Global supply chains have evolved into intricate networks connecting businesses across continents, but they're increasingly vulnerable to disruption. From pandemic-related shutdowns to geopolitical tensions and climate disasters, today's supply chains face unprecedented challenges that can impact your business operations without warning.

When you're managing international logistics, you'll encounter obstacles like transportation delays, inventory management complexities, and regulatory compliance issues. These challenges don't just affect large corporations—they ripple through businesses of all sizes, potentially increasing costs and delivery times for your customers.

Understanding these supply chain vulnerabilities is the first step toward building resilience. Throughout this article, you'll discover the most significant challenges facing global supply chains today and practical strategies to navigate them effectively.

Understanding Global Supply Chain Fundamentals

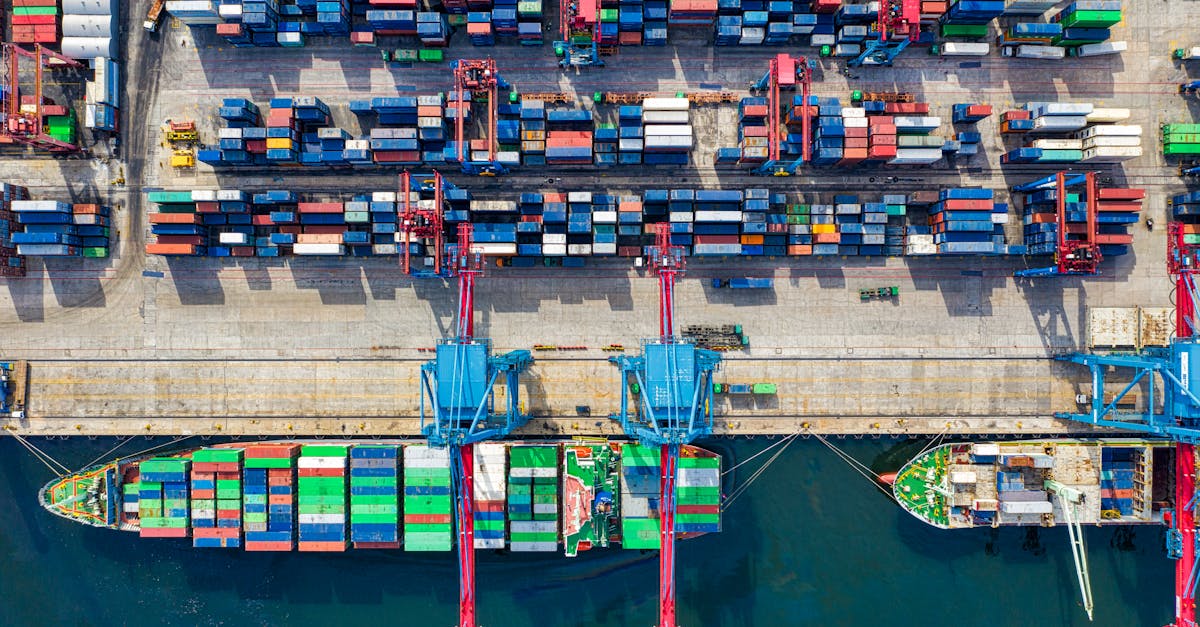

Global supply chains form the backbone of international commerce, enabling the efficient movement of goods and services across borders. These complex networks involve multiple stakeholders and processes that must work in harmony to deliver products from manufacturers to end consumers.

The Interconnected Nature of Modern Supply Networks

Modern supply networks are highly interconnected systems linking suppliers, manufacturers, distributors, retailers, and customers across different countries and continents. This interconnectedness creates a web where raw materials from Africa can be processed in Asia, assembled in Europe, and sold in North America—all coordinated through sophisticated logistics systems. Digital technologies like IoT sensors, blockchain, and AI-powered analytics further integrate these networks by providing real-time visibility and data-driven decision making. Companies like Apple, Toyota, and Amazon exemplify this interconnection, with supply chains spanning dozens of countries and involving thousands of suppliers. The COVID-19 pandemic exposed how disruptions in one region rapidly cascade globally, with manufacturing delays in China causing product shortages throughout international markets within weeks.

