Key Takeaways

- HS codes are a standardized numerical system used globally to classify traded products, serving as the foundation for customs tariffs and international trade statistics across 200+ countries.

- Accurate HS code classification prevents costly customs delays, helps avoid penalties up to $100,000 per violation, and ensures proper duty rates - potentially saving companies 3-7% in duty costs.

- The first six digits of HS codes are standardized worldwide (chapter, heading, subheading), while countries add 2-4 additional digits for national tariff codes that determine specific regulations and duties.

- Finding the correct HS code requires identifying detailed product characteristics, using official customs websites, and potentially leveraging commercial search tools for complex classifications.

- Multi-functional products, composite goods, and items undergoing modifications present the greatest classification challenges, often requiring expert consultation for proper categorization.

- Country-specific extensions and regional trade agreements create additional classification considerations that directly impact duty rates, import controls, and documentation requirements.

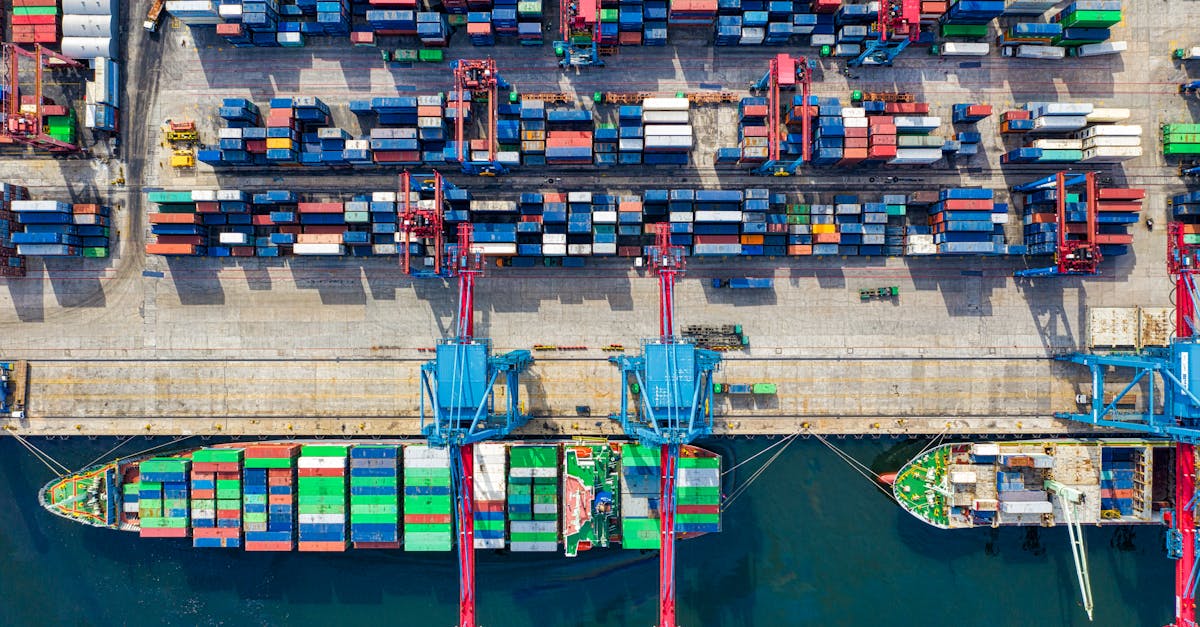

Navigating international trade can feel like trying to decipher a foreign language. At the center of this complex world are Harmonized System (HS) codes - the universal classification system that determines how your products are identified, taxed, and regulated across borders.

When you're shipping products internationally, finding the correct HS code isn't just a bureaucratic step - it's essential for compliance and can significantly impact your bottom line. With thousands of possible classifications and frequent updates to the system, even experienced importers and exporters find themselves struggling to pinpoint the right codes for their merchandise.

This guide will walk you through everything you need to know about HS codes, from understanding their structure to efficiently finding the correct classification for your products, helping you navigate international trade with confidence.

