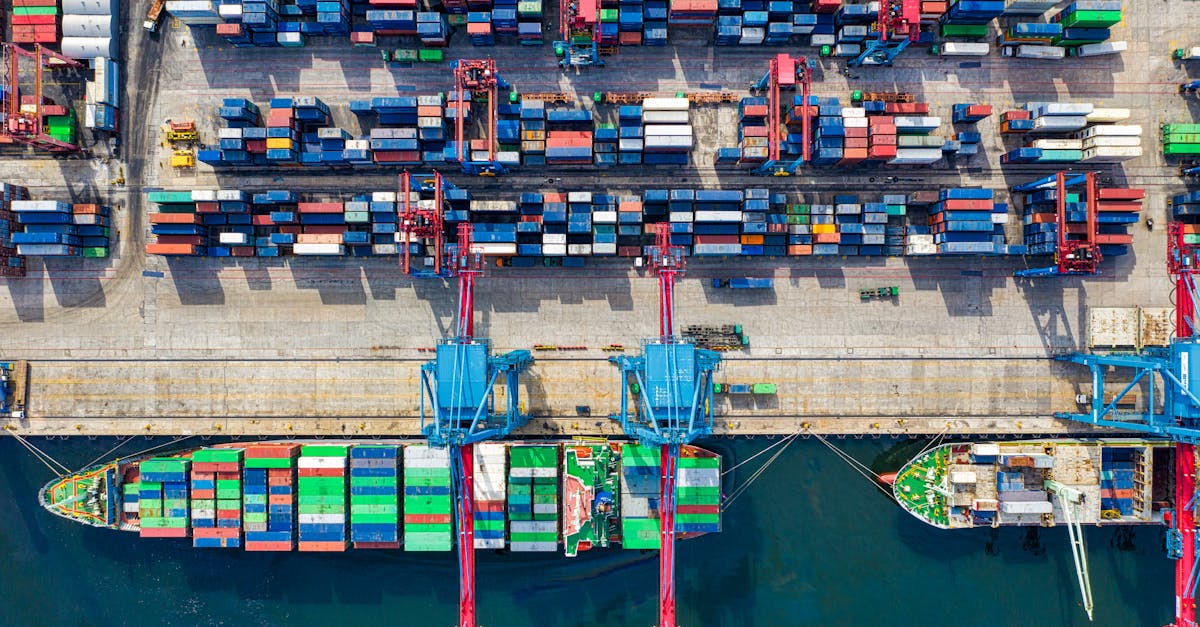

Navigating the complex world of international shipping in Qatar requires reliable partners who understand the unique demands of global logistics. freight forwarding companies in Doha serve as your essential link in the supply chain, managing everything from customs clearance to storage solutions while ensuring your cargo reaches its destination safely and efficiently.

Doha's strategic location has transformed it into a major Middle Eastern trade hub, with its freight forwarding sector experiencing remarkable growth in recent years. Whether you're importing raw materials, exporting finished products, or coordinating complex multimodal shipments, the right freight forwarder in Doha can streamline your operations, reduce costs, and help you navigate regulatory requirements. With numerous providers offering specialized services across air, sea, and land transportation, finding the perfect logistics partner for your business needs has never been more important.

The Role of Freight Forwarding in Qatar's Growing Economy

Qatar's economic transformation over the past decade has positioned freight forwarding as a critical component of its national development strategy. The country's GDP expanded by 4.8% in 2022, with logistics and transportation contributing approximately 7% to this growth. This economic evolution creates specialized demands that freight forwarders are uniquely equipped to address.

Freight forwarding companies in Doha serve as the backbone of Qatar's import-export infrastructure, facilitating over 60% of the country's international trade. These specialized logistics providers manage everything from customs documentation to final-mile delivery, ensuring seamless movement of goods through Qatar's borders. Their expertise becomes particularly valuable when navigating Qatar's unique customs regulations and import procedures.

