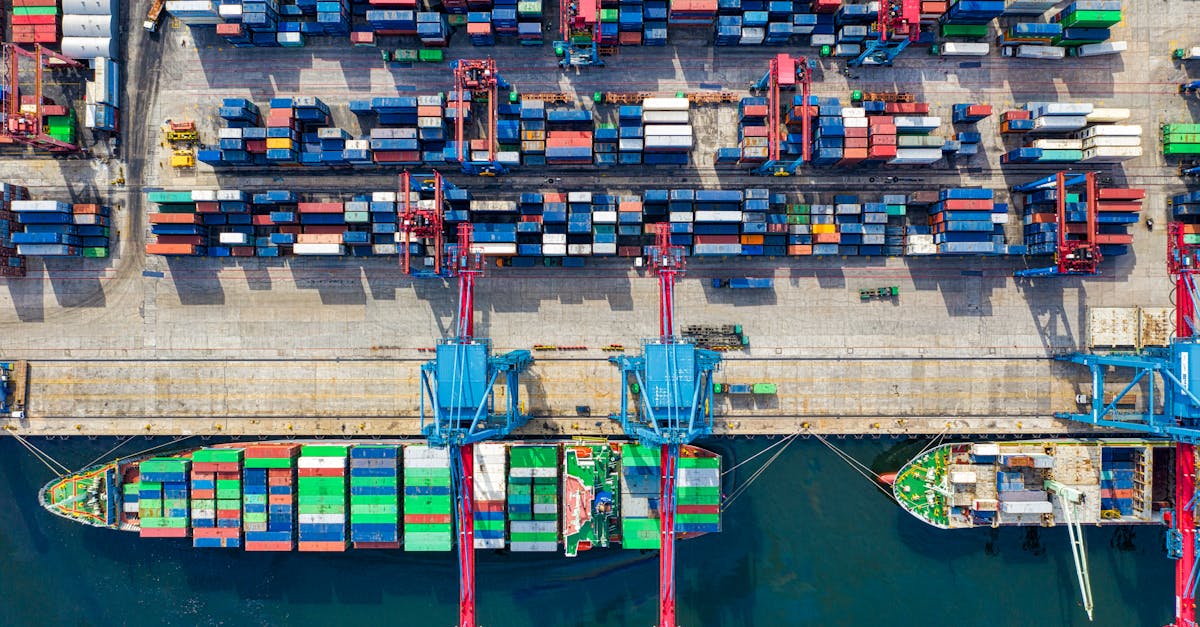

Navigating customs clearance in Middle Eastern ports can be a complex process for businesses looking to expand their import-export operations in this strategically important region. From the bustling container terminals of Jebel Ali in Dubai to the emerging logistics hubs in Saudi Arabia and Oman, each country maintains distinct regulatory requirements and documentation procedures.

Understanding the nuances of customs procedures across these ports isn't just beneficial—it's essential for avoiding costly delays and compliance issues. With recent modernization efforts and digital transformation initiatives, many Middle Eastern ports have streamlined their clearance processes, though traditional challenges like language barriers and varying interpretation of regulations remain. You'll need to prepare for both the region-wide commonalities and country-specific requirements to ensure smooth cargo movement through these vital trade gateways.

Understanding Customs Clearance in Middle Eastern Ports

Customs clearance in Middle Eastern ports follows specific protocols uniquely shaped by regional trade policies, cultural considerations, and economic priorities. The process involves several key components including documentation verification, cargo inspection, tariff assessment, and final release approval. Each port across countries like UAE, Saudi Arabia, Qatar, and Oman implements these procedures with distinct local variations.

When navigating customs procedures in these ports, you're dealing with a blend of traditional practices and modern digitized systems. Jebel Ali Port in Dubai, for example, utilizes advanced scanning technology that processes over 90% of containers without physical inspection, while smaller ports in the region may still rely on manual verification methods.

The documentation requirements typically include commercial invoice, bill of lading, certificate of origin, packing list, and import license for restricted goods. Additionally, Middle Eastern ports often require Arabic translations of key documents, particularly in Saudi Arabian and Kuwaiti ports where local language compliance is strictly enforced.

