Navigating the complex world of international shipping between Asia and the Middle East requires strategic planning and market knowledge. As two regions experiencing rapid economic growth, their trade relationship continues to strengthen, creating numerous opportunities for businesses looking to expand their reach.

When you're shipping goods from manufacturing hubs like China, Japan, or South Korea to Middle Eastern markets such as the UAE, Saudi Arabia, or Qatar, you'll encounter unique challenges and advantages. From choosing between sea and air freight to understanding customs regulations and documentation requirements, each decision impacts your shipping timeline, costs, and overall supply chain efficiency.

The Growing Trade Between Asia and the Middle East

Asia and the Middle East have developed a robust trade relationship over the past decade, with bilateral trade volumes exceeding $1.2 trillion annually. This economic partnership extends beyond traditional oil and gas exchanges to encompass technology, consumer goods, and infrastructure development projects.

Key Trade Routes and Hubs

Maritime corridors connecting major Asian manufacturing centers to Middle Eastern ports form the backbone of this growing trade relationship. Key shipping routes include:

- Malacca Strait-Red Sea corridor connecting Southeast Asian hubs to Gulf ports

- China-Persian Gulf direct shipping lines with 7-14 day transit times

- South Asia-Arabian Peninsula routes carrying textiles, pharmaceuticals, and machinery

- Japan/Korea-UAE lanes specializing in automotive and electronics shipments

Strategic port facilities like Jebel Ali (UAE), King Abdullah Port (Saudi Arabia), and Port of Salalah (Oman) serve as primary entry points for Asian goods entering Middle Eastern markets. These ports have invested heavily in capacity expansion, with container handling capabilities increasing by 45% since 2015.

Economic Drivers Fueling Trade Growth

Several economic factors contribute to the intensifying trade relationship between these regions:

- Diversification initiatives in Gulf economies reducing dependency on oil revenues

- Infrastructure megaprojects requiring Asian construction materials and expertise

- Growing middle-class populations in both regions creating new consumer markets

- Complementary economic strengths with Asia's manufacturing prowess meeting Middle East's resource wealth

- Strategic investment partnerships facilitating cross-regional business development

The trade landscape is further transformed by economic transformation programs like Saudi Vision 2030 and UAE Centennial 2071, creating $380 billion in new trade opportunities across various sectors.

Evolving Product Categories

The composition of goods flowing between Asia and the Middle East has evolved significantly, moving beyond commodities to include:

| Product Category | Annual Trade Value | Growth Rate (5-year) |

|---|---|---|

| Consumer Electronics | $87 billion | 23% |

| Automotive | $64 billion | 18% |

| Textiles & Apparel | $42 billion | 15% |

| Machinery | $38 billion | 12% |

| Food Products | $29 billion | 21% |

Chinese manufactured goods now account for 31% of all imports entering GCC markets, while South Korean and Japanese products contribute an additional 24% market share in high-value segments.

Impact of Regional Trade Agreements

Free trade agreements and economic partnerships have accelerated market access between Asian and Middle Eastern nations. Recent developments include:

- China-GCC Strategic Dialogue framework establishing preferential trade terms

- India-UAE Comprehensive Economic Partnership Agreement reducing tariffs on 80% of product categories

- ASEAN-GCC Trade and Investment Framework creating streamlined customs procedures

- Japan-Middle East Investment Initiative facilitating technology transfer and joint ventures

These agreements have reduced average import tariffs by 12-18% on key products, significantly impacting shipping volumes and logistics planning requirements for businesses operating between these regions.

Key Shipping Routes From Asia to the Middle East

Maritime routes connecting Asia and the Middle East form the backbone of the $1.2 trillion trading relationship between these regions. Each route offers distinct advantages in terms of transit time, cost efficiency, and strategic positioning for businesses engaged in cross-continental trade.

