When you think about how products travel across continents in mere hours, you're witnessing the global air logistics network in action. This intricate system connects businesses, economies, and consumers worldwide through a carefully orchestrated web of aircraft, airports, and shipping facilities designed to move cargo with unprecedented speed and efficiency.

In today's fast-paced market, the global air logistics network serves as the backbone of international commerce, enabling everything from just-in-time manufacturing to rapid delivery of critical medical supplies. It's transformed how companies manage inventory, fulfill orders, and respond to market demands across borders. Whether you're tracking an overnight package or managing a multinational supply chain, you're tapping into a vast aerial infrastructure that operates 24/7 to keep goods flowing around the planet.

Understanding the Global Air Logistics Network

The global air logistics network operates as an intricate ecosystem that facilitates rapid cargo movement worldwide. This complex system integrates various elements to create seamless transportation chains that support international trade and commerce.

Key Components of Air Logistics Systems

Air logistics systems comprise five essential components that work in harmony to ensure efficient cargo delivery. Aircraft fleets form the backbone of the network, ranging from dedicated freighters like the Boeing 747-8F with 137-ton capacity to passenger aircraft with belly cargo capabilities. Air cargo terminals serve as processing hubs where shipments undergo consolidation, deconsolidation, and security screening through sophisticated handling equipment and warehouse management systems. Ground handling operations include aircraft loading/unloading, tarmac transport, and specialized equipment for unique cargo types. Information technology infrastructure powers the network through cargo management systems, tracking platforms, and customs clearance software that enable real-time visibility. Regulatory frameworks establish standardized procedures for safety, security, and cross-border movements, including IATA regulations and country-specific customs requirements that govern air cargo operations globally.

Historical Development of Global air freight

The evolution of global air freight spans several distinct eras that transformed cargo transportation. During the 1920s-1940s, early mail services laid the groundwork when airlines like Pan American Airways began carrying mail alongside passengers. The post-WWII expansion (1950s-1960s) saw surplus military aircraft converted to cargo use and the establishment of dedicated air freight companies like Flying Tiger Line. The containerization revolution of the 1970s-1980s introduced standardized Unit Load Devices (ULDs) that dramatically improved loading efficiency and cargo protection. The globalization era (1990s-2000s) witnessed integrated carriers like FedEx and DHL creating comprehensive door-to-door networks while e-commerce emergence drove demand for faster deliveries. Since 2010, the digital transformation phase has brought advanced tracking systems, predictive analytics, and drone technology that continue reshaping the industry while sustainability concerns drive innovations in fuel efficiency and alternative propulsion methods.

Major Players in the Global Air Logistics Market

The global air logistics market features several key players who dominate the industry through extensive networks, specialized services, and technological capabilities. These organizations range from passenger airlines with cargo divisions to dedicated freight carriers that form the backbone of international air shipments.

Commercial Airlines and Cargo Operations

Commercial airlines contribute significantly to global air cargo capacity through their belly cargo operations. Airlines like Emirates SkyCargo, Cathay Pacific Cargo, and Lufthansa Cargo leverage their passenger routes to transport freight in aircraft lower decks, creating an efficient dual-revenue model. Delta Air Lines handles over 2.2 billion cargo ton-miles annually, utilizing space in approximately 800+ aircraft that already fly scheduled routes. These carriers offer specialized services including temperature-controlled shipping for pharmaceuticals, live animal transport, and high-value item handling across their established global networks.

Dedicated Air Freight Companies

Dedicated air freight companies focus exclusively on cargo transportation, operating purpose-built freighter aircraft designed for maximum payload capacity. FedEx Express operates the world's largest cargo airline with 670+ aircraft serving 220+ countries and handling over 6.8 million packages daily. UPS Airlines maintains 500+ aircraft connecting 815 destinations with specialized services for time-critical shipments, healthcare logistics, and dangerous goods transport. DHL Aviation's 260+ aircraft specialize in express parcel delivery across 220 countries, while new entrants like Amazon Air have rapidly expanded to 85+ aircraft since 2016, focusing primarily on supporting the e-commerce giant's distribution network. These carriers invest heavily in advanced tracking systems, route optimization technology, and sustainable aviation initiatives to maintain competitive advantages in the rapidly evolving global logistics landscape.

