The Gulf region stands at a critical crossroads of global trade, connecting East and West through its strategic shipping lanes and world-class ports. Yet despite its advantageous position, logistics operations here face distinctive challenges that can impact your supply chain efficiency and bottom line. From extreme climate conditions affecting storage to complex customs regulations varying across GCC countries, navigating this landscape requires specialized knowledge.

Recent geopolitical tensions have further complicated the logistics equation in the Gulf. With disruptions in the Red Sea and Strait of Hormuz occasionally forcing carriers to reroute shipments, you'll need to factor in potential delays and increased costs. Additionally, as Gulf nations push toward economic diversification beyond oil, their rapidly evolving infrastructure presents both opportunities and adjustment hurdles for logistics providers.

Current Logistics Landscape in the Gulf Region

The Gulf region's logistics environment combines world-class facilities with emerging infrastructure networks, creating a dynamic ecosystem for global trade. This landscape continues to evolve as GCC countries invest heavily in transportation and supply chain capabilities.

Key Infrastructure and Transit Hubs

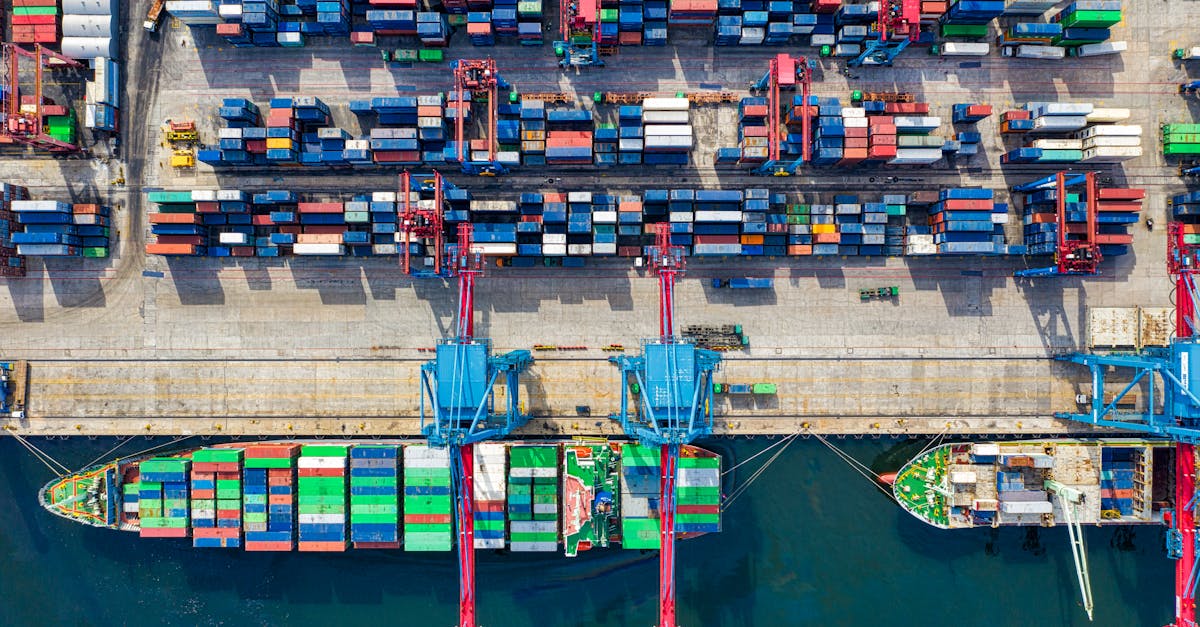

The Gulf region hosts some of the world's most advanced logistics infrastructure through strategically positioned ports, airports, and land transport networks. Dubai's Jebel Ali Port stands as the largest marine terminal in the Middle East, handling over 14.1 million TEU annually and connecting to more than 150 shipping lines. Saudi Arabia's King Abdullah Port has emerged as one of the fastest-growing ports globally, climbing to 83rd position in global container handling within just five years of operation.

air freight capabilities are equally impressive with hubs like Dubai International Airport, Hamad International Airport in Qatar, and Abu Dhabi International Airport serving as critical nodes in global supply chains. These facilities feature temperature-controlled storage areas, specialized handling equipment, and streamlined customs processes to expedite cargo movement.

