E-commerce in the Middle East is experiencing unprecedented growth, transforming how consumers shop and businesses operate across the region. From Dubai's gleaming skyscrapers to the bustling markets of Cairo, digital retail is reshaping commercial landscapes at remarkable speed. Yet behind this boom lies a complex logistical ecosystem that powers every click, package, and delivery.

Understanding e-commerce logistics in the Middle East requires navigating a unique blend of challenges and opportunities. You'll find a region where ultra-modern fulfillment centers operate alongside traditional delivery methods, where cross-border commerce faces distinct regulatory hurdles, and where last-mile delivery adapts to diverse urban and rural environments. With regional e-commerce expected to exceed $50 billion by 2025, the stakes for optimizing these logistics networks have never been higher.

The Evolution of E-commerce Logistics in the Middle East

E-commerce logistics in the Middle East has transformed dramatically over the past decade, evolving from basic postal services to sophisticated supply chain networks. This evolution reflects the region's digital transformation journey and its unique market characteristics, including diverse demographics, varying infrastructure levels, and distinct cultural preferences.

The growth trajectory began around 2010 when pioneering platforms like Souq.com (later acquired by Amazon) and Noon.com entered the market. These early movers faced significant logistical hurdles, including limited address systems, cash-dominated economies, and fragmented courier networks. Initial logistics solutions were often improvised, with merchants handling their own deliveries or relying on basic third-party services.

By 2015, the ecosystem had matured considerably with specialized logistics providers emerging to address regional challenges. Companies like Fetchr introduced GPS-based delivery systems to overcome address limitations, while aramex expanded its cross-border capabilities to facilitate international e-commerce. This period also saw the introduction of the first automated warehouses and rudimentary inventory management systems tailored to local market conditions.

The COVID-19 pandemic in 2020 accelerated this evolution exponentially. E-commerce adoption rates soared 300% in some markets, forcing a rapid scaling of logistics infrastructure. This period witnessed three major developments: the expansion of fulfillment centers across major cities, integration of AI for route optimization, and introduction of innovative last-mile solutions like locker systems and drone deliveries in UAE and Saudi Arabia.

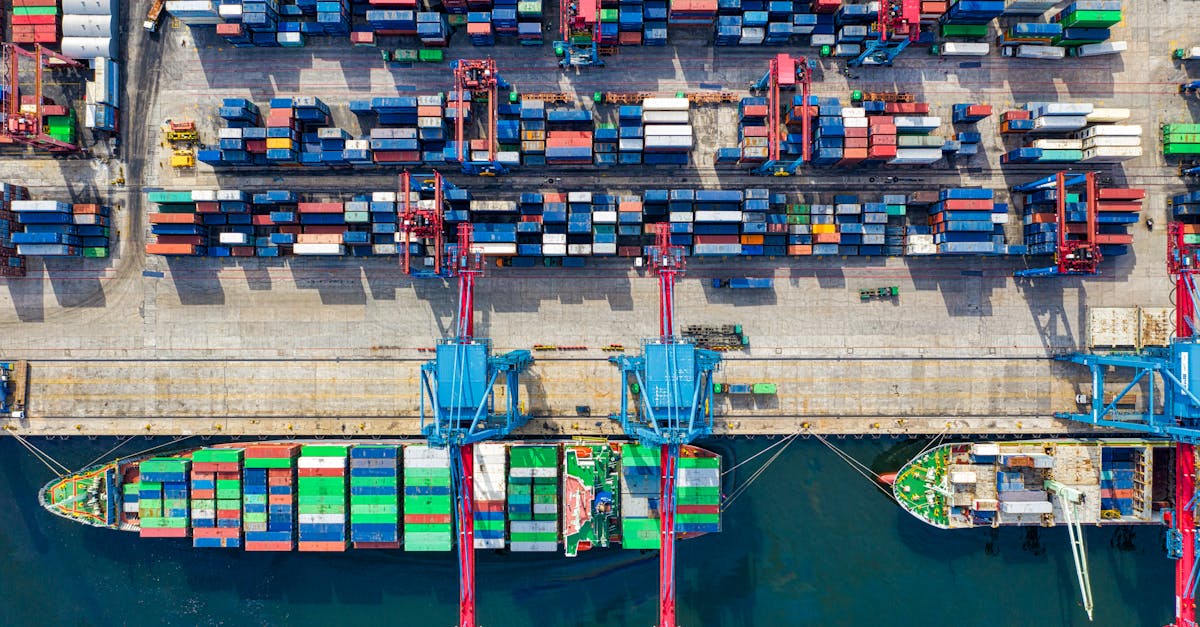

Today's Middle Eastern e-commerce logistics landscape features sophisticated networks that combine global best practices with localized solutions. Major logistics hubs in Dubai, Riyadh, and Cairo now house automated fulfillment centers using robotics for picking and packing. Same-day delivery has become standard in urban centers, while rural areas benefit from micro-distribution points and mobile pickup stations that accommodate the region's geographical challenges.

