Key Takeaways

- A complete set of essential documents for importing from China includes commercial invoices, packing lists, bills of lading/air waybills, certificates of origin, and any required import licenses or product-specific certifications.

- Commercial invoices must contain detailed product descriptions, HS codes, complete buyer/seller information, and accurate pricing to prevent customs delays and ensure proper duty assessment.

- Packing lists should detail physical aspects of the shipment (quantities, weights, dimensions) without pricing information, helping customs officials verify shipment contents efficiently.

- Bills of Lading for ocean freight are negotiable ownership documents requiring physical presentation, while Air Waybills are non-negotiable and process electronically, making air shipments generally faster to clear.

- Product-specific certificates vary by industry (electronics, food, textiles, etc.) and are essential for demonstrating compliance with safety standards and regulations in your destination country.

- Digital documentation systems and working with experienced customs brokers can significantly reduce processing times, minimize errors, and help navigate complex import regulations when bringing goods from China.

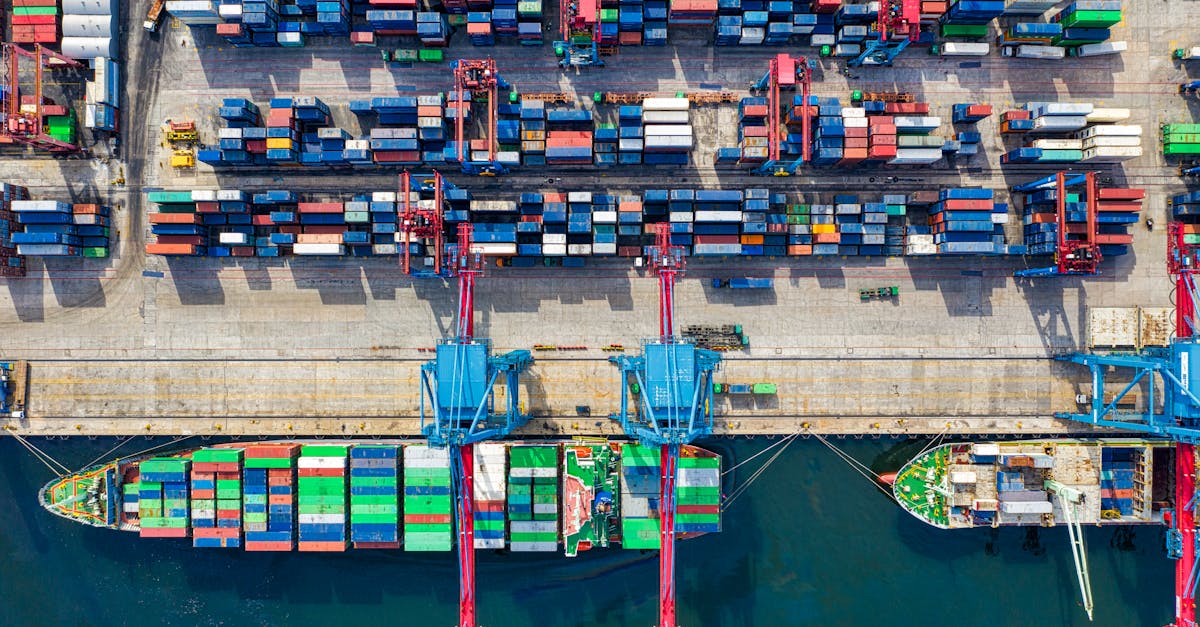

Navigating the complex world of international trade can be overwhelming, especially when importing goods from China. One of the biggest challenges you'll face is ensuring you have all the necessary documentation in place before your shipment arrives.

From commercial invoices and packing lists to bills of lading and certificates of origin, the paperwork required for Chinese imports can seem endless. Getting these documents right isn't just about compliance—it's about avoiding costly delays, preventing customs holds, and ensuring your products reach their destination without unnecessary complications.

This guide will walk you through the essential documents needed when importing from China, helping you create a smooth import process that saves time, money, and stress.

Understanding Import Documents for Chinese Goods

Importing from China involves a complex web of documentation that serves as the foundation for a successful international transaction. Each document plays a specific role in the import process, from verifying the goods' origin to ensuring compliance with customs regulations.

Key Documents for Chinese Imports

The essential documents for importing Chinese goods include commercial invoices detailing the transaction's financial aspects, packing lists identifying the contents of each package, and bills of lading serving as receipts for the shipped goods. Additional critical documents include certificates of origin verifying the manufacturing location, import licenses for restricted items, and customs entry forms declaring goods to customs authorities.

Commercial Invoice Requirements

Commercial invoices from Chinese suppliers must contain comprehensive details about your transaction. These include the seller's and buyer's complete contact information, detailed product descriptions with HS codes, unit and total prices, payment terms, and delivery conditions. Chinese customs authorities scrutinize these invoices for accuracy, particularly regarding valuation, which directly impacts duty calculations and tax assessments.

