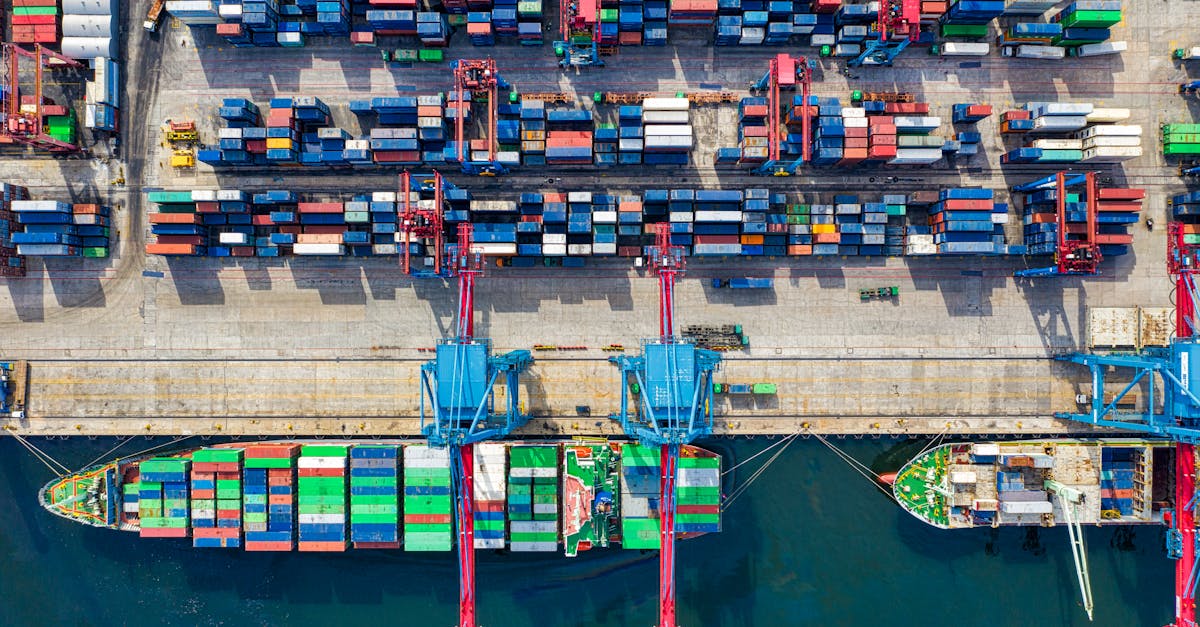

Navigating the complex logistics landscape of Asia requires strategic solutions that optimize your supply chain. Freight consolidation services have emerged as a cornerstone for businesses looking to streamline shipments and reduce costs while maintaining efficiency across this diverse continent.

When you're managing multiple smaller shipments throughout Asia's bustling trade routes, consolidation transforms these fragmented loads into unified, cost-effective transportation solutions. By combining your cargo with other shippers' goods heading to similar destinations, you'll benefit from economies of scale that weren't previously accessible with LCL (Less than Container Load) shipments. This approach is particularly valuable in Asia's rapidly expanding markets where logistics infrastructure varies dramatically between developed hubs like Singapore and emerging centers in Vietnam or Indonesia.

What Are Freight Consolidation Services?

Freight consolidation services combine multiple smaller shipments from different shippers into a single container or transport unit. This logistics strategy enables businesses to ship goods more efficiently while sharing transportation costs with other companies moving cargo along similar routes.

Benefits of Consolidated Shipping

Consolidated shipping offers numerous advantages for businesses operating in Asia's diverse markets. Cost reduction stands as the primary benefit, with companies saving 25-40% on transportation expenses compared to individual shipments. These savings come from shared container space, reduced documentation fees, and optimized handling costs.

Efficiency improvements extend beyond financial aspects. Your goods experience:

- Reduced transit times through streamlined customs clearance

- Lower carbon footprint with fewer partially-filled containers

- Decreased risk of damage from minimized handling touchpoints

- Enhanced security through professional consolidation facilities

For smaller businesses, consolidation creates access to shipping lanes and schedules previously unavailable due to volume constraints. This democratizes international shipping, allowing companies of all sizes to compete in Asian markets without maintaining massive inventory levels.