Current State of E-commerce in Middle Eastern Markets

The Middle East e-commerce landscape has evolved into a vibrant digital marketplace characterized by high growth rates and increasing consumer adoption. Regional e-commerce activity continues to accelerate across diverse markets, with varying levels of maturity in different countries within the region.

Key Growth Drivers and Market Size

The Middle East e-commerce market is currently valued at approximately $29 billion, with projections indicating growth to exceed $50 billion by 2025. Four primary factors drive this remarkable expansion:

- Smartphone penetration reaches over 90% in Gulf Cooperation Council (GCC) countries, enabling mobile-first shopping experiences across Saudi Arabia, UAE, and Qatar.

- Young demographic profile includes a population where 70% are under 30 years old in many Middle Eastern countries, representing digital-native consumers comfortable with online transactions.

- Government initiatives such as Saudi Vision 2030 and UAE's Smart Dubai actively promote digital transformation, creating favorable regulatory environments for e-commerce operations.

- COVID-19 acceleration shifted consumer behavior permanently, with 76% of Middle Eastern shoppers reporting they'll continue online purchasing habits formed during the pandemic.

Market growth varies significantly by country, with the UAE leading at a 38% annual growth rate, followed by Saudi Arabia at 35%, and Egypt emerging rapidly at 33%. These disparities reflect different stages of digital infrastructure development and consumer readiness across the region.

Major E-commerce Players in the Region

The competitive landscape features a mix of regional powerhouses and global entrants establishing strong market positions:

- Amazon/Souq.com dominates with approximately 30% market share following Amazon's $580 million acquisition of Souq in 2017, leveraging Amazon's global infrastructure with localized approaches.

- Noon.com operates as a strong regional competitor backed by $1 billion in funding from Saudi Arabia's Public Investment Fund and private investors, focusing on Arabic-language user experience and local merchandise.

- Namshi captures 12% market share in fashion e-commerce across the GCC, recently acquired by Emaar Malls for $281 million to strengthen its omnichannel strategy.

- Carrefour/MAF has transformed from traditional retail to become the largest grocery e-commerce player with 25% market share in online grocery, particularly strong in UAE and Saudi Arabia.

- Specialized platforms like Mumzworld (baby products), Awok (electronics), and Cobone (deals) have carved out niche positions by addressing specific consumer segments with tailored product selections.

International players including AliExpress and SHEIN have gained traction, particularly among price-sensitive consumers in Egypt, Jordan, and Lebanon. These platforms compete primarily on price point rather than delivery speed, accepting longer delivery windows to maintain competitive pricing structures.

Unique Logistics Challenges in the Middle East

E-commerce logistics in the Middle East faces distinctive challenges shaped by the region's diverse geography, cultural practices, and regulatory environments. These obstacles require innovative solutions tailored specifically to regional conditions to ensure efficient delivery networks and customer satisfaction.

Geographic and Infrastructure Considerations

The Middle East's varied landscape creates significant logistics hurdles for e-commerce operations. Urban centers like Dubai, Riyadh, and Abu Dhabi boast modern infrastructure with GPS-mapped streets and advanced addressing systems, enabling efficient deliveries within 24 hours. In contrast, rural areas and informal settlements often lack standardized addressing systems, with locations commonly referenced by landmarks rather than street names or building numbers.

Temperature extremes compound these challenges, with summer temperatures reaching 50°C (122°F) in countries like Saudi Arabia, UAE, and Kuwait. This heat necessitates specialized transportation methods for temperature-sensitive products such as electronics, pharmaceuticals, and groceries. Logistics providers have responded by implementing climate-controlled vehicles and optimizing delivery schedules for morning or evening hours to protect product integrity.