Road infrastructure projects like the GCC Railway Network and the expansion of highway systems between major commercial centers facilitate smoother cross-border transportation. The UAE's Etihad Rail project, spanning 1,200 kilometers when completed, will connect major industrial zones, cities, and ports, significantly reducing transit times for goods movement throughout the region.

Economic Importance of Logistics to GCC Countries

Logistics serves as a cornerstone of economic diversification strategies across the Gulf region, contributing substantially to GDP growth and employment. In the UAE, the logistics sector accounts for approximately 14% of GDP, creating over 322,000 jobs across various supply chain operations. Saudi Arabia's National Industrial Development and Logistics Program aims to position the Kingdom as a global logistics hub, targeting $36 billion in investments by 2030.

Bahrain's logistics sector has grown at an annual rate of 7.8% in recent years, benefiting from the country's strategic location and streamlined customs procedures. Oman's investment in the Duqm Special Economic Zone creates a significant logistics corridor connecting East Asia with European markets, leveraging its position outside the Strait of Hormuz.

The economic benefits extend beyond direct revenue generation to include enhanced trade facilitation, increased foreign direct investment, and creation of high-skilled employment opportunities. Free zones like Dubai's JAFZA house over 8,700 companies from 100+ countries, generating approximately 23.9% of Dubai's GDP and employing over 144,000 people. These specialized economic zones offer tax incentives, simplified administrative procedures, and infrastructure support tailored specifically to logistics operations.

Geographic and Climate Challenges

The Gulf region's unique geography and climate create distinct obstacles for logistics operations. These natural factors significantly impact transportation efficiency, infrastructure maintenance, and supply chain reliability throughout the year.

Extreme Weather Conditions

Extreme temperatures in the Gulf region pose substantial challenges to logistics operations. Summer temperatures regularly exceed 50°C (122°F), affecting both equipment performance and cargo integrity. Electronic systems in trucks and port equipment frequently overheat, causing operational delays and increasing maintenance costs by 30-40% compared to temperate regions. Heat-sensitive cargo, including pharmaceuticals, food products, and chemicals, requires specialized cold chain solutions with redundant cooling systems to prevent deterioration.

Dust storms and sandstorms disrupt visibility and transportation networks across the region, particularly during seasonal transitions. These weather events can reduce visibility to less than 500 meters, grounding air cargo operations and slowing road transport to a crawl. Major ports like Jebel Ali and Dammam implement weather protocols that sometimes halt loading and unloading operations for 24-48 hours during severe storms, creating ripple effects throughout supply chains.

Humidity levels exceeding 90% along coastal areas accelerate corrosion of equipment and packaging materials. Logistics companies must invest in corrosion-resistant containers and specialized packaging at a premium of 15-20% compared to standard solutions. Climate control facilities require constant maintenance due to the harsh environmental conditions, with HVAC systems typically operating at maximum capacity for 8-10 months annually.

Maritime Chokepoints and Security Concerns

The Gulf region's maritime geography creates natural bottlenecks that present ongoing logistical challenges. The Strait of Hormuz, measuring just 21 nautical miles at its narrowest point, handles approximately 21 million barrels of oil daily—roughly 21% of global petroleum liquids consumption. This critical chokepoint experiences periodic tensions that force shipping companies to implement costly security measures, including armed guards and route diversions that add 7-14 days to transit times.

Piracy remains an intermittent concern in the wider regional waters, particularly in the Gulf of Aden and along the Somali coast. Shipping companies operating in these waters pay insurance premiums 15-30% higher than comparable routes elsewhere, directly impacting freight rates and final delivery costs. Maritime security efforts, including international naval patrols and vessel hardening measures, add $10,000-$30,000 per voyage in security-related expenses.

Shallow waters and complex coastlines throughout the Gulf require specialized navigation and port infrastructure. Draft limitations at several ports restrict the size of vessels that can dock, often necessitating offshore transfers or limiting operations to smaller, less efficient vessels. Dredging operations cost Gulf states an estimated $120-150 million annually to maintain shipping channels, particularly after seasonal sandstorms deposit significant sediment in harbors and approaches.

Political and Regulatory Hurdles

Political tensions and complex regulatory frameworks significantly impact logistics operations across the Gulf region. Companies navigating this landscape face multiple bureaucratic challenges that affect efficiency, costs, and delivery timelines.

