Container Shipping Rates 2025: Market Analysis and Trends

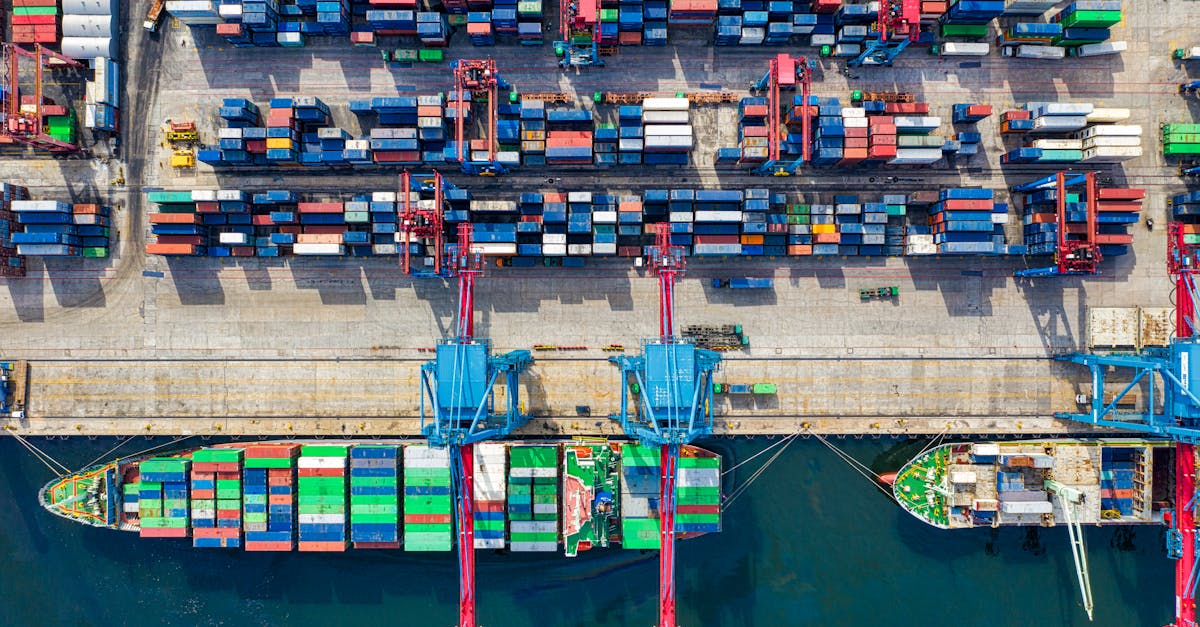

Container shipping rates have experienced significant volatility in recent years. This analysis covers current 2025 market conditions, rate trends, and factors influencing pricing across major trade routes.

2025 Container Rate Overview

Following the extreme volatility of 2020-2022, container rates have stabilized in 2025 but remain above pre-pandemic levels due to increased operational costs and infrastructure investments by carriers.

Current Rate Ranges by Route (40ft Container)

| Route | Q1 2025 Range | Year-over-Year Change |

|---|---|---|

| Asia-US West Coast | $1,800-$3,200 | -15% vs 2024 |

| Asia-US East Coast | $3,200-$5,500 | -10% vs 2024 |

| Asia-Europe | $2,500-$4,200 | -20% vs 2024 |

| Asia-Australia | $1,500-$2,800 | -12% vs 2024 |

Key Market Drivers in 2025

Capacity Management: Carriers have become more disciplined about capacity deployment, maintaining service reliability while optimizing vessel utilization rates.

Fuel Regulations: IMO 2020 sulfur regulations and emerging carbon reduction requirements continue to influence operational costs and pricing structures.

Infrastructure Investments: Port automation and digital transformation initiatives are gradually improving efficiency but require significant capital investment reflected in rates.

Seasonal Rate Patterns

Peak Season (July-October): Rates typically increase 20-40% due to retail inventory buildup for holiday seasons. Early booking is essential during this period.

Chinese New Year (January-February): Factory closures create capacity surpluses, offering opportunities for lower rates but with service disruptions.

Off-Peak (March-June): Most stable pricing period with best opportunities for annual contract negotiations.

Rate Forecasting Factors

- Global economic growth: GDP expansion drives trade volume and rate pressure

- Energy costs: Fuel price volatility directly impacts surcharge levels

- Port congestion: Delays increase carrier costs and rate volatility

- Currency fluctuations: Exchange rate changes affect regional competitiveness

Strategic Implications for Shippers

Regular shippers should consider annual contracts to secure rate stability and capacity guarantees. Spot market rates offer flexibility but expose businesses to volatility during peak periods.

Multi-year partnerships with reliable freight forwarders can provide access to better rates and service reliability compared to direct carrier bookings for smaller volume shippers.