Bill of Lading Specifics

A properly executed bill of lading for Chinese imports includes the shipper's and consignee's names and addresses, vessel information, ports of loading and discharge, container numbers, and detailed cargo descriptions. This document serves as both a receipt from the shipping company and a title document transferring ownership rights. For sea shipments from China, you'll typically receive either a Master Bill of Lading issued by the shipping line or a House Bill of Lading from a freight forwarder.

Certificate of Origin Guidelines

Certificates of Origin for Chinese goods require specific information including the exporter's and importer's details, a complete goods description, country of origin declaration, and authorized signatures. These certificates are typically issued by the China Council for the Promotion of International Trade (CCPIT) or its local branches. For preferential duty treatment under trade agreements, Form A certificates or other specialized forms may be required depending on your importing country's regulations.

Commercial Invoice Requirements

Commercial invoices serve as critical financial documents in Chinese imports, detailing the transaction between you and your supplier. These documents play a fundamental role in customs clearance and provide evidence of the purchase agreement.

Key Elements of a Valid Commercial Invoice

A properly formatted commercial invoice includes specific information essential for smooth customs processing. Your invoice must contain the seller and buyer's complete company details including name, address, and contact information. The document requires a unique invoice number and date of issuance for tracking purposes. Include comprehensive product descriptions listing quantities, unit prices, and total values for each item. Specify payment terms, currency used, and incoterms (shipping terms) that define delivery responsibilities. List the country of origin for all products and include harmonized system (HS) codes for each item to facilitate customs classification. Most Chinese customs authorities also require the invoice to include shipping marks, container numbers, and shipping method details.

Common Mistakes to Avoid

Importers frequently make errors on commercial invoices that cause customs delays and additional costs. Incomplete product descriptions lacking specific details about materials, functions, or models can trigger customs inspections. Incorrect HS code assignments lead to improper duty calculations and potential penalties. Missing or inaccurate country of origin information violates import regulations and may result in rejected shipments. Discrepancies between the commercial invoice and other import documents like the packing list or bill of lading create red flags for customs officials. Failing to include proper signatures or company stamps on invoices from Chinese suppliers often results in documentation rejection. Ambiguous or missing incoterms create confusion about shipping responsibilities and liability during transit. Address these potential pitfalls by thoroughly reviewing all documents before submission and working with experienced freight forwarders familiar with China-specific requirements.

Packing List Documentation

Packing lists provide a detailed inventory of your shipment from China, serving as an essential document for customs clearance and verification. These documents help customs officials verify the contents against other shipping documents and ensure nothing is missing or incorrectly declared.

What Is a Packing List?

A packing list is an itemized document that details the contents of each package in your shipment from China. It identifies the specific items, quantities, weights, and dimensions of all goods within each container or package. Unlike commercial invoices, packing lists don't include pricing information but focus solely on physical descriptions of the shipment contents. Customs authorities use packing lists to verify that what's being imported matches what was declared on other documents like the commercial invoice.

Key Elements of a Complete Packing List

Complete packing lists for Chinese imports include several essential elements:

- Shipper and consignee details - Full names, addresses, and contact information

- Reference numbers - Order numbers, invoice numbers, and tracking IDs

- Package count - Total number of cartons, pallets, or containers

- Individual package identifiers - Numbers assigned to each package

- Package dimensions - Length, width, and height measurements in appropriate units

- Weights - Both gross and net weights for each package

- Detailed contents list - Specific descriptions of items in each package

- Shipping marks - Any special handling instructions or markings on packages

- Date of packing - When goods were packaged for shipment

How Packing Lists Differ from Commercial Invoices

Packing lists and commercial invoices serve distinct purposes in the import documentation process:

| Feature | Packing List | Commercial Invoice |

|---|---|---|

| Primary purpose | Physical inventory | Financial document |

| Price information | Not included | Detailed pricing |

| Focus | Physical characteristics | Transaction details |

| Customs use | Verify physical shipment | Assess duties and taxes |

| Required detail | Package-level contents | Item-level values |

| Legal significance | Shipping verification | Contract fulfillment |

While commercial invoices focus on financial aspects of the transaction, packing lists concentrate on the physical aspects of your shipment. Customs officials reference both documents to ensure consistency throughout the import process.

Common Mistakes to Avoid

Packing list errors can cause significant delays when importing from China. Avoid these common mistakes:

- Inconsistent quantities - Ensure item counts match across all shipping documents

- Missing product details - Include comprehensive descriptions of all products

- Inaccurate measurements - Double-check all weights and dimensions

- Poor organization - List items logically by package or container number

- Illegible handwriting - Use typed documents whenever possible

- Missing reference numbers - Include all tracking and order numbers

- Incomplete consignee information - Verify all contact details are current

Checking your packing lists for accuracy before shipment helps prevent customs delays and ensures faster clearance of your goods.