Cross-Border Documentation Requirements

Gulf logistics operations contend with extensive documentation requirements that vary between countries. Each GCC nation maintains its own specific paperwork protocols, including commercial invoices, certificates of origin, import licenses, and packing lists. For example, Saudi Arabia requires detailed Arabic translations on all shipping documents, while the UAE maintains strict requirements for product labeling and certificate authenticity. These inconsistencies create a documentation burden for logistics providers managing regional supply chains.

Digital documentation adoption remains uneven across the region. While the UAE has implemented advanced electronic systems like Dubai Trade Portal, neighboring countries like Kuwait and Oman still rely heavily on paper-based processes for certain requirements. This disparity forces logistics companies to maintain parallel documentation systems, increasing administrative costs by 12-15% compared to operations in more standardized markets.

Security-related documentation adds another layer of complexity. Following regional conflicts, enhanced security measures have introduced additional vetting requirements for cargo entering sensitive zones, including detailed cargo manifests and security declarations that weren't previously mandatory.

Customs Procedures and Delays

customs clearance inconsistencies represent a major obstacle for Gulf logistics operations. Processing times vary dramatically across borders—from 24 hours in Dubai to 7-10 days at some Saudi Arabian entry points. These disparities create significant challenges for supply chain planning and inventory management.

Inspection protocols differ substantially between GCC countries:

- Qatar applies risk-based inspections with approximately 15% of shipments undergoing physical examination

- Saudi Arabia maintains higher inspection rates around 35-40%, with additional scrutiny for consumer goods

- UAE ports utilize advanced scanning technology, reducing physical inspection needs to below 10% for most cargo

Tariff classification discrepancies compound these challenges. Despite the GCC Customs Union's harmonized system, interpretation variations lead to differing duty assessments for identical products. Recent research by PwC identified valuation disagreements in 28% of cross-border shipments within the Gulf region.

Regulatory changes often occur with minimal notice periods. In 2022, three GCC countries implemented significant customs procedure modifications with implementation windows of less than 30 days, forcing logistics providers to rapidly adjust operations and documentation processes.

Supply Chain Disruptions in the Gulf

The Gulf region's supply chains face persistent disruptions that impact business operations and economic stability. These disruptions stem from various sources, creating complex challenges for logistics providers operating throughout the GCC countries.

Impact of Regional Conflicts

Regional conflicts create significant supply chain vulnerabilities across the Gulf. The Yemen conflict has disrupted shipping routes in the Red Sea and Gulf of Aden, with Houthi rebels targeting commercial vessels in 43 separate incidents during 2022-2023. These disruptions force carriers to reroute around the Cape of Good Hope, adding 7-10 days to transit times and increasing shipping costs by 15-20%. Iran-related tensions near the Strait of Hormuz periodically threaten the passage of oil tankers, affecting approximately 21 million barrels of oil daily – roughly 21% of global petroleum liquids consumption. For logistics operators, these geopolitical flashpoints necessitate contingency planning, alternative routing strategies, and increased security measures that add $3,000-5,000 per container shipment in security and insurance costs.

COVID-19 Effects on Regional Logistics

COVID-19 transformed Gulf logistics operations with immediate and lasting consequences. Port congestion emerged as a critical challenge, with container dwell times at Jebel Ali increasing by 60% during peak pandemic periods. Workforce shortages affected operational capacity, with major Gulf ports experiencing 15-25% staff reductions due to illness and mobility restrictions. Air cargo capacity plummeted when passenger flights were suspended, reducing belly cargo capacity by 80% in the initial months of the pandemic. Gulf carriers pivoted to "preighter" operations, converting 37 passenger aircraft to temporary cargo use across Emirates, Etihad, and Qatar Airways.

The pandemic accelerated digital transformation, with Dubai Customs reporting a 52% increase in digital customs declarations and Qatar implementing contactless cargo processing at Hamad International Airport. Cross-border procedures became more complex, with testing requirements and document verification extending clearance times by 48-72 hours at land borders between Saudi Arabia and the UAE. Supply chain visibility emerged as a priority investment area, with 67% of Gulf logistics companies increasing spending on track-and-trace technologies to provide real-time shipment updates during disrupted conditions.

Technology Adoption and Digital Transformation

Technology adoption and digital transformation are reshaping logistics operations across the Gulf region. Despite substantial investments in cutting-edge solutions, the pace of technological integration varies significantly between countries and companies, creating both competitive advantages and notable implementation challenges.