The region's geographic diversity—from densely populated urban centers to remote desert communities—has prompted the development of hybrid delivery models. These models include:

- Micro-fulfillment centers positioned strategically in suburban areas

- Mobile distribution points serving nomadic or remote populations

- Neighborhood-based pickup locations functioning as community hubs

- Drone delivery pilots in UAE and Saudi Arabia for hard-to-reach locations

Cross-Border Shipping Complexities

Cross-border e-commerce in the Middle East encounters multi-layered complications not seen in more unified markets. Despite geographic proximity, the region's 15+ countries maintain distinct customs regulations, documentation requirements, and restricted product categories. A shipment moving from the UAE to Saudi Arabia typically requires 5-7 different customs documents and passes through multiple verification stages.

Tariff structures vary dramatically across the region, with duty rates ranging from 0% in free zones to 100%+ for specific categories like luxury goods in certain countries. This variability creates pricing unpredictability for both merchants and consumers. Tax differences further complicate matters, with VAT rates varying from 0% in Kuwait to 5% in UAE and Saudi Arabia, to 14% in Egypt.

Regulatory fragmentation creates additional friction points:

- Product compliance standards differ between GCC and non-GCC countries

- Prohibited and restricted items lists vary by country (electronics, supplements, books)

- Payment processing regulations require country-specific solutions

- Data localization laws in Saudi Arabia and UAE mandate in-country servers

Logistics providers have developed specialized cross-border solutions including:

- Consolidated customs clearance services with pre-approval workflows

- Regional distribution hubs in strategic locations like Jebel Ali Free Zone

- Real-time shipment tracking with customs status visibility

- Dynamic duties and taxes calculators integrated into checkout experiences

These cross-border complexities add an average of 2-3 days to delivery times and increase logistics costs by 15-30% compared to domestic shipments, creating significant challenges for regional e-commerce growth.

Last-Mile Delivery Solutions in Middle Eastern Cities

Last-mile delivery represents the most critical and challenging component of e-commerce logistics in the Middle East. This final step of transporting products from distribution centers to customers' doorsteps accounts for up to 41% of total supply chain costs in the region and directly impacts customer satisfaction and retention rates.

Urban vs. Rural Delivery Dynamics

Urban delivery in Middle Eastern metropolises operates at vastly different efficiency levels compared to rural distribution. Cities like Dubai, Abu Dhabi, and Riyadh benefit from advanced infrastructure with GPS-mapped streets, enabling 95% delivery success rates on first attempts. In contrast, rural areas face delivery success rates as low as 60% due to informal addressing systems and scattered populations.

Major urban centers support sophisticated delivery options, including:

- Same-day delivery services in Dubai and Abu Dhabi, reaching 85% of city residents

- Time-slot deliveries with 1-2 hour windows in Saudi urban centers

- Pickup points strategically located throughout cities, with over 2,000 lockers installed across GCC metropolitan areas

- Concierge deliveries in premium high-rise buildings, particularly in Dubai Marina and Downtown areas

Rural delivery challenges encompass:

- Lack of standardized addresses in villages and remote areas

- Extended delivery distances averaging 3-4 times longer than urban routes

- Limited transportation infrastructure with unpaved roads in many areas

- Irregular delivery schedules dependent on population density and accessibility

Innovative Approaches to Address Delivery Challenges

E-commerce companies and logistics providers have implemented creative solutions to overcome Middle Eastern last-mile challenges. WhatsApp integration has emerged as a crucial tool, with 78% of regional logistics companies now using the platform for real-time delivery coordination and location sharing.

Technological innovations transforming last-mile delivery include:

- AI-powered route optimization reducing delivery times by up to 25% in congested urban centers

- Crowdsourced delivery networks like Fetchr and FODEL connecting over 4,000 local couriers across the region

- Address-free delivery systems using mobile location technologies instead of physical addresses

- Autonomous delivery pilots in Dubai and Abu Dhabi technology parks, with drones covering limited residential zones

Cultural adaptations have proven equally important:

- Pre-scheduled delivery appointments respecting privacy concerns in conservative areas

- Same-gender couriers available upon request in Saudi Arabia and Qatar

- Unmarked packaging options for sensitive product categories

- Extended evening delivery windows accommodating local lifestyle patterns and religious practices

The motorcycle delivery fleet has expanded dramatically, growing by 320% since 2018 across major Middle Eastern cities, proving particularly effective in navigating dense urban traffic. Meanwhile, partnerships with local mini-markets and neighborhood shops have created over 15,000 alternative pickup points, providing flexible delivery options beyond traditional home delivery.

Warehousing and Fulfillment Centers Across the Region

The Middle East's e-commerce ecosystem relies on strategically positioned warehousing and fulfillment infrastructure to meet growing consumer demands. These facilities form the backbone of regional logistics operations, enabling efficient storage, processing, and distribution of products throughout diverse markets.

