Key Takeaways

- Understanding U.S. import duties requires knowledge of customs duties (tariffs), Merchandise Processing Fees (MPF), and Harbor Maintenance Fees (HMF), which vary based on product type, value, and country of origin.

- The Harmonized Tariff Schedule (HTS) classification system assigns a specific 10-digit code to every product, directly determining applicable duty rates and requiring accurate product categorization.

- Special exemptions like the $800 de minimis threshold (Section 321) and preferential rates through Free Trade Agreements can significantly reduce or eliminate import duties when properly utilized.

- Common costly mistakes include product misclassification, valuation errors, and documentation problems, which can result in penalties, shipment delays, and unexpected expenses.

- Legal strategies to minimize import duties include utilizing Foreign Trade Zones (FTZs), applying the First Sale Rule for multi-tiered transactions, and employing tariff engineering to achieve favorable classifications.

- Recent changes in U.S. import duties include Section 301 tariffs on Chinese goods, Section 232 tariffs on steel and aluminum, and COVID-19 related adjustments affecting duty collection and enforcement.

Navigating the complex world of duties and taxes when importing to the USA can feel overwhelming. Whether you're a business owner expanding your supply chain or an individual purchasing items from abroad, understanding your financial obligations is crucial to avoid unexpected costs and delays.

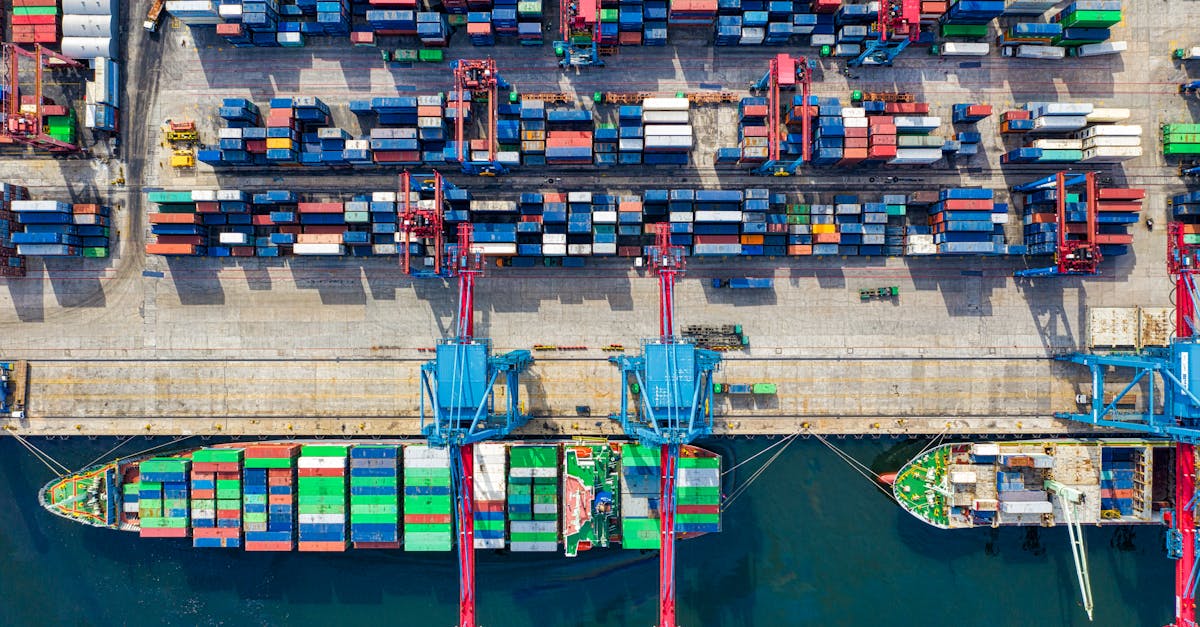

When you import goods into the United States, you'll encounter various fees including customs duties, merchandise processing fees, harbor maintenance fees, and potentially excise taxes. These charges vary significantly based on factors like product type, country of origin, and declared value. The U.S. Customs and Border Protection (CBP) enforces these regulations, and staying compliant isn't optional—it's the law.

