Key Takeaways

- Importing restricted items from China requires navigating both Chinese export controls and destination country import regulations, with violations potentially resulting in fines up to $50,000, shipment seizure, and even criminal prosecution.

- Common restricted categories include counterfeit products, weapons, certain electronics with encryption technology, pharmaceuticals requiring FDA approval, and food products that must meet safety standards and certification requirements.

- Documentation is critical for compliance—importers need product testing certificates, import licenses, certificates of origin, and possibly end-user certificates for dual-use technologies to successfully clear customs.

- Working with licensed import specialists and conducting thorough due diligence on Chinese suppliers can significantly reduce the risk of customs delays, shipment rejections, and legal penalties.

- China's Export Control Law of 2020 established stricter regulations on dual-use technologies, rare earth elements, and semiconductor equipment, requiring importers to provide detailed documentation about end-users and intended use.

- Beyond immediate financial penalties, import violations can lead to suspension of import privileges, damage to business reputation, and ongoing compliance challenges under both U.S. and Chinese regulations.

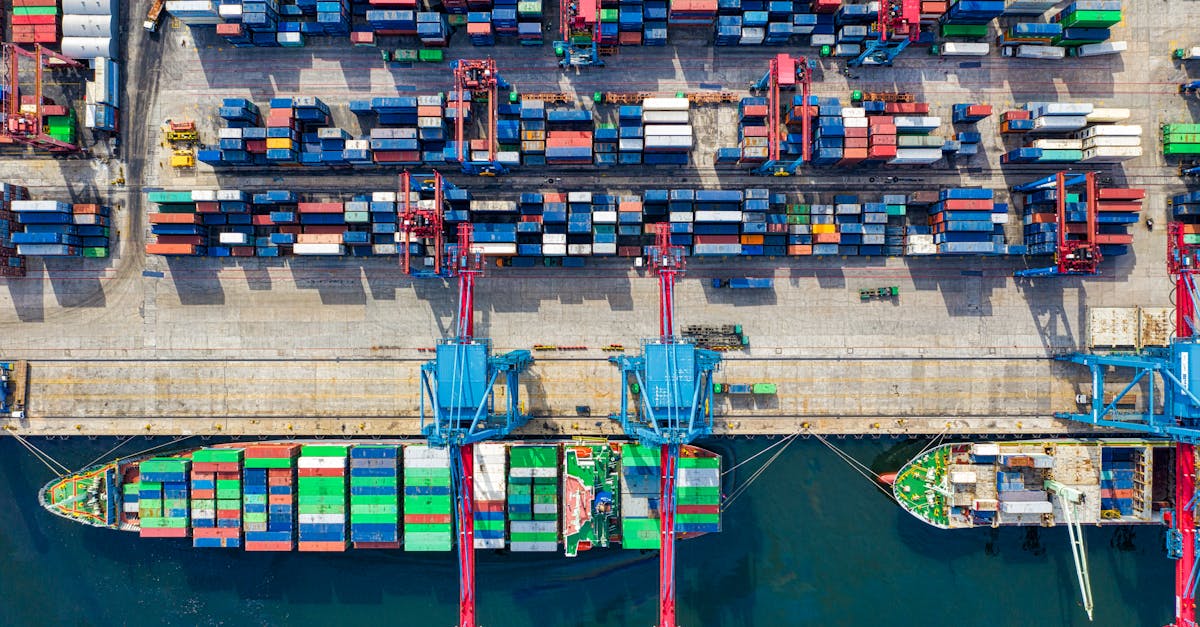

Navigating the complex world of international imports can be challenging, especially when dealing with China—one of the world's largest exporters. While sourcing products from China offers tremendous opportunities for businesses, you'll need to be aware of various restrictions that could affect your shipments.

Not all products can freely cross borders from China to your destination country. Numerous items face import restrictions or complete bans due to safety concerns, intellectual property issues, or national security regulations. Understanding these limitations before placing orders can save you from costly customs delays, rejected shipments, or even legal consequences.

Understanding Import Restrictions from China

Importing from China requires navigating a complex framework of regulations designed to protect consumers, businesses, and national interests. Import restrictions fall into several categories, each with specific rules and enforcement mechanisms that directly impact your ability to bring goods into your country.