Strategic Hub Locations

The Middle East's warehousing network centers on key strategic locations that maximize regional coverage and minimize delivery timeframes. Dubai's Jebel Ali Free Zone houses over 100 e-commerce fulfillment facilities within its 57 square kilometers, offering tax advantages and seamless port connectivity. Saudi Arabia has developed major logistics clusters in Riyadh and Jeddah, with the King Abdullah Economic City emerging as a distribution powerhouse handling 30% of the kingdom's e-commerce volume. Egypt's 6th of October City serves as the primary fulfillment hub for North Africa, while Bahrain's Logistics Zone provides cost-effective alternatives with 40% lower operating expenses compared to neighboring markets. These strategic locations connect through transportation corridors like the Saudi Land Bridge and the UAE's Etihad Rail, creating an integrated regional network that reduces cross-border delivery times by up to 60%.

Automation and Technology Integration

Middle Eastern fulfillment centers have embraced automation to enhance operational efficiency and meet escalating e-commerce demands. Leading facilities now feature robotic picking systems that increase order processing speeds by 300% and reduce error rates to below 0.5%. Warehouse management systems with AI-driven inventory optimization maintain 99.8% accuracy while reducing storage costs by 25%. Advanced technologies include:

- Conveyor systems with RFID tracking for real-time product movement monitoring

- Automated storage and retrieval systems (AS/RS) that maximize vertical space utilization

- Vision-based sorting mechanisms that process 20,000+ items hourly

- IoT-enabled climate control systems for temperature-sensitive products

Noon.com's Dubai fulfillment center exemplifies this technological integration, utilizing 250+ autonomous mobile robots to manage its 45,000-square-meter facility. Similarly, Amazon's Riyadh distribution center employs computer vision technology to verify package contents with 99.9% accuracy. These technological investments have reduced order fulfillment times from days to hours, with 85% of urban orders now processed within 24 hours of placement.

The Rise of 3PL and 4PL Services in Middle Eastern E-commerce

Third-party logistics (3PL) and fourth-party logistics (4PL) providers have transformed e-commerce operations across the Middle East, offering specialized expertise and infrastructure that empower businesses of all sizes. These service providers have become essential partners for e-commerce companies navigating the region's complex logistics landscape, from established marketplaces to emerging direct-to-consumer brands.

3PL providers in the Middle East manage core logistics functions including warehousing, inventory management, order fulfillment, and transportation. This comprehensive approach allows e-commerce businesses to focus on product development, marketing, and customer acquisition while outsourcing the operational complexities of order delivery. Companies like Aramex, Fetchr, and NAQEL have expanded their 3PL offerings significantly, developing specialized e-commerce solutions tailored to regional market conditions.

4PL providers take this support a step further, orchestrating entire supply chain ecosystems and integrating multiple 3PLs, technology platforms, and fulfillment networks. These strategic partners design comprehensive logistics strategies, manage vendor relationships, and optimize end-to-end operations. DB Schenker and DHL Supply Chain have established robust 4PL operations in the region, serving as "control towers" that coordinate complex multi-country logistics operations.

The growth in these logistics services directly correlates with the Middle East's e-commerce expansion, creating a symbiotic relationship that fuels continued digital retail development. As online shopping volumes increase, more sophisticated logistics demands emerge, driving further innovation in the 3PL and 4PL sectors.

| Service Type | Market Size (2022) | Projected Growth (by 2026) | Key Regional Players |

|---|---|---|---|

| 3PL Services | $8.2 billion | 6.8% CAGR | Aramex, Fetchr, NAQEL |

| 4PL Services | $3.5 billion | 9.3% CAGR | DHL Supply Chain, DB Schenker, Agility Logistics |

E-commerce businesses across the Middle East increasingly recognize the competitive advantages gained through strategic logistics partnerships, incorporating these service providers as integral components of their growth strategies rather than mere vendors.

Impact of COVID-19 on Regional E-commerce Logistics

The COVID-19 pandemic transformed Middle Eastern e-commerce logistics virtually overnight, catalyzing changes that might otherwise have taken years to materialize. When lockdowns were implemented across the region in March 2020, e-commerce order volumes surged by 300-500% in key markets like the UAE and Saudi Arabia, pushing existing logistics networks to their limits.