Understanding the tariff structure is crucial as rates vary significantly between countries. The UAE applies a standard 5% duty on most goods, while Saudi Arabia's rates range from 5-20% depending on the product category. Qatar maintains similar structures but offers more exemptions for goods supporting infrastructure development projects.

Inspection protocols differ markedly across regional ports. Bahrain's Khalifa Bin Salman Port conducts risk-based inspections on approximately 15% of incoming shipments, while Oman's Sohar Port implements both X-ray scanning and physical inspections based on risk profiles determined through their electronic clearance system.

Prohibited and restricted items receive heightened scrutiny throughout Middle Eastern ports. Common restrictions apply to alcohol, pork products, and religious materials, but each country maintains specific lists. Kuwait prohibits approximately 30 categories of goods beyond regional norms, while the UAE has more liberal policies particularly in free zones.

The clearance timeline varies significantly by port. Jebel Ali's average clearance time stands at 2-3 days for standard shipments, King Abdullah Port in Saudi Arabia averages 4-5 days, and smaller regional ports may require 5-7 days for the complete process. Electronic pre-clearance systems can reduce these timeframes by 30-40% in major ports.

Key Middle Eastern Ports and Their Customs Procedures

Middle Eastern ports serve as crucial gateways for global trade, each with distinctive customs clearance protocols. These major logistics hubs have developed specific procedures that reflect their unique regulatory environments, trade volumes, and technological capabilities.

United Arab Emirates: Dubai and Abu Dhabi

The UAE's ports rank among the region's most efficient with streamlined customs procedures. Jebel Ali Port in Dubai processes over 15 million TEUs annually and utilizes the Dubai Trade Portal for electronic documentation submission. Customs clearance typically takes 24-48 hours, with a risk-based inspection system that examines approximately 5% of shipments through advanced scanning technology.

Abu Dhabi's Khalifa Port employs the ATLAS e-clearance system where importers submit declarations online and receive automated risk assessment. The port maintains specialized clearance channels for perishable goods, dangerous materials, and high-value items. Pre-arrival clearance applications can be submitted up to 5 days before vessel arrival, reducing dwell time by up to 60% for regular importers with established trade records.

Saudi Arabia: Jeddah and Dammam

Saudi ports operate under the Saudi Customs Authority with distinct procedures at each location. Jeddah Islamic Port handles 65% of Saudi Arabia's imports with a SABER electronic platform for pre-arrival document verification. Customs processing averages 3-5 days with mandatory physical inspection for first-time importers and random checks for established traders.

Dammam's King Abdulaziz Port specializes in industrial cargo and petrochemical products with sector-specific clearance protocols. The port requires Fasah platform registration for document submission, with Arabic translations mandatory for all commercial documents. Importers must secure a customs broker registered with the Saudi Customs Authority and should anticipate additional religious compliance inspections for food, pharmaceuticals, and media materials.

Qatar: Hamad Port

Hamad Port handles 95% of Qatar's seaborne trade with a modernized customs infrastructure. The Al Nadeeb single-window clearance system integrates customs, port authority, and regulatory agency approvals into one platform. Document submission occurs electronically with authorized digital signatures accepted for most commercial paperwork.

The port employs a three-tier inspection regime based on risk profiling: green channel (document review only), yellow channel (scanning required), and red channel (full physical inspection). Food importers benefit from dedicated clearance lanes with on-site testing facilities that reduce clearance times to 24 hours for perishable goods. Qatar Customs applies a fixed 5% duty on most imports with exemptions for essential food items and construction materials serving the country's development projects.

Essential Documentation for Middle Eastern Customs Clearance

Proper documentation forms the backbone of successful customs clearance in Middle Eastern ports. Each document serves a specific purpose in the customs verification process and requires meticulous preparation to avoid clearance delays.

Required Certificates and Permits

Middle Eastern customs authorities require several key documents for successful cargo clearance. Commercial invoices must detail the complete transaction, including itemized costs, payment terms, and parties involved. Bills of lading establish ownership and serve as shipping contracts between carriers and shippers. Certificates of origin verify the manufacturing country and determine eligibility for preferential duty rates under trade agreements. Packing lists outline container contents with exact quantities, weights, and dimensions for inspection verification.

