Key Takeaways

- China's warehouse and logistics infrastructure offers strategic advantages including cost-effectiveness (15-30% lower than Western markets), advanced technology integration, and optimal geographic positioning near major transportation hubs.

- Modern Chinese warehouses have evolved from basic storage facilities to sophisticated supply chain hubs featuring automated systems, real-time inventory management, and IoT technology that improves operational efficiency by an average of 35%.

- Major logistics hubs in Shanghai, Guangdong-Hong Kong-Macau, and Beijing-Tianjin-Hebei regions provide comprehensive services including specialized e-commerce fulfillment, temperature-controlled storage, and customs clearance facilities.

- Navigating China's regulatory landscape requires understanding import-export documentation, customs procedures, and leveraging Free Trade Zones that offer simplified clearance and tax benefits for international operations.

- Future trends shaping China's logistics include digital transformation with 5G and blockchain technology, sustainable "green logistics" initiatives, and specialized cross-border e-commerce infrastructure supporting global delivery timeframes.

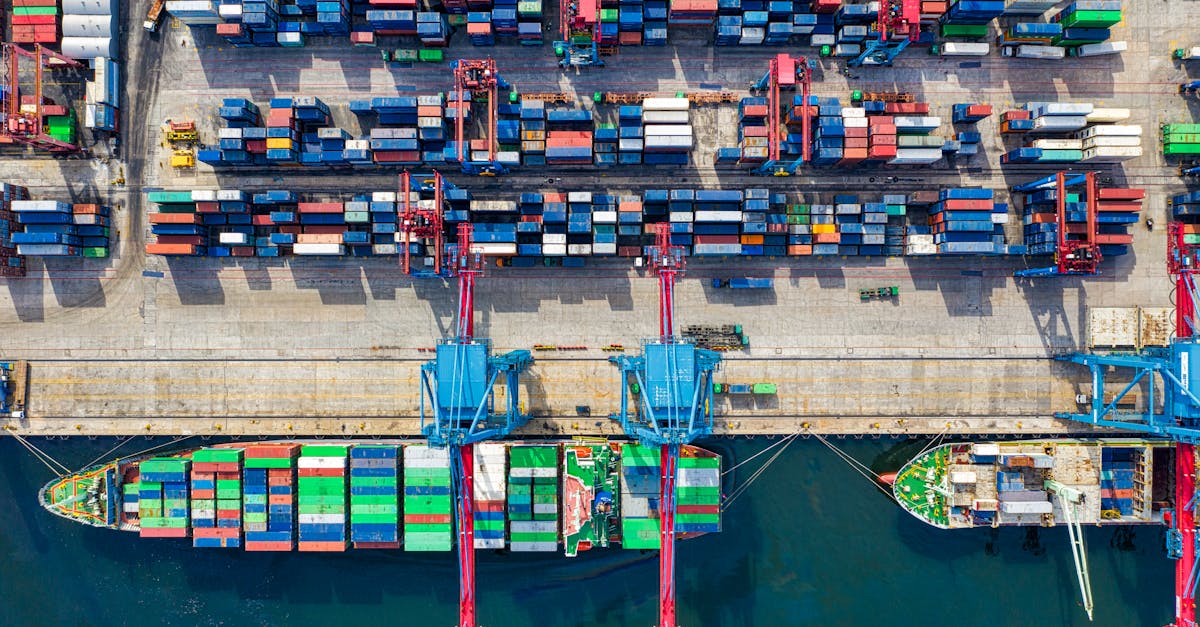

When you're expanding your business globally, China's warehouse and logistics solutions offer unparalleled advantages for streamlining your supply chain operations. With China's position as a manufacturing powerhouse and its sophisticated logistics infrastructure, you'll find comprehensive services that can transform your international shipping capabilities.

China's warehouse facilities provide state-of-the-art inventory management systems, competitive storage costs, and strategic locations near major ports and transportation hubs. Whether you're seeking fulfillment services, cross-border e-commerce solutions, or consolidated shipping options, Chinese logistics providers deliver end-to-end solutions tailored to your specific business needs. These services can significantly reduce your operational costs while improving delivery times to global markets.

The Evolution of China's Warehouse and Logistics Industry

China's warehouse and logistics sector has undergone remarkable transformation over the past three decades, evolving from basic storage facilities to sophisticated supply chain ecosystems. This evolution directly impacts how your business can leverage Chinese logistics infrastructure for global operations.