The Malacca Strait and Suez Canal Route

The Malacca Strait-Suez Canal corridor serves as the primary maritime artery for Asia-Middle East trade, handling approximately 70% of containerized freight between these regions. Ships departing from major Asian ports like Shanghai, Singapore, and Hong Kong navigate through the Malacca Strait, cross the Indian Ocean, enter the Red Sea, and traverse the Suez Canal before reaching Mediterranean and Gulf ports. This 8,000-nautical-mile journey typically takes 14-18 days for container vessels, making it significantly faster than alternative routes. The corridor's efficiency has improved since the 2021 Suez Canal expansion, which increased daily vessel capacity from 49 to 97 ships and reduced transit times by 7 hours.

| Route Segment | Distance (nautical miles) | Average Transit Time |

|---|---|---|

| Malacca Strait | 550 | 1-2 days |

| Indian Ocean Crossing | 3,700 | 7-9 days |

| Red Sea & Suez Canal | 1,300 | 2-3 days |

| Mediterranean/Gulf Approach | 2,450 | 4-5 days |

Alternative Shipping Lanes

Several alternative routes have gained prominence for specific trade flows between Asia and the Middle East. The Cape of Good Hope route, circumnavigating Africa, extends voyage time to 24-30 days but serves as a critical contingency during Suez Canal disruptions as demonstrated during the 2021 Ever Given incident. The Northern Sea Route through Arctic waters has reduced Shanghai-UAE shipping distances by 30% during navigable summer months, though ice conditions limit year-round viability. Emerging multimodal corridors like the India-Middle East-Europe Economic Corridor (IMEC) and the International North-South Transport Corridor combine sea, rail, and road transportation, cutting transit times by up to 40% for certain cargo types. These alternatives provide strategic redundancy in the Asia-Middle East supply chain network, offering shippers multiple routing options based on cargo urgency, fuel costs, and evolving geopolitical conditions.

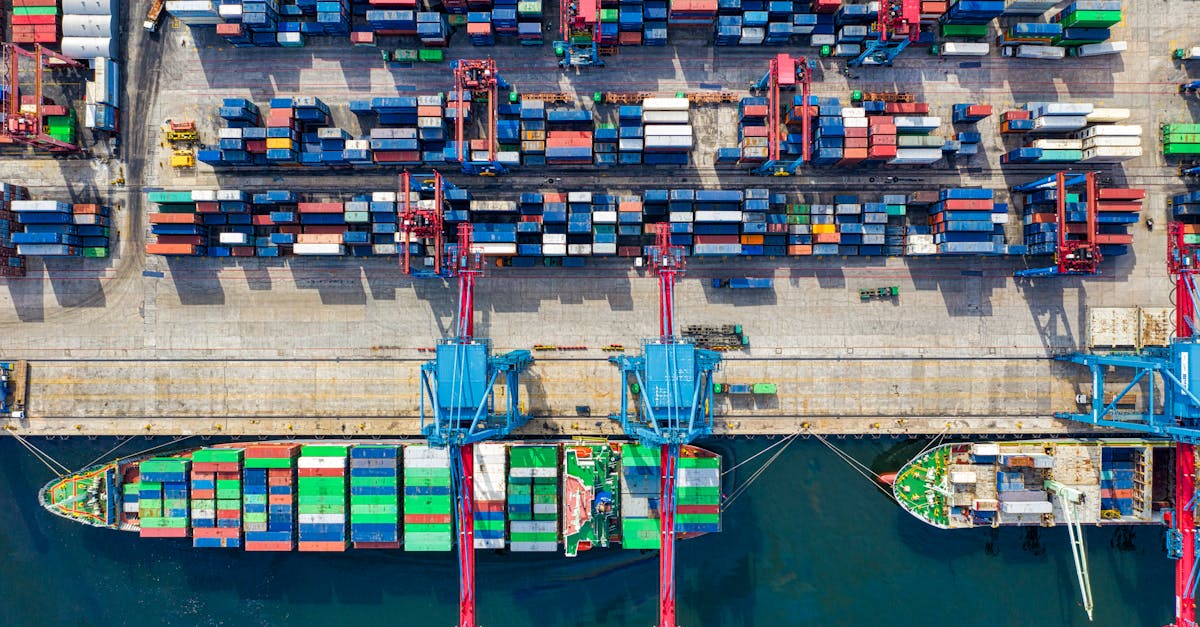

Major Ports and Logistics Hubs

The success of Asia-Middle East shipping operations depends heavily on strategic port selection and logistics infrastructure. These interconnected hubs form the backbone of the $1.2 trillion annual trade relationship, offering specialized facilities and services that enhance supply chain efficiency.