Understanding U.S. Import Duties and Taxes

The U.S. import duty and tax system operates on a complex framework of tariffs, fees, and regulations. Understanding this system helps importers navigate the financial obligations associated with bringing goods into the United States and avoid costly penalties or delays.

How the U.S. Customs System Works

The U.S. customs system functions through a structured process of declaration, examination, and clearance. When goods arrive at U.S. ports of entry, importers must file an entry with U.S. Customs and Border Protection (CBP), including detailed information about the shipment such as product classification, valuation, and country of origin. CBP uses the Harmonized Tariff Schedule (HTS) to classify imported goods, assigning each product a specific code that determines its duty rate. The valuation method typically relies on the "transaction value" - the price actually paid for the goods, though alternative methods exist for special circumstances. Customs officers may inspect shipments to verify compliance with regulatory requirements, trade agreements, and accurate duty assessment. Once duties and taxes are paid and all requirements are met, CBP releases the goods into domestic commerce.

Key Federal Agencies Involved in Imports

Multiple federal agencies oversee different aspects of the import process, creating a comprehensive regulatory framework. CBP serves as the primary enforcement agency, collecting duties and ensuring compliance with trade laws at all ports of entry. The International Trade Administration (ITA) promotes fair trade practices and helps U.S. businesses navigate international markets. The Food and Drug Administration (FDA) regulates imported food, drugs, cosmetics, and medical devices to ensure they meet U.S. safety standards. The Department of Agriculture (USDA) oversees agricultural products, enforcing regulations related to plant and animal health. The Consumer Product Safety Commission (CPSC) monitors consumer products for potential hazards, while the Environmental Protection Agency (EPA) regulates imports that might affect environmental quality. The Bureau of Industry and Security (BIS) controls exports and imports of sensitive technologies and enforces trade sanctions. Importers often need approvals from multiple agencies depending on the nature of their products, making interagency coordination a critical aspect of successful importing.

Types of Import Duties in the United States

The U.S. import duty system consists of several different charges that apply to incoming goods. Each type of duty serves a specific purpose within the customs framework and affects the total cost of importing goods into the country.

Customs Duty (Tariffs)

Customs duties, commonly known as tariffs, are taxes imposed on imported goods based on their classification in the Harmonized Tariff Schedule (HTS). These duties vary significantly depending on the product type, country of origin, and applicable trade agreements. The U.S. maintains different duty rates, including ad valorem (percentage of value), specific (fixed amount per unit), compound (combination of both), and preferential rates for countries with free trade agreements such as USMCA, formerly NAFTA. For example, electronics might face a 2-5% duty rate while certain textiles could incur duties of 15-32% of their declared value.

Merchandise Processing Fee (MPF)

The Merchandise Processing Fee covers the administrative costs of processing imports through U.S. Customs. This fee applies to formal entries (typically shipments valued over $2,500) and informal entries. For formal entries, the MPF ranges from $27.23 minimum to $528.33 maximum per shipment and is calculated at 0.3464% of the declared value. Informal entries (goods valued under $2,500) are subject to a flat fee of $2.14-$9.83 depending on whether the entry is automated, manual, or requires customs officer assistance. Certain imports under specific trade agreements like USMCA are exempt from MPF charges.

Harbor Maintenance Fee (HMF)

The Harbor Maintenance Fee funds the maintenance of U.S. ports and harbors. This fee applies only to water-transported imports at a rate of 0.125% of the declared value with no minimum or maximum limits. The HMF doesn't apply to goods imported by air, land transportation, or mail. This fee is collected directly from importers and managed by Customs and Border Protection but allocated to the Harbor Maintenance Trust Fund, which is administered by the U.S. Army Corps of Engineers for dredging, channel maintenance, and related port infrastructure projects throughout the United States.