From Traditional Storage to Modern Supply Chain Hubs

Traditional Chinese warehouses in the 1980s and early 1990s primarily offered simple storage solutions with minimal value-added services. These facilities featured basic infrastructure, manual inventory management, and limited technology integration. The focus remained on storing goods rather than optimizing distribution.

By the early 2000s, China's entry into the WTO catalyzed significant modernization. Warehouses began incorporating semi-automated systems, improved inventory tracking capabilities, and expanded beyond mere storage to include basic distribution functions. This transition marked the beginning of China's integrated logistics approach.

Today's Chinese logistics facilities represent comprehensive supply chain hubs equipped with:

- Fully automated storage and retrieval systems (ASRS)

- Real-time inventory management platforms

- Cross-docking capabilities for efficient distribution

- Value-added services including kitting, labeling, and quality control

- Multi-modal transportation connections

Technological Advancements Transforming the Industry

Digital technology has fundamentally reshaped China's warehouse operations. The implementation of warehouse management systems (WMS) revolutionized inventory control, allowing for precise tracking of goods throughout the supply chain journey.

Advanced technologies now common in Chinese warehouses include:

| Technology | Adoption Rate | Key Benefits |

|---|---|---|

| IoT Sensors | 67% of modern facilities | Real-time monitoring, predictive maintenance |

| AI/Machine Learning | 42% of large warehouses | Demand forecasting, route optimization |

| Robotics/Automation | 53% of tier-1 city warehouses | 300% increase in picking efficiency |

| Blockchain | 28% of export-focused facilities | Enhanced traceability, secure documentation |

| Cloud Computing | 76% of major logistics providers | Scalable data management, accessibility |

These technological implementations have increased operational efficiency by an average of 35% while reducing order processing errors by 78% compared to traditional methods.

Government Initiatives and Infrastructure Development

China's government has strategically invested in logistics infrastructure development through multiple initiatives. The Belt and Road Initiative represents the most ambitious program, connecting China to global markets through enhanced transportation networks across Asia, Europe, and Africa.

Additional government programs shaping the industry include:

- Made in China 2025 prioritizing smart logistics technology development

- Western Region Development Plan expanding infrastructure in inland provinces

- Yangtze River Economic Belt promoting multimodal transportation options

- Free Trade Zones offering preferential policies for logistics companies

- Digital Silk Road initiative enhancing digital connectivity for trade facilitation

These initiatives have resulted in the development of 82 national-level logistics hubs and over 120 specialized economic zones with advanced logistics capabilities.

The Rise of E-commerce and Its Impact on Warehousing

China's e-commerce boom has profoundly reshaped warehousing requirements. The explosive growth of platforms like Alibaba and JD.com created demand for specialized fulfillment centers capable of processing high volumes of individual orders rather than bulk shipments.

E-commerce has driven warehouse evolution through:

- Distributed warehouse networks placing inventory closer to consumers

- High-speed sorting systems processing thousands of orders hourly

- Last-mile delivery integration connecting warehouses directly to consumers

- Reverse logistics capabilities handling returns efficiently

- Dynamic inventory allocation responding to real-time demand patterns

Chinese fulfillment centers now process over 83 billion parcels annually, requiring increasingly sophisticated warehouse solutions to maintain efficiency.

Key Benefits of China Warehouse and Logistics Solutions

China's warehouse and logistics solutions offer substantial advantages for businesses seeking to optimize their supply chain operations. These benefits directly impact your bottom line while enhancing operational efficiency and market reach.

Cost-Effectiveness and Economies of Scale

China's warehouse solutions deliver significant cost savings through economies of scale. Average operational costs are typically 15-30% lower than in Western markets due to streamlined workforce management and bulk processing capabilities. You'll benefit from competitive storage rates starting at $0.5-2 per square meter in tier-2 cities, compared to $3-8 in major Western hubs. Chinese logistics providers also offer consolidated shipping options that reduce transportation costs by combining multiple smaller shipments into full container loads, potentially saving 20-40% on shipping expenses. Volume-based discounts on customs clearance, packaging, and handling services further amplify these savings, making China's logistics infrastructure particularly valuable for growing businesses with increasing shipping volumes.