Asian Export Centers

Asia's export infrastructure features world-class ports that serve as critical gateways for Middle Eastern trade. Shanghai Port, China's largest maritime facility, handles over 43 million TEUs annually, specializing in consumer electronics and manufactured goods bound for Gulf markets. Singapore's PSA terminals process approximately 37 million TEUs yearly, functioning as a transshipment hub with direct services to Jebel Ali, Dammam, and other Middle Eastern destinations.

Hong Kong's deep-water port maintains its prominence with advanced automated systems that expedite container processing and documentation for Middle Eastern shipments. In South Asia, India's Nhava Sheva (JNPT) near Mumbai accounts for 40% of India's container traffic with specialized terminals for petrochemical products and consumer goods destined for UAE and Saudi markets.

South Korean export activities concentrate at Busan Port, which handles 75% of the country's container traffic and offers specialized facilities for automotive exports to Middle Eastern dealerships. Malaysian trade flows through Port Klang and Tanjung Pelepas, with the latter serving as a regional hub for Middle Eastern carriers like Qatar Airways Cargo's sea-air operations.

Middle Eastern Receiving Ports

The Middle East has developed sophisticated port infrastructure to accommodate growing Asian imports. Jebel Ali Port in Dubai stands as the region's premier logistics hub, handling 14.1 million TEUs annually with 67 berths and specialized facilities for temperature-controlled goods from Asia. Saudi Arabia's King Abdullah Port, a cornerstone of the country's Vision 2030 initiative, features fully automated container terminals that process Asian shipments 25% faster than regional competitors.

Qatar's Hamad Port has emerged as a strategic gateway with its $7.4 billion investment in state-of-the-art facilities, including a dedicated 1.7 million square meter logistics zone for Asian imports. Oman's Sohar Port leverages its position outside the Strait of Hormuz to offer congestion-free processing of Asian shipments, with integrated free zones that simplify distribution throughout the GCC.

Kuwait's Shuwaikh Port specializes in receiving consumer goods and construction materials from Asian suppliers, while Bahrain's Khalifa Bin Salman Port operates as an efficient transshipment center with a 12-hour turnaround time for vessels carrying Asian cargo. In emerging markets, Iraq's Grand Faw Port development project aims to create a direct gateway for Asian imports with planned capacity of 7.5 million TEUs upon completion.

Shipping Methods and Container Options

Selecting the right shipping method and container option significantly impacts your logistics efficiency when moving goods from Asia to the Middle East. Your choice affects transit times, costs, and cargo security throughout the supply chain.

FCL vs. LCL Shipping Considerations

Full Container Load (FCL) shipping provides exclusive use of an entire container for your cargo, offering enhanced security and protection from handling damage. This option proves most cost-effective when shipping volumes exceed 15 cubic meters or 10 standard pallets, with typical transit times from major Asian ports to the Middle East ranging from 14-21 days. FCL shipments benefit from reduced handling as containers remain sealed from origin to destination, minimizing risks of damage or loss.

Less than Container Load (LCL) consolidation allows you to share container space with other shippers, making it economical for smaller shipments under 15 cubic meters. LCL typically costs 30-40% less than FCL for small volumes but adds 3-5 days to transit times due to additional consolidation and deconsolidation processes. This option provides flexibility for irregular shipments or market entry testing without committing to full container costs. Popular consolidation hubs include Singapore, Hong Kong, and Dubai, where cargo from multiple Asian origins is consolidated for Middle Eastern destinations.