Country-specific documents include SASO certificates for Saudi Arabia, confirming products meet Saudi quality standards. The UAE requires ESMA certification for regulated products like electronics and automotive parts. Health certificates are mandatory for food imports across the region, with Qatar and Kuwait imposing strict documentation requirements for agricultural products. Additionally, Islamic countries require halal certificates for meat and food products, issued by recognized certification bodies.

Import licenses are needed for restricted goods such as pharmaceuticals, chemicals, and telecommunications equipment. Bahrain's Customs Affairs authority requires pre-approval for industrial machinery imports, while Oman implements special permit requirements for chemicals and hazardous materials through its e-Customs portal.

Electronic Documentation Systems

Electronic documentation systems have revolutionized Middle Eastern customs procedures, creating efficiency through digital submission platforms. The UAE's Mirsal 2 system processes over 85% of Dubai's customs declarations electronically, reducing clearance times by up to 70% compared to paper-based methods. Saudi Arabia's FASAH platform integrates with 25 government agencies, enabling single-window submission for importers and freight forwarders.

Qatar's Al Nadeeb system offers real-time tracking of documentation status and automated validation checks to catch errors before submission. Bahrain's Ofoq electronic platform connects customs operations with port authorities, streamlining communication between stakeholders. Oman's Bayan system includes mobile applications for document submission and tracking, allowing for corrections through digital channels rather than in-person visits.

These platforms feature varying capabilities and integration levels. Kuwait's KGCS (Kuwait General Customs System) provides pre-arrival processing but requires separate security permit applications. Jordan's ASYCUDA World system enables risk-based assessment, automatically routing high-risk shipments for additional document verification. Document retention requirements also vary, with the UAE mandating 5-year digital record keeping and Saudi Arabia requiring 10 years of archived customs documentation.

Common Challenges in Middle Eastern Customs Clearance

Navigating customs clearance in Middle Eastern ports presents several recurring challenges that impact importers and exporters. These obstacles can significantly affect clearance times, compliance costs, and overall supply chain efficiency across the region's diverse regulatory landscapes.

Regulatory Compliance Issues

Regulatory compliance presents a major hurdle in Middle Eastern customs clearance due to frequently changing import regulations and requirements. Countries like Saudi Arabia and the UAE update their customs regulations quarterly, making it difficult to maintain compliance without local expertise. For example, Saudi Arabia's recent implementation of the SABER product certification system has created adjustment challenges for many international shippers, with 35% reporting difficulties adapting to the new requirements.

Inconsistent interpretation of regulations between ports compounds these difficulties. A shipment cleared without issues at Jebel Ali might face different scrutiny at Dammam Port due to varying interpretations of the same GCC Unified Customs Law. Technical barriers to trade also emerge through country-specific standards like UAE's ESMA requirements for electronics or Saudi Arabia's SASO certification for consumer goods, which often involve costly testing and certification procedures from approved laboratories.

Penalty structures vary dramatically across the region, with fines for documentation errors ranging from 5% of shipment value in Oman to 25% in Kuwait. These unpredictable variables create significant compliance risks for businesses operating across multiple Middle Eastern markets.

Language and Cultural Barriers

Language barriers create substantial obstacles throughout the customs clearance process in Middle Eastern ports. Documentation requirements often include Arabic translations of commercial documents, particularly in Saudi Arabia, Kuwait, and Qatar. These translations must be certified by approved translators, adding both time (typically 2-3 days) and cost (approximately $50-100 per document) to the clearance process.

Communication challenges with customs officials can lead to misunderstandings and delays. While major ports like Jebel Ali employ multilingual staff, smaller ports often have limited English proficiency among officials. This language gap frequently results in miscommunications about shipment specifications or regulatory requirements, extending clearance times by 1-2 days on average.