Strategic Geographic Positioning

Chinese warehousing facilities occupy optimal locations that maximize distribution efficiency. Facilities in eastern coastal regions like Shanghai, Shenzhen, and Ningbo provide direct access to major shipping ports, reducing transit times by 1-3 days. Central distribution hubs in cities like Xi'an and Chongqing serve as critical junctures along the Belt and Road Initiative routes, connecting Asian and European markets. You'll find specialized free trade zones in cities such as Guangzhou and Hangzhou that offer streamlined customs procedures and tax incentives. This strategic positioning enables 24-48 hour delivery windows to major Asian markets and 5-10 day shipping timeframes to European destinations, giving your business remarkable geographical advantages for international commerce.

Advanced Technology Integration

Chinese warehouses implement cutting-edge technologies that dramatically improve operational performance. Automated sorting systems process up to 40,000 packages per hour, while AI-powered inventory management platforms reduce stock discrepancies by 35-45%. Real-time tracking capabilities provide minute-by-minute updates on shipment locations using GPS and RFID technology, maintaining 99.8% tracking accuracy. Cloud-based warehouse management systems integrate with your existing business software, enabling automated data synchronization and reducing manual entry errors by up to 95%. Robotics applications in Chinese fulfillment centers have increased picking efficiency by 300% while reducing labor costs. These technological advancements translate to faster order processing, reduced errors, and enhanced visibility throughout your supply chain.

Top Warehouse Facilities in Major Chinese Logistics Hubs

China's major logistics hubs host world-class warehouse facilities that serve as crucial nodes in global supply chains. These strategically located centers combine advanced infrastructure, technology integration, and operational efficiency to provide comprehensive logistics solutions for businesses of all sizes.

Shanghai and Yangtze River Delta Region

The Shanghai and Yangtze River Delta region houses China's most sophisticated warehouse infrastructure, handling over 40% of the country's international trade volume. Shanghai's Yangshan Deep Water Port, connected to the 8.5 million square meter Lingang Logistics Park, features temperature-controlled storage, automated sorting systems, and customs clearance facilities. International logistics providers like DHL, Maersk, and Kuehne+Nagel operate extensive facilities in this hub, with warehouses ranging from 50,000 to 150,000 square meters. The Suzhou Comprehensive Bonded Zone offers tax advantages for cross-border e-commerce with its state-of-the-art fulfillment centers equipped with robotic picking systems that process 200,000+ orders daily.

Guangdong-Hong Kong-Macau Greater Bay Area

The Greater Bay Area serves as China's southern logistics powerhouse, processing approximately 30% of the country's export cargo. Shenzhen's Yantian Port District contains multiple Grade A warehousing complexes with 24/7 operations and specialized e-commerce processing capabilities. The Dongguan Changping Logistics Park, spanning 3 million square meters, features rail-connected warehouses that reduce transportation costs by up to 25% compared to truck-only facilities. Hong Kong's connectivity enhances this region's value, with the HKIA Logistics Park offering seamless air-to-land cargo transfer and specialized pharmaceutical storage meeting EU GDP standards. Major facilities here include JD.com's 550,000 square meter smart logistics park in Dongguan and Cainiao's fully automated distribution center in Guangzhou.

Beijing-Tianjin-Hebei Economic Zone

The Beijing-Tianjin-Hebei Economic Zone forms northern China's logistics nucleus, serving 300+ million consumers across North and Northeast China. Tianjin's port-adjacent Dongjiang Free Trade Port Zone contains 2 million square meters of bonded warehousing with specialized facilities for automotive, electronics, and cold chain industries. The Beijing Airport Logistics Park features time-sensitive cargo handling with express customs clearance and specialized e-commerce fulfillment operations. Hebei's Xiong'an New Area has developed next-generation warehouse facilities incorporating green building standards, solar power integration, and IoT-enabled inventory management. GLP's Tianjin Binhai Logistics Center exemplifies modern warehousing with its 42-meter high automated storage and retrieval systems handling 75,000+ SKUs simultaneously.

Modern Technological Advancements in Chinese Logistics

Technological innovation serves as the cornerstone of China's rapidly evolving logistics landscape. These advancements have transformed traditional warehousing into highly efficient, data-driven operations that significantly reduce costs and streamline global supply chains.

Automation and Robotics in Chinese Warehouses

Automation technology has revolutionized Chinese warehouse operations through the integration of sophisticated robotics systems. JD.com's fully automated fulfillment center in Shanghai processes 200,000+ orders daily with 80% fewer staff requirements compared to traditional facilities. These warehouses employ Automated Guided Vehicles (AGVs) that navigate independently throughout facilities, transporting inventory between stations without human intervention. Robotic picking arms now achieve 99.9% accuracy rates, dramatically reducing error-related costs while operating 24/7.