Current Implementation of Logistics Technology

Gulf logistics companies are increasingly embracing technological solutions to enhance operational efficiency. Major ports like DP World's Jebel Ali have implemented automated container handling systems, reducing vessel turnaround times by up to 30%. Saudi Logistics Hubs have deployed IoT sensors across warehousing facilities, enabling real-time inventory tracking and predictive maintenance. These technologies have proven particularly valuable in addressing regional challenges such as extreme climate conditions.

Blockchain technology has gained traction for increasing supply chain transparency and reducing documentation errors. Abu Dhabi Ports' Maqta Gateway, the first blockchain solution in the region, has cut processing times for trade documentation from days to minutes and reduced administrative costs by approximately 20%. In Kuwait and Bahrain, logistics firms are utilizing AI-powered route optimization systems that account for regional factors like traffic patterns and temperature variations.

Mobile applications for freight management have become standard tools among Gulf logistics providers. Companies like Agility Logistics offer platforms with real-time tracking capabilities, enabling customers to monitor shipments across multiple transport modes. Data analytics applications have helped regional logistics firms identify bottlenecks at border crossings and optimize warehouse layouts based on regional trade patterns.

Barriers to Digital Innovation

Despite progress, several significant barriers hinder widespread digital transformation in Gulf logistics. The fragmented regulatory environment across GCC countries creates implementation challenges for region-wide technology solutions. For instance, electronic documentation accepted in the UAE might still require paper copies in Oman, forcing companies to maintain parallel systems. Compliance with varying data sovereignty laws across the region adds further complexity to cloud-based logistics platforms.

Workforce skill gaps represent another substantial obstacle. Many logistics companies in the region face difficulties recruiting professionals with both logistics expertise and digital competencies. A 2023 industry survey revealed that 65% of Gulf logistics firms cited skilled labor shortages as their primary barrier to technology implementation. This gap is particularly pronounced in specialized areas like supply chain analytics and robotic process automation.

Infrastructure limitations persist in certain areas despite significant investments. Internet connectivity issues in remote logistics hubs and border crossings can disrupt cloud-based systems. The interoperability between legacy systems and new technologies creates integration challenges, with many established logistics companies operating decades-old warehouse management systems that don't easily connect with modern platforms. Small and medium-sized logistics providers often lack the capital resources for comprehensive digital transformation, creating a technological divide between industry leaders and smaller operators.

Cultural resistance to technological change affects adoption rates across the region. Traditional business practices that prioritize personal relationships over digital efficiency remain influential in certain market segments. Security concerns about sharing sensitive supply chain data have slowed cloud adoption, particularly among companies handling government contracts or operating in strategic sectors like energy logistics.

Last-Mile Delivery Challenges

Last-mile delivery in the Gulf region presents unique logistical hurdles that directly impact fulfillment costs and customer satisfaction. These challenges are particularly acute in both densely populated urban centers and remote rural locations, requiring specialized solutions and strategic planning.

Urban Congestion Issues

Urban congestion severely hampers last-mile delivery efficiency in Gulf cities like Dubai, Riyadh, and Doha. Traffic density in downtown Dubai increases delivery times by 30-45 minutes during peak hours, while Riyadh's ongoing infrastructure developments create unpredictable road closures affecting delivery routes. Major cities across the region face limited parking options, forcing delivery personnel to park illegally or walk significant distances to complete deliveries.

Address systems in many Gulf urban areas lack standardization, with buildings often identified by landmarks rather than specific street addresses. In Kuwait City, for example, approximately 40% of deliveries require additional phone calls to locate recipients. This inconsistency creates delivery inefficiencies and increases operational costs by an estimated 15-20%.

High-rise living compounds the challenge, with delivery personnel navigating complex security protocols and elevator wait times in luxury developments. In Doha's Pearl-Qatar and Dubai Marina, drivers report spending up to 12 minutes per delivery just accessing customer apartments, significantly reducing daily delivery capacity.

Rural Delivery Obstacles

Rural delivery in the Gulf presents fundamentally different challenges centered around vast distances and infrastructure limitations. Remote areas in Saudi Arabia's interior regions or Oman's mountainous territories can require transport times exceeding 3-4 hours from distribution centers, dramatically increasing fuel costs and vehicle wear. These extended delivery routes make same-day or next-day service economically unfeasible for many logistics providers.