Cultural differences in business practices further complicate customs interactions. The region's relationship-based business culture means that established importers with local connections often experience smoother clearance processes than new market entrants. Working hours differ significantly during religious holidays such as Ramadan, when customs processing capacity decreases by up to 40% with shortened working hours. Prayer times throughout the day also impact operational schedules, with processing pauses five times daily at ports in Saudi Arabia, Qatar, and Kuwait.

These cultural and linguistic challenges necessitate working with experienced customs brokers familiar with local nuances to navigate the clearance process effectively across Middle Eastern ports.

Strategies for Efficient Customs Clearance

Efficient customs clearance in Middle Eastern ports requires strategic approaches that address regional complexities while leveraging available resources. These strategies can significantly reduce clearance times, minimize costs, and help avoid compliance issues in the diverse regulatory environments across the region.

Working with Local Customs Brokers

Local customs brokers provide invaluable expertise that streamlines the clearance process in Middle Eastern ports. These professionals possess in-depth knowledge of port-specific procedures, documentation requirements, and regulatory nuances that aren't readily apparent to foreign businesses. For instance, brokers in Jebel Ali Port can navigate the UAE's Mirsal 2 system efficiently, while those in Saudi Arabia understand the intricacies of FASAH and SABER certification requirements.

When selecting a customs broker, look for firms with:

- Established relationships with local customs authorities

- Multilingual staff proficient in both Arabic and English

- Experience handling goods in your specific industry sector

- Physical presence at multiple ports if you're operating across several countries

- Track record of compliance with regional regulations

Top-tier brokers often maintain offices in free zones and commercial hubs like Dubai's JAFZA or Riyadh's King Abdullah Economic City, positioning them to respond quickly to emerging clearance issues. Their services typically include pre-arrival document preparation, classification assistance, duty calculation, and representation during physical inspections.

Technology Solutions for Customs Management

Technological tools offer significant advantages for managing customs clearance across Middle Eastern ports. Modern customs management systems integrate with port authority platforms to enable real-time shipment tracking, automated documentation preparation, and proactive compliance monitoring. These solutions reduce manual errors and acceleration clearance times by 30-40% in major ports like Jebel Ali and Hamad Port.

Key technology solutions include:

- Electronic Data Interchange (EDI) systems that seamlessly transmit shipping data to customs authorities

- Blockchain-based platforms for secure document sharing and verification, reducing fraud risks

- Automated HS code classification tools that ensure accurate tariff determinations

- AI-powered analytics for predicting clearance times and identifying potential delays

- Mobile applications that provide real-time status updates and alert notifications

Companies like Maersk and DP World offer integrated digital solutions specifically designed for Middle Eastern markets. These platforms interface directly with regional customs systems such as UAE's Mirsal 2, Saudi Arabia's FASAH, and Qatar's Al Nadeeb, creating a unified digital ecosystem for shipment processing.

Advanced users implement predictive analytics to identify optimal shipping routes and timing based on historical clearance data, potentially reducing port delays by up to 25% during peak seasons at busy hubs like Jeddah Islamic Port.

Recent Changes in Middle Eastern Customs Policies

Digital Transformation Initiatives

Middle Eastern customs authorities have accelerated digital transformation efforts across major ports since 2021. The UAE's Federal Customs Authority launched an enhanced version of their Mirsal 3 platform in late 2022, implementing blockchain technology to validate certificates of origin and reduce fraud. Saudi Arabia's FASAH platform integrated artificial intelligence capabilities for risk assessment, cutting declaration processing times by 65% at Jeddah Islamic Port. Oman's Bayan system now features mobile accessibility, allowing importers to track shipments and submit declarations from smartphones. These digital advancements have streamlined operations and improved transparency throughout the customs clearance process.

Regulatory Harmonization Efforts

The Gulf Cooperation Council (GCC) has intensified efforts to standardize customs regulations across member states. In 2023, Kuwait, Bahrain, Qatar, and the UAE adopted unified electronic documentation standards, eliminating redundant paperwork for cross-border shipments. Saudi Arabia implemented the Regional Integrated Customs Framework in March 2023, aligning inspection protocols with neighboring countries. The framework established three common risk profiles that determine inspection levels: green (minimal inspection), yellow (document verification), and red (comprehensive physical inspection). This standardization has reduced clearance times for intra-GCC trade by approximately 40% and decreased compliance costs for businesses operating across multiple GCC markets.