Major logistics companies like SF Express and Cainiao have invested ¥10+ billion in automated sorting systems that process parcels three times faster than manual methods. These systems incorporate conveyor networks spanning thousands of meters, automated palletizers, and robotic arm technology for precise inventory handling. Cross-belt sorters now process up to 20,000 items hourly while maintaining tracking accuracy within millimeters.

Chinese manufacturers are also producing warehouse automation solutions at 30-40% lower costs than Western alternatives, making these technologies more accessible to mid-sized companies entering the market. The integration of IoT sensors throughout facilities enables real-time monitoring of equipment performance, reducing maintenance costs by 25% through predictive maintenance protocols.

AI and Big Data Applications in Supply Chain Management

AI and big data analytics have transformed Chinese logistics decision-making processes through advanced predictive capabilities. Alibaba's logistics arm uses AI algorithms to analyze 100+ variables across 10 million daily orders, accurately forecasting inventory requirements 30 days in advance with 95% accuracy. These systems identify optimal warehouse locations, reducing transportation costs by 15-20% through network optimization.

Machine learning applications now power demand forecasting models that incorporate regional purchasing patterns, seasonal variations, and even weather conditions to predict inventory needs. Companies like Meituan leverage AI to analyze 5+ terabytes of delivery data daily, optimizing routes and reducing delivery times by up to 30%. Real-time analytics platforms process millions of data points from RFID tags, barcodes, and IoT sensors to create comprehensive visibility across multiple supply chain tiers.

China's digital logistics platforms integrate with government customs systems, automating clearance procedures and reducing documentation errors by 70%. Blockchain technology implemented by companies like Cosco Shipping provides immutable tracking records across international shipments, reducing disputes and verification times. These digital innovations enhance transparency throughout the entire supply chain, allowing businesses to track shipments from factory floors to final delivery destinations with unprecedented precision.

Navigating Regulatory Challenges in Chinese Logistics

China's regulatory landscape for logistics and warehousing presents a complex environment that requires careful navigation. Understanding these regulations isn't just beneficial—it's essential for successful operations. The Chinese government consistently updates its logistics-related policies to enhance efficiency, environmental sustainability, and security across supply chains.

Import-Export Documentation Requirements

Chinese customs documentation requires precise attention to detail when moving goods in or out of the country. All products entering China need a complete set of documents including commercial invoices, packing lists, bills of lading, and certificates of origin. Additional certifications like CCC (China Compulsory Certification) apply to products in 20+ categories including electronics, toys, and automotive parts.

Import licenses are mandatory for restricted goods such as certain agricultural products, mechanical equipment, and cultural items. The Single Window system implemented by Chinese Customs enables electronic submission of documentation, reducing processing times from 3-5 days to typically 24-48 hours. Working with experienced customs brokers familiar with HS code classification prevents costly delays that can reach up to 30 days for non-compliant shipments.

Customs Clearance Procedures and Challenges

Customs clearance in China follows a systematic process that begins with pre-arrival declaration and ends with final release of goods. The Advanced Manifest Rule requires submission of cargo information 24 hours before vessel loading for sea freight and 4 hours before arrival for air freight. Inspections occur based on a risk assessment system that categorizes importers into classes A, B, C, and D, with class A companies enjoying expedited clearance and reduced inspection rates of approximately 5%.

Common clearance challenges include valuation disputes, where customs may question declared values if they fall below reference prices in their database. Classification discrepancies often trigger additional inspections, especially for multi-function products that could fall under multiple HS codes. Special licensing requirements for regulated items like food, cosmetics, and pharmaceuticals necessitate pre-approval from agencies like CFDA or CIQ, adding 10-15 days to standard clearance timelines.

Free Trade Zones and Special Economic Areas

China's Free Trade Zones (FTZs) offer significant advantages for logistics operations, including simplified customs procedures and tax benefits. The Shanghai FTZ, established in 2013, pioneered the "single-window" clearance system that reduced processing time by 60%. Hainan Free Trade Port provides zero-tariff policies for qualified goods and a reduced corporate income tax rate of 15% compared to the standard 25%.