Specialized Cargo Requirements

Temperature-controlled containers (reefers) maintain specific temperature ranges for perishable goods like pharmaceuticals, chemicals, and food products during the hot Middle Eastern transit. These specialized units add approximately 30-40% to standard shipping costs but protect temperature-sensitive cargo throughout the 2-3 week journey, with continuous monitoring systems ensuring temperature integrity.

Oversized cargo requires flat racks or open-top containers for items exceeding standard container dimensions, such as industrial equipment or construction materials. These specialized options accommodate goods up to 40 feet in length or heights exceeding 8'6", though they may require special permits at both origin and destination ports. Break-bulk shipping serves as an alternative for exceptionally large cargo like turbines or heavy machinery that doesn't fit containerized options.

Dangerous goods transportation follows strict International Maritime Dangerous Goods (IMDG) regulations, requiring proper documentation, specialized packaging, and specific container placement onboard vessels. Shippers must provide accurate Material Safety Data Sheets (MSDS) and employ appropriate hazard labels. Many Middle Eastern ports enforce additional restrictions on hazardous materials imports, requiring pre-arrival notification at least 48 hours before vessel arrival.

Shipping Costs and Transit Times

Shipping costs and transit times between Asia and the Middle East vary significantly based on multiple factors including distance, shipping method, and current market conditions. Understanding these elements helps businesses optimize their supply chain operations and manage expectations effectively.

Factors Affecting Pricing

Freight rates from Asia to the Middle East are influenced by several key variables that directly impact your bottom line. Distance between specific ports affects baseline costs, with shipments from Southeast Asia to the Gulf typically costing 15-25% more than those from China to Dubai. Container type and size create substantial price differences—standard 20-foot containers average $800-1,500 while specialized refrigerated containers command premiums of 40-100% above standard rates. Fuel surcharges fluctuate monthly, recently averaging 20-30% of base shipping costs following global oil price trends. Cargo value and weight density also affect pricing through dimensional weight calculations, with low-density, high-volume shipments often incurring higher rates despite lighter weights.

Current market data shows sea freight from Shanghai to Jebel Ali ranges from $1,200-2,500 per standard container, while air freight averages $3.50-5.00 per kilogram for the same route. Transit times typically span:

| Shipping Method | Origin | Destination | Transit Time | Average Cost (USD) |

|---|---|---|---|---|

| Sea Freight (FCL) | Shanghai | Jebel Ali | 18-24 days | $1,200-2,500/container |

| Sea Freight (LCL) | Shanghai | Jebel Ali | 22-28 days | $40-60/CBM |

| Air Freight | Shanghai | Dubai | 5-7 days | $3.50-5.00/kg |

| Sea-Air Combined | Hong Kong | Riyadh | 12-15 days | $2.20-3.00/kg |

| Express Courier | Singapore | Doha | 3-4 days | $8.00-12.00/kg |

Additional charges often overlooked include terminal handling fees ($150-300 per container), customs clearance fees ($75-200 per shipment), and documentation costs ($50-100 per set). These supplementary costs can add 15-25% to your quoted freight rates.

Seasonal Variations in Shipping Schedules

Seasonal patterns significantly impact both availability and pricing when shipping from Asia to the Middle East. Chinese New Year (January-February) creates major disruptions with manufacturing shutdowns lasting 2-3 weeks, causing pre-holiday rate increases of 30-50% and extended transit times of 5-7 additional days. The Ramadan/Eid period affects port operations throughout the Middle East, with reduced working hours extending delivery times by 3-5 days and creating port congestion that peaks 1-2 weeks after the holiday.

Peak shipping season (August-October) coincides with back-to-school and year-end holiday preparations, driving capacity constraints and price premiums of 20-40% above annual averages. Conversely, shipping during Q1 (January-March, excluding Chinese New Year) offers opportunities for cost savings of 15-25% due to reduced demand.