The 2022 FIFA World Cup highlighted the essential nature of efficient freight forwarding in Qatar, with more than 3,000 TEUs (Twenty-foot Equivalent Units) of special event cargo processed through Hamad Port. This successful handling of time-sensitive shipments demonstrated how integral freight forwarders are to Qatar's ability to host international events and support its tourism sector.

Qatar's National Vision 2030 emphasizes economic diversification, with logistics identified as a primary growth sector. This strategic focus has encouraged the development of specialized freight forwarding services catering to emerging industries like pharmaceuticals, manufacturing, and technology. Local freight forwarders now offer customized solutions for these sectors, including temperature-controlled transportation, specialized packaging, and expedited customs clearance.

The expansion of Hamad Port and Hamad International Airport has created additional opportunities for freight forwarding companies. These world-class facilities handle over 1.5 million tons of air cargo and 3 million TEUs of sea freight annually, providing forwarders with advanced infrastructure to optimize their operations and offer more competitive services to clients throughout the region.

Top Freight Forwarding Companies in Doha

Doha's logistics landscape features a mix of international corporations and local specialists that excel in cargo management and transportation solutions. These companies leverage Qatar's strategic location and infrastructure to deliver reliable shipping services across global trade routes.

International Giants Operating in Doha

DHL Global Forwarding maintains a significant presence in Doha with comprehensive air, sea, and land freight services. The company operates a 4,500 square meter facility near Hamad International Airport, providing temperature-controlled storage for sensitive cargo. DB Schenker, another major player, offers specialized services for oil and gas logistics, utilizing their integrated management system to handle project cargo weighing up to 100 tons. Kuehne + Nagel's Doha operations feature advanced tracking technology that provides real-time updates across 100+ countries, making them a preferred choice for businesses requiring visibility throughout the supply chain. Expeditors International has established a reputation for customs brokerage excellence, processing over 500 shipments daily with a 98% on-time clearance rate.

Local Freight Forwarding Leaders

Gulf Warehousing Company (GWC) stands as Qatar's leading logistics provider with over 3 million square meters of warehousing space. GWC played a crucial role during the 2022 FIFA World Cup, handling 35,000+ event-related shipments with zero delivery failures. Milaha (Qatar Navigation) leverages its 60+ years of maritime experience to offer integrated supply chain solutions, operating a fleet of 80 vessels serving regional ports. Qatar Cargo Services specializes in time-critical shipments, maintaining a 95% on-time delivery record for express freight with same-day customs clearance capabilities. Al Madina Logistics has carved a niche in pharmaceutical transportation, operating GDP-certified cold chain facilities that maintain temperature integrity within ±0.5°C during transit. Suhail Shipping focuses on breakbulk and project cargo, successfully managing over 200 oversized equipment deliveries for Qatar's infrastructure projects in the past three years.

Services Offered by Doha's Freight Forwarders

Doha's freight forwarding companies provide comprehensive logistics solutions tailored to diverse cargo requirements and international shipping needs. These service providers combine specialized expertise with cutting-edge technology to facilitate seamless movement of goods through Qatar's strategic trade hubs.

air freight Services

Air freight services in Doha offer rapid transportation solutions for time-sensitive and high-value shipments. Leading forwarders operate through Hamad International Airport, handling over 2 million tons of cargo annually through dedicated terminals equipped with specialized storage facilities. These services include:

- Express delivery options with 24-48 hour worldwide delivery timeframes for urgent consignments

- Temperature-controlled transport for pharmaceuticals, perishables, and sensitive electronics maintaining precise conditions between -20°C and +25°C

- Charter services for oversized cargo, project equipment, and exclusive shipments requiring dedicated aircraft

- Consolidation programs that combine multiple smaller shipments into single air consignments, reducing costs by 15-30% for SMEs

- Documentation management including air waybills, certificates of origin, and customs declarations

Most Doha forwarders maintain partnerships with major airlines, securing preferential rates and guaranteed space allocations during peak seasons.