How Freight Consolidation Works

Freight consolidation follows a structured process designed to maximize efficiency and minimize costs. The process begins at consolidation warehouses where shipments from multiple shippers arrive and undergo verification against shipping documents. Warehouse staff then sort and organize these shipments based on destination, shipping schedule, and cargo type.

Consolidators meticulously plan container loading to optimize space utilization and weight distribution. Your shipments are:

- Grouped with compatible cargo heading to the same destination

- Loaded in a specific sequence based on delivery priorities

- Secured properly to prevent shifting during transit

- Documented in a master bill of lading

Once loaded, the consolidated container travels as a single unit to its destination port, where deconsolidation occurs. At the destination warehouse, the container contents are separated according to individual consignees, and each shipment continues to its final delivery point through local transportation networks.

Technology plays a crucial role in modern consolidation services, with warehouse management systems tracking inventory in real-time and optimization software determining the most efficient loading configurations. This technological integration enhances visibility throughout the shipping process, providing you with accurate tracking information from pickup to delivery.

The Asian Freight Consolidation Landscape

Asia's freight consolidation market has evolved into a sophisticated network spanning multiple countries with varying levels of infrastructure development. Strategic hubs across the continent leverage geographic advantages and technological advancements to facilitate efficient cargo movement, while established and emerging service providers compete to offer innovative consolidation solutions.

Major Consolidation Hubs in Asia

Asia's freight consolidation infrastructure centers around several strategic locations that serve as gateways for international trade. Singapore stands as the premier consolidation hub in Southeast Asia, processing over 36 million TEUs annually with its world-class port facilities and strategic location at the Strait of Malacca. Hong Kong and Shanghai dominate in East Asia, leveraging their sophisticated port infrastructure and proximity to manufacturing centers in mainland China. In South Asia, ports like Mumbai and Colombo function as critical transshipment points connecting East-West trade routes.

Emerging hubs include Vietnam's Ho Chi Minh City and Da Nang ports, which have seen container throughput increase by 15% annually since 2018. Malaysia's Port Klang and Thailand's Laem Chabang offer cost-effective alternatives with expanding specialized consolidation zones. These hubs feature advanced warehousing facilities, streamlined customs procedures, and multimodal transport connections that enable efficient cargo consolidation and distribution throughout the region.

Key Players in the Asian Market

The Asian freight consolidation landscape features diverse service providers ranging from global logistics giants to specialized regional operators. Global players like Maersk, DHL, and Kuehne+Nagel maintain extensive networks across Asia, offering end-to-end consolidation services integrated with their broader logistics portfolios. DHL, for example, operates over 200 consolidation warehouses across Asia, handling more than 5 million shipments annually.

Regional specialists such as Kerry Logistics and CJ Logistics have carved out significant market share through their deep understanding of local markets and customs regulations. These companies typically offer more customized consolidation solutions for specific trade lanes or industries. For instance, Kerry Logistics specializes in China-ASEAN consolidation corridors, while Japan's Nippon Express excels in high-value electronics consolidation.

Digital freight forwarders and consolidation platforms like Flexport and Cargobase are disrupting traditional models by providing transparent pricing and real-time visibility. These tech-enabled providers have gained traction particularly among SMEs shipping to and from emerging Asian markets. The competitive landscape continues to evolve as more traditional players invest in digital capabilities while tech-focused entrants expand their physical network presence across key Asian consolidation hubs.

Types of Freight Consolidation Services in Asia

Freight consolidation services in Asia encompass several specialized options tailored to different shipping needs and cargo types. Each service type offers unique advantages for businesses looking to optimize their supply chain operations across Asian markets.