Calculating Import Taxes for U.S. Shipments

Calculating import taxes for shipments to the United States requires understanding several interconnected factors. The final duties and taxes you'll pay depend on three primary elements: how your goods are valued, their classification code, and their country of origin.

Customs Valuation Methods

Customs valuation determines the base amount on which duties and taxes are calculated. The U.S. Customs and Border Protection (CBP) uses several methods to determine the customs value of imported goods, applying them in a hierarchical order:

- Transaction Value Method - The price actually paid or payable for merchandise when sold for export to the U.S., plus specific additions such as packing costs, commissions, royalties, and assists.

- Transaction Value of Identical Merchandise - The value of identical goods imported at or about the same time.

- Transaction Value of Similar Merchandise - The value of similar (though not identical) goods imported at or about the same time.

- Deductive Value Method - Based on the resale price in the U.S. minus certain deductions.

- Computed Value Method - Calculated using production costs, profit, and general expenses.

- Fallback Method - Used when no other method applies, based on reasonable adjustments to the above methods.

CBP typically prefers the transaction value method, which accounts for approximately 90% of all import valuations. When declaring values, you must include all costs paid to the seller, including commissions and royalties.

Harmonized Tariff Schedule (HTS) Classification

The HTS classification system assigns a specific 10-digit code to every product entering the U.S., directly determining applicable duty rates. Proper classification involves:

- First 6 digits: Internationally standardized through the Harmonized System (HS)

- Digits 7-8: U.S. tariff schedule subdivisions

- Digits 9-10: Statistical reporting numbers

Classification follows specific rules:

- Find the appropriate section and chapter based on the material or function of your goods

- Identify the correct heading (4-digit level) and subheading (6-digit level)

- Apply the General Rules of Interpretation (GRIs) to resolve any classification conflicts

- Consider any applicable Section or Chapter Notes that might affect classification

For example, cotton t-shirts are classified under HTS code 6109.10.0027, which carries a different duty rate than synthetic t-shirts (6109.90.1065). An incorrect classification can result in underpayment of duties, penalties, or shipment delays.

Country of Origin Considerations

The country of origin significantly impacts the duty rates applied to your imports through preferential trade agreements. Key considerations include:

- Most-Favored-Nation (MFN) Status: Countries with MFN status receive the standard duty rates found in Column 1 of the HTS.

- Free Trade Agreements (FTAs): Imports from countries with U.S. FTAs typically qualify for reduced or zero duty rates. Major agreements include:

- USMCA (with Canada and Mexico)

- U.S.-Korea Free Trade Agreement

- Dominican Republic-Central America FTA

- Generalized System of Preferences (GSP): Provides duty-free treatment for products from designated developing countries.

- Section 301 Tariffs: Additional duties on specific products from certain countries, notably China.

To claim preferential treatment, you must provide proper documentation, such as certificates of origin. Products must meet specific rules of origin, which often require substantial transformation or regional value content requirements. For instance, under USMCA, automobiles must have 75% of components manufactured in North America to qualify for preferential treatment.

Special Import Tax Programs and Exemptions

The U.S. offers several programs and exemptions that can significantly reduce or eliminate duties and taxes on imported goods. These special provisions help businesses and individuals save money when bringing products into the country under specific conditions.

De Minimis Threshold and Section 321

The de minimis threshold under Section 321 allows shipments valued at $800 or less to enter the U.S. duty-free and tax-free. This provision applies to shipments imported by one person on one day, creating substantial savings for e-commerce retailers and individuals making small international purchases. To qualify for Section 321 exemption, your shipment must:

- Have a total value of $800 or less

- Be imported for personal use or as a commercial sample

- Not contain goods subject to other federal agency requirements

- Not include merchandise subject to quotas or antidumping duties

Many e-commerce platforms strategically split larger orders into multiple shipments to take advantage of this threshold, though CBP monitors for intentional order splitting to prevent abuse of this exemption.