New Tariff Structures and Free Zones

Several Middle Eastern nations have restructured their tariff systems to support economic diversification goals. The UAE modified its customs duties in September 2022, introducing tariff exemptions for 400+ manufacturing inputs to stimulate local production. Qatar established graduated tariffs based on local availability, with rates ranging from 0-10% for goods with domestic alternatives. Oman expanded its free zone incentives at Sohar Port, offering 25-year tax holidays and 100% foreign ownership for specific industry sectors. Saudi Arabia's Economic Cities Authority created specialized customs channels at King Abdullah Economic City, providing expedited clearance for pharmaceutical and food products with processing times under 12 hours.

Compliance and Security Measures

Middle Eastern customs authorities have implemented stricter compliance and security protocols in response to global supply chain vulnerabilities. Kuwait Customs introduced mandatory Authorized Economic Operator (AEO) certification for high-volume importers in January 2023, requiring enhanced security standards and compliance histories. Bahrain implemented advanced scanning technology at Khalifa bin Salman Port, screening 95% of incoming containers without physical inspection. The UAE now requires advance cargo information 24 hours before vessel arrival, compared to the previous 12-hour requirement. Qatar Customs developed specialized inspection teams for sensitive goods categories, including pharmaceuticals, chemicals, and electronics, adding targeted expertise to the clearance process.

COVID-19 Policy Adaptations

The pandemic prompted lasting changes to customs procedures across Middle Eastern ports. Saudi Arabia permanently adopted virtual customs inspections for low-risk shipments, originally implemented as a temporary COVID-19 measure. The UAE established dedicated fast-track channels for medical supplies and essential goods, processing these shipments within 6 hours of arrival. Oman's customs authority maintained its contactless declaration system post-pandemic, eliminating in-person document submissions for 85% of imports. Qatar implemented a risk-based quarantine protocol for goods from high-risk regions, creating a streamlined process that balances health security with efficient trade facilitation.

Cost Considerations for Customs Clearance in the Region

Standard Customs Fees and Charges

Middle Eastern customs clearance involves several standard fees that impact your total shipping expenses. Customs duty rates vary significantly across the region, with the UAE maintaining a standard 5% import duty on most goods, while Saudi Arabia's rates range from 5-20% depending on the product category. Documentation processing fees typically range from $50-150 per shipment in major ports like Jebel Ali and Hamad Port, while smaller ports often charge 10-15% more for the same services.

Storage fees begin accruing after the free period ends—typically 3-5 days in Jebel Ali and 2-3 days in Jeddah Islamic Port. These charges escalate at a rate of approximately $15-25 per TEU per day, increasing progressively the longer your cargo remains in customs. Handling fees for physical inspections average $100-200 per container in the UAE and Qatar, rising to $250-350 in Saudi ports where more rigorous inspection protocols exist.

Country-Specific Tariff Considerations

Each Middle Eastern country implements distinct tariff structures reflecting their economic priorities. The UAE exempts over 8,000 product categories from duties when imported through free zones like JAFZA, creating opportunities for substantial cost savings. Qatar imposes additional 'quality control fees' of 0.5-1% on food products and electronics, requiring specific certification that costs $75-150 per product type.

Saudi Arabia applies supplementary religious certification fees of $200-350 for food items requiring halal certification, with particularly strict requirements for meat and dairy products. Oman offers preferential tariffs averaging 3% lower than standard GCC rates for goods originating from countries with bilateral trade agreements, including the United States and Singapore. Bahrain implements a sliding scale duty structure where luxury goods face rates up to 100% (particularly on alcohol and tobacco), while raw materials for manufacturing often qualify for complete exemption.

Broker and Agent Fees

Customs brokerage fees form a significant portion of clearance expenses in Middle Eastern ports. Local brokers charge between $150-400 per standard shipment in major ports like Jebel Ali and King Abdulaziz Port, with fees scaling based on cargo value. International logistics providers like DHL and FedEx typically charge 20-30% premium over local brokers but offer integrated tracking systems and standardized processing.

