Key Takeaways

- Proper customs classification directly impacts your bottom line, with accurate classifications potentially saving 3-8% on duty payments and reducing clearance times by 1-3 days.

- The Harmonized System (HS) provides a standardized 6-digit code structure for global trade, with countries adding additional digits for local requirements (like the 10-digit US Harmonized Tariff Schedule).

- Accurate classification requires identifying essential product characteristics and systematically applying the General Rules of Interpretation (GRI) to determine the correct category.

- Multi-function products and technology/software items present unique classification challenges that often require research of binding rulings or consultation with customs experts.

- Misclassification penalties can be severe, including fines up to twice the lawful duties, increased scrutiny of future shipments, and potential criminal prosecution in fraud cases.

- Best practices include establishing documented classification systems, conducting regular reviews, training staff, and maintaining comprehensive documentation to defend your classifications during audits.

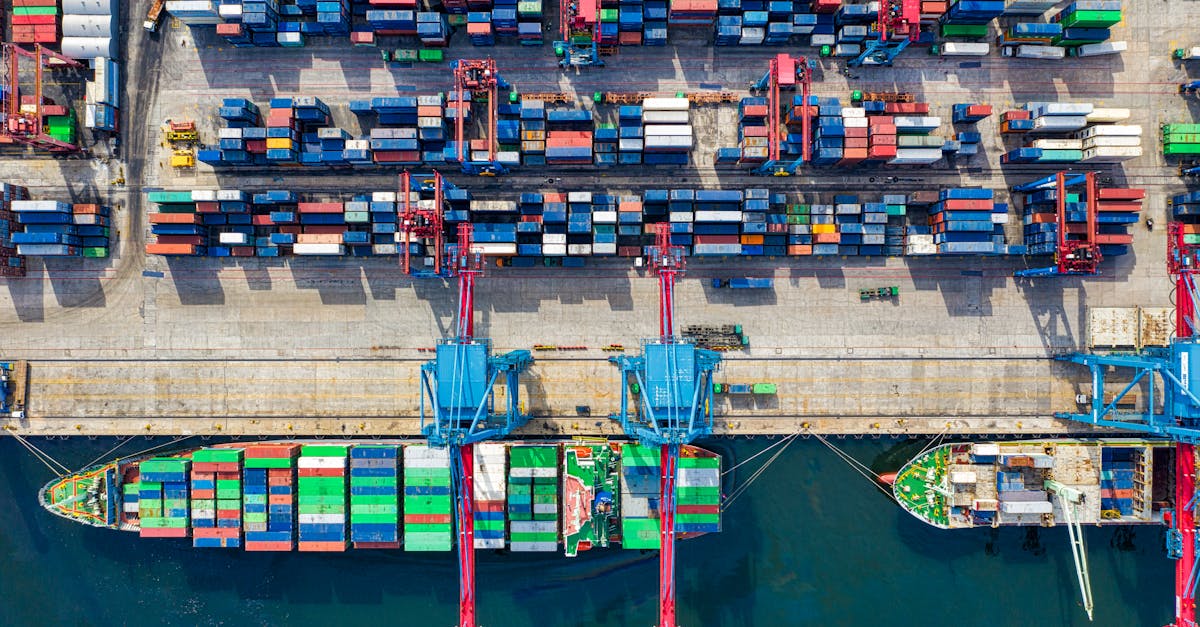

Navigating the complex world of customs classifications can feel like decoding a foreign language. Whether you're importing products for your business or shipping internationally, knowing how to properly classify your goods isn't just regulatory compliance—it's a strategy that can save you significant time and money.

When you misclassify items, you risk delays, penalties, and possibly paying higher duties than necessary. The Harmonized System (HS) used worldwide includes over 5,000 commodity groups, each identified by a six-digit code. Getting this right means understanding both the rules and your products in detail.

This guide will walk you through the essentials of customs classification, from basic principles to practical steps for determining the correct codes for your goods. You'll learn how to navigate tariff schedules and avoid common pitfalls that even experienced importers encounter.

Why Accurate Customs Classification Matters

Accurate customs classification directly impacts your business's bottom line, compliance status, and operational efficiency. Understanding the importance of precision in this area helps you navigate international trade more effectively.

Financial Implications

Customs classification determines the duty rates applied to your imported goods. Different HS codes carry different tariff rates, with some products qualifying for preferential treatment under trade agreements. A single digit error in classification can result in:

- Overpayment of duties by thousands of dollars annually

- Missed opportunities for duty exemptions or reductions

- Unexpected financial liabilities during post-entry audits

- Additional fees for customs brokers to correct misclassified entries

Companies that properly classify their products save an average of 3-8% on duty payments through legitimate classification strategies and preferential trade agreement utilization.