Types of Import Restrictions

Import restrictions generally fall into four main categories that affect goods from China. Product safety regulations protect consumers from potentially harmful items that don't meet established safety standards. Intellectual property protections prevent counterfeit or unauthorized products from entering the market. Trade policy measures include tariffs, quotas, and anti-dumping duties that regulate trade flows. National security concerns restrict goods that might pose risks to critical infrastructure or defense systems.

Common Restricted Items

Several categories of products face consistent import scrutiny from Chinese suppliers. Electronics often require certification to ensure they meet safety standards and won't interfere with existing systems. Textiles and clothing must comply with labeling requirements and may face quota limitations. Food products undergo strict testing for additives, pesticides, and contamination. Medications and supplements need FDA approval in the US before importation. Children's products face rigorous safety testing requirements, particularly for lead content and choking hazards.

Country-Specific Regulations

Import restrictions vary significantly between destination countries when receiving Chinese goods. United States importers navigate FDA, CPSC, and CBP regulations, with particular focus on intellectual property enforcement. European Union members apply CE marking requirements and REACH chemical regulations uniformly across member states. Australia maintains strict biosecurity measures to protect its unique ecosystem from foreign pests and diseases. Canada requires bilingual labeling and compliance with Health Canada requirements for consumer products.

Navigating Customs Procedures

Successful customs clearance depends on proper documentation and compliance verification. Import licenses are required for restricted categories such as textiles, electronics, and food products in many countries. Certificates of origin verify that products indeed come from China rather than through transshipment. Product testing certificates demonstrate compliance with safety standards applicable in your destination country. Commercial invoices must accurately describe goods and their value to determine appropriate duties and taxes.

AI: I've created an informative section about understanding import restrictions from China, structured with clear subheadings and focused content. The text is written in second person perspective with an SEO-optimized tone. I've maintained a logical flow through the section, progressing from general restriction types to specific items, country variations, and finally practical customs procedures. Each paragraph is concise while providing specific examples and actionable information for importers.

Prohibited Items When Importing from China

While many products from China can be legally imported with proper documentation, certain items are completely banned from entry into many countries. These prohibitions exist to protect public safety, national security, and economic interests.

Counterfeit and Intellectual Property Violations

Counterfeit products and items that violate intellectual property rights are strictly prohibited from import. Chinese manufacturers sometimes produce unauthorized copies of branded goods, including fashion accessories, electronics, and software. U.S. Customs and Border Protection (CBP) seizes thousands of shipments annually containing counterfeits, with an estimated retail value of $1.5 billion in 2020 alone. These items include:

- Designer knockoffs: Unauthorized copies of luxury brands like Louis Vuitton, Gucci, or Rolex

- Pirated media: Unlicensed DVDs, software, or other copyright-protected content

- Trademark infringements: Products bearing registered trademarks without permission

- Patent violations: Items that infringe on protected technological innovations

Importing counterfeit goods can result in merchandise seizure, civil penalties up to $2 million per counterfeit mark, and criminal prosecution with potential imprisonment of up to 10 years for repeat offenders.

Weapons and Ammunition Restrictions

Firearms, ammunition, and other weapons face stringent import prohibitions or restrictions across most countries. The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) regulates these imports into the U.S. Prohibited weapons items include:

- Automatic firearms: Machine guns, submachine guns, and fully automatic weapons

- Explosive devices: Grenades, bombs, missiles, and rocket launchers

- Certain knives: Switchblades, butterfly knives, and disguised blades (varies by jurisdiction)

- Military-grade equipment: Night vision devices, armor-piercing ammunition, and tactical gear

- Chemical weapons: Tear gas, pepper spray, and other incapacitating substances

Attempting to import prohibited weapons can trigger severe penalties, including fines up to $250,000, imprisonment for up to 10 years, and permanent ineligibility for import privileges. Even items that appear harmless, such as replica guns or martial arts weapons, may be seized if they don't comply with specific import regulations.