Infrastructure deficiencies compound rural delivery difficulties, with approximately 30% of rural roads in certain Gulf regions remaining unpaved or poorly maintained. During rainy seasons, particularly in Oman's northern mountains and Saudi Arabia's southwestern regions, road access becomes unreliable, causing delivery suspensions or significant delays. GPS coverage gaps in remote areas further complicate navigation, with delivery drivers often relying on local knowledge rather than digital mapping.

The dispersed population in rural Gulf communities creates economic inefficiencies, with delivery density averaging just 2-3 packages per trip compared to 15-20 in urban zones. Companies struggle with the cost-effectiveness of maintaining service to these areas, with data from regional logistics providers indicating rural delivery costs running 2.5-3 times higher per package than urban counterparts. These economic realities have created service gaps, with many e-commerce platforms either excluding remote locations or imposing substantial delivery surcharges for rural customers.

Sustainability Concerns in Gulf Logistics

Sustainability has emerged as a critical focus for logistics operations in the Gulf region, driven by changing regulatory landscapes and growing environmental awareness. Logistics companies now face dual pressures of maintaining operational efficiency while addressing environmental impacts of their activities across supply chains.

Environmental Regulations

Environmental regulations affecting Gulf logistics have tightened significantly in recent years, creating a complex compliance landscape. The UAE implemented Federal Law No. 24 regarding environmental protection, imposing stricter emissions standards on transportation fleets and warehouse operations. Saudi Arabia's Vision 2030 includes specific environmental targets requiring logistics companies to reduce carbon footprints by 15-20% by 2030. Emissions monitoring requirements now mandate quarterly reporting for companies operating more than 25 vehicles in Qatar and the UAE, with non-compliance penalties ranging from $5,000 to $50,000 depending on the violation's severity. International regulations like IMO 2020, which caps sulfur content in marine fuels at 0.5%, have increased operational costs for shipping companies by 20-30% in Gulf waters. Logistics providers must navigate these evolving regulations while balancing cost implications against sustainability objectives.

Green Logistics Initiatives

Green logistics initiatives are gaining momentum across the Gulf region as companies respond to environmental concerns and regulatory pressures. Dubai's Green Mobility Initiative has established 300 electric vehicle charging stations, encouraging logistics companies to transition 25% of their delivery fleets to electric vehicles by 2025. DP World has implemented solar power systems at Jebel Ali Port, reducing carbon emissions by 48,000 tons annually while decreasing energy costs by 30%. Warehousing facilities in Abu Dhabi's KIZAD industrial zone have adopted energy-efficient building standards, incorporating solar panels and smart energy management systems that reduce power consumption by up to 40%. Saudi Arabian logistics company NAQEL Express has optimized delivery routes using AI algorithms, reducing fuel consumption by 22% and cutting emissions from last-mile operations. The Qatar Airways Cargo's "WeQare" sustainability program focuses on reducing packaging waste, having eliminated 80% of plastic materials in their supply chain operations. These initiatives demonstrate the region's growing commitment to balancing economic growth with environmental responsibility in logistics operations.

Future Outlook for Gulf Logistics

The Gulf logistics sector stands at a pivotal juncture, poised for transformative growth amid regional economic diversification initiatives. Several emerging opportunities and strategic development plans are reshaping the logistics landscape across GCC countries.

Emerging Opportunities

E-commerce expansion represents a primary growth driver for Gulf logistics, with the regional market projected to reach $50 billion by 2025. This rapid growth is creating demand for specialized fulfillment centers, particularly in the UAE and Saudi Arabia where online shopping adoption rates have increased 40% since 2020. The rise of omnichannel retail has sparked investment in automated micro-fulfillment centers, allowing faster delivery times in dense urban areas like Dubai and Riyadh.

Advanced technology integration presents another significant opportunity, with IoT-enabled logistics solutions reducing operational costs by 15-20% for early adopters. Companies like Aramex have implemented AI-powered route optimization, cutting delivery times by up to 25% while reducing fuel consumption. Autonomous vehicle trials at Jebel Ali Port demonstrate the potential for driverless transport within controlled logistics environments, potentially reducing labor costs by 30%.

Cross-border trade facilitation initiatives, including the Abraham Accords and improved Saudi-Qatar relations, have opened new logistics corridors. Trade between the UAE and Israel grew to $1.2 billion in 2022, creating demand for dedicated logistics services between these previously disconnected markets. The reopening of land borders between Saudi Arabia and Qatar has reduced shipping times by 5-7 days for certain routes, benefiting regional distributors.