Free Trade Agreements

The U.S. maintains free trade agreements (FTAs) with 20 countries, reducing or eliminating duties on qualifying goods. Major agreements include:

- United States-Mexico-Canada Agreement (USMCA): Replaced NAFTA in 2020, eliminating tariffs on qualifying goods traded between the three North American countries

- Dominican Republic-Central America FTA (CAFTA-DR): Covers Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and the Dominican Republic

- U.S.-Korea Free Trade Agreement (KORUS): Eliminates 95% of tariffs between the two nations

To claim FTA benefits, your imported goods must meet specific rules of origin and you must provide a certificate of origin or other documentation proving the products qualify. Each agreement has unique requirements for qualification, so checking the specific rules for your product category is essential before claiming preferential treatment.

Duty Drawback Options

Duty drawback programs allow importers to receive refunds on 99% of duties, taxes, and fees paid on imported merchandise that is later exported or destroyed under CBP supervision. Three primary types of drawback include:

- Direct Identification Drawback: When the exact imported merchandise is exported or destroyed

- Substitution Drawback: When similar merchandise is exported instead of the actual imported goods

- Manufacturing Drawback: When imported materials are used in manufacturing products that are later exported

To claim drawback, you must file a complete drawback claim within 5 years of the date of importation and maintain thorough documentation of both the import and export transactions. While the process requires detailed record-keeping, it offers substantial financial benefits for businesses that both import and export goods, particularly manufacturers using imported components in exported products.

How to Pay Duties and Taxes When Importing to USA

Paying duties and taxes correctly is a critical part of the U.S. import process. The payment procedure involves specific filing requirements, various payment options, and often collaboration with customs professionals to ensure compliance and efficient processing.

Entry Filing Process

The entry filing process begins when your goods arrive at a U.S. port of entry. You must file entry documents with U.S. Customs and Border Protection (CBP) within 15 calendar days of your shipment's arrival. These documents include:

- Entry Manifest (CBP Form 7533) or Application and Special Permit for Immediate Delivery (CBP Form 3461)

- Commercial invoice or pro forma invoice

- Packing lists

- Bill of lading or air waybill

- Certificate of origin for goods claiming preferential treatment

- Any required permits or licenses for restricted items

CBP reviews these documents to determine the dutiable status of your merchandise and calculates the final amount owed. For formal entries (shipments valued over $2,500), you'll receive a CBP Form 7501 (Entry Summary) that details all duties, taxes, and fees assessed on your import.

Payment Methods and Timing

CBP accepts multiple payment methods for import duties and taxes:

| Payment Method | Processing Time | Advantages |

|---|---|---|

| ACH (Automated Clearing House) | Same-day processing | Preferred method, faster release of goods |

| Credit Card (for entries under $25,000) | Immediate | Convenient for smaller shipments |

| Check or Money Order | 1-3 business days | Traditional option |

| Single Transaction Bond | Varies | Covers single import transaction |

| Continuous Bond | Yearly | Cost-effective for frequent importers |

The timing of payments follows two main schedules:

- Immediate Payment: Required for informal entries (under $2,500) and certain restricted goods

- Periodic Monthly Statement: Available for approved importers, allowing payment of all duties from the previous month by the 15th working day of the following month

To use the Periodic Monthly Statement option, you must enroll in the Automated Broker Interface (ABI) program and establish an ACH account with CBP.

Working with Customs Brokers

Customs brokers streamline the duty payment process by managing complex documentation and compliance requirements. Licensed by CBP, these professionals:

- Prepare and file entry documents on your behalf

- Calculate accurate duty amounts based on proper classification

- Advise on potential duty exemptions or reductions

- Facilitate electronic payments through their established channels

- Represent you in communications with CBP

- Help resolve any discrepancies or issues that arise during the customs clearance process

When selecting a customs broker, consider their experience with your specific product category, technological capabilities, and fee structure. Most brokers charge a base fee plus additional charges for complex entries or special handling.