Weather conditions introduce predictable disruptions, with monsoon season (June-September) affecting South Asian routes and causing delays of 2-5 days, while summer temperatures exceeding 45°C (113°F) in the Gulf region necessitate special handling for temperature-sensitive cargo.

Forward-planning strategies include booking shipments 4-6 weeks in advance during peak seasons versus 2-3 weeks during off-peak periods. Contract rates negotiated for annual volumes offer stability against spot market fluctuations, typically providing 10-15% savings over published rates during volatile periods.

Documentation and Customs Requirements

Navigating the complex documentation and customs requirements for shipping from Asia to the Middle East demands meticulous preparation and regional expertise. These requirements form the backbone of successful cross-continental shipments, directly impacting clearance times, compliance status, and overall supply chain efficiency.

Essential Paperwork for Cross-Continental Shipping

The foundation of any Asia-to-Middle East shipment lies in properly prepared documentation that meets both international standards and regional requirements. Key documents include:

- Commercial Invoice: Contains comprehensive details about the goods, including quantity, description, value, and country of origin. Middle Eastern customs authorities require 3-5 copies, often with consular legalization for high-value shipments.

- Bill of Lading (B/L): Serves as proof of contract between shipper and carrier while establishing ownership of goods. For Middle Eastern destinations, a "clean" on-board B/L without notations about damaged cargo is essential.

- Certificate of Origin: Verifies where products were manufactured or produced. This document requires authentication by the Chamber of Commerce and, for certain Middle Eastern countries like Saudi Arabia and UAE, necessitates additional embassy attestation.

- Packing List: Provides itemized details of package contents, including weights, dimensions, and package counts. For mixed-product shipments to GCC countries, customs officials typically require SKU-level descriptions.

- Import Licenses: Required for restricted or regulated products entering Middle Eastern markets. These licenses must be secured before shipping from Asian origins, with processing times ranging from 3-6 weeks for countries like Qatar and Bahrain.

Electronic documentation systems have streamlined this process, with platforms like Dubai Trade Portal and Saudi's FASAH system accepting digital submissions for pre-arrival clearance, reducing clearance times by up to 70% compared to paper-based processes.

Country-Specific Import Regulations

Middle Eastern countries maintain distinct import regulations that vary significantly across the region:

- United Arab Emirates: Implements a 5% standard import duty on most goods, with exemptions for specific sectors like healthcare equipment. The UAE requires Arabic labeling for consumer products and enforces strict regulations on food items, demanding halal certification for all meat products and detailed nutritional information.

- Saudi Arabia: Enforces comprehensive SASO (Saudi Standards, Metrology and Quality Organization) certification requirements for electronics, toys, and automotive parts. Import bans exist on 47 categories of products that conflict with religious principles, while certain imported goods must pass SFDA (Saudi Food and Drug Authority) testing before market release.

- Qatar: Implemented a 100% customs duty on alcohol and a 50% duty on tobacco products. Qatar prohibits pork products entirely and requires Certificate of Conformity for machinery and industrial equipment from approved third-party inspection agencies.

- Kuwait: Maintains strict import controls on agricultural products, requiring phytosanitary certificates and country of origin documentation authenticated by both the Kuwaiti embassy and Chamber of Commerce in the exporting country.

- Oman: Enforces detailed product registration requirements for pharmaceuticals, cosmetics, and food supplements, with specific packaging requirements mandating dual-language labeling (Arabic and English).

- Bahrain: Recently implemented the OFOQ single window system, streamlining customs clearance. Specific technical standards apply to electrical goods, requiring conformity assessment reporting before customs clearance.

Document processing through pre-arrival submission systems like UAE's Mirsal 2 or Saudi Arabia's FASAH platform can reduce clearance times from 5-7 days to 24-48 hours when properly utilized. Advanced technological integration between Asian exporters and Middle Eastern customs systems, including blockchain documentation trials at Jebel Ali Port, promises further efficiency gains for cross-continental shipping operations.