Major Disruptions Affecting Global Supply Chains

Global supply chains face unprecedented challenges that have exposed critical vulnerabilities in these complex networks. These disruptions have fundamentally altered how businesses approach supply chain management, forcing companies to reevaluate their strategies and build more resilient systems.

COVID-19 Pandemic Impacts

The COVID-19 pandemic created the most significant supply chain disruption in modern history. When the virus emerged in early 2020, manufacturing facilities across China—responsible for producing 28% of global manufacturing output—shut down, triggering immediate shortages of critical components. This initial shock cascaded throughout global networks, causing:

- Production halts: Factories worldwide experienced shutdowns due to parts shortages, worker illness, and government restrictions

- Shipping congestion: Port capacity reduced by 20-40% in major hubs like Los Angeles and Rotterdam

- Demand volatility: Consumer spending shifted dramatically from services to goods, creating a 34% surge in e-commerce sales

- Labor shortages: Transportation and warehousing sectors lost 3.1 million workers globally during peak pandemic periods

These disruptions revealed critical dependencies in just-in-time inventory systems that prioritized efficiency over resilience. The semiconductor shortage exemplifies this vulnerability, where a 26-week lead time for chips paralyzed automotive production and created a $210 billion revenue loss for the industry in 2021.

Geopolitical Tensions and Trade Wars

Escalating geopolitical conflicts have fractured established trade relationships and created persistent supply chain uncertainties. The U.S.-China trade war initiated in 2018 imposed tariffs on $550 billion of Chinese goods and $185 billion of U.S. exports, forcing companies to:

- Diversify sourcing: 92% of companies surveyed by McKinsey reported actively pursuing supplier diversification strategies

- Relocate production: Manufacturing shifts to Vietnam, Mexico, and India increased by 27% between 2018-2022

- Navigate complex regulations: Companies face compliance challenges with UFLPA, CBAM, and other trade restrictions

- Absorb increased costs: Tariff-related expenses have added 2-6% to production costs for affected industries

The Russia-Ukraine conflict further disrupted global supply chains by limiting access to critical raw materials. Ukraine exports 46% of global sunflower oil and 12% of wheat, while Russia provides 43% of global palladium and 11% of nickel—all experiencing severe supply constraints following the conflict's onset in 2022.

Logistics and Transportation Challenges

Logistics and transportation form the backbone of global supply chains, yet they're increasingly fraught with complex obstacles. These challenges directly impact product availability, delivery timelines, and overall operational costs for businesses worldwide.

Rising Freight Costs

Freight costs have skyrocketed across all transportation modes in recent years, creating significant financial pressure on global supply chains. ocean freight rates increased by over 400% between 2019 and 2022, with some routes experiencing even more dramatic spikes. Air cargo rates similarly doubled during peak pandemic periods, while trucking costs rose 30-40% in many regions due to fuel price volatility and driver shortages.

Several factors contribute to these persistent high costs:

- Fuel price fluctuations directly impact transportation expenses, with diesel and bunker fuel prices remaining unstable due to geopolitical tensions and production constraints

- Capacity imbalances between major trade routes create situations where containers and vessels aren't optimally distributed, leading to premium pricing on high-demand lanes

- Labor shortages across the logistics sector have driven up wages for truck drivers, port workers, and warehouse staff, costs that carriers pass to shippers

- Equipment scarcity, particularly shipping containers, has created artificial supply constraints that shipping lines leverage in pricing strategies

These elevated costs force companies to reevaluate their transportation strategies, including modal shifts from air to ocean or implementing zone skipping in domestic distribution networks to consolidate shipments and reduce per-unit costs.

Port Congestion and Capacity Constraints

Port congestion has emerged as a critical bottleneck in global supply chains, with vessels waiting weeks for berth space at major gateways. The Port of Los Angeles/Long Beach experienced record backlogs in 2021-2022, with over 100 vessels simultaneously anchored offshore during peak periods. Similar congestion affected major Asian and European ports, creating ripple effects throughout global shipping networks.