Legal and Compliance Consequences

Incorrect classifications expose your business to serious regulatory risks. Customs authorities worldwide actively enforce classification compliance through:

- Monetary penalties reaching up to four times the duty amount

- Seizure of improperly classified merchandise

- Import privileges suspension or revocation

- Increased scrutiny of future shipments

In the US alone, Customs and Border Protection (CBP) issued over $40 million in classification-related penalties to importers in recent years. These penalties apply regardless of whether the misclassification was intentional or accidental.

Operational Efficiency

Beyond financial and legal considerations, accurate classification streamlines your supply chain operations by:

- Reducing customs clearance delays that disrupt production schedules

- Minimizing resource allocation for resolving classification disputes

- Enabling accurate landed cost calculations for better pricing strategies

- Supporting informed sourcing decisions based on duty implications

Proper classification reduces average clearance times by 1-3 days compared to shipments requiring additional classification verification, directly improving inventory management and customer satisfaction.

Understanding Harmonized System (HS) Codes

The Harmonized System (HS) serves as the foundation for classifying goods in global trade. Created by the World Customs Organization (WCO), this standardized numerical language enables consistent identification of products across borders regardless of language barriers or local regulations.

The Structure of HS Codes

HS codes follow a hierarchical structure divided into 21 sections and 99 chapters that systematically organize all tradable goods. Each code consists of six digits—the first two identify the chapter, the middle two represent the heading, and the final two indicate the subheading. For example, in the code 090121 for roasted caffeinated coffee: 09 represents Chapter 9 (Coffee, Tea, Maté and Spices), 0901 refers to coffee, and 090121 specifically identifies roasted, non-decaffeinated coffee. This structured approach creates a logical framework where codes progress from raw materials to manufactured products, with animal products in early chapters (1-5) and machinery in later chapters (84-85).

Regional Variations: HTS and Combined Nomenclature

While the first six digits of product codes remain uniform worldwide, countries and trading blocs add additional digits to accommodate local requirements. The U.S. Harmonized Tariff Schedule (HTS) extends HS codes to 10 digits—the seventh and eighth digits correspond to U.S. tariff rates, while the ninth and tenth provide statistical tracking information. The European Union's Combined Nomenclature adds two digits to create 8-digit codes tailored to EU-specific regulations and duty rates. Japan's customs system extends codes to 9 digits, and Canada's tariff classification uses 10 digits with country-specific suffixes. These regional variations maintain international compatibility through the standardized first six digits while allowing customs authorities to implement domestic trade policies, apply preferential treatment under trade agreements, and collect precise import/export statistics.

Key Steps to Classify Your Goods Correctly

Accurate customs classification requires a methodical approach and attention to detail. Following these key steps ensures you assign the correct HS code to your products and avoid costly errors during the customs clearance process.

Identifying the Essential Characteristics

Identifying your product's essential characteristics forms the foundation of accurate customs classification. Start by gathering complete product specifications, including composition, function, and manufacturing processes. For manufactured goods, obtain technical drawings, material lists, and production details that customs officials might request. Determine what makes your product unique—its primary purpose, materials, and how it's used by consumers. Physical characteristics like dimensions, weight, and components matter significantly in classification decisions. For example, a "measuring instrument" made primarily of plastic versus one made of precious metals falls under different HS codes despite similar functions. Consider your product's packaging too, as retail-packaged items often receive different classifications than bulk shipments of the same goods.

Using the General Rules of Interpretation

The General Rules of Interpretation (GRI) provide the official framework for classifying goods when their category isn't immediately clear. These six rules must be applied sequentially, with each rule only considered if the previous ones don't yield a definitive classification. GRI 1 emphasizes classifying goods according to the heading descriptions and relevant section or chapter notes. For instance, when classifying a multi-purpose electronic device, first check if any heading specifically describes it. GRI 2 extends classification to incomplete or unfinished articles and mixtures. GRI 3 addresses goods that could fall under multiple headings, prioritizing the most specific description over general ones. GRI 4 covers goods not classifiable under previous rules, while GRIs 5 and 6 address containers and subheadings. Following these rules systematically prevents common classification errors such as relying solely on product names rather than actual characteristics.