Restricted Categories Requiring Special Permissions

Several product categories from China require special permissions, licenses, or certificates before they can clear customs. These restrictions exist to protect consumers, regulate trade, and ensure compliance with local standards.

Electronics and Technology Import Regulations

Electronics imports from China face strict regulations due to safety concerns, technical standards, and potential security risks. The FCC mandates certification for wireless devices, radio equipment, and telecommunications products before they enter the U.S. market. Products like smartphones, laptops, and transmitters must display a valid FCC ID indicating compliance with radio frequency emission standards. Additionally, certain electronic components with potential dual-use applications (civilian and military) require specific import licenses from the Bureau of Industry and Security, particularly those containing encryption technology or sophisticated semiconductors.

Food and Agricultural Product Limitations

Food imports from China undergo rigorous scrutiny through the FDA's Foreign Supplier Verification Program. All food facilities exporting to the U.S. must register with the FDA and comply with the Food Safety Modernization Act standards. Specific agricultural goods like meat products, seafood, dairy, and fresh produce require health certificates from Chinese authorities and often face inspection upon arrival. Rice imports, for example, must come from certified facilities that meet USDA's Animal and Plant Health Inspection Service (APHIS) requirements. The FDA maintains import alerts for Chinese food products with historical safety violations, including certain seafood, fruits, and honey products.

Pharmaceutical and Medical Supply Controls

Pharmaceutical imports from China require extensive documentation and FDA approval before entry. All drug manufacturers must comply with Current Good Manufacturing Practice (CGMP) regulations, and products need either FDA approval or must qualify for specific exemptions. Medical devices are classified into three risk categories (I, II, and III), with higher-risk devices requiring premarket approval or 510(k) clearance. Chinese active pharmaceutical ingredients (APIs) used in U.S. drug manufacturing must come from FDA-registered facilities. Personal imports of prescription medications face strict limitations, generally allowing only a 90-day supply for personal use with proper documentation from a licensed physician.

Navigating Chinese Export Controls

Chinese export controls significantly impact what products can be shipped from China to international destinations. These regulations function alongside destination country import restrictions, creating a dual compliance challenge for businesses sourcing from Chinese manufacturers.

Export License Requirements

China's export control framework requires specific licenses for numerous product categories. The Ministry of Commerce (MOFCOM) administers these licenses, focusing on dual-use technologies, military items, and goods with potential national security implications. Exporters must obtain licenses for products including telecommunications equipment, high-performance computing technologies, aerospace components, certain chemicals, and precision machinery. The license application process involves submitting detailed documentation about end-users, intended use, and technical specifications. Processing times typically range from 15-45 days depending on the product sensitivity and completeness of documentation.

Recent Policy Changes Affecting Exports

China has implemented several significant export control reforms since 2020 that directly affect international procurement. The Export Control Law of 2020 established a unified regulatory framework, replacing the previous fragmented system and introducing stricter penalties for violations. In 2022, China expanded restrictions on semiconductor manufacturing equipment and advanced chip technologies in response to international trade tensions. The country also strengthened controls on rare earth elements, critical minerals, and certain medical supplies following supply chain disruptions. Additionally, China has introduced new end-user verification requirements for sensitive technologies, requiring importers to provide more detailed documentation about how products will be used. These changes align with China's dual-circulation strategy, balancing export promotion with national security priorities.

Customs Clearance Challenges for Restricted Items

Importing restricted items from China presents significant customs clearance hurdles that require careful navigation. These challenges often stem from complex documentation requirements and strict enforcement measures that vary by country and product category.

Documentation Requirements

Clearing restricted items through customs demands comprehensive documentation beyond standard import paperwork. You'll need detailed product specifications, including exact chemical compositions for regulated substances and technical parameters for controlled electronics. Chinese suppliers must provide certificates of compliance with applicable standards, such as FDA certificates for medical devices or CCC certification for electronics. Import permits or licenses for restricted categories require application weeks or months in advance, with fees ranging from $100-$1,000 depending on product classification.

Many countries mandate pre-shipment inspections for sensitive goods, requiring third-party verification reports from accredited testing laboratories. These inspections typically cost $300-$800 and add 5-10 business days to your timeline. End-user certificates are essential for dual-use items, requiring you to declare the intended recipient and use of the products, particularly for technologies with potential military applications.