Bonded logistics parks within these zones allow for postponed duty payments until goods enter the domestic market. The Guangdong-Hong Kong-Macau Greater Bay Area features specialized cross-border e-commerce zones with simplified customs clearance for B2C shipments, processing over 1 billion parcels annually. Companies operating in these areas benefit from VAT refunds on exports and can conduct foreign exchange transactions more freely than in non-special areas.

Compliance with Transportation and Storage Regulations

Transportation regulations in China vary by province and cargo type, with specific requirements for dangerous goods, temperature-controlled items, and oversized freight. Trucks operating between provinces need route-specific permits and must comply with weight restrictions that limit standard containers to 24 tons compared to 26-28 tons in many Western countries. Environmental regulations impose strict emissions standards, with major cities like Beijing and Shanghai implementing "green zones" that prohibit high-emission vehicles during daytime hours.

Storage facilities must adhere to fire safety codes that include mandatory sprinkler systems, fire-resistant building materials, and regular inspections. Hazardous materials storage requires special licenses from local Environmental Protection Bureaus and Safety Supervision Administrations. Food and pharmaceutical warehousing demands HACCP certification and temperature-controlled environments with continuous monitoring systems. Non-compliance penalties have increased significantly, with fines reaching up to ¥2 million for serious violations and potential business suspension.

Working with Licensed Logistics Partners

Partnering with licensed Chinese logistics providers circumvents many regulatory hurdles through their established compliance frameworks. These partners possess essential permits including the A-class Customs Declaration License and the International freight forwarding License required for cross-border operations. Their established relationships with customs officials and regulatory bodies streamline approval processes and reduce clearance times by an average of 40%.

Third-party logistics (3PL) providers with Class A customs broker certification offer bonded warehousing services that defer duty payments until goods enter domestic circulation. When selecting logistics partners, verify their experience in your specific industry vertical and their compliance record with regulatory authorities. Leading providers maintain dedicated compliance teams that monitor regulatory changes and proactively update operating procedures to maintain seamless operations despite China's evolving regulatory environment.

Choosing the Right China Warehouse and Logistics Partner

Selecting an optimal warehouse and logistics partner in China requires careful evaluation of multiple factors to ensure your supply chain operates efficiently. Your choice directly impacts operational costs, delivery times, and overall customer satisfaction in the Chinese market and beyond.

Assessment Criteria for Service Providers

Service providers in China's logistics sector vary significantly in capabilities, specialization, and service quality. Evaluate potential partners based on their infrastructure capacity, looking at warehouse size, technology implementation, and handling capabilities for your specific product types. Check their geographic coverage across China's major logistics hubs to ensure they can effectively distribute your products to target markets. Companies like SF Express, with over 2,000 warehouses nationwide, offer comprehensive coverage compared to regional operators.

Experience in your industry is critical—partners familiar with your product category understand specific handling requirements, regulatory compliance issues, and market dynamics. For example, electronic product distributors need partners experienced with ESD (Electrostatic Discharge) protection protocols and relevant certification processes.

Examine their technology integration capabilities, focusing on warehouse management systems, inventory tracking, and data analysis tools. Partners using advanced WMS platforms like Manhattan Associates or SAP provide superior visibility and control over inventory. Verification tools include requesting system demos, visiting physical facilities, and examining case studies of similar clients.

Financial stability indicators such as years in business (minimum 5-7 years for established reliability), client retention rates, and growth patterns help assess long-term partnership viability. Request references from current clients operating in similar industries and volumes to gauge real-world performance and relationship management capabilities.

Contract Considerations and Negotiation Tips

Contract negotiations with Chinese logistics providers require attention to specific terms that protect your interests while establishing a productive partnership. Outline clear service level agreements (SLAs) that define precise metrics for performance evaluation, including 98%+ order accuracy rates, consistent 24-hour order processing timeframes, and maximum allowable damage percentages (typically below 0.5%).

Pricing structures should accommodate volume fluctuations with tiered rates based on storage volume, order quantity, and seasonal adjustments. Include detailed breakdowns of base storage costs (per pallet/cubic meter), handling fees, and value-added service charges. Negotiate favorable terms for peak seasons with transparent surge pricing formulas rather than undefined "peak season surcharges."

Flexibility provisions allow for scaling operations during growth periods or market changes. Establish contract terms that permit warehouse space adjustments (increasing or decreasing by 20-30% with minimal penalties) and staffing level modifications during high-demand periods. Include technology update clauses ensuring your partner commits to maintaining and upgrading systems that integrate with your supply chain management platforms.