Immediate Supply Chain Disruptions

Supply chain disruptions appeared immediately following pandemic restrictions. air freight capacity decreased by 70% in Q2 2020, while container shipping costs from Asia to Middle Eastern ports increased by 300%. Major logistics hubs experienced significant bottlenecks, with customs clearance times extending from 2-3 days to 7-10 days at ports like Jebel Ali and King Abdullah Port. E-commerce operators responded by increasing local sourcing by 45% and implementing safety protocols that initially reduced warehouse productivity by 25-30%.

Accelerated Digital Transformation

The pandemic accelerated digital transformation across the logistics sector. Contactless delivery adoption increased by 85% in urban centers, while digital documentation replaced paper-based processes for 65% of regional shipments. Companies like Aramex and Fetchr implemented:

- Automated sorting systems increasing throughput by 150%

- AI-powered route optimization reducing delivery times by 30%

- Digital payment integration expanding from 35% to 78% of transactions

- Warehouse management systems with real-time inventory visibility

- Enhanced tracking capabilities allowing customers to monitor deliveries with 99.8% accuracy

Emergence of New Delivery Models

COVID-19 necessitated innovative delivery solutions across the Middle East. Traditional models evolved rapidly to include:

- Scheduled delivery slots replacing open-ended delivery promises

- Curbside pickup increasing by 230% in shopping malls and retail outlets

- Dark stores converted from retail spaces to micro-fulfillment centers

- Hyperlocal delivery networks utilizing local businesses as fulfillment points

- Drone delivery trials in the UAE decreasing delivery times by 55% for urgent packages

Long-Term Structural Changes

The pandemic's impact resulted in permanent structural changes to regional logistics. Warehouse space demand increased by 75% across GCC countries, with vacancy rates dropping below 5% in prime locations. Investment in automation technologies grew by 200%, with companies like Noon.com and Amazon implementing systems that reduced human touchpoints by 60%. The logistics workforce expanded by 25%, with specialized e-commerce fulfillment roles growing by 40%.

Market Consolidation and Investment

The pandemic triggered significant market consolidation and new investments in e-commerce logistics. Capital investment in logistics technology reached $1.2 billion in 2020-2021, a 350% increase over pre-pandemic levels. Major developments included:

- Alibaba's $100 million expansion of its regional logistics network

- Amazon's acquisition of three regional fulfillment providers

- Saudi Arabia's Public Investment Fund investing $550 million in last-mile solutions

- UAE-based logistics startups raising $320 million in venture funding

- Cross-border logistics partnerships increasing by 65% among regional operators

Country-Specific Impacts

COVID-19 impacts varied significantly across Middle Eastern markets:

| Country | E-commerce Growth (2020) | Logistics Infrastructure Changes | Notable Developments |

|---|---|---|---|

| UAE | 53% | 300% increase in automated fulfillment capacity | Introduced 30-minute delivery in Dubai |

| Saudi Arabia | 49% | 85% expansion of warehouse facilities | Launched rural delivery initiative reaching 95% of population |

| Egypt | 38% | 45% growth in delivery fleet size | Developed neighborhood mini-hubs reducing last-mile costs by 30% |

| Kuwait | 43% | 60% increase in locker system deployment | Implemented nationwide address standardization |

| Bahrain | 45% | 70% growth in cross-border shipping capacity | Introduced blockchain-based customs clearance reducing processing by 80% |

Consumer Behavior Shifts

The pandemic permanently altered consumer expectations about delivery. Pre-COVID, only 25% of Middle Eastern consumers regularly shopped online; that figure now exceeds 65%. Express delivery demand (same-day or next-day) increased from 10% to 45% of all orders. Cash-on-delivery transactions declined from 62% to 31% of orders, while contactless payments became the preferred option for 58% of consumers across the region.

Future Trends and Opportunities for Logistics Providers

The Middle Eastern e-commerce logistics sector stands at the cusp of significant transformation, driven by technological innovation and evolving market demands. Logistics providers who adapt to these emerging trends position themselves for substantial growth in a market projected to exceed $50 billion by 2025.

Emerging Technologies Transforming the Landscape

Autonomous delivery solutions represent the fastest-growing technology segment in Middle Eastern logistics, with drone deliveries already operational in parts of Dubai and Abu Dhabi. Companies like Aramex have launched pilot programs using autonomous ground vehicles for last-mile delivery in urban centers, reducing delivery times by 35%. Blockchain technology is gaining traction for enhancing supply chain transparency, with platforms like TradeLens adopted by DP World to streamline documentation processes across 12 regional ports, cutting customs clearance times by 40%.