FCL vs. LCL Consolidation

FCL (Full Container Load) consolidation combines multiple shippers' goods to fill an entire container, offering cost efficiency while maintaining control over shipping schedules. This option typically results in 15-20% savings compared to booking individual containers and reduces handling, making it ideal for time-sensitive or high-value shipments. LCL (Less than Container Load) consolidation, on the other hand, accommodates smaller shipment volumes by combining goods from multiple shippers in shared containers. This service provides 30-40% cost savings for businesses with insufficient cargo to fill a container, opening access to major Asian trade lanes such as China-Southeast Asia routes, Japan-Korea connections, and intra-ASEAN shipments.

air freight Consolidation Options

Air freight consolidation services in Asia offer rapid transit solutions for time-critical shipments while maximizing cost efficiency. Direct air consolidation combines multiple shipments into a single air waybill, reducing documentation fees and handling charges by 25-35% compared to individual air shipments. Major hubs for this service include Hong Kong International Airport, Singapore Changi, and Seoul Incheon, each processing over 2 million tons of cargo annually. For greater flexibility, deferred air consolidation services pool shipments with similar destinations but lower urgency, cutting costs by 40-50% compared to direct air shipments. Regional-specific consolidation programs like China-ASEAN Express and Japan-Southeast Asia Airbridge cater to particular trade corridors with dedicated departure schedules and specialized handling for regional trade compliance.

Cost Considerations for Asian Freight Consolidation

Freight consolidation in Asia presents complex cost structures that directly impact profit margins and supply chain efficiency. Understanding the financial aspects of consolidation services helps businesses make informed decisions that align with their logistics budgets and operational needs.

Pricing Models and Fee Structures

Asian freight consolidation services operate on several distinct pricing models that vary by provider and shipping route. The most common model is volume-based pricing, where rates decrease as shipment volume increases—typically offering 15-25% savings when reaching certain cubic meter thresholds. Weight-based pricing applies particularly to air freight consolidation, with charges calculated per kilogram and discounted rate breaks at 45kg, 100kg, 300kg, and 500kg levels. For regular shippers, many consolidators offer contracted rates with guaranteed space allocation and fixed pricing for 3-6 month periods, providing budget predictability despite market fluctuations.

Additional fees include documentation charges ($25-75 per shipment), handling fees ($5-15 per cubic meter), warehouse storage ($2-8 per pallet per day), and customs processing fees (varying by country—Singapore averages $45 while Japan can exceed $100). Port congestion surcharges fluctuate seasonally, reaching peaks of $400-800 per container during Chinese New Year and $300-500 during Southeast Asian monsoon seasons. Insurance fees typically range from 0.3-0.7% of cargo value depending on goods classification and destination country risk assessment.

Strategies for Cost Optimization

Effective cost management in Asian freight consolidation requires strategic planning and operational adjustments. Consolidating shipments by geography saves 12-18% on transportation costs by grouping goods bound for neighboring destinations like Thailand, Vietnam, and Cambodia rather than shipping separately. Timing shipments to avoid peak seasons reduces costs by 10-15%, particularly by scheduling around Chinese New Year (January-February), Golden Week (October), and year-end holiday periods when capacity tightens and rates increase.

Packaging optimization delivers dual benefits—reducing dimensional weight by 15-20% through right-sized packaging while simultaneously enhancing protection during transit through Asian ports. Forming shipper alliances with complementary businesses creates opportunities to share container space regularly, potentially saving each partner 20-30% compared to individual LCL shipments. Digital freight platforms like Freightos and Flexport provide instant comparison of consolidation options across multiple service providers, revealing price differences of 8-25% between carriers serving the same Asian routes.

Material declaration accuracy prevents costly delays and fines at customs checkpoints, which can add $500-2,000 to shipment costs in strict regulatory environments like Japan and South Korea. Long-term volume commitments with specific consolidators secure preferential rates 10-15% below spot market prices while guaranteeing capacity allocation during high-demand periods that frequently affect key Asian trade lanes connecting manufacturing centers to global markets.

Challenges in Asian Freight Consolidation

While freight consolidation offers substantial benefits for businesses operating in Asia, it also presents unique challenges that require strategic approaches. Companies engaging in consolidation services across the region face several obstacles that can impact efficiency, costs, and delivery timelines if not properly managed.

Navigating Regulatory Differences

Regulatory complexity represents a primary challenge in Asian freight consolidation. Each country maintains distinct customs regulations, documentation requirements, and compliance standards that directly impact consolidation processes. For example, Japan requires specific fumigation certificates for wooden packaging materials, while Thailand enforces strict regulations on food and agricultural imports requiring additional documentation.