Sea Freight Solutions

Sea freight solutions represent the backbone of Doha's logistics operations, processing approximately 70% of Qatar's import and export volume. Hamad Port's strategic location connects Qatar to 120+ direct destinations worldwide, offering:

- FCL (Full Container Load) services for exclusive use of 20ft, 40ft, and 45ft containers with dedicated sailing schedules

- LCL (Less than Container Load) options allowing cost-effective shipping of smaller cargo volumes starting from 1 cubic meter

- Break-bulk handling for non-containerized cargo including construction materials, vehicles, and industrial equipment

- RORO (Roll-on/Roll-off) transportation for wheeled cargo such as automobiles, trucks, and heavy machinery

- Project cargo management for oversized industrial components weighing up to 300 tons with specialized lifting equipment

| Service Type | Average Transit Time | Cost Efficiency | Volume Capacity |

|---|---|---|---|

| FCL Shipping | 20-45 days | ★★★★☆ | 33-67 cubic meters |

| LCL Shipping | 25-50 days | ★★★☆☆ | 1-20 cubic meters |

| Break-bulk | 30-60 days | ★★☆☆☆ | Unlimited |

| RORO | 25-45 days | ★★★☆☆ | Vehicle-dependent |

Doha's freight forwarders often provide complementary port services including customs clearance, container inspection, and cargo insurance.

Land Transportation Options

Land transportation options complete Doha's comprehensive freight forwarding ecosystem, connecting sea and air cargo to final destinations throughout Qatar and neighboring GCC countries. Local forwarders operate:

- Domestic trucking networks covering all regions of Qatar with same-day and next-day delivery options

- Cross-border services to Saudi Arabia, UAE, Bahrain, and Kuwait with transit times ranging from 12 hours to 3 days

- Specialized vehicle fleets including refrigerated trucks, flatbeds, lowboys, and hydraulic trailers for diverse cargo requirements

- Multimodal solutions that seamlessly integrate road transport with air and sea freight for door-to-door service

- Last-mile delivery options customized for retail, e-commerce, and B2B distribution with real-time tracking

Most established freight forwarders in Doha maintain dedicated customs clearance teams at Abu Samra border crossing, expediting documentation processing and reducing transit delays by up to 70% compared to non-specialized carriers.

How to Choose the Right Freight Forwarding Partner in Doha

Selecting an appropriate freight forwarding partner in Doha requires careful evaluation of several critical factors. Your choice directly impacts operational efficiency, cost-effectiveness, and the reliability of your supply chain in Qatar's dynamic market.

Key Factors to Consider

When evaluating freight forwarders in Doha, focus on their industry experience and specialized expertise. Companies with 5+ years of experience in Qatar's logistics sector typically demonstrate better understanding of local regulations and procedures. Check their licensing credentials, including Qatar Chamber of Commerce registration and International Federation of Freight Forwarders Associations (FIATA) membership, which indicates adherence to global standards.

Assess their service portfolio to ensure it aligns with your specific shipping needs—whether air freight, sea freight, or multimodal transportation. Freight forwarders offering comprehensive solutions like DHL Global Forwarding or GWC provide single-point accountability for your entire logistics chain. Examine their technology integration capabilities, as advanced tracking systems and digital documentation processing reduce transit times by up to 30%.

Geographic coverage is equally important; partners with strong networks throughout the GCC region offer seamless cross-border shipment handling. Financial stability indicators such as consistent revenue growth and low debt-to-equity ratios suggest the forwarder can sustain quality service without disruption. Finally, request and contact at least three client references to verify their performance record in handling cargo similar to yours.

Red Flags to Watch Out For

Beware of freight forwarders that provide vague pricing structures or resist putting quotes in writing. Reputable companies like Kuehne + Nagel and Milaha offer transparent breakdowns of all charges, including base rates, fuel surcharges, and documentation fees. Excessive delays in communication—responses taking longer than 24 hours—signal potential service issues during actual shipment handling.

Limited insurance options represent another serious concern; professional forwarders offer multiple coverage levels appropriate for different cargo values and types. Companies lacking proper certifications such as ISO 9001 or industry-specific credentials (AEO status) may struggle with quality assurance processes. Watch for outdated technology platforms, as this often translates to manual documentation processing that increases error rates by 15-20%.