Challenges in Asia-Middle East Shipping

Shipping between Asia and the Middle East presents numerous obstacles that require careful navigation and strategic planning. These challenges can significantly impact transit times, costs, and overall supply chain reliability for businesses operating in these regions.

Geopolitical Factors and Security Concerns

Geopolitical tensions create substantial shipping challenges across Asia-Middle East trade routes. The Strait of Hormuz, handling approximately 20% of global oil shipments, faces recurring threats of closure during regional conflicts, forcing carriers to implement security surcharges of $100-300 per container. Maritime piracy remains active in specific zones, particularly in the Gulf of Aden and parts of the Indian Ocean, where piracy incidents increased 15% in 2022 compared to previous years. These security concerns necessitate costly vessel rerouting, armed security personnel, and specialized insurance premiums ranging from 0.1% to 3% of cargo value.

Trade sanctions and diplomatic disputes between nations introduce additional complexity. For example, the Qatar diplomatic crisis (2017-2021) rerouted shipping through Oman instead of UAE ports, increasing transit times by 5-7 days and costs by up to 25%. Current restrictions on trade with Iran affect transshipment options and create compliance requirements for shippers, including comprehensive cargo verification and enhanced documentation. Companies violating these restrictions face penalties exceeding $1 million and potential exclusion from U.S. markets.

Political instability in key transit countries, including Yemen, Iraq, and parts of the Levant, creates unpredictable border closures and regulatory changes. These disruptions demand flexible contingency routing and buffer inventory, typically requiring 20-30% additional stock to maintain reliable supply.

Weather and Environmental Considerations

Seasonal weather patterns significantly impact Asia-Middle East shipping operations throughout the year. Monsoon seasons in South and Southeast Asia (June-September) generate waves exceeding 5 meters in height, reducing vessel speeds by 15-20% and extending transit times by 3-5 days on primary routes. These conditions increase the risk of cargo damage, particularly for sensitive electronics and textiles, requiring enhanced packaging specifications with at least IP65 water resistance ratings for vulnerable shipments.

Extreme temperatures present another critical challenge, with summer temperatures in the Arabian Gulf regularly exceeding 45°C (113°F). These conditions affect reefer container operations, increasing fuel consumption by 25-30% to maintain required temperatures for pharmaceuticals, food products, and chemicals. The heat also impacts port operations, with productivity decreasing 10-15% during peak summer months due to reduced working hours and equipment limitations.

Dust storms and reduced visibility in Middle Eastern ports cause approximately 15-20 days of operational delays annually across the region. Major ports like Jeddah and Dubai experience 8-12 temporary closures yearly due to severe sand storms, primarily during spring months. These environmental disruptions ripple through supply chains, requiring buffer planning of 7-10 days for time-sensitive shipments during high-risk seasons.

Climate change has intensified these challenges, with rising sea levels affecting port infrastructure and increasing the frequency of extreme weather events along shipping lanes. Studies indicate a 30% increase in severe weather incidents along the Asia-Middle East corridor over the past decade, necessitating enhanced forecasting systems and more frequent route adjustments by carriers.

Choosing the Right Shipping Partner

Selecting an optimal shipping partner is critical for successful Asia-Middle East logistics operations. The right freight forwarder or shipping company can navigate the complexities of international shipping while providing cost-effective solutions tailored to your specific cargo requirements.

Evaluating Freight Forwarders vs. Direct Carriers

Freight forwarders offer comprehensive logistics coordination between Asia and the Middle East, managing documentation, customs clearance, and multi-carrier relationships. They're particularly valuable for businesses shipping irregular volumes or requiring consolidated shipments. Direct carriers, by contrast, provide end-to-end control of your cargo with their own vessels, potentially offering more predictable transit times and simplified communication channels for high-volume shippers.

When comparing potential partners, examine their established presence in both regions. Leading freight forwarders like Kuehne+Nagel, DHL Global Forwarding, and DB Schenker maintain extensive networks across Asian manufacturing hubs and Middle Eastern ports, providing specialized regional knowledge that's invaluable for navigating local regulations and practices.