Termination clauses require particular attention—specify notice periods (typically 60-90 days), transition assistance obligations, and conditions for early termination with clearly defined penalties. Address intellectual property protections, especially for proprietary packaging designs, customer data, and specialized handling procedures unique to your products. Data ownership and security provisions should explicitly state that customer information and transaction data belongs to your company, with strict protocols for handling, storage, and transfer compliance with both Chinese regulations and international standards like GDPR.

Future Trends Shaping China's Logistics Landscape

Digital Transformation and Smart Logistics

Digital transformation drives China's logistics evolution with smart technologies revolutionizing warehouse operations. The integration of 5G networks enables real-time tracking and monitoring across supply chains, reducing delivery times by up to 40% compared to traditional systems. Blockchain implementation enhances transparency, with major platforms like Cainiao and JD Logistics already utilizing distributed ledger technology to verify product authenticity and streamline customs documentation.

Smart warehouses represent the next frontier in logistics efficiency. These facilities employ interconnected IoT sensors that monitor everything from temperature conditions to inventory levels without human intervention. For example, Suning Logistics' automated warehouse in Nanjing processes over 200,000 orders daily using a network of 500+ sensors and autonomous robots, achieving 99.99% inventory accuracy.

Green Logistics and Sustainability Initiatives

Environmental consciousness is reshaping China's logistics practices with concrete sustainability measures. Electric vehicle (EV) adoption for delivery services has accelerated, with companies like SF Express converting 30% of their delivery fleet to electric vehicles, reducing carbon emissions by approximately 120,000 tons annually. Green warehousing practices include solar panel installation, energy-efficient lighting systems, and water recycling facilities that can cut energy consumption by up to 45%.

China's government supports these initiatives through tax incentives for companies implementing sustainable logistics solutions. The 14th Five-Year Plan explicitly targets a 13.5% reduction in energy consumption per unit of GDP, placing significant pressure on logistics operators to adopt eco-friendly practices. Leading logistics parks in Shenzhen, Shanghai, and Chongqing now operate under strict environmental standards, utilizing renewable energy sources for at least 20% of their power needs.

Cross-Border E-Commerce Logistics Evolution

Cross-border e-commerce drives significant changes in China's logistics landscape with specialized infrastructure development. Bonded warehouses in key regions like Hangzhou, Guangzhou, and Zhengzhou now process over 2 million international packages daily, enabling 72-hour delivery to major Asian markets and 7-day delivery to Europe and North America. These facilities offer streamlined customs clearance through integrated electronic declaration systems that reduce processing times from days to hours.

China-Europe freight trains have become vital components of cross-border logistics, with over 15,000 train journeys completed since 2011. These routes connect 92 Chinese cities with 21 European countries, offering transit times of 10-15 days compared to 30+ days by sea freight. This rail network supports specialized logistics services including temperature-controlled containers for perishable goods and high-value merchandise transportation with enhanced security features.

Last-Mile Delivery Innovations

Last-mile delivery represents both a challenge and opportunity in China's evolving logistics ecosystem. Autonomous delivery vehicles now operate in controlled environments like university campuses and industrial parks across 30+ Chinese cities. Companies such as Meituan and Alibaba deploy over 500 delivery robots collectively, handling approximately 50,000 daily orders without human intervention.

Community-based distribution models are gaining traction, with neighborhood pickup points reducing delivery costs by up to 25%. These micro-fulfillment centers serve as collection points for multiple e-commerce platforms, creating a unified delivery experience for consumers. In high-density urban areas, underground logistics networks utilize existing subway infrastructure for package transportation during off-peak hours, moving goods beneath congested streets in cities like Shanghai and Beijing.

Integration of Logistics with New Retail Concepts

The boundaries between retail and logistics continue to blur with innovative fulfillment models emerging across China. Omnichannel logistics solutions enable retailers to fulfill orders from any inventory location, including traditional warehouses, dark stores, and retail locations. JD.com's integrated logistics network connects over 800 warehouses with 7,000+ pickup stations and delivery partners, creating a seamless experience that reduces delivery times to under 24 hours for 90% of orders.