Reluctance to provide warehouse inspection opportunities raises questions about storage conditions and security protocols. Additionally, freight forwarders with limited local staff in Doha may lack the necessary relationships with customs authorities to resolve clearance issues efficiently. Finally, companies unwilling to customize solutions for specialized cargo requirements (temperature-controlled pharmaceuticals, oversized equipment) typically lack the expertise needed for complex logistics operations.

The Impact of New Port Facilities on Doha's Freight Industry

Doha's freight sector has transformed dramatically with Qatar's investment in modern port infrastructure. These advanced facilities have created ripple effects throughout the logistics ecosystem, benefiting freight forwarding companies and reshaping cargo handling capabilities.

Hamad Port's Transformation of Maritime Logistics

Hamad Port represents a cornerstone of Qatar's maritime infrastructure development, handling over 3 million TEUs annually since its full operation in 2016. This deep-water port features 12 specialized berths and a 4,000-vehicle capacity RORO terminal that's expanded freight handling capacity by 400% compared to the old Doha port. Freight forwarders now operate in a facility with automated container management systems that reduce processing times by up to 70%, allowing for faster cargo clearance and enhanced operational efficiency.

| Hamad Port Statistics | Value |

|---|---|

| Annual Container Capacity | 3+ million TEUs |

| RORO Terminal Capacity | 4,000 vehicles |

| Capacity Increase vs. Old Port | 400% |

| Container Processing Time Reduction | Up to 70% |

The port's strategic location offers freight forwarders direct connections to 40+ global destinations, eliminating previous reliance on regional transshipment hubs in Dubai or Jebel Ali. This direct connectivity has reduced transit times by 5-7 days for many European and Asian routes, creating competitive advantages for Doha-based logistics companies.

Technology Integration at Modern Port Facilities

Qatar's port modernization includes cutting-edge digital infrastructure that's revolutionized freight management practices. The Port Management Information System (PMIS) implemented at Hamad Port connects freight forwarders directly with customs authorities and shipping lines through a single digital platform. This integration has streamlined documentation processing, reducing paperwork processing time from 2-3 days to under 4 hours for standard shipments.

Advanced scanning technology allows for non-intrusive cargo inspection, with over 95% of containers processed without physical examination. Freight forwarders benefit from predictive analytics tools that forecast vessel arrivals with 98% accuracy, enabling better resource allocation and warehouse planning. These technological advancements have positioned Doha-based freight companies at the forefront of logistics innovation in the Middle East.

Economic Implications for Freight Forwarding Companies

The enhanced port infrastructure has created substantial economic opportunities for freight forwarding operations in Doha. Operational costs have decreased by approximately 15-20% for companies utilizing the new facilities, primarily through reduced dwell times and lower demurrage charges. The port's free zone areas provide tax incentives and 100% foreign ownership options, attracting 47 international freight forwarding companies to establish regional headquarters in Doha since 2018.

Import-export volumes handled by Doha-based freight forwarders have increased by 35% in the last three years, driven by improved port efficiency and expanded shipping routes. Companies specializing in temperature-controlled cargo benefit from the port's 110,000-square-meter cold storage facility, creating new opportunities in pharmaceuticals and perishables freight forwarding that weren't previously viable through Doha's logistics network.

Sustainability Initiatives and Green Logistics

Hamad Port's environmental design has positioned Doha as a leader in sustainable freight operations. The port implements shore-to-ship power systems that reduce vessel emissions by 60% while docked, allowing freight forwarders to offer greener supply chain solutions to environmentally conscious clients. Solar installations provide 30% of the port's energy requirements, lowering operational costs that translate to competitive service rates.

The port's water treatment and recycling systems process 85% of wastewater for reuse, reducing environmental impact while meeting international sustainability standards. These green initiatives have enabled 22 Doha freight forwarding companies to achieve ISO 14001 environmental certification, enhancing their appeal to global clients with corporate sustainability requirements.