Bill of Lading or Air Waybill

A Bill of Lading (B/L) or Air Waybill serves as the contract of carriage between the shipper and the carrier for goods imported from China. These documents work as both a receipt confirming the carrier has taken possession of your goods and evidence of the shipping agreement terms.

Differences Between Ocean and Air Shipping Documents

Ocean and air shipping documents differ significantly in their legal status and transferability. A Bill of Lading for ocean freight is a negotiable document that represents ownership of the goods, allowing you to transfer title by endorsing the original B/L. In contrast, an Air Waybill (AWB) is non-negotiable and functions primarily as a receipt for the shipment rather than a title document.

Ocean shipments typically require original Bills of Lading in physical form, which must be surrendered to release the cargo at the destination. Air Waybills are generally processed electronically, eliminating the need for original document presentation before cargo release. This difference makes air shipments faster to process at customs, reducing potential delays.

Documentation complexity varies between the two methods. Ocean Bills of Lading contain more detailed terms and conditions, including specific clauses about carrier liability and force majeure events. Air Waybills feature simplified terms and standardized formats based on International Air Transport Association (IATA) regulations, making them more consistent across different carriers.

The typical processing time illustrates another key difference - ocean B/Ls often require 3-5 business days to issue and dispatch while air waybills are generated almost immediately after cargo acceptance. This timeframe impacts your overall logistics planning and document preparation schedule when importing from China.

Certificate of Origin

A Certificate of Origin (CO) verifies the country where products were manufactured or substantially transformed. This document plays a crucial role in determining applicable tariffs and ensuring compliance with trade agreements when importing from China.

How to Verify Authenticity

Authentication of a Certificate of Origin requires careful examination of several key elements. First, check for official seals or stamps from authorized Chinese agencies such as the China Council for the Promotion of International Trade (CCPIT) or local Chambers of Commerce. These organizations apply distinct watermarks and security features that are difficult to counterfeit.

Look for the certificate's unique reference number and verify it through the issuing authority's online verification system. Many Chinese certification bodies now provide digital verification services where you can confirm the document's legitimacy by entering the certificate number.

Examine the document's format and compare it with official templates. Legitimate Certificates of Origin from China follow standardized formats with specific layouts, fonts, and information placement. Any deviations from these standards may indicate potential fraud.

Contact the issuing authority directly if you have doubts about a certificate's authenticity. Provide the certificate number, date of issue, and exporter information to confirm the document was officially issued and recorded in their system.

Digital certificates with electronic signatures are becoming increasingly common in China-origin documentation. These e-COs contain encrypted data that helps verify their authenticity more efficiently than paper documents.

Documents required for importing from china

Navigating the complexities of international trade requires meticulous attention to documentation, especially when importing from China. The right paperwork not only ensures compliance with customs regulations but also helps avoid costly delays and penalties. This guide outlines the essential documents you need for a smooth import process from China.

Why Proper Documentation Matters

Proper documentation serves as the foundation for successful importing. Customs authorities rely on these papers to verify product details, assess duties, and ensure compliance with trade regulations. When your documentation is incomplete or incorrect, shipments face detention, delays, and potentially significant financial losses.

Chinese exports require specific paperwork that meets both international standards and country-specific requirements. Understanding these document requirements helps streamline your import process and build more efficient supply chains.

Having organized documentation protects your business legally when disputes arise with suppliers, carriers, or customs authorities. Complete papers provide evidence of transaction terms and product specifications that can prove invaluable in resolving conflicts.

Key Documents Overview

| Document Type | Purpose | Required By |

|---|---|---|

| Commercial Invoice | Details transaction and product information | Customs, Tax Authorities |

| Packing List | Itemizes shipment contents | Customs, Freight Forwarders |

| Bill of Lading/Air Waybill | Contract of carriage and receipt | Customs, Carriers |

| Certificate of Origin | Verifies manufacturing country | Customs, Trade Authorities |

| Import License | Authorizes import of restricted goods | Government Agencies |

| Product Certifications | Verifies compliance with safety standards | Regulatory Bodies |

Commercial invoices establish the transaction value and product details for customs valuation. This document forms the basis for duty assessment and includes comprehensive information about both buyer and seller.

Packing lists provide detailed inventories of each container or package in your shipment. Customs officials use these documents during physical inspections to verify the contents match declared items.

Bills of lading serve dual purposes as both receipts for goods shipped and title documents. They contain critical shipping information including vessel details, ports, and delivery terms.

Commercial Invoice

Commercial invoices serve as primary documents for international trade transactions, detailing the sale between you and your Chinese supplier. Customs authorities use these invoices to determine the true value of imported goods for duty and tax assessment purposes.

Key Elements of a Commercial Invoice

A complete commercial invoice includes several essential components that satisfy customs requirements. The document must contain full company details for both buyer and seller, including registered business names, addresses, tax ID numbers, and contact information for representatives handling the transaction.

Each invoice requires a unique identification number and issue date for tracking purposes. These reference numbers help link the invoice to purchase orders and other shipping documents throughout the import process.