Import duties and taxation systems vary significantly across Asian markets, creating complications for consolidated shipments containing goods from multiple shippers. In countries like Indonesia and Vietnam, frequent regulatory changes often occur with minimal notice, requiring consolidators to constantly update their compliance processes. These differences can lead to:

- Delayed clearance at borders when documentation doesn't meet specific country requirements

- Unexpected additional costs from varying duty calculation methods

- Complex paperwork management requiring specialized knowledge of each market

- Potential cargo holds when consolidators must verify compliance for multiple shippers' goods

Many consolidators address these challenges by maintaining dedicated compliance teams with country-specific expertise and implementing digital documentation systems that automatically validate requirements for each destination.

Infrastructure and Capacity Issues

Infrastructure limitations present significant operational challenges for freight consolidation across Asia. The quality of transportation networks varies dramatically—from Singapore's state-of-the-art logistics facilities to less developed infrastructure in emerging markets like Cambodia and Myanmar where road quality, port capacity, and warehouse facilities remain underdeveloped.

Port congestion at major Asian hubs creates bottlenecks that impact consolidated shipments, with terminals in Shanghai and Manila regularly experiencing delays of 3-5 days during peak seasons. These capacity constraints affect consolidation timelines in several ways:

- Warehouse capacity shortages in high-density areas forcing consolidators to operate multiple smaller facilities

- Limited cold chain infrastructure in developing markets compromising temperature-sensitive consolidated shipments

- Last-mile delivery challenges in congested urban centers like Jakarta and Bangkok where traffic adds unpredictable delays

- Seasonal capacity constraints during manufacturing peaks (particularly pre-Chinese New Year) when consolidation space becomes scarce

Technology adoption differences across the region further complicate seamless consolidation operations. While Singapore and Hong Kong utilize advanced tracking and management systems, consolidation partners in secondary markets may rely on manual processes, creating visibility gaps in the consolidated shipment journey.

To overcome these infrastructure challenges, effective consolidators establish strategic partnerships with local logistics providers who understand regional nuances and maintain buffer capacity to accommodate seasonal fluctuations in consolidation demand.

Technology Transforming Freight Consolidation in Asia

Advanced technological solutions are revolutionizing freight consolidation services across Asia, streamlining operations and enhancing efficiency throughout the supply chain. These innovations address traditional pain points while creating new competitive advantages for businesses operating in the region's diverse markets.

Digital Platforms and Visibility Solutions

Digital platforms have fundamentally transformed freight consolidation in Asia by providing unprecedented shipment visibility and control. Platforms like Logixboard, FreightViewer, and BluJay's Transportation Management connect shippers, freight forwarders, and carriers in real-time ecosystems that optimize consolidation opportunities. These platforms enable you to monitor shipment status across multiple carriers, receive automated alerts for delays, and access documentation electronically from anywhere.

Real-time tracking technologies, including GPS and IoT sensors, now deliver precise location data and environmental monitoring for consolidated shipments. Major consolidators like DHL and DB Schenker have implemented these systems throughout their Asian networks, allowing you to track individual items within consolidated loads with 99.8% accuracy. The visibility extends beyond location to include temperature, humidity, and shock data—critical for pharmaceutical and electronics shipments traversing varied Asian climate zones.

Data analytics platforms further enhance consolidation efficiency by identifying optimal load combinations, predicting transit bottlenecks, and suggesting alternative routing during disruptions. Companies implementing these analytics solutions report 15-20% improvements in container utilization rates and 22% reductions in transit delays across Asian shipping lanes.

Automation and Robotics in Consolidation Warehouses

Consolidation warehouses across Asia have embraced automation to increase throughput capacity and accuracy. Automated sorting systems in Singapore, Hong Kong, and Shanghai hubs now process over 10,000 parcels per hour with error rates below 0.1%, significantly outperforming manual operations. Robotic systems handle the physical consolidation process, from package identification to optimal placement within containers.

Automated guided vehicles (AGVs) now navigate warehouse floors in major Asian consolidation centers, transporting goods between staging areas without human intervention. These systems reduce labor costs by 35-40% while increasing processing speeds by 65%. In South Korea's Incheon logistics hub, Naver's logistics division utilizes over 100 AGVs that communicate with central warehouse management systems to prioritize movements based on consolidation schedules.