Regulatory Framework for Freight Forwarding in Qatar

Qatar maintains a comprehensive regulatory structure governing all freight forwarding operations within its borders. This framework ensures high standards of service, protects business interests, and promotes fair competition in the logistics sector. Understanding these regulations is essential for companies seeking reliable freight forwarding partners in Doha.

Key Regulatory Bodies

Qatar's freight forwarding industry operates under the oversight of several governmental authorities. The Ministry of Transport serves as the primary regulatory body, establishing core policies that guide logistics operations throughout the country. The General Authority of Customs handles import/export compliance and enforces tariff regulations at all ports of entry. Meanwhile, the Qatar Free Zones Authority oversees specialized economic zones where many freight forwarders operate under modified regulatory conditions.

These organizations collaborate to implement Qatar's National Logistics Strategy, which aims to position the country as a premier logistics hub by 2030. Their coordinated efforts have streamlined documentation requirements and reduced processing times by 35% since 2019.

Licensing Requirements

Freight forwarding companies in Doha must obtain specific licenses before conducting business operations. The basic Commercial Registration requires extensive documentation, including:

- Proof of QAR 200,000 minimum capital investment

- Detailed company constitution and articles of association

- Bank references and financial statements

- Criminal background clearances for all partners

- Qatari sponsor documentation (51% local ownership requirement)

Additionally, specialized permits are necessary for handling particular cargo types, such as dangerous goods certification, pharmaceutical handling licenses, or perishable goods authorizations. Companies must renew these licenses annually, demonstrating continued compliance with all regulatory standards.

Customs Regulations and Compliance

Qatar's customs regulations follow the Gulf Cooperation Council (GCC) Unified Customs Law while incorporating Qatar-specific provisions. Key compliance elements include:

| Regulatory Aspect | Requirement | Implementation Timeline |

|---|---|---|

| Documentation | Electronic submission via Customs Clearance Single Window | Mandatory since January 2021 |

| HS Code Compliance | Adherence to 2022 Harmonized System codes | Fully implemented by March 2022 |

| Valuation Methods | Six WTO-approved methods for goods valuation | Consistent application since 2016 |

| Restricted Items | Updated quarterly prohibited/restricted goods list | Latest revision April 2023 |

| Pre-arrival Processing | Submission 24 hours before vessel arrival | 12 hours for air freight |

Non-compliance with these regulations can result in significant penalties, including fines up to QAR 100,000, temporary operation suspensions, or permanent license revocation for repeated violations.

Recent Regulatory Developments

Qatar has introduced several regulatory changes to modernize its freight forwarding sector. The implementation of the Al Nadeeb electronic customs clearance system has digitized 95% of customs procedures, reducing processing times from days to hours. The 2022 Foreign Investment Law now permits 100% foreign ownership in certain logistics activities, though freight forwarding still requires Qatari partnership.

Environmental regulations have also become stricter, with the Qatar Clean Program mandating carbon footprint reporting for logistics companies operating fleets exceeding 10 vehicles. These sustainable logistics initiatives align with Qatar National Vision 2030's environmental pillar and prepare the industry for global green shipping requirements.

Future Trends in Doha's Freight Forwarding Market

Technological Disruption in Logistics

Doha's freight forwarding sector is experiencing rapid technological transformation. Blockchain technology is revolutionizing documentation processes, reducing verification times by up to 80% and virtually eliminating paperwork errors. AI-powered predictive analytics now allow freight forwarders to anticipate shipping disruptions 5-7 days in advance, enabling proactive rerouting strategies. Several leading companies, including DHL Global Forwarding and GWC, have implemented IoT tracking systems that provide real-time visibility into cargo location and condition. These systems monitor temperature fluctuations as small as 0.5°C, critical for pharmaceutical and perishable goods shipments. Digital freight platforms have gained 35% market adoption in Doha since 2021, creating a more transparent marketplace where shippers can compare rates and transit times instantly.