Strategic Development Plans

The GCC Railway Network stands as a cornerstone project for regional logistics integration, with 2,177 kilometers of track planned to connect all six Gulf states. This $15.4 billion project will reduce heavy cargo transport costs by approximately 30% while cutting delivery times by half between major industrial centers. Saudi Arabia has completed 265 kilometers of its section, while the UAE's Etihad Rail has connected key industrial zones to Khalifa Port, demonstrating tangible progress.

Port expansion initiatives are transforming maritime capabilities across the region, with Saudi Arabia's $17 billion investment in King Abdullah Port aiming to increase capacity to 25 million TEUs by 2030. Oman's Duqm Port development includes a 2,000-hectare special economic zone focused on logistics services, strategically positioned outside the Strait of Hormuz. These expansions are complemented by "smart port" technology implementations, with DP World's BoxBay high-bay storage system increasing container handling efficiency by 70% while reducing land usage.

Specialized logistics zones are emerging to support high-value sectors like pharmaceuticals and aerospace. Saudi Arabia's King Fahd International Airport Pharma Zone provides GDP-compliant storage facilities, attracting global healthcare companies seeking regional distribution hubs. The UAE's Aerospace Logistics Hub at Al Maktoum International Airport offers specialized handling for aircraft components, supporting the region's growing aviation maintenance sector with temperature-controlled facilities and streamlined customs procedures.

Digital trade corridors are forming through investments in unified customs platforms and blockchain-based documentation systems. The UAE's ATLAS platform connects 16 government entities, reducing import/export processing times from days to hours. Kuwait and Bahrain are implementing similar systems, with integration planned to create seamless cross-border documentation flows, potentially reducing administrative costs by up to 20% for frequent shippers.

Human capital development programs address the logistics talent gap, with Qatar's Logistics Academy and Saudi Arabia's Logistics Academy providing specialized training. These institutions offer industry-recognized certifications in supply chain management, customs clearance, and digital logistics, having graduated over 5,000 logistics professionals since 2018. Public-private partnerships with global logistics firms like DHL and Maersk ensure curriculum relevance, creating a pipeline of skilled professionals to support the sector's growth.

Key Takeaways

- The Gulf region faces unique logistics challenges including extreme weather conditions (temperatures exceeding 50°C), maritime chokepoints (like the Strait of Hormuz), and geopolitical tensions that force carriers to reroute shipments.

- Cross-border documentation requirements vary significantly between GCC countries, creating administrative burdens that increase costs by 12-15% compared to more standardized markets, with customs clearance times ranging from 24 hours to 7-10 days.

- Recent supply chain disruptions in the Gulf stemmed from regional conflicts and COVID-19, with shipping reroutes adding 7-10 days to transit times and increasing costs by 15-20%, while pandemic-related challenges accelerated digital transformation.

- Last-mile delivery faces dual challenges: urban congestion (extending delivery times 30-45 minutes) and address standardization issues in cities, versus the economic inefficiency of rural deliveries that cost 2.5-3 times more per package.

- Environmental regulations are tightening across the Gulf, with initiatives like Dubai's Green Mobility Initiative encouraging companies to transition 25% of delivery fleets to electric vehicles by 2025.

- Future opportunities include e-commerce expansion (projected to reach $50 billion by 2025), the GCC Railway Network (expected to reduce cargo transport costs by 30%), and development of specialized logistics zones for pharmaceuticals and aerospace.

Conclusion

The Gulf region's logistics landscape stands at a pivotal crossroads of challenge and opportunity. Navigating this complex environment requires understanding both the substantial hurdles and promising developments reshaping the sector.

You'll find that success in Gulf logistics demands adaptability to extreme climate conditions adaptability to regulatory variations and resilience against geopolitical disruptions. The region's world-class ports and strategic location create unmatched advantages despite these challenges.

As digital transformation accelerates and sustainability initiatives gain momentum the logistics sector will continue driving economic diversification across Gulf nations. The expanding e-commerce market improved cross-border trade and specialized logistics zones present significant growth opportunities.

Companies that can effectively manage these unique regional challenges while leveraging emerging technologies and infrastructure will be positioned to thrive in this dynamic market for years to come.