Autonomous loading systems represent the cutting edge of consolidation technology, using 3D scanning to identify optimal container loading patterns. These systems consider dimensions, weight distribution, destination, and handling requirements to maximize space utilization. COSCO's Shanghai facility employs these systems to achieve 93% container utilization rates—11% higher than manual loading methods.

Blockchain for Documentation and Compliance

Blockchain technology is streamlining documentation processes and enhancing compliance tracking across Asian freight consolidation networks. Digital bills of lading and customs documentation on blockchain platforms have reduced paperwork processing times from days to minutes while virtually eliminating document loss. The TradeLens platform, developed by Maersk and IBM, now connects over 150 ports and terminals across Asia, enabling instant verification of shipping documents.

Smart contracts built on blockchain automate payment releases when specific consolidation milestones are met, improving cash flow for all supply chain participants. This technology has reduced payment disputes by 43% among participating Asian logistics providers while accelerating settlement times. For cross-border shipments through multiple Asian countries, blockchain creates an immutable record of compliance documentation, reducing customs delays by an average of 56%.

Blockchain's ability to track goods provenance is particularly valuable for consolidated shipments containing regulated items. In Japan and Singapore, pharmaceutical consolidators use blockchain to maintain complete temperature and handling records from origin to destination, ensuring regulatory compliance while simplifying audits. This technology has proven especially valuable for food products moving through multiple Asian consolidation points, with full traceability maintained regardless of how shipments are split or combined.

Choosing the Right Freight Consolidation Partner

Selecting an optimal freight consolidation partner in Asia's dynamic logistics environment requires careful evaluation of several critical factors. Your choice directly impacts shipping efficiency, cost-effectiveness, and overall supply chain performance across Asian markets.

Essential Criteria for Selection

The selection of a freight consolidation partner hinges on five key criteria that determine service quality and compatibility with your business needs. Network coverage tops the list, as partners with established routes across major Asian hubs like Singapore, Hong Kong, and emerging markets such as Vietnam offer more flexible shipping options. Experience matters significantly—partners with 5+ years in Asian markets understand regional nuances in customs procedures and documentation requirements across countries like China, Japan, and Thailand.

Technology capabilities represent another crucial factor, with advanced partners offering real-time tracking systems, digital documentation processing, and integration with your existing supply chain management software. Look for consolidators using warehouse management systems that provide container loading visualization and optimization algorithms that maximize space utilization by 15-20% compared to manual planning methods.

Financial stability deserves thorough examination; review potential partners' credit ratings, payment terms, and insurance coverage options. Partners with dedicated customs compliance teams demonstrate their commitment to navigating complex regulatory environments across Asian countries, potentially reducing clearance delays by 30-40% compared to less experienced operators.

Service specialization completes the essential criteria set—some consolidators excel in specific industries like electronics, textiles, or perishables, offering specialized handling, packaging, and documentation expertise tailored to your product requirements.

Evaluating Industry Experience and Expertise

Industry experience manifests in a consolidator's track record handling your specific product types across Asian markets. Partners with specialized expertise demonstrate familiarity with commodity-specific regulations, packaging requirements, and handling procedures. For example, electronics consolidators understand static protection protocols, while those specializing in textiles recognize folding techniques that maximize container space utilization.

Review case studies and client references from businesses in your industry that ship to your target markets. Experienced consolidators readily provide statistics on key performance indicators like on-time delivery rates (ideally exceeding 95%), damage rates (below 0.5%), and documentation accuracy (above 98%). These metrics reveal operational efficiency and reliability across different Asian shipping lanes.

Regional expertise proves particularly valuable when navigating distinct market requirements. Partners with offices in mainland China understand local transportation networks and provincial regulations, while those with strong Korean operations navigate that country's stringent import documentation requirements. Their localized knowledge translates to fewer delays and more predictable transit times across complex Asian supply chains.

Service Level Agreements and Performance Metrics

Comprehensive SLAs establish clear expectations and accountability in your freight consolidation partnership. Effective agreements include specific performance metrics like consolidation timeframes (24-48 hours from receipt), on-time departure rates (minimum 95%), and accurate documentation processing (99%+). These measurable standards provide objective evaluation criteria and create transparency in service delivery.