Product descriptions on commercial invoices must be detailed and specific. Include the exact type of merchandise, model numbers, materials, dimensions, and intended use of the products to avoid customs classification disputes.

| Required Element | Description | Example |

|---|---|---|

| Company Information | Complete legal names and addresses | ABC Imports, 123 Main St, New York, NY 10001, USA |

| Invoice Number | Unique reference identifier | INV-CH-2023-0456 |

| Product Details | Specific descriptions of goods | Men's leather wallets, Model LW-501, genuine cowhide, brown, 4.5"×3.5" |

| Quantity | Number of units per product | 1,000 units |

| Unit Price | Cost per individual item | $5.50 USD per unit |

| Total Value | Full transaction amount | $5,500 USD |

| Incoterms | Delivery and cost responsibility terms | FOB Shanghai |

| HS Codes | Harmonized System classification codes | 4202.32.1000 |

Payment terms and conditions must be clearly stated, including the currency used, payment method, and any special arrangements like letters of credit or payment installments. These details establish the financial framework of the transaction.

Commercial invoices require accurate Harmonized System (HS) codes for each product. These internationally standardized numbers classify goods for customs purposes and determine applicable duty rates in your destination country.

Common Mistakes to Avoid

Importers frequently make errors when preparing commercial invoices that can trigger customs delays. Incomplete product descriptions that lack specificity about materials, functions, or components make it difficult for customs officials to properly classify goods, often resulting in requests for additional information.

Incorrect assignment of HS codes leads to serious complications including improper duty assessment, compliance violations, and potential penalties. Verify all classifications with customs experts, especially for complex or multi-function products.

Discrepancies between commercial invoice values and other shipping documents raise red flags with customs authorities. Ensure that values, quantities, and descriptions match exactly across all documentation to avoid intensive customs scrutiny and potential fraud investigations.

Missing information about country of origin, especially for products assembled with components from multiple countries, creates customs processing issues. Clearly indicate where products were manufactured or underwent substantial transformation.

Packing List

A packing list provides customs officials and freight handlers with a detailed inventory of your shipment from China. This document helps facilitate inspection processes by clearly identifying the contents, quantities, and organization of goods within each package or container.

What Is a Packing List?

A packing list serves as an itemized document that comprehensively details your shipment's contents. Unlike commercial invoices, packing lists focus on physical characteristics rather than financial information, listing specific items, quantities, weights, and dimensions without including pricing details.

Customs officers use packing lists to verify that actual shipment contents match the declared goods on other import documents. This verification helps prevent smuggling attempts and ensures accurate duty assessment based on complete cargo information.

Freight handlers rely on packing lists to properly handle, store, and transport goods according to their packaging requirements. The document provides critical information about fragile items, special handling instructions, and weight distribution considerations.

Key Elements of a Complete Packing List

Effective packing lists contain several critical components that facilitate efficient customs clearance. The document must include complete shipper and consignee information, including full legal names, addresses, contact details, and reference numbers that match other shipping documents.

Package counts and shipment totals should clearly indicate the total number of boxes, crates, or pallets along with their combined weight and dimensions. These figures help carriers allocate appropriate space and equipment for transport.

| Element | Description | Example |

|---|---|---|

| Shipper/Consignee Information | Company names and complete addresses | Dragon Exports Co., 123 Industrial Road, Shenzhen, China |

| Package Count | Total number of packages/containers | 8 cartons, 1 pallet |

| Package Identifiers | Individual box numbers and markings | Carton #1-8, marked "ABC Electronics 2023" |

| Product Details | Description of items in each package | Carton #1: 50 units of Model TX-500 Bluetooth speakers |

| Dimensions | Size of each package | Carton #1: 60cm × 40cm × 30cm |

| Weights | Gross and net weights | Gross: 25kg, Net: 22.5kg per carton |

| Special Handling | Any particular requirements | "Fragile - Handle with Care" |

Individual package identifiers such as box numbers, container numbers, or tracking codes should be clearly listed. This numbering system helps customs officials locate specific packages for inspection without examining the entire shipment.

Detailed package contents must be listed for each package, specifying exactly which items are in which boxes. This information allows for targeted inspections rather than requiring unpacking of the entire shipment if customs has concerns about specific products.

Packing List vs. Commercial Invoice

Packing lists differ from commercial invoices in several important ways that affect their use in the import process. While commercial invoices focus on financial details including pricing, payment terms, and transaction values, packing lists exclude all pricing information and focus solely on physical characteristics of the goods.

Commercial invoices serve primarily as legal documents for customs valuation and duty assessment purposes. In contrast, packing lists function as operational documents that facilitate physical handling and verification of the shipment throughout the logistics chain.

Customs authorities use these documents differently during clearance processes. They reference commercial invoices to calculate duties and taxes while consulting packing lists during physical inspections to verify that declared items match the actual shipment.

Common Mistakes to Avoid

When preparing packing lists for imports from China, certain errors commonly disrupt the clearance process. Inconsistent quantities between your packing list and other shipping documents raise immediate red flags with customs officials, often leading to full inspections and clearance delays.