Researching Binding Rulings

Binding rulings provide valuable precedents that can streamline your classification process. These official decisions from customs authorities offer legally binding classifications for specific products. Before submitting your classification, search databases like the U.S. Customs and Border Protection's CROSS (Customs Rulings Online Search System) or the EU's EBTI (European Binding Tariff Information) for similar products. These databases contain thousands of previous rulings searchable by keyword, product description, or HS code. For example, searching "solar panel mounting hardware" in CROSS reveals multiple rulings that distinguish between aluminum and steel components with different duty rates. When existing rulings don't address your specific product, consider requesting your own binding ruling—a process that typically takes 30-45 days but provides certainty for up to three years (in the U.S.) or three to six years (in the EU). These rulings protect you from reclassification during that period, even if customs officials initially disagree with your classification.

Common Classification Challenges and Solutions

Customs classification frequently presents complex challenges that can significantly impact duty rates and compliance. Navigating these challenges requires specific strategies and an understanding of common pitfalls in the classification process.

Dealing with Multi-Function Products

Multi-function products create substantial classification difficulties because they combine multiple purposes or functionalities. When classifying these items, apply GRI 3, which provides a hierarchical approach for determining the essential character. For example, a smartphone functions as both a communication device and a computing device, requiring careful analysis to determine which function predominates. Consider:

- Principal function analysis: Identify whether one function clearly outweighs others in importance, usage, or design

- Component value evaluation: Compare the relative value of different components to determine which represents the essential character

- Market perception review: Examine how the product is marketed and perceived by consumers

- Customs precedents: Research previous rulings on similar multi-function products to establish classification patterns

Many importers successfully resolve multi-function classification challenges by consulting binding rulings. A fitness tracker with heart rate monitoring capabilities, for instance, might be classified as a medical device or as a sports equipment item depending on how its primary function is determined.

Technology and Software Classification Issues

Technology and software classification presents unique challenges due to rapid innovation and the intangible nature of digital products. The Harmonized System was originally designed for physical goods, creating gaps in classification frameworks for digital products. When classifying technology items:

- Physical vs. digital considerations: Determine whether the software is delivered on physical media (classified with the media) or electronically (potentially classified as a service)

- Functionality assessment: Identify the core purpose of the software—educational, entertainment, or business functionality each leads to different classifications

- Bundled products evaluation: For hardware/software combinations, determine if they're classified separately or as a functional unit

- Updates to classification guidelines: Monitor international agreements like the Information Technology Agreement (ITA) that impact duty rates on tech products

Many customs authorities have developed specialized units to address technology classification. The U.S. Customs and Border Protection, for example, offers specific guidance for software classifications that distinguishes between operating systems, applications, and software services. Companies like Microsoft and Adobe have established standard classification codes for their product suites to ensure consistent treatment across global markets.

Tools and Resources for Customs Classification

Accurate customs classification requires access to reliable tools and specialized resources. These resources range from official government databases to professional assistance from customs experts who can navigate the complexities of international trade regulations.

Government Databases and Classification Aids

Government databases serve as primary resources for customs classification research. The U.S. Customs and Border Protection (CBP) offers the Customs Ruling Online Search System (CROSS), which contains over 200,000 previous classification rulings. Similarly, the EU provides the European Binding Tariff Information (EBTI) database with searchable classification decisions. These databases allow you to search for similar products and understand how authorities have classified them in the past.

Digital classification tools like the Harmonized Tariff Schedule Search Engine and CBP's Informed Compliance Publications provide detailed guidance on specific product categories. The WCO's HS Explanatory Notes, though subscription-based, offer authoritative interpretations of HS headings and subheadings with examples and clarifications on ambiguous cases. For technical products, specialized classification databases like the FDA Product Code Builder for medical devices or the BIS Commerce Control List for controlled goods provide industry-specific classification guidance.

Working with Customs Brokers and Consultants

Customs brokers offer specialized expertise in navigating classification challenges. Licensed customs brokers possess in-depth knowledge of tariff schedules and maintain relationships with customs authorities, providing insights that aren't readily available through public resources. They typically charge $150-300 per hour or may work on retainer for ongoing classification support.

Customs consultants specialize in complex classification issues such as advance rulings, classification reviews, and creating product databases. They're particularly valuable when dealing with novel products, multi-function items, or goods subject to special trade programs. Many consultancies offer classification automation services that integrate with your inventory management systems, reducing manual classification work by up to 80%. For businesses with diverse product lines, establishing an ongoing relationship with a consultant proves more cost-effective than addressing classification issues reactively after errors occur.