This congestion stems from multiple interconnected factors:

- Infrastructure limitations at ports unable to handle increasingly larger vessels, with outdated equipment and insufficient berthing space

- Labor disruptions from pandemic-related absences, strikes, and shortages of qualified workers to operate cranes and move containers

- Chassis and truck shortages creating "dwell time" problems where containers can't move promptly from terminals to inland destinations

- Digital coordination gaps between shipping lines, terminal operators, customs agencies, and inland carriers that prevent smooth cargo flows

These bottlenecks create cascading delays, with each congested port amplifying problems throughout the network. Vessels arriving late to one port miss their scheduled berth windows at subsequent ports, perpetuating a cycle of delays. For manufacturers and retailers, these constraints translate to inventory uncertainty, extended lead times, and missed sales opportunities when products don't reach markets on schedule.

Technology and Digital Transformation Hurdles

Digital transformation presents both opportunities and significant challenges for global supply chains. While technology enhances connectivity and efficiency, implementation barriers and security concerns create substantial obstacles for organizations attempting to modernize their operations.

Cybersecurity Vulnerabilities

Supply chain cybersecurity vulnerabilities have increased exponentially as digitization accelerates across global networks. Recent statistics show that supply chain attacks rose by 42% in 2021, affecting over 1,600 companies worldwide. These vulnerabilities manifest in several critical areas: compromised vendor systems, unsecured IoT devices monitoring shipments, and API weaknesses between interconnected platforms. Organizations face sophisticated threats like the SolarWinds breach, which demonstrated how attackers can exploit trusted relationships between technology providers and their customers. Protecting sensitive shipment data, intellectual property, and customer information requires multi-layered security protocols, including regular penetration testing, vendor security assessments, and end-to-end encryption for data in transit. Companies like Maersk, which lost over $300 million in a NotPetya cyberattack, exemplify the financial and operational devastation these vulnerabilities can cause when exploited.

Integration Across Different Systems

System integration challenges create significant bottlenecks in supply chain digital transformation initiatives. Legacy systems built on outdated technologies often can't communicate with modern cloud-based platforms, creating data silos that fragment critical information. Companies struggle with incompatible data formats, inconsistent standards, and proprietary software interfaces that don't easily exchange information. The average global enterprise maintains 14 different supply chain systems that must work together seamlessly. Integration difficulties appear most prominently during mergers and acquisitions, international expansion, and when implementing new technologies like blockchain or AI-powered demand forecasting. Organizations face prohibitive costs—integration projects typically consume 30-40% of IT budgets—and technical complexity when connecting disparate systems like ERP platforms, warehouse management software, and transportation management systems. Successful integration requires standardized data models, robust middleware solutions, and API-first architectures that enable flexible connections between systems regardless of their underlying technology.

Environmental and Sustainability Pressures

Global supply chains face intensifying environmental and sustainability pressures as climate change concerns mount worldwide. Companies across industries now confront dual challenges of maintaining operational efficiency while reducing ecological impact throughout their supply networks.

Carbon Footprint Reduction Demands

Carbon footprint reduction has become a critical priority for supply chain managers facing pressure from multiple stakeholders. Consumers increasingly favor brands with demonstrated environmental commitments, with 73% of global consumers willing to change consumption habits to reduce environmental impact according to Nielsen research. Investors now evaluate companies based on ESG (Environmental, Social, Governance) metrics, directing capital toward businesses with lower carbon profiles. These pressures create operational challenges including:

- Transportation emissions from lengthy global shipping routes, with maritime shipping alone contributing approximately 3% of global greenhouse gas emissions

- Manufacturing impacts across distributed production facilities with varying environmental standards and energy sources

- Material sourcing complexities when balancing cost effectiveness against sustainable harvesting or extraction practices

- Packaging waste management throughout multi-stage distribution networks spanning different countries with diverse recycling capabilities

Companies like Unilever and Walmart have responded by setting science-based targets for emissions reductions throughout their supply chains, implementing comprehensive supplier evaluation programs that measure and incentivize carbon reduction initiatives.