Livestream commerce creates unpredictable logistics demands with sudden inventory spikes. Leading logistics providers now offer specialized services for influencer marketing campaigns, with dedicated warehouse sections and priority fulfillment channels for flash sales. These systems can process 100,000+ orders within minutes following popular livestream events, with predictive inventory algorithms ensuring product availability based on forecasted demand patterns.

Conclusion

Leveraging China's warehouse and logistics solutions offers your business a competitive edge in today's global marketplace. The combination of strategic locations near major transport networks cost-effective operations and cutting-edge technology creates unparalleled efficiency for international trade.

As China continues to invest in digital infrastructure sustainable practices and cross-border e-commerce capabilities your business can tap into an evolving ecosystem that streamlines supply chain management from end to end.

By partnering with the right logistics provider in China you'll not only navigate regulatory complexities with ease but also position your business to capitalize on emerging trends like smart logistics and integrated retail solutions. China's logistics landscape isn't just about moving products—it's your gateway to sustainable global growth and enhanced customer satisfaction.

Frequently Asked Questions

Why is China considered a leader in warehouse and logistics solutions?

China has emerged as a leader in warehouse and logistics due to its manufacturing dominance, advanced infrastructure, and strategic location. The country offers sophisticated supply chain ecosystems with competitive storage costs, cutting-edge inventory management systems, and facilities strategically positioned near major transportation hubs. These advantages help businesses reduce operational costs by 15-30% compared to Western markets while improving delivery times to global customers.

What technological advancements have transformed China's warehousing industry?

China's warehousing industry has been revolutionized by automation, robotics, IoT, AI, and cloud computing. JD.com's fully automated fulfillment center in Shanghai exemplifies this transformation. These technologies enable real-time inventory management, predictive analytics for demand forecasting, and automated sorting systems that significantly reduce errors and processing times. This digital integration has transformed traditional warehousing into highly efficient, data-driven operations with enhanced supply chain visibility.

How has e-commerce affected China's warehouse facilities?

E-commerce has dramatically transformed Chinese warehousing, driving the development of specialized fulfillment centers designed to handle high volumes of individual orders rather than bulk shipments. These facilities feature advanced sorting systems, efficient picking processes, and optimized layouts for rapid order processing. They're specifically configured to support fast-paced order fulfillment and effective last-mile delivery solutions, which are critical for meeting consumer expectations for quick shipping.

What are the main logistics hubs in China?

China's primary logistics hubs include the Shanghai and Yangtze River Delta region (supporting 40% of international trade), the Guangdong-Hong Kong-Macau Greater Bay Area (processing 30% of export cargo), and the Beijing-Tianjin-Hebei Economic Zone (serving 300+ million consumers). These regions feature state-of-the-art warehouse facilities with multi-modal transportation connections, advanced technology integration, and strategic positioning near major ports and transportation networks.

What regulatory challenges exist in China's logistics landscape?

Navigating China's logistics regulations requires understanding complex customs documentation, clearance procedures, and transportation regulations. Businesses must manage proper import-export documentation, follow systematic customs clearance processes, and ensure compliance with specific transportation and storage regulations. Working with licensed logistics partners who understand these requirements is essential for avoiding delays and penalties while taking advantage of benefits offered by Free Trade Zones.

How should businesses select a warehouse and logistics partner in China?

When choosing a logistics partner in China, evaluate their infrastructure capacity, industry experience, technology integration, and financial stability. Assess their warehouse size, geographic coverage, and familiarity with your product handling requirements. Establish clear service level agreements (SLAs), negotiate flexible pricing structures, and include termination clauses. Ensure transparency in pricing and include provisions for technology updates and intellectual property protection.

What role do Free Trade Zones play in China's logistics system?

Free Trade Zones (FTZs) significantly simplify customs procedures and offer valuable tax benefits. Within these zones, goods can be imported, stored, and re-exported without immediate customs clearance or duty payments. FTZs also permit value-added processing before goods enter the domestic market or are exported internationally. These zones reduce administrative burdens, lower operational costs, and provide greater flexibility for international businesses managing inventory and distribution in China.

What future trends are shaping China's logistics landscape?

Key trends include digital transformation through 5G networks and blockchain technology; green logistics with electric vehicles and eco-friendly practices; specialized cross-border e-commerce infrastructure including bonded warehouses; innovations in last-mile delivery such as autonomous vehicles and community-based distribution; and integration with new retail concepts like omnichannel solutions and livestream commerce. These developments are creating new challenges and opportunities for logistics providers serving global markets.