Many importers establish a power of attorney with their broker, authorizing them to act as their agent in customs matters. This arrangement allows brokers to make payments on your behalf, often through their own bond that covers your duties and taxes temporarily until you reimburse them.

Common Mistakes When Paying Import Duties

Importers frequently encounter costly errors when handling U.S. import duties and taxes. These mistakes can lead to penalties, shipment delays, and unexpected expenses that impact your bottom line. Understanding these common pitfalls helps you establish more efficient import processes and maintain compliance with customs regulations.

Misclassification Issues

Harmonized Tariff Schedule (HTS) misclassification ranks as the most frequent error importers make. Using incorrect HTS codes results in paying incorrect duty rates, potentially leading to underpayment penalties or overpayment of duties. For example, classifying textile products under the wrong category can result in duty differences of 5-20%. CBP regularly conducts post-entry audits to identify classification errors, and if they determine you've consistently misclassified items, you might face penalties up to the domestic value of the merchandise for fraud or gross negligence cases.

Valuation Errors

Customs valuation errors occur when importers incorrectly declare the value of their goods. Common valuation mistakes include omitting assist values (tools, dies, molds provided to manufacturers), royalties, license fees, or subsequent proceeds that should be added to the transaction value. Another frequent error is deducting international freight costs from CFR (Cost and Freight) or CIF (Cost, Insurance, and Freight) prices without proper documentation. CBP requires accurate declared values that include all payments made as conditions of sale. Undervaluing goods by just 10% can trigger significant penalties and retroactive duty assessments going back five years.

Documentation Problems

Incomplete or inaccurate documentation creates serious compliance issues during the import process. Missing certificates of origin prevent you from claiming preferential duty rates under free trade agreements like USMCA or GSP. Inadequate commercial invoices lacking required elements such as detailed product descriptions, quantities, and values delay customs clearance by 3-5 business days on average. Improper record-keeping also causes problems during CBP audits, as importers must maintain all import records for five years from the date of entry. Electronic documentation errors in the Automated Commercial Environment (ACE) system, particularly discrepancies between commercial documents and electronic filings, trigger automatic holds that extend clearance times by up to two weeks while CBP reviews the discrepancies.

Strategies to Minimize Import Duties Legally

Smart importers use legal strategies to reduce duty payments while maintaining full compliance with U.S. customs regulations. These approaches leverage specific provisions within import laws to optimize duty liability without crossing into non-compliance territory.

Foreign Trade Zones (FTZs)

Foreign Trade Zones provide significant duty advantages for importers managing complex supply chains. FTZs are secured areas under CBP supervision considered outside U.S. customs territory for duty purposes. When you store merchandise in an FTZ, you don't pay duties until products enter U.S. commerce, allowing for improved cash flow management. Additionally, if you re-export goods from an FTZ to international markets, you avoid paying U.S. duties entirely. Manufacturing operations within FTZs can also benefit from "inverted tariff relief," where you pay the lower duty rate on the finished product rather than the higher rates on component parts.

First Sale Rule

The First Sale Rule offers a legal method to reduce the dutiable value of imported merchandise. This provision allows you to base customs valuation on the first sale in a multi-tiered transaction chain, typically the manufacturer's price to the middleman rather than the higher price paid by the importer. To qualify for First Sale treatment, you must provide documentation proving the transaction was "bona fide," conducted at arm's length, and destined for export to the U.S. Required documentation includes invoices showing both transactions, proof the goods were clearly destined for U.S. export at the time of the first sale, and evidence the manufacturer and middleman operate as separate entities. When properly implemented, First Sale can reduce duty payments by 10-20% on qualifying transactions.