Regulatory Compliance Requirements

Environmental regulatory compliance has evolved from a secondary consideration to a fundamental business requirement affecting global supply chain operations. The regulatory landscape includes overlapping and sometimes contradictory requirements:

- Regional carbon pricing mechanisms such as the EU Emissions Trading System affecting cross-border production costs

- Extended Producer Responsibility (EPR) laws in 33+ countries mandating manufacturers take responsibility for post-consumer product waste

- Chemical and substance restrictions including REACH in Europe and similar regulations in markets like China and California

- Deforestation prevention regulations like the EU Deforestation Regulation requiring companies to verify products aren't linked to forest degradation

- Carbon border adjustment mechanisms creating new tariffs based on embedded carbon content in imported goods

The compliance burden creates significant operational challenges through increased documentation requirements, supplier monitoring responsibilities, and potential supply route restrictions. For example, the automotive industry faces complex reporting requirements for critical minerals sourcing across global supplier networks. Meanwhile, the fashion industry contends with growing transparency mandates regarding textile production environmental impacts.

These evolving requirements demand sophisticated traceability systems capable of documenting environmental compliance across multiple tiers of suppliers—often extending to raw material origins. Companies succeeding in this environment have invested in digital tracking technologies, third-party verification processes, and collaborative supplier development programs to ensure adherence to rapidly evolving environmental standards.

Strategies for Supply Chain Resilience

Building resilient supply chains requires proactive strategies that address vulnerabilities while maintaining operational efficiency. Companies are now implementing comprehensive approaches to withstand disruptions and ensure business continuity in an increasingly volatile global landscape.

Risk Assessment and Management Approaches

Risk assessment forms the foundation of supply chain resilience by systematically identifying and quantifying potential threats. Leading organizations employ sophisticated risk mapping techniques that categorize risks based on probability and impact, allowing for prioritized mitigation efforts. Many companies utilize digital twin technology—virtual replications of physical supply chains—to simulate disruption scenarios and test response strategies before implementation. For example, Procter & Gamble's risk management system incorporates AI-driven predictive analytics to forecast potential disruptions at specific nodes in their network.

Advanced supply chain visibility tools enhance risk management by providing real-time monitoring of shipments, inventory levels, and supplier performance. These platforms integrate data from IoT sensors, logistics partners, and market intelligence to create early warning systems for emerging threats. Companies like Unilever and Cisco have established dedicated supply chain risk management teams that conduct quarterly vulnerability assessments and maintain continuously updated contingency plans for critical suppliers and transportation routes.

Diversification and Nearshoring Options

Supplier diversification reduces dependency on single sources by establishing relationships with multiple vendors across different geographic regions. This multi-sourcing strategy creates redundancy in the supply base, allowing operations to continue when individual suppliers face disruptions. Many manufacturers now follow a "China plus one" approach, maintaining Chinese manufacturing while developing parallel capacity in countries like Vietnam, Malaysia, or Mexico to balance efficiency with resilience.

Nearshoring brings production closer to end markets, reducing transportation complexity and shortening lead times. This strategic shift offers greater control over operations while reducing exposure to international shipping disruptions. Companies like General Motors have expanded manufacturing in regional hubs—establishing production facilities in the United States, Mexico, and Canada—creating interlocking supply networks that can compensate for localized disruptions. Similarly, European companies are relocating portions of their manufacturing from Asia to Eastern European countries like Poland and Romania.

The implementation of regional supply chain clusters creates self-contained ecosystems where raw materials, component manufacturing, and final assembly operate in proximity. These clusters minimize cross-border dependencies and establish more agile supply networks with faster response capabilities. Successful diversification strategies combine geographic distribution with careful supplier qualification processes to ensure new partners meet quality, capacity, and compliance requirements without introducing additional risks.

Future Outlook for Global Supply Chains

Global supply chains are evolving rapidly in response to recent disruptions, with several key trends shaping their future trajectory. Organizations implementing strategic adaptations today are positioning themselves for success in an increasingly complex international trade environment.

Acceleration of Digital Transformation

Digital transformation is revolutionizing supply chain operations through advanced technologies that enhance visibility and responsiveness. AI-powered demand forecasting systems reduce inventory errors by up to 50%, while blockchain applications provide immutable transaction records that strengthen supplier trust. Companies like Unilever and Walmart have implemented digital control towers that consolidate data from disparate systems, creating comprehensive dashboards that enable real-time decision making across their networks.

IoT devices and sensors are creating connected supply chains that transmit critical information automatically. These smart devices track everything from temperature fluctuations in pharmaceutical shipments to precise location data for high-value components, eliminating manual monitoring and reducing loss incidents by 30-40% in many implementations.