What Is the Harmonized System (HS) Code?

The Harmonized System (HS) Code is a standardized numerical method used to classify traded products worldwide. This system serves as the foundation for customs tariffs and international trade statistics in over 200 countries and economies.

The Purpose and Structure of HS Codes

HS codes operate on a 6-digit structure that's universally recognized across participating countries. The first two digits identify the chapter (broad category), the next two define the heading within that chapter, and the final two digits specify the subheading for more detailed classification. Each level provides increasingly specific product identification—for example, chapter 09 represents coffee, tea, and spices; heading 0901 narrows down to coffee; and subheading 090111 specifically identifies non-decaffeinated coffee that hasn't been roasted.

Many countries add additional digits (typically 2-4 more) to create national tariff codes that further classify products for domestic purposes. These national extensions allow customs authorities to apply country-specific regulations, collect more granular trade data, and impose precise duties on imported items.

How HS Codes Are Used in International Trade

HS codes create a common commercial language for businesses, customs officials, and government agencies involved in global trade. Exporters use these codes on shipping documentation to ensure their products clear customs efficiently and receive appropriate tariff treatment. Import authorities rely on HS codes to determine applicable duties, taxes, and regulatory requirements for incoming shipments.

These codes also facilitate trade statistics collection, helping governments monitor import/export patterns and make informed policy decisions. HS classifications additionally support trade agreement implementation by clearly defining which products qualify for preferential tariff rates under specific agreements like USMCA or EU trade deals.

For businesses, accurate HS code assignment affects profit margins directly through duty rates, compliance requirements, and potential penalties for misclassification. Supply chain managers use these codes to calculate landed costs, while product developers consider HS classifications when designing new products to optimize for favorable duty rates in target markets.

Benefits of Accurate HS Code Classification

Accurate HS code classification delivers tangible advantages for businesses engaged in international trade. Proper classification streamlines customs processes and optimizes financial outcomes across global operations.

Avoiding Customs Delays and Penalties

Correct HS code classification prevents costly customs delays at international borders. Shipments with accurate codes move through customs verification faster, reducing warehouse storage fees and avoiding delivery deadline violations. For example, correctly classified electronics typically clear customs 3-5 days faster than misclassified items.

Misclassification carries significant financial consequences, including:

- Monetary penalties ranging from $5,000 to $100,000 per violation

- Seizure of incorrectly classified merchandise

- Suspension of import/export privileges in severe cases

- Potential legal proceedings for willful misclassification

Customs authorities worldwide have enhanced their verification systems, making detection of classification errors more common. Companies like Midway Imports saved $75,000 in potential penalties by implementing systematic HS code verification protocols for their textile shipments.

Ensuring Proper Duty Rates and Tax Calculations

Accurate HS code classification directly impacts the duty rates applied to your products. Each product category carries specific tariff rates, and even minor classification errors can result in substantial overpayments. A chemical manufacturer utilizing the correct 6-digit code rather than a similar-sounding alternative reduced their duty rate from 8.7% to 2.5%, saving $45,000 annually.

Proper classification provides additional financial benefits:

- Access to preferential duty rates under free trade agreements

- Identification of duty exemption opportunities for qualifying products

- Correct application of country-specific tax treatments

- Prevention of duty drawback claim rejections

- Accurate calculation of value-added taxes and other import fees

Companies with systematic classification processes report average duty savings of 3-7% compared to those using ad-hoc methods. These savings compound over time, creating sustainable competitive advantages in pricing strategy and profit margins.

Step-by-Step HS Code Lookup Process

Finding the correct HS code for your products requires a methodical approach to navigate the complex classification system. Following a structured process helps ensure accuracy and compliance with international trade regulations.

Identifying Your Product's Characteristics

Product identification forms the foundation of accurate HS code classification. Start by gathering comprehensive details about your item, including its composition, function, and manufacturing process. Document specific materials (cotton, steel, plastic), intended use (medical, industrial, consumer), and construction methods that distinguish your product from similar items. For example, a desk lamp made primarily of brass requires different classification than one made of plastic with identical functionality.