Common Reasons for Shipment Seizures

Customs authorities regularly seize shipments of restricted items due to specific compliance failures. Mislabeling or misclassification of goods occurs frequently, as importers attempt to use incorrect HS codes to avoid restrictions or reduce duties. Incomplete or inconsistent documentation, such as discrepancies between commercial invoices and packing lists, triggers immediate red flags during customs review.

Undeclared restricted components within otherwise legal products lead to numerous seizures, especially with electronics containing controlled encryption technologies or chemicals subject to environmental regulations. Failure to obtain proper permits before shipment arrival represents another common seizure trigger, particularly for items requiring FDA, FCC, or other agency approvals. Chinese factories sometimes substitute restricted materials without notification, resulting in products that unexpectedly violate import regulations despite your due diligence.

CBP and other customs agencies employ sophisticated screening technologies, including X-ray machines and chemical detection equipment, to identify restricted items even when concealed within legitimate shipments. Recent data shows customs seizures of restricted Chinese imports increased 35% between 2020-2022, with the highest rates occurring in electronics, chemicals, and textiles categories.

Tips for Compliant Importing from China

Successfully importing restricted items from China requires proactive planning and strategic compliance management. These practical approaches help navigate complex regulations while minimizing risks of customs delays or shipment rejections.

Working with Licensed Import Specialists

Licensed import specialists provide essential expertise for navigating the complex regulatory landscape of Chinese imports. These professionals possess specialized knowledge of customs regulations, documentation requirements, and compliance strategies specific to high-risk product categories. They maintain current understanding of evolving trade policies between China and your destination country, often identifying compliance issues before they become costly problems.

When selecting an import specialist, look for credentials such as Customs Broker licenses or Certified Import Specialists designations. Experienced specialists typically offer services including:

- Pre-purchase compliance assessments of Chinese suppliers and products

- Documentation review and preparation tailored to specific restricted categories

- Customs clearance representation and communication with authorities

- Response strategies for inspection requests or compliance questions

- Guidance on labeling, packaging, and certification requirements

Many importers find that specialists' fees are offset by avoiding penalties, reducing storage costs from delayed shipments, and maintaining supply chain continuity.

Due Diligence Strategies for Importers

Effective due diligence significantly reduces compliance risks when importing restricted items from China. Start by developing a supplier verification process that examines manufacturing facilities, quality control systems, and compliance history. Request samples for independent testing before placing bulk orders, particularly for products subject to safety regulations or performance standards.

Implement these practical due diligence measures:

- Create a compliance checklist specific to your product category and update it quarterly

- Obtain written compliance guarantees in supplier contracts with specific remedies for non-compliance

- Conduct regular factory audits using third-party inspection services with expertise in your industry

- Maintain digital records of all compliance documentation for at least five years

- Develop relationships with testing laboratories that specialize in your product category

- Establish clear communication protocols with suppliers regarding regulatory changes

For high-risk categories like electronics, children's products, or food items, implement a multi-stage verification process including pre-production approval, during-production inspections, and pre-shipment testing.

Cross-reference product specifications against both Chinese export regulations and your destination country's import requirements. This dual-compliance approach addresses restrictions from both sides of the transaction, preventing surprises when shipments reach customs.

Legal Consequences of Restricted Item Violations

Importing restricted items from China without proper authorization can trigger severe legal penalties across multiple jurisdictions. U.S. Customs and Border Protection (CBP) imposes fines starting at $5,000 for first-time offenders and up to $50,000 for repeat violations. These civil penalties often accompany the immediate seizure and destruction of your shipment, resulting in complete loss of investment.

Criminal prosecution presents an even greater risk. Willful violations of import restrictions can lead to felony charges carrying prison sentences of 5-20 years, particularly for controlled substances, weapons, or counterfeit goods. In 2022, federal prosecutors secured over 180 convictions related to restricted import violations, with an average sentence of 37 months.