Additional agent services include document preparation assistance ($50-100 per submission), customs representation during inspections ($75-150 per instance), and classification consultations ($200-500 for complex goods). Specialized services such as temporary import bond arrangements cost $300-600 plus a refundable deposit of 5-10% of the goods' value. Most brokers in the UAE and Qatar offer volume-based discounts of 10-15% for clients exceeding 20 shipments monthly, while Saudi brokers typically require higher volumes (30+ shipments) to qualify for similar reductions.

Cost-Saving Strategies and Considerations

Implementing strategic approaches can significantly reduce your customs clearance expenses. Advanced electronic filing through platforms like Mirsal 2 in the UAE and FASAH in Saudi Arabia reduces processing fees by 20-30% compared to paper-based submissions. Pre-arrival clearance options available in major ports like Jebel Ali and Hamad Port can eliminate storage charges entirely when properly executed 48-72 hours before vessel arrival.

Free zone utilization provides substantial savings, with deferred duty payments and minimal documentation requirements saving an average of $250-400 per container. Accurate HS code classification prevents costly reclassification penalties, which typically equal 25-50% of the duty difference in Saudi Arabia and 10-20% in the UAE. Consolidating multiple smaller shipments into single larger consignments reduces per-shipment documentation fees, potentially saving 30-40% on administrative costs when moving goods to the same destination.

Impact of Recent Policy Changes on Costs

Recent regulatory shifts across the Middle East have altered the customs clearance cost landscape. The UAE's implementation of value-added tax (VAT) at 5% since 2018 adds this amount to the CIF value plus duty calculation, increasing overall import costs. Saudi Arabia's expedited clearance program introduced in 2021 offers 40-60% faster processing for a premium fee of $200-350 per shipment, providing cost-benefit advantages for time-sensitive cargo.

Regional economic diversification initiatives have created over 25 specialized customs channels across GCC ports, each with different fee structures based on cargo type and priority level. Digitalization investments have reduced document processing fees by 15-25% in ports using fully electronic systems, though many smaller ports still maintain higher fees while transitioning from paper-based systems. The GCC's harmonization efforts since 2022 have standardized penalties for declaration errors, with fines now ranging from $300-1,500 depending on the infraction type rather than varying dramatically between countries.

Key Takeaways

- Middle Eastern ports combine traditional customs practices with modern digital systems, with major hubs like Jebel Ali offering advanced processing while smaller ports still rely on manual verification.

- Documentation requirements vary by country but typically include commercial invoices, bills of lading, certificates of origin, and Arabic translations, with specialized certifications like SASO (Saudi Arabia) or ESMA (UAE) for certain products.

- Electronic customs systems have revolutionized clearance processes, with platforms like UAE's Mirsal, Saudi Arabia's FASAH, and Qatar's Al Nadeeb reducing processing times by up to 70% compared to paper-based methods.

- Regulatory compliance presents significant challenges due to frequently changing import regulations, inconsistent interpretation between ports, and country-specific standards that require constant monitoring.

- Working with experienced local customs brokers who understand port-specific procedures and have established relationships with authorities can dramatically improve clearance efficiency and reduce delays.

- Recent policy changes include GCC-wide standardization efforts, specialized customs channels for certain industries, and enhanced digital transformation initiatives that have streamlined cross-border trade in the region.

Conclusion

Navigating customs clearance in Middle Eastern ports requires thorough preparation and understanding of each country's unique requirements. While digital transformation has streamlined processes at major hubs like Jebel Ali and Hamad Port the region still presents distinctive challenges.

Your success depends on partnering with experienced local brokers who understand port-specific protocols and can navigate language barriers. Leveraging technology solutions and staying current with evolving regulations will significantly reduce clearance times and costs.

Remember that documentation requirements vary substantially between countries with Arabic translations often mandatory. By planning ahead and accounting for regional variations in tariffs inspection procedures and prohibited items you'll position your business for smoother operations throughout this dynamic region.