Physical attributes like dimensions, weight, and power specifications often determine classification breakpoints between similar products. Create a detailed product specification sheet that includes all relevant characteristics before attempting classification. This preparatory step eliminates common errors and provides essential reference information when consulting with customs brokers or classification specialists.

Using Official Customs Websites and Databases

Official customs websites offer authoritative HS code information directly from regulatory sources. Visit your country's customs website (e.g., U.S. Customs and Border Protection or European Commission's TARIC database) to access current classification schedules and explanatory notes. Most official sites provide searchable databases with keyword functionality, allowing you to enter product descriptions and receive potential classification options.

Navigate to the "Tariff Classification" or "HS Code Lookup" section on these websites, then use the search function with specific product terms. Many official platforms also offer downloadable PDF versions of complete tariff schedules organized by sections and chapters. Bookmark relevant chapters for future reference and set calendar reminders to check for quarterly or annual updates, as harmonized tariff schedules undergo regular revisions that impact classification and duty rates.

Leveraging Commercial HS Code Search Tools

Commercial HS code search tools streamline the classification process with enhanced user interfaces and additional features. Platforms like 3CE, CustomsInfo, and Descartes offer sophisticated search algorithms that identify potential classifications based on product descriptions. These tools typically provide side-by-side comparisons of similar codes, historical classification data, and integration with customs compliance systems.

Most commercial platforms include classification history tracking, allowing you to document and justify classification decisions for audit purposes. Advanced tools offer machine learning capabilities that improve search results based on your previous classifications and industry-specific terminology. While these services require subscription fees ranging from $500-$5,000 annually depending on features, they deliver significant value through time savings and error reduction. Companies handling high volumes of diverse products report 30-40% faster classification processes when using specialized commercial tools compared to manual research methods.

Common Challenges in HS Code Lookup

HS code classification presents several persistent challenges for importers and exporters, often resulting in costly delays and compliance issues. Even experienced trade professionals encounter difficulties when navigating the complex Harmonized System, particularly when dealing with specialized products or evolving regulations.

Navigating Similar Product Categories

Similar product categories create significant classification confusion as subtle differences can lead to entirely different HS code assignments. Multi-functional products, for example, may fall under multiple potential classifications depending on their primary purpose—a smartphone could be classified as a communication device, a camera, or a computing machine. Products with similar physical characteristics but different functions present another layer of complexity, such as specialized industrial equipment sharing components with consumer goods.

Classification becomes particularly challenging with composite goods containing multiple materials where determining the "essential character" requires detailed analysis. For instance, furniture made from both wood and metal requires careful evaluation to determine which material gives the item its essential character. The rule of specificity further complicates matters, directing classifiers to choose the most specific applicable heading when multiple options seem valid.

To overcome these challenges:

- Create detailed product specification sheets documenting all materials, components, and functions

- Compare similar products with established classifications as precedents

- Consult explanatory notes and classification rulings for guidance on borderline cases

- Develop a systematic decision tree for products commonly falling between categories

- Consider obtaining advance rulings for consistently problematic products

Handling Product Updates and Modifications

Product updates and modifications frequently necessitate HS code reclassification, creating significant compliance challenges. Manufacturing changes that alter a product's composition, function, or structure often shift its classification—even minor material substitutions can move products between duty brackets. For example, changing a chair's frame from wood to metal can result in an entirely different classification and duty rate.

Technological advancements pose particular problems as innovation often outpaces classification updates. Many emerging products like certain IoT devices or specialized software components don't clearly fit into existing categories, forcing importers to use imperfect classification matches. Additionally, HS codes undergo regular revisions every 5-7 years, with the most recent major update in 2022 introducing over 350 new classifications.