Consequences of Misclassification

Misclassifying goods for customs purposes carries substantial repercussions that extend beyond simple administrative corrections. These consequences can significantly impact your company's finances, legal standing, and overall business operations.

Penalties and Legal Implications

Customs authorities impose strict penalties for incorrect classifications, even when errors are unintentional. U.S. Customs and Border Protection (CBP) can issue fines ranging from $5,000 to $10,000 per incident for negligent misclassification and up to twice the lawful duties for grossly negligent violations. In cases of fraud, penalties can reach the domestic value of the merchandise and include criminal prosecution with potential imprisonment.

Beyond monetary penalties, legal implications include:

- Increased scrutiny - Your future shipments face more frequent examinations and delays after classification errors

- Loss of privileges - Customs authorities may revoke simplified clearance procedures or trusted trader status

- Seizure of goods - Severely misclassified items, especially those violating safety regulations or import restrictions, can be confiscated

- Compliance audits - A pattern of misclassification often triggers comprehensive customs audits extending back 5 years

Companies with repeat classification violations may also face inclusion on penalty registries that alert customs authorities worldwide, creating cross-border compliance challenges.

Business Impact of Classification Errors

Misclassification directly affects your company's bottom line and operational efficiency. Financial impacts include overpayment of duties, where companies routinely overpay by 3-8% through classification errors. Conversely, underpayment creates unexpected liability when discovered during audits, often with interest compounded over multiple years.

Operational disruptions manifest through:

- Supply chain delays - Misclassified shipments face extended customs clearance times, averaging 3-7 additional days

- Inventory shortages - Delayed or seized shipments create stockouts, affecting production schedules and customer deliveries

- Resource diversion - Resolving classification disputes requires significant staff time and legal resources

- Reputational damage - Persistent compliance issues can harm relationships with suppliers, customers, and regulatory bodies

Classification errors also impair strategic planning by introducing unpredictable costs and timing variables into your supply chain. Companies with effective classification systems gain competitive advantages through optimized duty planning and streamlined customs clearance, while those struggling with misclassification face persistent operational handicaps.

Best Practices for Maintaining Classification Compliance

Establish a Robust Classification System

A robust classification system forms the foundation of customs compliance. Create a standardized process that includes detailed product documentation, classification worksheets, and decision trees for each product line. Document your classification rationale with photographs, technical specifications, and material composition details for each product. Companies with documented classification systems experience 60% fewer customs delays compared to those with ad-hoc approaches.

Implement Regular Classification Reviews

Classification reviews keep your product codes current and compliant. Schedule quarterly reviews of your most frequently shipped items and comprehensive annual audits of your entire product catalog. During these reviews, verify that existing classifications still apply despite product modifications or regulatory changes. Target reviews particularly after:

- Product design or material changes

- Updates to the Harmonized Tariff Schedule

- New trade agreements affecting your products

- Supplier changes that alter country of origin

Train Your Team Effectively

Team training directly impacts classification accuracy. Develop a comprehensive training program covering HS code fundamentals, product-specific classification challenges, and documentation requirements. Include practical exercises where team members classify sample products and receive feedback. Cross-train personnel from purchasing, product development, and logistics departments to create a classification-aware culture throughout your organization.

Leverage Technology Solutions

Classification technology streamlines compliance while reducing human error. Implement specialized classification software that can store classification data, maintain audit trails, and integrate with your ERP system. These platforms typically offer features like:

- Built-in HS code databases with search functions

- Automated classification suggestion engines

- Document management for classification evidence

- Integration with customs authorities' databases

- Change tracking for audit purposes

Develop Strong Relationships with Customs Authorities

Proactive engagement with customs authorities improves compliance outcomes. Establish open communication channels with relevant customs officials and participate in voluntary compliance programs like the Customs-Trade Partnership Against Terrorism (C-TPAT) in the U.S. or Authorized Economic Operator (AEO) programs elsewhere. These relationships provide early access to regulatory changes and create goodwill that's valuable during classification disagreements.