Infrastructure Supporting Air Logistics Networks

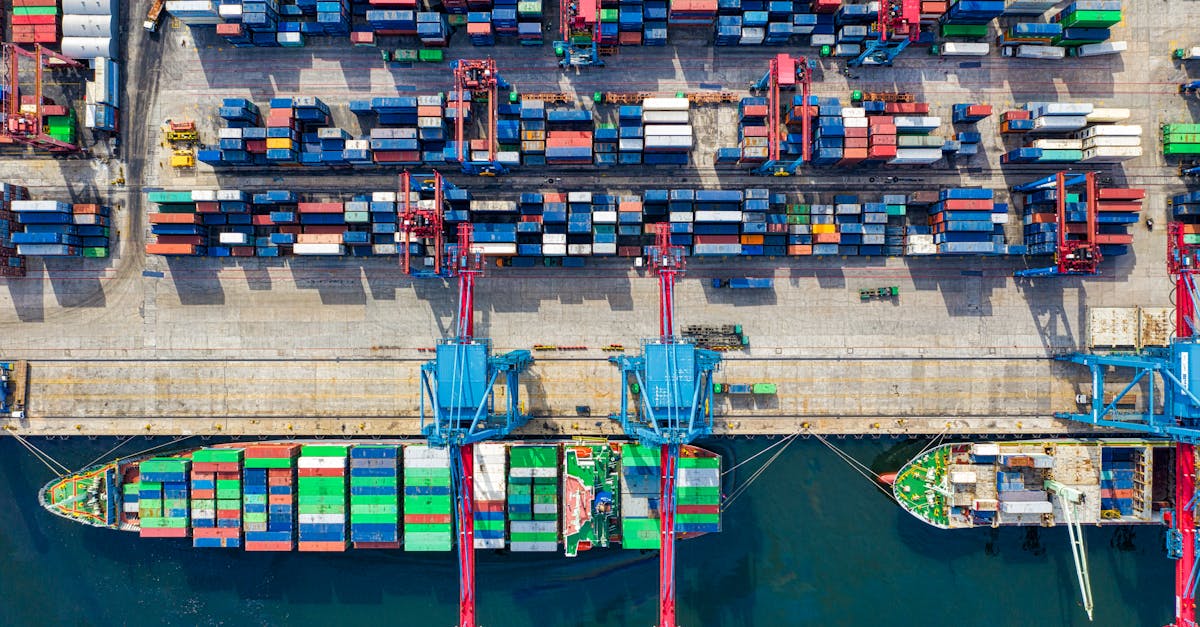

The physical and operational infrastructure forms the backbone of global air logistics networks, enabling seamless cargo movement across continents. These specialized facilities and systems work in tandem to ensure efficient handling, storage, and transfer of air freight throughout the supply chain.

Air Cargo Hubs and Mega Airports

Air cargo hubs serve as centralized processing centers where freight is consolidated, sorted, and redistributed to final destinations. These strategic facilities typically feature extensive warehouse space, automated sorting systems, and specialized storage areas for temperature-sensitive or hazardous goods. Hong Kong International Airport (HKG), handling over 4.8 million tons of cargo annually, exemplifies a premier global air cargo hub with its 24/7 operations and dedicated logistics park. Memphis International Airport, home to FedEx's global superhub, processes approximately 4.5 million tons of cargo yearly through its 3.8 million square foot sorting facility capable of handling 484,000 packages per hour.

The emergence of mega airports has transformed the air logistics landscape, with facilities like Dubai International (DXB) and Shanghai Pudong International (PVG) offering integrated customs clearance, cold chain facilities, and specialized pharmaceutical handling areas. These mega hubs typically feature multiple runways accommodating large freighter aircraft, extensive apron space for simultaneous loading/unloading operations, and advanced material handling equipment that reduces ground time for aircraft.

Ground Support and Intermodal Connections

Ground support equipment (GSE) encompasses the specialized vehicles and machinery essential for aircraft servicing and cargo handling operations. This equipment includes high loaders capable of lifting up to 35 tons of cargo to aircraft main decks, container dollies transporting unit load devices across tarmacs, and belt loaders for bulk cargo movement. Advanced GSE systems at major hubs now incorporate electric and hybrid vehicles, reducing carbon emissions while maintaining operational efficiency.

Intermodal connections link air cargo facilities with road, rail, and sometimes sea transportation networks, creating seamless transitions between transport modes. Modern air cargo complexes feature dedicated truck docks, rail spurs, and sophisticated cross-docking facilities to minimize handling time between different transportation methods. Amsterdam's Schiphol Airport exemplifies effective intermodal integration with its direct connections to European rail networks and major highways, allowing cargo to reach 80% of Europe's major economic centers within 24 hours of arrival. Similarly, Singapore's Changi Airport connects with the Port of Singapore through dedicated freight corridors, enabling rapid sea-air transfers for time-sensitive shipments moving between Asia and other continents.

Technology Transforming Global Air Logistics

Advanced technologies are revolutionizing how global air logistics networks operate, creating unprecedented efficiency and visibility. These innovations address traditional pain points while opening new possibilities for service providers and customers alike.