Missing or vague product details prevent customs from properly identifying goods during inspections. Include sufficient information about product models, materials, and identifying characteristics to facilitate quick verification.

Poor organization of the packing list makes it difficult for inspectors to locate specific items within the shipment. Arrange information logically by package number with clear indications of contents for each container or box.

Overlooking special handling requirements for fragile, hazardous, or temperature-sensitive goods can result in damaged merchandise. Clearly mark any special handling instructions prominently on both the packing list and the physical packaging.

Bill of Lading and Air Waybill

The Bill of Lading (B/L) for ocean shipments or Air Waybill (AWB) for air freight serves as a contract of carriage between you and the transportation carrier. These critical documents establish legal responsibility for goods during transit from China to your destination.

Ocean vs. Air Shipping Documents

Ocean and air shipping documents differ in several fundamental aspects that affect your import process. A Bill of Lading functions as a negotiable document that represents ownership of the goods, allowing for transfer of title during transit. In contrast, an Air Waybill is non-negotiable and primarily serves as a receipt rather than a title document.

Bills of Lading issued for ocean freight from China come in several formats, including original B/Ls that require physical presentation for cargo release, telex release B/Ls that allow electronic transfer, and sea waybills for direct consignment to specific receivers. Your choice depends on payment terms and security requirements.

Air Waybills offer simpler processes with standardized formats governed by International Air Transport Association (IATA) regulations. These documents move electronically throughout the logistics chain, facilitating faster cargo release at destination airports compared to ocean shipments.

| Feature | Bill of Lading (Ocean) | Air Waybill (Air) |

|---|---|---|

| Negotiability | Negotiable (can transfer ownership) | Non-negotiable |

| Format Types | Original, Telex Release, Sea Waybill | Standardized IATA format |

| Processing Time | 3-7 days after vessel departure | Same day as flight departure |

| Release Mechanism | Physical document or telex release | Electronic |

| Governing Rules | Hague-Visby or Hamburg Rules | Montreal Convention |

Processing times vary significantly between these document types. Ocean Bills of Lading typically require 3-7 days after vessel departure for issuance, while Air Waybills are generally available immediately upon flight departure from Chinese airports.

Document complexity also differs, with Bills of Lading containing more detailed terms and conditions covering maritime law provisions. Air Waybills maintain simpler structures focused primarily on transportation terms rather than extensive legal provisions.

Key Information Required

Both transportation documents require specific information to be legally valid for importing from China. Complete shipper and consignee details must include full legal names, addresses, and contact information that exactly match other shipping documents to avoid customs discrepancies.

Accurate cargo descriptions on these documents should align with commercial invoice information while focusing on physical characteristics rather than commercial details. Include package counts, weights, and basic product categories that allow for proper handling.

| Required Information | Description | Example |

|---|---|---|

| Shipper/Consignee | Full legal names and addresses | Golden Dragon Manufacturing, 789 Export Zone, Guangzhou, China 510000 |

| Notify Party | Additional contact for arrival notice | ABC Customs Broker, 567 Airport Rd, Los Angeles, CA 90045 |

| Vessel/Flight Details | Carrier information and voyage number | OOCL Hong Kong, Voyage EX447 / Cathay Pacific CX880 |

| Ports/Airports | Origin, destination, and transshipment points | From: Shanghai (CNSHA) To: Long Beach (USLGB) |

| Package Details | Number, type, weight, dimensions | 1×40' container, 12,500 kg gross, 65 cartons |

| Marks & Numbers | Container and seal numbers | MSCU7654321, Seal: CH33987654 |

| Incoterms | Delivery terms | FOB Shanghai |

Vessel or aircraft identification with voyage/flight numbers provides crucial tracking information. For ocean shipments, include carrier booking numbers, container numbers, and seal numbers that customs uses to verify container integrity.

Ports of loading, transshipment, and discharge must be clearly specified using international port codes. For air shipments, list the exact airports of departure and arrival using IATA three-letter codes.

Transportation terms and conditions, including delivery terms (Incoterms) and freight payment status (prepaid or collect), establish financial responsibility for transportation costs and the exact point where risk transfers from seller to buyer.

Import License and Permits

Importing goods from China requires specific licenses and permits that vary based on product type and destination country. These documents establish your legal authority to import certain products and demonstrate compliance with regulatory requirements.

Industry-Specific Documentation Requirements

Industry-specific documentation requirements govern imports in regulated sectors such as food, pharmaceuticals, electronics, and textiles. Each industry has unique documentation needs based on safety concerns, quality standards, and regulatory oversight. For food imports, you'll need FDA registration, Prior Notice of Imported Food, and potentially phytosanitary certificates. Pharmaceutical imports require FDA approval documentation, certificates of analysis, and Good Manufacturing Practice (GMP) certifications. Electronics imports must have FCC compliance documentation, safety certifications like UL or CE marks, and RoHS compliance statements. Textile imports typically need fiber content labels, flammability certificates, and country of origin documentation.