Visibility commitments specify tracking update frequency and communication protocols during transit exceptions. Leading consolidators provide real-time milestone notifications and proactive alerts for potential delays, along with resolution timeframes for common disruptions like port congestion or customs holds. These commitments ensure you maintain visibility throughout your shipment's journey across multiple Asian countries.

Operational guarantees address handling procedures, temperature controls for sensitive cargo, and container utilization targets. The best partners commit to specific space optimization percentages (typically 85-90% for mixed cargo) and secure loading protocols that minimize shifting during transit. Financial terms in SLAs clarify liability limitations, insurance requirements, and compensation procedures for service failures, creating accountability within your logistics partnership.

Cost Structure and Pricing Transparency

Transparent pricing structures reveal all potential costs associated with freight consolidation services across Asian networks. Comprehensive quotes itemize base consolidation fees, documentation charges, handling costs, and potential destination fees at ports like Busan or Manila. This transparency eliminates surprise charges and enables accurate landed cost calculations for your products.

Volume commitments influence pricing significantly, with tiered structures offering progressively lower rates as shipment volumes increase. Partners providing annual volume incentives reward consistent business with rate reductions of 5-15% based on quarterly or annual shipping volumes. These arrangements create predictable logistics budgets and incentivize consolidation efficiencies.

Additional services like specialized packaging, customs brokerage, or last-mile delivery carry supplemental costs that vary by market. The most transparent partners provide comprehensive fee schedules for these services across different Asian countries, allowing you to evaluate the total cost impact of using a single provider for multiple logistics functions throughout your supply chain.

Technology Integration Capabilities

Advanced technology integration capabilities differentiate modern freight consolidators in Asia's digitizing logistics landscape. API connectivity allows direct information exchange between your systems and your consolidator's platforms, eliminating manual data entry and reducing documentation errors by up to 30%. These integrations enable automated booking submissions, milestone updates, and documentation sharing throughout the consolidation process.

Visibility platforms provide real-time tracking across Asian transportation networks, with leading consolidators offering mobile applications and web portals that display consolidation status, container locations, and estimated arrival times. The most sophisticated systems incorporate predictive analytics that forecast potential delays based on historical performance data and current conditions at major Asian ports and border crossings.

Documentation management systems streamline compliance processes by maintaining digital libraries of country-specific requirements and templates. These systems automatically validate information completeness and compliance with destination requirements in markets like Japan or Indonesia, reducing rejection rates and expediting customs clearance. Partners offering comprehensive technology solutions ultimately enhance your supply chain visibility and control while reducing administrative workload throughout the consolidation process.

Key Takeaways

- Freight consolidation services combine multiple smaller shipments into single containers, saving businesses 25-40% on transportation costs while improving efficiency across Asia's diverse markets.

- Major consolidation hubs in Asia include Singapore, Hong Kong, Shanghai, and emerging centers like Ho Chi Minh City, each offering strategic advantages for regional distribution networks.

- Different consolidation options exist for various needs - FCL consolidation provides control and 15-20% savings while LCL accommodates smaller volumes with 30-40% cost savings compared to individual shipments.

- Regulatory complexity presents significant challenges, with each Asian country maintaining distinct customs requirements, import duties, and compliance standards that impact consolidation processes.

- Advanced technologies like digital platforms, warehouse automation, and blockchain are transforming Asian freight consolidation by improving visibility, efficiency, and documentation processing.

- When selecting a freight consolidation partner, evaluate their network coverage, technology capabilities, regional expertise, transparent pricing structures, and ability to provide detailed service level agreements.

Conclusion

Freight consolidation in Asia offers a strategic advantage for businesses looking to optimize their supply chains in this dynamic region. By leveraging the right consolidation services you'll reduce costs significantly while improving efficiency and expanding market reach.

The evolving landscape of consolidation hubs both established and emerging presents opportunities to tailor your logistics strategy to specific needs. Whether you choose FCL LCL or air freight consolidation understanding the cost structures and technological capabilities available will maximize your competitive edge.

Selecting the right consolidation partner with strong regional expertise and technological integration capabilities is perhaps your most crucial decision. As Asia's freight consolidation ecosystem continues to advance those who adapt and form strategic partnerships will position themselves for sustained logistics success in this vital global market.