AI and Predictive Analytics in Route Optimization

Artificial intelligence transforms route planning in air logistics through complex data analysis and real-time decision-making capabilities. Machine learning algorithms analyze historical flight data, weather patterns, airport congestion, and fuel consumption to determine optimal routing options for cargo aircraft. For example, Lufthansa Cargo uses AI to reduce fuel consumption by 5% through more efficient flight paths that account for jet streams and temperature variations.

Predictive analytics helps logistics operators anticipate disruptions before they occur. These systems identify potential bottlenecks caused by weather events, airport capacity issues, or maintenance requirements 24-48 hours in advance, allowing for proactive rerouting. IBM's Watson platform integrates with major carriers to process over 100,000 variables simultaneously when planning intercontinental cargo routes.

Dynamic route optimization adjusts flight plans mid-journey based on changing conditions. When unexpected airspace restrictions occur, AI systems can recalculate optimal paths within minutes, minimizing delivery delays and fuel waste. DHL's SmartSensor technology pairs with their routing algorithms to modify temperature-sensitive shipment routes based on real-time environmental conditions.

Tracking and Visibility Solutions

IoT-enabled tracking devices provide continuous location updates and environmental monitoring throughout the air logistics journey. Advanced sensors monitor temperature, humidity, pressure, and shock exposure for sensitive cargo like pharmaceuticals and electronics. These devices transmit data every 2-15 minutes depending on the sensitivity of the shipment, enabling intervention if conditions exceed acceptable parameters.

Blockchain technology ensures data integrity across the supply chain by creating immutable records of handling events. The International Air Transport Association's ONE Record initiative uses blockchain to create a single digital record for each shipment, accessible to all authorized stakeholders. This reduces documentation errors by up to 80% and speeds customs clearance processes.

Digital twins replicate physical logistics operations in virtual environments for enhanced visibility and simulation capabilities. UPS uses digital twin technology to create virtual models of their air network, allowing planners to test different scenarios before implementing changes. These simulations reduce the risk of disruptions during peak shipping seasons by identifying potential failure points in advance.

Mobile applications connect customers directly to shipment tracking information with unprecedented detail. FedEx's SenseAware platform pairs with their mobile app to provide customers with real-time location data, temperature readings, and estimated arrival times. The application also sends automated alerts when shipments encounter delays or environmental excursions, enabling proactive management of recipient expectations.

Challenges Facing the Global Air Logistics Network

Despite its critical role in global commerce, the air logistics industry confronts significant obstacles that impact operational efficiency and future growth. These challenges range from environmental pressures to complex regulatory frameworks that logistics providers must navigate to maintain competitive service offerings.

Environmental Concerns and Sustainability

Environmental impact remains the most pressing challenge for the global air logistics network. The aviation sector generates approximately 2-3% of global CO2 emissions, with cargo operations accounting for a significant portion. Air freight companies face mounting pressure from consumers, regulators, and investors to reduce their carbon footprint through several approaches:

- Fuel efficiency improvements: Airlines like Lufthansa Cargo and FedEx have invested in next-generation aircraft such as the Boeing 777F, which uses 17% less fuel than older models.

- Sustainable aviation fuel (SAF) adoption: DHL Express committed to using 30% SAF blends by 2030, though limited production capacity and high costs (2-5 times conventional jet fuel) remain obstacles.

- Operational optimizations: Route planning software from providers like Airspace Technologies helps reduce empty legs and unnecessary fuel consumption.

- Carbon offset programs: UPS's carbon neutral shipping option allows customers to neutralize emissions from their shipments through verified environmental projects.

The industry's path toward meeting emissions reduction targets faces economic hurdles, as sustainable technologies often increase operational costs in the short term, creating tension between environmental goals and competitive pricing strategies.

Regulatory Hurdles and International Trade Policies

Navigating the complex web of international regulations creates substantial operational challenges for air logistics providers. Regulatory obstacles manifest in various forms:

- Customs clearance delays: Different documentation requirements across countries lead to processing times ranging from hours to days, disrupting supply chain predictability.

- Security protocols: Enhanced screening measures implemented after security incidents, such as the 2010 Yemen cargo plane bomb plot, add processing time and operational costs.

- Landing rights restrictions: Many countries limit foreign carrier access to domestic routes, creating capacity imbalances and inefficient routing patterns.

- Trade tariffs and barriers: Escalating trade tensions, exemplified by the U.S.-China trade dispute that imposed 7.5-25% tariffs on various goods categories, directly impact shipping volumes and routes.

- Inconsistent hazardous materials regulations: Variations in lithium battery transport rules between the EU, U.S., and Asia create compliance challenges for electronics shipments.