Create a Compliance Documentation Library

Documentation serves as your defense during customs audits. Maintain a centralized repository of all classification decisions, including:

- Product specifications and technical drawings

- Laboratory analysis reports confirming composition

- Manufacturer's affidavits about product characteristics

- Previous customs rulings on similar products

- Meeting notes documenting classification decisions

- Correspondence with customs authorities

Implement a Prior Disclosure Strategy

A prior disclosure strategy mitigates penalty risks when errors occur. Develop clear procedures for self-reporting classification errors to customs authorities before they're discovered during an audit. Companies that voluntarily disclose violations typically face reduced penalties—in the U.S., prior disclosure can reduce potential penalties by up to 97%. Your strategy should include protocols for:

- Internal discovery of possible errors

- Preliminary assessment of scope and impact

- Timely notification to customs authorities

- Comprehensive corrective action plans

Conduct Regular Risk Assessments

Risk assessments identify vulnerability areas in your classification process. Evaluate your classification procedures quarterly, focusing on high-risk products with complex compositions or subjective classification criteria. Analyze past customs queries and historical classification changes to identify patterns requiring additional attention. Prioritize improvements to your classification system based on these risk assessments.

Conclusion

Mastering customs classification is both an art and a science that can significantly impact your business's bottom line. By understanding HS codes properly applying the General Rules of Interpretation and utilizing available resources you'll navigate international trade more confidently and cost-effectively.

Remember that accurate classification isn't just about compliance—it's a strategic business advantage that can reduce duties streamline operations and prevent costly penalties. Whether you're handling classifications in-house or partnering with experts the investment in proper classification pays dividends through smoother customs clearance fewer delays and optimized duty payments.

Take proactive steps today to establish robust classification processes train your team and leverage technology solutions. Your commitment to classification excellence will protect your business while opening doors to global trade opportunities.

Frequently Asked Questions

What is customs classification and why is it important?

Customs classification is the process of categorizing goods according to the Harmonized System (HS) for international trade. It's crucial because it determines duty rates, ensures regulatory compliance, and facilitates smooth border crossings. Accurate classification can save businesses 3-8% on duty payments while preventing penalties, delays, and increased scrutiny from customs authorities.

How do HS codes work?

HS codes are six-digit numerical codes organized in a hierarchical structure across 21 sections and 99 chapters. Each code represents specific product categories, with the first two digits indicating the chapter, the next two identifying the heading, and the final two specifying the subheading. Countries often add additional digits to accommodate local regulations while maintaining international compatibility.

What are the consequences of misclassifying goods?

Misclassification can result in severe penalties, including substantial fines and potential criminal prosecution for fraud. Additional consequences include increased customs scrutiny, seizure of goods, loss of preferential treatment, compliance audits, overpayment of duties, and supply chain disruptions like delays and inventory shortages.

How can I determine the correct classification code for my product?

Start by identifying essential product characteristics (specifications, materials, and packaging). Apply the General Rules of Interpretation (GRI) methodically. Research binding rulings from customs authorities for similar products. For complex items, consider consulting customs databases, using digital classification tools, or seeking assistance from customs brokers or consultants.

What special challenges exist for classifying technology products?

Technology products present unique challenges due to rapid innovation and the intangible nature of digital goods. Classification depends on whether software is delivered physically or electronically. Multi-function products like smartphones require essential character determination through principal function analysis, component value evaluation, and market perception review. Stay updated on evolving classification guidelines for digital products.

What tools can help with customs classification?

Helpful resources include government databases like the U.S. Customs CROSS system and the EU's EBTI database, which provide access to previous rulings. Digital classification tools and specialized technical product databases offer automated assistance. Customs brokers and consultants provide expertise for navigating complex classifications and can offer valuable insights and automation services.

How can businesses maintain classification compliance?

Establish a robust classification system with detailed product documentation and standardized processes. Conduct regular reviews of classifications, especially when products change. Provide comprehensive team training and leverage technology solutions. Build relationships with customs authorities, maintain a compliance documentation library, and implement a prior disclosure strategy when errors are discovered.

What are the General Rules of Interpretation (GRI)?

The GRI is a six-rule framework for classifying goods when categories are unclear. The rules must be applied sequentially: Rule 1 focuses on headings and section/chapter notes; Rule 2 covers incomplete/unfinished articles; Rule 3 addresses items potentially classifiable under multiple headings; Rules 4-6 deal with similar goods, packaging, and subheadings respectively. Following this framework prevents common errors.

Can classification errors be corrected after submission?

Yes, through a voluntary prior disclosure process. When companies discover classification errors, proactively disclosing them to customs authorities can significantly reduce penalties. This approach demonstrates good faith compliance efforts and can transform potential large fines into minimal or no penalties. Always consult with a customs attorney before making disclosures.

How often should businesses review their product classifications?

Businesses should review classifications at least annually and whenever product specifications change, even slightly. Regular reviews are essential when sourcing new materials, changing manufacturing processes, or entering new markets. Companies with large product catalogs should implement a rolling review schedule to ensure all classifications remain current and compliant.