For chemical product imports, Material Safety Data Sheets (MSDS) and Environmental Protection Agency (EPA) registrations are mandatory. Medical device imports require FDA 510(k) clearance or Premarket Approval (PMA) documentation, along with quality system certificates. Toy imports need CPSC certification, testing reports for lead and phthalates, and age-grading documentation. Agricultural products require USDA permits, phytosanitary certificates, and possibly fumigation certificates depending on the specific product category and origin region.

Import License and Permits

Importing goods from China requires specific licenses and permits that vary based on product type and destination country. These documents establish your legal authority to import certain products and demonstrate compliance with regulatory requirements.

Industry-Specific Documentation Requirements

Industry-specific documentation requirements govern imports in regulated sectors such as food, pharmaceuticals, electronics, and textiles. Each industry has unique documentation needs based on safety concerns, quality standards, and regulatory oversight. For food imports, you'll need FDA registration, Prior Notice of Imported Food, and potentially phytosanitary certificates. Pharmaceutical imports require FDA approval documentation, certificates of analysis, and Good Manufacturing Practice (GMP) certifications. Electronics imports must have FCC compliance documentation, safety certifications like UL or CE marks, and RoHS compliance statements. Textile imports typically need fiber content labels, flammability certificates, and country of origin documentation.

For chemical product imports, Material Safety Data Sheets (MSDS) and Environmental Protection Agency (EPA) registrations are mandatory. Medical device imports require FDA 510(k) clearance or Premarket Approval (PMA) documentation, along with quality system certificates. Toy imports need CPSC certification, testing reports for lead and phthalates, and age-grading documentation. Agricultural products require USDA permits, phytosanitary certificates, and possibly fumigation certificates depending on the specific product category and origin region.

Customs Entry Forms

Customs entry forms document your imported goods for U.S. Customs and Border Protection (CBP) and determine duty obligations. These forms connect your shipment details with customs regulations and are critical for legal compliance when importing from China.

CBP Form 7501 Guidelines

The CBP Form 7501, Entry Summary, serves as the principal document for declaring imported merchandise to U.S. Customs. This form requires specific information including entry type codes, the Harmonized Tariff Schedule classification, country of origin, value, and duty calculations. When completing Form 7501, you'll need your Importer of Record number, detailed product descriptions, and accurate valuations for each item. Common sections requiring attention include Box 10 (country of origin), Box 27 (duty rate), and Box 35 (total entered value). Electronic filing through the Automated Commercial Environment (ACE) system processes your entry more efficiently than paper submissions, with most entries cleared in 1-2 business days when properly completed.

Product-Specific Certificates

Product-specific certificates verify compliance with international standards and regulations for goods imported from China. These documents ensure your products meet safety, quality, and performance requirements in your destination country, preventing customs delays and potential legal issues.

Safety Compliance Documentation

Safety compliance documentation confirms your imported products meet essential safety standards in the destination market. For U.S. imports, key certificates include the Consumer Product Safety Commission (CPSC) certification for consumer goods, Underwriters Laboratories (UL) certification for electrical products, and Food and Drug Administration (FDA) approval for medical devices, food, and cosmetics. When importing electronics, you'll need Federal Communications Commission (FCC) certification to prove compliance with electromagnetic interference standards. Children's products require additional documentation such as Children's Product Certificates (CPC) confirming compliance with lead content limits, phthalate restrictions, and physical/mechanical safety requirements.

Quality Testing Reports

Quality testing reports provide objective evidence of your product's performance, durability, and adherence to specifications. These reports typically include detailed test results covering physical properties, chemical composition, performance metrics, and durability assessments. For electronic products, EMC (Electromagnetic Compatibility) and electrical safety test reports verify the product functions safely without causing interference. Textile imports require flammability test reports and chemical content analyses for substances like formaldehyde and azo dyes. Heavy metals testing reports are essential for toys, jewelry, and kitchenware to confirm they're free from harmful levels of lead, cadmium, and mercury. Request testing from accredited laboratories recognized by organizations like ILAC (International Laboratory Accreditation Cooperation) or A2LA (American Association for Laboratory Accreditation) to ensure your reports will be accepted by U.S. customs authorities.

Payment Documentation

Payment documentation serves as evidence of financial transactions between importers and Chinese suppliers, protecting both parties and facilitating smooth customs clearance. These documents verify payment terms, track financial obligations, and provide proof of transaction for regulatory compliance.

Letters of Credit vs. Wire Transfers

Letters of Credit offer security for both importers and Chinese suppliers through bank-backed payment guarantees. Unlike wire transfers which provide immediate payment with minimal protection, Letters of Credit create a documented process requiring verification before releasing funds.

When using a Letter of Credit, the issuing bank commits to pay the supplier only after specific documentation requirements are met, including shipping documents and quality inspection reports. This conditional payment method requires precise documentation but reduces transaction risks significantly.