Advanced analytics and AI applications are revolutionizing demand forecasting and inventory management. E-commerce giants in the region have implemented predictive analytics systems that reduce stockouts by 28% while decreasing excess inventory costs by 32%. These systems analyze historical sales data, seasonal trends, and real-time consumer behavior to optimize stock levels across multiple fulfillment centers.

The Internet of Things (IoT) has transformed warehouse operations and shipment monitoring. Smart warehouses equipped with IoT sensors in Dubai and Riyadh have reported 45% higher picking efficiency and 60% fewer errors compared to traditional facilities. For temperature-sensitive products, IoT-enabled containers provide real-time monitoring across the supply chain, maintaining product integrity in the region's extreme climate conditions.

5G technology deployment across GCC countries is enabling edge computing applications for logistics operations. This infrastructure supports real-time route optimization, reducing delivery vehicle fuel consumption by 15-20% and supporting emerging technologies like augmented reality picking systems that improve warehouse operator accuracy by 37%.

Sustainability Initiatives in Middle Eastern Logistics

Carbon footprint reduction has become a strategic priority for leading logistics providers in the Middle East. Companies like DHL and Fetchr have introduced electric delivery fleets in major urban centers, with the UAE boasting over 500 electric delivery vehicles operating in Dubai alone. Saudi Arabia has committed $5 billion to develop green logistics infrastructure by 2025, including charging networks for electric delivery vehicles in Riyadh, Jeddah, and Dammam.

Packaging optimization initiatives focus on reducing waste while ensuring product protection. Regional e-commerce platforms have introduced reusable packaging options, with Noon.com reporting a 22% reduction in packaging materials through redesigned boxes and air-fill alternatives. Biodegradable packaging materials sourced from date palm waste and other local agricultural byproducts are gaining popularity, with production capacity increasing 300% since 2020.

Circular economy models are emerging in reverse logistics operations. Several logistics providers have established specialized recycling and refurbishment centers for returned electronics and apparel items. These facilities process returns for resale, reducing waste by 65% compared to traditional disposal methods while creating secondary market opportunities. Aramex's "Green Returns" program in the UAE has processed over 200,000 items for refurbishment rather than disposal.

Renewable energy adoption in logistics facilities continues to expand rapidly. Distribution centers in Dubai, Abu Dhabi, and Riyadh have installed solar panels covering over 1.5 million square feet of rooftop space, generating approximately 40% of their energy requirements. Qatar's newly constructed logistics parks incorporate mandatory renewable energy components, setting new regional standards for sustainable facility design.

Key Takeaways

- The Middle East e-commerce market is experiencing rapid growth, currently valued at $29 billion and projected to exceed $50 billion by 2025, driven by high smartphone penetration, young demographics, and government digital initiatives.

- Last-mile delivery presents unique challenges in the region, with urban areas achieving 95% first-attempt delivery success versus 60% in rural areas where addressing systems are informal, leading to innovations like WhatsApp integration and location-based delivery.

- Cross-border e-commerce faces complex regulatory hurdles including varying customs documentation, tariff structures (0-100%), and different VAT rates (0-14%), adding 2-3 days to delivery times and increasing logistics costs by 15-30%.

- COVID-19 accelerated digital transformation in logistics, with contactless delivery adoption increasing by 85%, warehouse automation growing by 200%, and permanent shifts in consumer behavior as online shopping increased from 25% to 65% of consumers.

- Strategic fulfillment hubs in locations like Dubai's Jebel Ali Free Zone, Saudi Arabia's economic cities, and Egypt's 6th of October City support regional distribution, while advanced automation technology has reduced order processing times from days to hours.

- Future opportunities include autonomous delivery solutions, blockchain for supply chain transparency, IoT-enabled warehouses (improving efficiency by 45%), and sustainability initiatives like electric delivery fleets and packaging optimization.

Conclusion

The Middle East e-commerce landscape stands at a pivotal crossroads with projected growth to $50 billion by 2025. You're witnessing a logistics revolution that's uniquely adapted to regional challenges through innovative solutions like climate-controlled transportation specialized delivery networks and blockchain integration.

As technology continues advancing logistics providers are embracing autonomous delivery AI-powered systems and sustainable practices. These developments aren't just improving operational efficiency but fundamentally reshaping the customer experience across diverse markets from tech-savvy urban centers to developing rural areas.

The future of e-commerce logistics in the Middle East will be defined by those who can best navigate this complex ecosystem while balancing technological innovation with cultural sensitivity and regulatory compliance. Companies that master these elements will capture significant opportunities in one of the world's most dynamic and promising e-commerce markets.