Tariff Engineering

Tariff engineering involves legally designing, configuring, or modifying products to achieve more favorable tariff classifications. This practice leverages the fact that minor changes to a product's characteristics can shift its HTS classification to a category with lower duty rates. Examples include importing unassembled furniture components instead of finished pieces, adding specific materials to textiles to change their classification, or modifying chemical compositions to qualify for preferential treatment. For tariff engineering to be legitimate, the modifications must be substantive and permanent, not temporary alterations designed to evade customs duties. CBP recognizes tariff engineering as a legal practice when the resulting product maintains its commercial identity and functionality while meeting the requirements of the claimed classification.

Recent Changes in U.S. Import Duties and Taxes

The U.S. import duty and tax landscape has undergone significant transformations in recent years. These changes stem from shifts in global trade policies, political administrations, and responses to unprecedented global events that have reshaped how duties and taxes are applied to imported goods.

Impact of Trade Wars and New Tariffs

Trade tensions between the United States and major trading partners have dramatically altered the import duty structure since 2018. Section 301 tariffs on Chinese goods imposed additional duties of 7.5% to 25% on approximately $370 billion worth of imports across thousands of product categories. These tariffs affected industries ranging from electronics and machinery to textiles and furniture, forcing importers to reconsider supply chains and pricing strategies.

The U.S. also implemented Section 232 tariffs on steel (25%) and aluminum (10%) imports from various countries, citing national security concerns. While some countries received exemptions through negotiations, these metal tariffs increased costs for manufacturers using these materials as inputs. The Miscellaneous Tariff Bill (MTB) of 2018, which temporarily reduced or suspended duties on certain imported raw materials not available domestically, expired in December 2020 and was later renewed with modifications in late 2022.

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in July 2020, introduced revised rules of origin for automotive products, requiring 75% North American content for duty-free treatment compared to NAFTA's 62.5% threshold. The agreement also updated digital trade provisions and intellectual property protections that affect cross-border e-commerce operations.

COVID-19 Related Adjustments

The pandemic prompted temporary duty relief measures for critical medical supplies and equipment. CBP implemented provisions under HTS subheading 9817.00.98, allowing duty-free entry for certain personal protective equipment (PPE) and medical devices. This exemption covered items like face masks, ventilators, and testing supplies when imported for emergency response to COVID-19.

Payment flexibility was extended to importers facing financial hardship during the pandemic. CBP temporarily allowed 90-day duty deferral options for certain imports (excluding Section 301 tariffs, antidumping duties, and countervailing duties) between March and April 2020. This provided cash flow relief for businesses struggling with supply chain disruptions and reduced consumer demand.

Remote working arrangements necessitated the digitization of customs processes, with CBP expanding electronic document submission capabilities and reducing requirements for original paperwork. The pandemic accelerated implementation of the 21st Century Customs Framework initiatives, including enhanced automated systems for duty collection and risk assessment. Additionally, changes to de minimis thresholds and enforcement became increasingly important as e-commerce shipments surged by over 40% during lockdown periods, creating new challenges for customs authorities monitoring proper duty collection on these small-value shipments.

Conclusion

Navigating the complex world of U.S. import duties and taxes requires careful planning and thorough knowledge. By understanding the various fees responsibilities and payment procedures you'll avoid costly surprises at the border.

Remember that classification valuation and country of origin are the three pillars that determine your duty liability. Take advantage of duty minimization strategies like FTZs and the First Sale Rule while staying compliant with CBP regulations.

The import landscape continues to evolve with trade policies and global events making it essential to stay informed. Working with qualified customs brokers can help you navigate these complexities effectively.

With proper preparation and attention to detail you can streamline your importing process while maximizing duty savings opportunities for your business.

Frequently Asked Questions

What are the main fees associated with importing goods to the US?

The main fees include customs duties (tariffs), merchandise processing fees, harbor maintenance fees, and possibly excise taxes. These vary based on product type, country of origin, and declared value. Customs duties are the primary fee, calculated as a percentage of the item's value, while merchandise processing and harbor maintenance fees cover administrative costs and port maintenance respectively.