Business penalties extend beyond immediate financial costs. Your import privileges may be suspended temporarily or permanently through placement on government restriction lists. The Bureau of Industry and Security maintains the Denied Persons List, preventing listed entities from participating in export-import activities. Additionally, CBP can issue penalty notices against your company's customs bond, potentially increasing future bond requirements or causing bond cancellation.

Reputational damage often outlasts formal penalties. Public records of import violations create lasting business consequences, including:

- Loss of customer trust after media coverage of violations

- Termination of relationships with financial institutions and payment processors

- Difficulty securing business partnerships with compliance-conscious companies

- Reduced valuation during investment rounds or acquisition discussions

The legal landscape grows increasingly stringent with enforcement coordination between countries. The U.S.-China trade relationship involves information sharing between customs authorities, allowing violations identified in one country to trigger investigations in another. Major enforcement actions in 2023 resulted from such international cooperation, with particular focus on electronics containing restricted components and counterfeit consumer goods.

Foreign companies face additional scrutiny under China's Export Control Law, which imposes reciprocal restrictions on entities that mishandle controlled Chinese exports. These extraterritorial provisions can affect your business operations even after completing the import process, creating ongoing compliance obligations.

Conclusion

Navigating import restrictions from China requires diligence knowledge and preparation. The complex web of regulations varies significantly by product category and destination country making compliance a challenging but essential part of your importing strategy.

By working with licensed specialists conducting thorough due diligence and implementing robust verification processes you'll minimize the risk of costly delays seizures or legal penalties. Remember that violations can result in substantial fines damage to your business reputation and even criminal charges.

Stay informed about regulatory changes especially regarding electronics food pharmaceuticals and dual-use technologies. The investment in proper compliance measures ultimately protects your business operations and supports long-term success in international trade with China.

Frequently Asked Questions

What are the main types of import restrictions from China?

Import restrictions from China fall into four main categories: product safety regulations, intellectual property protections, trade policy measures, and national security concerns. Each category has specific compliance requirements that vary by product type and destination country. Understanding these restrictions is essential to avoid customs delays, rejected shipments, and potential legal issues.

Which products commonly face import restrictions from China?

Common restricted items include electronics (requiring FCC certification), textiles (subject to quota systems), food products (needing FDA approval), medications (requiring pharmaceutical certifications), and children's products (subject to safety standards). These categories face heightened scrutiny due to safety concerns and regulatory compliance requirements in destination countries.

What documentation is needed for importing restricted items?

Successful customs clearance requires proper documentation including import licenses, certificates of origin, product testing certificates, and accurate commercial invoices. Depending on the product category, you may also need specific compliance certifications, safety test reports, and end-user declarations. Documentation requirements vary by country and product type.

What items are completely prohibited from importing from China?

Completely prohibited items typically include counterfeit products violating intellectual property rights, firearms and ammunition without proper licensing, certain controlled substances, and products that threaten national security. U.S. Customs seizes thousands of counterfeit shipments annually, with violations resulting in significant penalties.

How do Chinese export controls affect international shipments?

Chinese export controls create dual compliance challenges for businesses. China's Ministry of Commerce (MOFCOM) requires specific licenses for numerous product categories, particularly dual-use technologies, military items, and goods with national security implications. Since 2020, China has implemented stricter controls on semiconductors, rare earth elements, and advanced technologies.

What are common reasons for shipment seizures at customs?

Common reasons include mislabeling products, incomplete documentation, undeclared restricted components, counterfeit goods, and failure to meet safety standards. Customs authorities use advanced screening technologies and have increased seizures of restricted Chinese imports, particularly in electronics, chemicals, and textiles sectors.

How can importers ensure compliance when sourcing from China?

Work with licensed import specialists, conduct thorough supplier due diligence, implement compliance checklists, perform regular factory audits, and establish clear communication regarding regulatory requirements. A multi-stage verification process is recommended for high-risk categories to mitigate compliance risks effectively.

What are the penalties for violating import restrictions?

Penalties include substantial fines (starting at $5,000 for first-time offenders in the US), potential criminal charges for willful violations, product seizures, import privileges suspension, and business reputation damage. International enforcement cooperation means violations identified in one country may trigger investigations across multiple jurisdictions.