- Establishing a reclassification protocol triggered by product specification changes

- Implementing a modification tracking system linking engineering changes to HS code reviews

- Creating a calendar alert system for scheduled HS code revisions affecting your product lines

- Developing relationships with customs authorities for guidance on ambiguous classifications

- Conducting regular compliance audits focusing on products that have undergone modifications

Best Practices for HS Code Classification

Implementing effective HS code classification practices enhances compliance and optimizes trade operations. These best practices represent proven approaches used by successful importers and exporters to maintain accuracy and efficiency in their classification processes.

Maintaining Accurate Product Documentation

Comprehensive product documentation forms the foundation of accurate HS code classification. Create detailed specification sheets that include material composition (percentages of each component), manufacturing processes, functionality descriptions, and technical drawings or diagrams. Document changes to product specifications immediately, as even minor modifications can affect classification. Companies with systematic documentation report 42% fewer classification errors and save an average of 8 hours per product when determining HS codes.

Implement these documentation practices:

- Standardize specification formats across all products to ensure consistency

- Include photographs from multiple angles showing key product features

- Document intended use and functionality in clear, technical language

- Maintain digital archives of previous versions to track changes

- Create cross-reference tables linking materials to potential HS chapters

Leading importers maintain classification libraries where they store previous rulings and documentation by product category, creating institutional knowledge that prevents repeated research for similar items.

Working with Customs Brokers and Experts

Customs brokers and classification specialists provide invaluable expertise for complex HS code determinations. Engage these professionals strategically by establishing clear communication protocols and sharing comprehensive product information. Companies that regularly consult with customs experts report 37% fewer classification disputes and recover an average of $32,000 annually in duty overpayments.

Maximize partnerships with customs professionals through:

- Schedule quarterly classification reviews for product portfolios

- Share product development roadmaps to anticipate classification needs

- Request written classification rationales for future reference

- Participate in joint training sessions to build internal capacity

- Establish clear escalation procedures for classification disagreements

Partner with brokers who specialize in your specific industry rather than generalists. Industry-specific brokers maintain deeper knowledge of precedents and common classification challenges in your product categories.

International HS Code Variations to Consider

While the first six digits of HS codes are standardized globally, significant variations exist beyond this foundation. International traders encounter different classification extensions, interpretations, and requirements across countries and trading blocs that directly impact compliance and duty obligations.

Country-Specific Extensions and Requirements

Country-specific extensions transform the standardized 6-digit HS code into national tariff codes with varying structures and complexity. The U.S. uses a 10-digit system (HTS), with digits 7-8 representing tariff subheadings and 9-10 indicating statistical reporting requirements. The EU employs an 8-digit Combined Nomenclature (CN) followed by additional TARIC codes for specific trade measures. Japan and China maintain 9-digit systems with unique domestic classifications reflecting their trading priorities.

These extensions aren't merely administrative—they directly affect:

- Duty rates: A product classified under HS code 8517.62 (network equipment) carries a 0% duty in the UK but faces different rates in Australia depending on the additional digits.

- Import controls: The 8th digit in EU codes often determines if specific safety certifications or licenses apply.

- Documentation requirements: Countries like Brazil and India require additional documentation based on their extended classifications.

Companies that maintain country-specific code databases report 84% fewer customs delays compared to those using only the standard 6-digit codes.

Regional Trade Agreement Considerations

Regional trade agreements create additional classification complexities through preferential duty rates and special rules of origin. The USMCA (North America), RCEP (Asia-Pacific), and EU-UK Trade and Cooperation Agreement each establish unique classification requirements determining whether products qualify for preferential treatment.

Key considerations include:

- Rules of origin verification: Under USMCA, automotive products require specific regional value content percentages reflected in their classification.

- Cumulation provisions: The EU's Pan-Euro-Mediterranean cumulation system affects how products are classified based on materials sourcing.

- Product-specific rules: RCEP establishes different change-in-tariff-heading requirements for various product categories.

- Certification requirements: Different agreements require specific formats for origin certification linked to HS classification.