Service Capabilities and Specializations

Different shipping partners excel in distinct areas of expertise. Assess your cargo requirements and match them with providers offering specialized services:

- Temperature-controlled shipping capabilities for pharmaceuticals, food products, and chemicals

- Project cargo handling for oversized or heavy industrial equipment common in infrastructure projects

- E-commerce fulfillment expertise for retailers expanding into Middle Eastern markets

- Dangerous goods certification for companies shipping hazardous materials

- Integrated customs services with dedicated teams familiar with regional documentation requirements

Partners with established Middle Eastern operations understand the nuances of importing into countries like the UAE, Saudi Arabia, and Qatar, including requirements for Arabic documentation and conformity with halal standards where applicable.

Technology Integration and Visibility

Modern shipping between Asia and the Middle East demands robust digital capabilities. Evaluate potential partners based on their technology offerings:

- Real-time tracking systems that provide continuous cargo visibility across ocean and multimodal transports

- Digital documentation platforms that streamline paperwork and reduce customs delays

- API connectivity that integrates with your existing supply chain management systems

- Predictive analytics tools that forecast potential disruptions along key shipping routes

- Electronic Bill of Lading (eBL) adoption that accelerates documentation processes

Industry leaders like Maersk, CMA CGM, and MSC have invested heavily in digital transformation, offering sophisticated platforms that enhance shipping transparency between Asian origins and Middle Eastern destinations.

Reliability Metrics and Performance History

Partner reliability directly impacts your supply chain performance. Request and analyze specific performance indicators:

| Metric | Industry Standard | Elite Performance |

|---|---|---|

| On-time Arrival Rate | 70-75% | >85% |

| Documentation Accuracy | 90% | >98% |

| Damage-free Delivery | 95% | >99% |

| Customer Service Response Time | 24 hours | <4 hours |

| Claims Resolution Time | 30 days | <10 days |

Review potential partners' performance specifically on Asia-Middle East routes, as global averages may not reflect performance on these particular corridors. Request references from existing clients shipping similar products between these regions.

Pricing Structure and Contract Terms

Compare pricing models while considering total landed costs rather than just base freight rates. Evaluate:

- Transparent surcharge policies for fuel, peak seasons, and equipment imbalances

- Volume-based discount structures that reward consistent shipping patterns

- Contract flexibility that accommodates seasonal fluctuations common in Asia-Middle East trade

- Payment terms that align with your cash flow requirements

- Clear demurrage and detention policies at both origin and destination ports

The most cost-effective partner isn't necessarily the cheapest but offers the best value through service reliability, regional expertise, and operational efficiency that reduces your overall logistics costs.

Future Trends in Asia-Middle East Trade Corridors

The Asia-Middle East trade landscape is evolving rapidly, with emerging technologies, infrastructure developments, and shifting geopolitical alignments reshaping how goods move between these regions. Understanding these future trends helps you position your business strategically in this dynamic trade environment.

Digital Transformation in Shipping and Logistics

Digital technologies are revolutionizing Asia-Middle East shipping operations through end-to-end visibility and automation. Advanced tracking systems using IoT sensors now monitor shipments in real-time across 85% of premium container routes, providing location, temperature, and humidity data directly to stakeholders. Blockchain applications are streamlining documentation processes, reducing paperwork processing time by up to 80% while minimizing fraud risks. Major ports like Jebel Ali and Shanghai have implemented digital twin technology, creating virtual replicas of physical operations to optimize cargo handling and vessel turnaround times by 15-30%.

Sustainable Shipping Practices

Environmental considerations are transforming the Asia-Middle East shipping sector with tangible initiatives. Leading carriers on these routes have invested over $15 billion in alternative fuel vessels, including LNG-powered ships that reduce carbon emissions by 20-25% compared to traditional bunker fuel. Solar-powered port equipment has been deployed at facilities like King Abdullah Port and Singapore, cutting operational emissions by up to 40%. Carbon offsetting programs offered by 62% of major shipping lines operating between Asia and the Middle East allow businesses to neutralize their freight's environmental impact, addressing growing customer demands for sustainable supply chains.