Wire transfers, while simpler and faster, lack built-in protection mechanisms. These direct bank-to-bank transfers typically involve lower fees (averaging $25-50 per transaction) compared to Letters of Credit (which often cost 0.25-1% of the transaction value). Many established importers use wire transfers for trusted suppliers with proven track records, while new business relationships often benefit from the security of Letters of Credit.

- Payment timing: Letters of Credit release payment after documentation verification; wire transfers provide immediate payment

- Documentation requirements: Letters of Credit involve extensive paperwork; wire transfers require minimal documentation

- Risk level: Letters of Credit distribute risk between banks; wire transfers place risk primarily on the importer

- Processing time: Letters of Credit typically take 5-10 business days; wire transfers complete within 1-3 business days

- Cost structure: Letters of Credit include percentage-based fees; wire transfers charge flat fees

Working With Customs Brokers

Customs brokers serve as intermediaries between importers and government agencies, navigating complex import regulations and ensuring compliance with customs laws. They handle documentation preparation, classification of goods, and communication with customs officials to streamline the import process.

When to Hire Professional Assistance

Professional customs broker assistance becomes essential when importing high-value shipments exceeding $2,500, regulated products requiring special permits, or when dealing with unfamiliar markets. Brokers offer particular value for first-time importers unfamiliar with Chinese export procedures, businesses importing restricted categories like electronics or textiles, and companies lacking in-house customs expertise. Consider engaging a customs broker when facing complex tariff classifications, when time constraints require expedited clearance, or after experiencing previous customs delays or penalties. Professional assistance reduces the risk of costly errors, ensures accurate documentation, and transforms potential compliance headaches into smooth import experiences.

Digital Documentation Systems

Digital documentation systems streamline the import process from China by centralizing document management and facilitating electronic submissions to customs authorities. These platforms reduce paperwork, minimize errors, and accelerate clearance times while providing real-time tracking capabilities for shipments.

Electronic Filing Options

Electronic filing transforms how importers submit documentation to customs authorities when importing from China. The U.S. Customs and Border Protection's Automated Commercial Environment (ACE) serves as the primary system for processing trade-related data electronically. Through ACE, you can submit entry summaries, manifests, and cargo release information directly to CBP without paper forms.

Several electronic filing platforms integrate with ACE:

- ABI (Automated Broker Interface) connects customs brokers to CBP, allowing them to file entries and pay duties electronically

- AMS (Automated Manifest System) enables carriers to submit cargo manifests before arrival

- ISF (Importer Security Filing) facilitates the electronic submission of shipment information 24 hours before vessel loading

These systems reduce processing times from days to hours, with electronic submissions typically processed 60-70% faster than paper documentation. Filing electronically also provides instant validation checks that identify errors before submission, reducing the likelihood of customs holds.

Document Management Software

Document management software centralizes all import documentation in a secure digital environment. These platforms organize commercial invoices, packing lists, bills of lading, and certificates into searchable databases that support your import operations from China.

Key features of effective document management systems include:

- Cloud-based storage that enables access from any location with proper authentication

- Version control that maintains document history and tracks changes made by different users

- Automated workflows that route documents to appropriate team members for review and approval

- OCR (Optical Character Recognition) technology that extracts data from scanned documents

- Integration capabilities with customs systems and ERP platforms

Leading document management solutions like Cargowise, Descartes, and BluJay provide industry-specific features designed for international trade. These systems reduce document processing costs by approximately 30% compared to manual handling and decrease document retrieval time from hours to seconds.

Blockchain in Supply Chain Documentation

Blockchain technology creates immutable, transparent records of import documentation that enhance security and authenticity when trading with Chinese suppliers. This distributed ledger technology timestamps and encrypts each document, preventing unauthorized alterations and providing a verifiable chain of custody.

Blockchain implementations in import documentation offer several advantages:

- Smart contracts automatically execute predetermined actions when specific conditions are met

- Digital signatures verify document authenticity without physical paperwork

- Decentralized verification eliminates the need for third-party authentication

- Real-time visibility allows all authorized parties to access the same information simultaneously

Companies like Maersk and IBM have developed TradeLens, a blockchain-based platform specifically for international shipping documentation. Pilot programs show blockchain can reduce administrative costs by 15-20% and processing times by up to 40% for shipments from China. The technology also significantly reduces documentation fraud, which costs the industry billions annually.

Data Security Considerations

Data security protects sensitive import documentation from unauthorized access, modification, or theft throughout the digital supply chain. When importing from China using digital documentation systems, implementing robust security measures safeguards proprietary business information and ensures compliance with data protection regulations.