Environmental Sustainability Initiatives

Environmental considerations are reshaping Doha's freight forwarding landscape. Qatar's National Environment and Climate Change Strategy mandates a 25% reduction in logistics-related carbon emissions by 2030, prompting freight forwarders to adapt operations. Companies like Milaha and Kuehne + Nagel have introduced carbon calculators that allow clients to measure shipment emissions and purchase verified carbon offsets. Route optimization software implemented across the sector has reduced fuel consumption by 12-15% on average. The industry is also witnessing a transition to alternative fuels, with 28% of local delivery vehicles now operating on electric or CNG power. Hamad Port's Green Shipping Corridor initiative connects Doha with ports committed to zero-emission maritime transport, creating competitive advantages for environmentally conscious freight forwarders.

Evolving Supply Chain Resilience Strategies

Post-pandemic supply chain vulnerabilities have catalyzed new resilience strategies among Doha's freight forwarders. Multi-sourcing practices have increased by 47% since 2020, with freight companies advising clients to diversify supplier networks across at least three geographic regions. Nearshoring arrangements have grown exponentially, particularly for time-sensitive components, reducing transit times by 40-60%. Advanced inventory modeling services are now offered by 65% of Doha's major freight forwarders, calculating optimal stock levels based on demand variability and lead time disruptions. Regional warehousing networks have expanded by 30% to support just-in-case inventory strategies, with Qatar's strategic location serving as a buffer stock hub for Middle Eastern operations. These resilience enhancements position Doha's freight sector as a critical stabilizing force in global supply chains.

Rise of Specialized Logistics Services

Doha's freight forwarding market is increasingly segmenting into specialized niches. The pharmaceutical logistics sector has grown by 42% annually since 2021, driven by temperature-controlled handling requirements and Qatar's expanding healthcare system. E-commerce fulfillment services have seen 55% year-over-year growth, with freight forwarders establishing dedicated facilities featuring automated sorting systems processing 15,000+ parcels daily. Project logistics for infrastructure development now represents 22% of the market, with companies like Suhail Shipping specializing in oversized cargo handling for Qatar's ongoing construction projects. Energy sector logistics has evolved to support Qatar's LNG export expansion, with specialized forwarding teams managing complex equipment transportation. These specializations require freight forwarders to develop industry-specific expertise and certifications, transforming generalists into vertical market specialists.

Key Takeaways

- Freight forwarding companies in Doha serve as essential supply chain partners, managing everything from customs clearance to storage while ensuring safe and efficient cargo transport throughout Qatar's growing economy.

- Top freight forwarders in Doha include international giants like DHL Global Forwarding and DB Schenker, alongside local leaders such as Gulf Warehousing Company (GWC) and Milaha, offering specialized services tailored to Qatar's unique market demands.

- Doha's freight forwarders provide comprehensive logistics solutions including air freight (handling 2+ million tons annually), sea freight (processing 70% of Qatar's import/export volume), and land transportation connecting Qatar with neighboring GCC countries.

- When selecting a freight forwarding partner in Doha, evaluate their experience, licensing credentials, service portfolio, technology integration, geographic coverage, and financial stability while watching for red flags like vague pricing or outdated technology.

- Hamad Port's advanced infrastructure has transformed Doha's freight industry, reducing processing times by up to 70%, connecting directly to 40+ global destinations, and enabling freight forwarders to offer more competitive and environmentally sustainable services.

- Future trends shaping Doha's freight forwarding market include technological disruption through blockchain and AI, sustainability initiatives reducing carbon emissions, evolving supply chain resilience strategies, and the rise of specialized logistics services.

Conclusion

Choosing the right freight forwarding partner in Doha isn't just a business decision—it's a strategic advantage in today's competitive market. As Qatar continues its impressive economic transformation through Vision 2030 with state-of-the-art facilities like Hamad Port and advanced regulatory frameworks these logistics specialists have become indispensable.

Whether you're managing time-sensitive shipments working with specialized cargo or expanding your global reach the expertise offered by Doha's diverse freight forwarding landscape can dramatically impact your bottom line. With technological innovations and sustainability initiatives reshaping the industry your logistics partner should be equipped to adapt and thrive.

The right freight forwarder will serve not just as a service provider but as a crucial extension of your business enabling you to focus on growth while they handle the complexities of global trade.