How does the US customs process work when importing goods?

The process begins when goods arrive at a US port. Importers must file an entry with US Customs and Border Protection (CBP) with detailed shipment information within 15 days. CBP classifies goods using the Harmonized Tariff Schedule to determine duty rates. Customs officers may inspect shipments for compliance with regulations before releasing them into US commerce.

Which government agencies are involved in regulating US imports?

Several agencies oversee different aspects of importing: CBP (enforces import regulations), International Trade Administration (promotes trade), FDA (regulates food and drugs), USDA (oversees agricultural products), Consumer Product Safety Commission (ensures product safety), Environmental Protection Agency (enforces environmental standards), and Bureau of Industry and Security (controls export/import of sensitive items).

What is the Harmonized Tariff Schedule (HTS) and why is it important?

The HTS is a standardized numerical classification system used to categorize imported goods and determine applicable duty rates. Each product receives a specific code that affects how much duty must be paid. Accurate classification is crucial as incorrect HTS codes can result in wrong duty assessments, penalties, shipment delays, and potential legal issues for importers.

How are import duties and taxes calculated?

Import duties are calculated based on three main factors: the product's valuation (typically transaction value), its HTS classification code, and country of origin. The duty rate specified in the HTS is applied to the customs value of the goods. Additional fees like the Merchandise Processing Fee and Harbor Maintenance Fee may also apply based on shipment value and transportation method.

What is the de minimis threshold and how does it benefit importers?

The de minimis threshold (Section 321) allows shipments valued at $800 or less to enter the US duty-free and tax-free. This provision significantly benefits e-commerce retailers and individuals making small international purchases. To qualify, shipments must be imported by one person on one day and meet specific CBP requirements regarding documentation and product admissibility.

How do Free Trade Agreements affect import duties?

Free Trade Agreements (FTAs) reduce or eliminate duties on qualifying goods imported from 20 partner countries, including those under USMCA (Canada and Mexico) and CAFTA-DR. To claim these benefits, products must meet specific "rules of origin" requirements proving they were sufficiently produced or processed in the FTA partner country, and importers must provide proper documentation.

What is duty drawback and who can benefit from it?

Duty drawback is a refund program for duties, taxes, and fees paid on imported merchandise that is later exported or destroyed. There are three main types: direct identification, substitution, and rejected merchandise drawback. Manufacturers, importers, and exporters can benefit from these refunds by filing claims with proper documentation, potentially recovering significant amounts previously paid to customs.

What payment methods are available for import duties and taxes?

Importers can pay duties and taxes through several methods: Automated Clearinghouse (ACH) for electronic payments, credit cards (with transaction limits), checks, and through customs bonds. Many established importers use continuous bonds to secure payment obligations and opt for Periodic Monthly Statements, which allow consolidated payments for multiple entries made during a month.

How can importers legally minimize their duty payments?

Importers can reduce duties legally through several strategies: utilizing Foreign Trade Zones to defer or reduce duties, applying the First Sale Rule to base valuation on the first sale in a multi-tiered transaction, implementing tariff engineering by modifying products to qualify for lower duty rates, and taking advantage of duty drawback programs for exported goods. All strategies must comply with customs regulations.

What recent changes have affected US import duties and taxes?

Recent significant changes include Section 301 tariffs on Chinese goods, Section 232 tariffs on steel and aluminum, temporary duty relief for medical supplies during COVID-19, payment flexibility programs for importers facing hardship, increased digitization of customs processes, and adjustments to de minimis thresholds in response to e-commerce growth. These changes have substantially altered the import duty landscape.

What are common mistakes importers make when paying duties?

Common mistakes include misclassification of goods with incorrect HTS codes, valuation errors such as omitting assist values or undervaluing goods, and documentation problems including incomplete or inaccurate paperwork. These errors can result in underpayment of duties, substantial penalties (up to four times the duty amount in some cases), shipment delays, and potential legal issues.