Traders utilizing preferential trade agreement provisions save an average of 3-7% in duty costs but face increased classification scrutiny, with audits occurring in approximately 25% of high-volume preferential claims.

Conclusion

Mastering HS code classification is vital for your international trade success. With the right approach you'll not only ensure compliance but also optimize duty payments and avoid costly penalties.

Remember that proper documentation systematic verification and expert consultation are your strongest allies in navigating this complex system. Consider investing in specialized tools to streamline your classification process especially when dealing with diverse product lines.

Stay vigilant about country-specific extensions and regional trade agreements that may affect your classifications. By implementing the strategies outlined in this guide you'll transform HS code lookup from a daunting challenge into a competitive advantage for your business.

Your efforts toward accurate classification will pay dividends through smoother customs clearance reduced compliance risks and optimized duty payments.

Frequently Asked Questions

What is an HS code and why is it important?

An HS code (Harmonized System code) is a standardized numerical method used to classify traded products worldwide. It serves as the foundation for customs tariffs and international trade statistics in over 200 countries. HS codes are crucial because they directly impact duty rates, tax calculations, compliance requirements, and potential penalties. Accurate classification streamlines customs processes, prevents costly delays, and optimizes financial outcomes for businesses engaged in international trade.

How is an HS code structured?

HS codes operate on a 6-digit system that is standardized globally. The first two digits identify the chapter, the next two define the heading, and the final two specify the subheading for detailed classification. Many countries add additional digits (creating 8-10 digit codes) for national tariff codes and domestic purposes. This hierarchical structure creates a progressively more detailed classification of products for customs and trade purposes.

What happens if I use the wrong HS code?

Using incorrect HS codes can result in serious consequences including monetary penalties, seizure of goods, delayed shipments, and potential legal issues. You may overpay duties and taxes or face retroactive assessments if underpaid. Misclassification can also trigger compliance audits and damage your company's reputation with customs authorities. Companies implementing systematic classification verification have avoided penalties reaching tens of thousands of dollars.

How do I find the correct HS code for my product?

Start by identifying your product's key characteristics (composition, function, manufacturing process). Create a detailed product specification sheet and consult official customs websites and databases for authoritative information. Commercial HS code search tools can streamline the process with user-friendly interfaces. For complex products, consider consulting with customs brokers or classification specialists to ensure accuracy and compliance with current regulations.

How often do HS codes change?

The World Customs Organization (WCO) updates the Harmonized System every five years, with the most recent revision implemented in 2022. However, individual countries may make changes to their national extensions more frequently. Businesses should maintain a classification review protocol to track product modifications and stay updated on regulatory changes. Regular compliance audits and relationships with customs authorities can help navigate these updates effectively.

Can the same product have different HS codes in different countries?

Yes. While the first six digits of HS codes are standardized globally, countries add their own extensions (additional digits) that can vary significantly. For example, the U.S. uses a 10-digit HTS code while the EU uses an 8-digit CN code. These variations can affect duty rates, import controls, and documentation requirements. Products may also be classified differently due to interpretation differences or specific regional trade agreements requiring unique classification approaches.

How can accurate HS classification save my business money?

Accurate HS classification can lead to substantial savings through correct duty rate application, preventing overpayments that directly impact profit margins. Companies with systematic classification processes report average duty savings of 3-7%. For example, one chemical manufacturer saved $45,000 annually by using the correct code. Proper classification also prevents costly delays, penalties, and administrative expenses associated with correcting errors, creating sustainable competitive advantages in pricing strategy.

What documentation should I maintain for HS code classification?

Maintain detailed product specification sheets that include material composition, manufacturing processes, functionality descriptions, and technical diagrams. Keep records of classification decisions, including rationale and any precedents or rulings referenced. Document correspondence with customs authorities and brokers regarding classification decisions. Companies with robust documentation practices report up to 70% fewer classification errors and can demonstrate due diligence during customs audits.