Regionalization and Localization Trends

The shift toward regionalized supply networks is gaining momentum as companies prioritize operational stability over lowest-cost production. 67% of manufacturing executives are actively developing regional supply ecosystems that reduce cross-border dependencies. This regionalization creates compact supply clusters that minimize transportation distances, lower carbon emissions, and increase responsiveness to local market needs.

Localized production hubs, particularly for critical industries like pharmaceuticals, semiconductors, and essential consumer goods, are expanding in North America and Europe. These strategic manufacturing centers incorporate redundancy by design, balancing efficiency with resilience through flexible production capacity that can quickly pivot during disruptions.

Sustainability as a Competitive Advantage

Sustainable supply chain practices are transitioning from optional initiatives to competitive necessities. 83% of consumers consider environmental impact in purchasing decisions, driving companies to implement comprehensive sustainability programs throughout their supply networks. Circular supply chain models that emphasize product lifecycle management, material reclamation, and waste reduction are replacing traditional linear approaches.

Renewable energy adoption in transportation and manufacturing operations is accelerating, with major logistics providers committing to carbon-neutral delivery networks by 2030. Companies implementing sustainable practices report tangible benefits beyond environmental impact, including 15-25% reductions in operational costs through improved resource efficiency and reduced waste management expenses.

Geopolitical Realignment and Trade Patterns

The global trade landscape is undergoing significant restructuring as geopolitical tensions reshape established commercial relationships. Supply chains are adapting to a fragmented global order characterized by competing trade blocs and strategic autonomy initiatives. Companies are developing multi-regional strategies that maintain access to key markets while minimizing exposure to volatile trade policies.

Friend-shoring—prioritizing trade with politically aligned nations—is emerging as an alternative to pure economic efficiency considerations. This approach creates more predictable regulatory environments and reduces compliance complexities, though it often introduces higher production costs. Organizations are implementing sophisticated scenario planning tools that model various geopolitical outcomes and develop contingency options for critical supply relationships.

Workforce Transformation and Automation

Supply chain workforces are evolving as automation technologies transform traditional roles and create demand for new skills. Warehouse automation systems reduce manual handling requirements by 40-60% while improving accuracy and throughput. These technologies don't eliminate human roles but shift labor needs toward specialized positions in technology management, data analysis, and system optimization.

Remote operations capabilities expanded during the pandemic are becoming permanent features of supply chain management. Digital collaboration tools enable distributed teams to coordinate complex operations across multiple locations, creating more flexible and resilient organizational structures. Companies investing in workforce development programs report 30% higher retention rates and faster adoption of new technologies compared to organizations without structured training initiatives.

Key Takeaways

- Global supply chains face unprecedented challenges including pandemic disruptions, geopolitical tensions, and environmental pressures that impact businesses of all sizes

- Transportation hurdles like port congestion and soaring freight costs (400% increase between 2019-2022) create significant bottlenecks in the movement of goods worldwide

- Digital transformation offers solutions but introduces new vulnerabilities, with supply chain cyberattacks increasing 42% in 2021 and affecting over 1,600 companies

- Risk management strategies including supplier diversification, nearshoring, and digital monitoring systems have become essential for building resilient supply networks

- Sustainability has evolved from an optional initiative to a competitive necessity, with 83% of consumers considering environmental impact in purchasing decisions

- Future supply chains are trending toward regionalization and localization with 67% of manufacturing executives developing regional supply ecosystems to reduce cross-border dependencies

Conclusion

Global supply chains face unprecedented challenges that require adaptive strategies for survival. You'll need to embrace digital transformation while addressing cybersecurity risks and integration hurdles. Building resilience through diversification supplier relationships and nearshoring can protect your operations from disruptions.

Environmental pressures and complex regulations now demand sustainable practices throughout your supply network. Companies that invest in visibility tools risk assessment technologies and workforce development will be better positioned to navigate this evolving landscape.

The future points toward regionalized networks digital integration and sustainability as competitive advantages. By understanding these challenges and implementing proactive solutions you can transform vulnerabilities into opportunities for innovation and growth in your global supply chain operations.