The IATA's ONE Record initiative attempts to standardize data exchange across the air cargo supply chain, but adoption remains uneven across regions. Companies operating in multiple jurisdictions must maintain specialized compliance teams to interpret and adapt to continuously evolving regulatory frameworks, adding significant administrative overhead to global operations.

Future Trends in Global Air Logistics

The global air logistics network is undergoing rapid transformation as new technologies, shifting economic patterns, and evolving consumer demands reshape the industry. These developments are creating both opportunities and challenges for stakeholders throughout the air cargo ecosystem.

Emerging Markets and Shifting Trade Routes

Emerging markets are redrawing the map of global air logistics networks, creating new hubs and corridors that reflect changing economic realities. Countries across Southeast Asia, particularly Vietnam, Thailand, and Malaysia, have experienced 15-20% annual growth in air cargo volumes as manufacturing shifts from traditional centers. The Middle East has positioned itself as a critical connecting point between East and West, with UAE-based carriers increasing their cargo capacity by 35% since 2018. African markets like Ethiopia, Kenya, and Rwanda are developing specialized air cargo capabilities for high-value exports such as fresh flowers, pharmaceutical products, and electronic components.

These shifts are prompting logistics providers to reorient their networks and establish strategic presence in these regions. Regional expansion requires carriers to navigate unique infrastructure challenges, regulatory environments, and competitive landscapes. Carriers investing in emerging market capabilities today are gaining first-mover advantages in what industry analysts predict will be the highest-growth air cargo markets over the next decade.

The Impact of E-commerce on Air Freight Demand

E-commerce has fundamentally transformed air logistics networks, creating unprecedented demand for rapid, reliable cross-border shipping capabilities. Online retail now generates over 40% of air cargo volume on major international routes, up from just 15% a decade ago. Peak shopping events like Singles' Day, Black Friday, and Cyber Monday create massive demand surges, with volumes increasing by 300-400% during these periods.

The e-commerce effect extends beyond pure volume - it's changing customer expectations and operational requirements. Cross-border e-commerce purchases require specialized customs clearance processes, last-mile delivery coordination, and returns management capabilities that traditional air cargo operations weren't designed to handle. Major carriers have responded by developing specialized e-commerce solutions offering:

- Integrated customs clearance technologies that reduce international shipping delays by up to 70%

- Warehouse automation systems that process small parcels at 5-10x the speed of traditional cargo handling

- Dedicated e-commerce aircraft configurations with specialized unit load devices for parcel shipments

- Digital platforms connecting e-commerce marketplaces directly to air capacity booking systems

The convergence of e-commerce and air logistics is also driving smaller airports to develop specialized cargo facilities, creating a more distributed network that brings air shipping capabilities closer to consumers. Regional airports handling under 5 million passengers annually have increased their cargo investments by 25% to capture e-commerce-related growth opportunities.

Key Takeaways

- The global air logistics network consists of five key components: aircraft fleets, air cargo terminals, ground handling operations, information technology infrastructure, and regulatory frameworks that work together to facilitate worldwide cargo movement.

- Major players in the industry include commercial airlines with belly cargo operations (like Emirates SkyCargo and Lufthansa Cargo) and dedicated freight carriers (such as FedEx Express with 670+ aircraft and UPS Airlines with 500+ aircraft).

- Air cargo hubs like Hong Kong International Airport (4.8 million tons annually) and Memphis International Airport (FedEx's superhub) serve as crucial infrastructure, featuring advanced automation and specialized storage for various cargo types.

- Advanced technologies transforming the industry include AI for route optimization (reducing fuel consumption by 5%), IoT-enabled tracking devices, blockchain for documentation, and digital twins for network simulation.

- The sector faces significant challenges including environmental concerns (aviation generates 2-3% of global CO2 emissions) and complex regulatory frameworks that create customs delays and compliance issues across different jurisdictions.

- Future growth is being driven by emerging markets in Southeast Asia and Africa, while e-commerce now generates over 40% of air cargo volume on major international routes, creating unprecedented demand for rapid cross-border shipping.

Conclusion

The global air logistics network stands as an essential pillar of modern commerce connecting businesses across continents with unprecedented speed and efficiency. As you've seen this complex ecosystem encompasses sophisticated aircraft fleets specialized infrastructure and cutting-edge technologies working in harmony.

Today's air logistics landscape faces dual challenges of environmental sustainability and regulatory complexity while embracing transformative technologies like AI blockchain and IoT. With e-commerce driving demand and emerging markets creating new opportunities the network continues to evolve.

Your business's ability to leverage this dynamic system could be the competitive advantage you need in today's fast-paced global marketplace. The future of air logistics promises even greater connectivity efficiency and innovation as the industry adapts to meet tomorrow's demands.