Essential security protocols include:

- End-to-end encryption for all documents in transit and at rest

- Multi-factor authentication requiring at least two verification methods before granting access

- Role-based access controls limiting document visibility based on job responsibilities

- Regular security audits identifying and addressing vulnerabilities in your digital systems

- Secure API connections when integrating with customs systems and supplier platforms

Data residency requirements also affect digital documentation, particularly when dealing with Chinese suppliers. Documents stored on servers in China may be subject to different legal frameworks than those stored in the U.S. Evaluate where your digital documentation provider stores data and ensure compliance with both U.S. and Chinese regulations regarding data privacy.

Conclusion

Navigating the documentation requirements for Chinese imports doesn't have to be overwhelming. With proper preparation of your commercial invoices packing lists bills of lading and certificates of origin you'll minimize customs delays and avoid unnecessary costs.

Don't underestimate the value of digital documentation systems and professional customs brokers especially when dealing with regulated products or unfamiliar markets. Remember that each document serves a specific purpose in verifying product origin compliance with regulations and facilitating payment.

By maintaining organized accurate documentation you're not just satisfying customs requirements—you're protecting your business legally and setting the foundation for successful long-term importing from China. This attention to detail ultimately translates to a more efficient profitable importing operation.

Frequently Asked Questions

What documents are essential for importing goods from China?

The essential documents for importing from China include commercial invoices, packing lists, bills of lading or air waybills, certificates of origin, import licenses (for certain products), customs entry forms like CBP Form 7501 (for US imports), and product-specific certificates. Having complete and accurate documentation ensures smooth customs clearance and helps avoid delays and additional costs.

What is a commercial invoice and why is it important?

A commercial invoice is a bill for the goods from the seller to the buyer that includes complete company details, unique invoice numbers, detailed product descriptions, quantities, values, payment terms, and HS codes. It's crucial because customs authorities use it to determine import duties and taxes, verify the shipment contents, and ensure compliance with trade regulations.

What information should be included in a packing list?

A complete packing list should include shipper and consignee details, package counts, dimensions, weights, detailed content descriptions, individual package identifiers, and handling instructions. Unlike commercial invoices, packing lists don't include pricing information. They help customs officials verify shipment contents and are essential for efficient inspection and clearance.

What's the difference between a Bill of Lading and an Air Waybill?

A Bill of Lading (B/L) is a negotiable document used for ocean freight that serves as a receipt, contract of carriage, and title to the goods. An Air Waybill (AWB) is non-negotiable and used for air freight, primarily serving as a receipt and contract of carriage. B/Ls have longer processing times and more complex terms, while AWBs are processed more quickly and electronically.

Why is a Certificate of Origin important for imports?

A Certificate of Origin (CO) verifies where products were manufactured, which is crucial for determining applicable tariffs and ensuring compliance with trade agreements. It can qualify goods for preferential duty treatment under free trade agreements. Authentic COs contain official seals, unique reference numbers, and standardized formats recognized by customs authorities.

When do I need an import license or permit?

Import licenses and permits are required for regulated products such as food, pharmaceuticals, electronics, textiles, chemicals, medical devices, toys, and agricultural products. Requirements vary by product type and destination country. These documents establish legal authority to import certain products and ensure compliance with safety, health, and environmental regulations.

What is CBP Form 7501 and why is it important?

CBP Form 7501 is the U.S. Customs Entry Summary form used to declare imported merchandise to Customs and Border Protection. It requires entry type codes, tariff classification, country of origin, value, and duty calculations. Accurate completion is critical to avoid penalties and delays. Most importers now file electronically through the Automated Commercial Environment (ACE) system.

What product-specific certificates might I need when importing from China?

Depending on your products, you may need safety compliance documentation (like CPSC certification for consumer goods or FDA approval for medical devices), quality testing reports from accredited laboratories, and industry-specific certificates. These verify that products meet safety, quality, and performance requirements of the importing country.

What payment documentation is required for imports from China?

Payment documentation serves as evidence of financial transactions and facilitates customs clearance. Options include Letters of Credit (offering security through bank-backed guarantees) or wire transfer receipts (providing proof of immediate payment). The choice depends on your relationship with the supplier, with Letters of Credit recommended for new business relationships despite higher costs.

Should I hire a customs broker for importing from China?

Consider hiring a customs broker for high-value shipments, regulated products, or unfamiliar markets. Brokers are licensed professionals who navigate complex import regulations, prepare documentation, calculate duties, and ensure compliance with customs laws. They reduce the risk of costly errors and can streamline the import process, often justifying their fees through time and money saved.

How can digital documentation systems improve the import process?

Digital documentation systems centralize document management, facilitate electronic submissions to customs, and reduce paperwork. Electronic filing through systems like ACE enables faster processing and error reduction. Document management software organizes import documentation securely, while blockchain technology can enhance security by providing immutable records and real-time visibility throughout the supply chain.

What are common documentation mistakes to avoid when importing from China?

Common mistakes include incomplete product descriptions, incorrect HS code assignments, discrepancies between documents, inconsistent quantities on packing lists, missing product details, and poor organization. Also avoid late document submission, incomplete supplier information, and neglecting to translate documents when required. Double-checking all documents before shipment can prevent customs delays and additional costs.