Expansion of the International North-South Transport Corridor

The International North-South Transport Corridor (INSTC) is emerging as a game-changing multimodal route connecting India to Russia via Iran and Central Asia. This 7,200-kilometer network reduces transit times between Mumbai and Moscow by 40% compared to traditional sea routes. Recent infrastructure investments exceeding $2 billion have enhanced rail connectivity at key junction points, while dedicated cargo terminals at Bandar Abbas and Chabahar ports have increased handling capacity by 5 million TEUs annually. The corridor's significance for Asia-Middle East trade lies in its creation of alternative northern distribution channels, particularly valuable for time-sensitive goods and specialized cargo.

China's Belt and Road Initiative in the Middle East

China's Belt and Road Initiative (BRI) continues to reshape trade infrastructure between Asia and the Middle East with substantial investments. Since 2013, over $123 billion has been committed to Middle Eastern infrastructure projects, including the $10.7 billion expansion of Khalifa Port in Abu Dhabi and $3.4 billion modernization of Duqm Port in Oman. These developments have increased container handling capacity by 14 million TEUs annually across the region. Chinese-built industrial zones adjacent to major ports create manufacturing and assembly hubs that reduce shipping distances for finished goods. The initiative's digital silk road component has enhanced trade through fiber optic networks, 5G infrastructure, and e-commerce platforms, streamlining cross-border transactions and logistics coordination.

Automation and Autonomous Shipping

Automation is transforming port operations and shipping across Asia-Middle East trade routes. Semi-automated container terminals at Singapore, Shanghai, and Jebel Ali now process cargo 35% faster than conventional facilities while reducing handling errors by 50%. Remote-controlled cranes and automated guided vehicles operate 24/7, significantly improving throughput capacity. In vessel operations, autonomous navigation systems are being tested on select regional routes, with 23 partially autonomous vessels already operating between Asian manufacturing hubs and Middle Eastern ports. These systems optimize routing based on weather conditions, traffic patterns, and fuel efficiency, potentially reducing transit times by 7-12% while enhancing safety through predictive analytics.

Key Takeaways

- The Asia-Middle East trade relationship exceeds $1.2 trillion annually, with maritime routes through the Malacca Strait-Suez Canal corridor handling 70% of containerized freight between these regions.

- Major ports like Jebel Ali (UAE), King Abdullah Port (Saudi Arabia), and Shanghai serve as critical logistics hubs with specialized facilities that enhance supply chain efficiency for cross-continental shipping.

- Shipping costs vary significantly based on factors like distance, container type, and seasonal fluctuations, with FCL shipping from Shanghai to Jebel Ali ranging from $1,200-2,500 per container with transit times of 18-24 days.

- Proper documentation is crucial for customs clearance, with requirements varying by country – essential paperwork includes commercial invoices, bills of lading, certificates of origin, and country-specific import licenses.

- Geopolitical tensions, extreme weather conditions, and regional regulations create unique challenges that require strategic planning, including security surcharges and temperature-controlled shipping solutions.

- Future trends reshaping Asia-Middle East trade include digital transformation through IoT and blockchain, sustainable shipping practices, China's Belt and Road Initiative, and increasing automation at port facilities.

Conclusion

Shipping from Asia to the Middle East presents both challenges and opportunities in today's dynamic trade environment. By understanding the key shipping routes specialized cargo requirements and documentation processes you'll be better positioned to make strategic decisions for your business.

Remember that selecting the right shipping partner with regional expertise can make all the difference in navigating complex customs regulations and managing logistics efficiently. Stay informed about emerging trends like digital transformation and sustainable shipping practices as these will shape the future of Asia-Middle East trade.

With careful planning attention to documentation and strategic partnerships your business can successfully tap into this $1.2 trillion trade relationship and capitalize on the growing opportunities between these two thriving regions.