Key Takeaways

- A Certificate of Origin (CO) is an official document that verifies where goods were manufactured or produced, serving as a crucial "passport" for products in international trade.

- There are several types of COs including non-preferential (standard), preferential (for reduced tariffs under trade agreements), electronic, and self-certified declarations, each serving different purposes.

- Properly documented COs can reduce duty payments by 5-35% and accelerate customs clearance by 2-3 days, making them vital for cost efficiency and supply chain management.

- To obtain a CO, exporters need supporting documentation including commercial invoices, manufacturing records, and supplier declarations, then submit applications to chambers of commerce or relevant authorities.

- Digital Certificates of Origin (eCOs) represent the future of trade documentation, reducing processing time by 60-70% and costs by 30-50% while enhancing security through blockchain technology.

- Best practices for managing COs include establishing systematic documentation processes, maintaining comprehensive supplier records, leveraging technology solutions, and conducting regular internal audits.

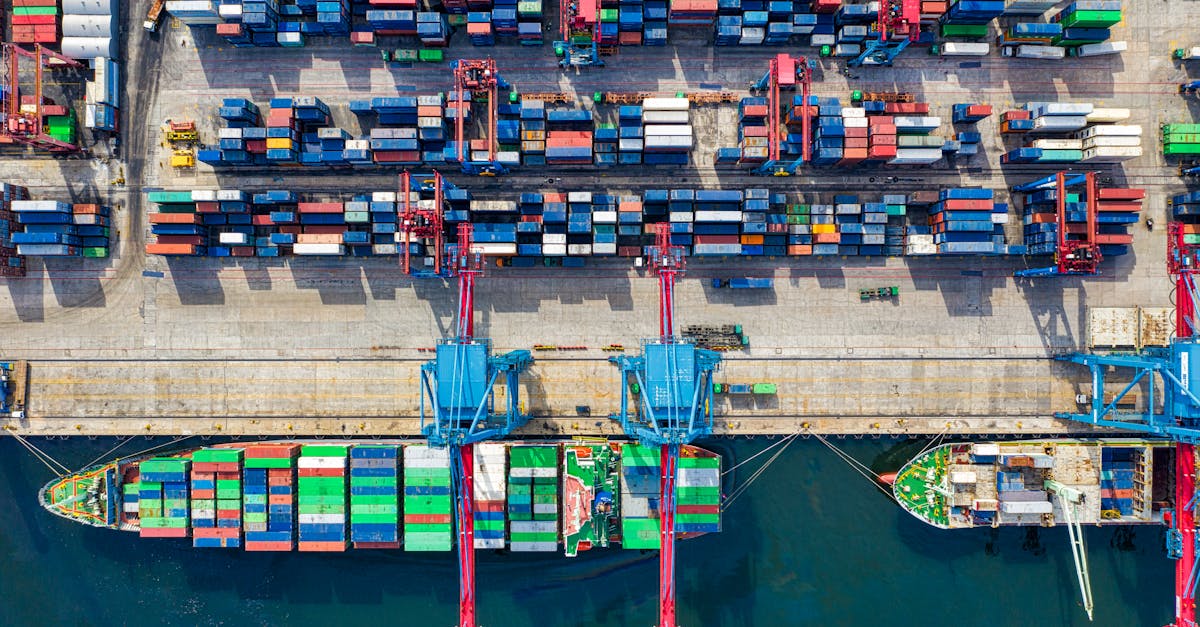

Navigating international trade requires careful attention to documentation, and few papers carry as much weight as a Certificate of Origin. This essential document verifies where your goods were manufactured or produced, playing a crucial role in determining applicable tariffs, duties, and whether your products qualify for preferential treatment under trade agreements.

When you're shipping products internationally, customs officials need to know exactly where those items originated—not just where they're coming from. Without proper origin documentation, your shipments may face delays, higher duty rates, or even rejection at the border. The difference between having the correct certificate and missing this vital paperwork can significantly impact your bottom line and customer relationships.

What Is a Certificate of Origin in International Trade

A Certificate of Origin (CO) is an official document that verifies the country where goods were manufactured, produced, or underwent substantial transformation. This critical trade document serves as a passport for your products, confirming their economic nationality in the international marketplace. Customs authorities in importing countries rely on COs to determine applicable tariff rates, duty assessments, and eligibility for preferential treatment under various trade agreements.

The certificate typically includes:

- Details about the exporter and importer

- Description of the goods being shipped

- Country of manufacture

- Declaration certifying the origin information

- Official stamps or signatures from authorized issuing bodies

COs come in several formats depending on the specific requirements of the destination country or applicable trade agreement. The most common types include:

- Non-preferential COs: Standard certificates used for general trade that don't qualify for reduced tariffs under special agreements

- Preferential COs: Specialized certificates for goods qualifying for reduced duties under Free Trade Agreements (FTAs) or other preferential arrangements

- Electronic COs: Digital versions accepted by countries embracing paperless trade systems

- Self-certified declarations: Statements of origin provided directly by authorized exporters in certain cases

In today's complex global trade landscape, accurate origin documentation is more than just a procedural requirement—it's a strategic business tool that can significantly impact your bottom line through proper duty optimization and trade agreement utilization.

Types of Certificates of Origin

Certificates of Origin come in several distinct formats, each serving specific purposes in international trade. Understanding these different types helps exporters select the appropriate documentation for their specific shipping requirements and trade agreement benefits.

Preferential Certificates of Origin

Preferential Certificates of Origin enable goods to receive reduced or zero tariff rates when imported into countries that have established Free Trade Agreements (FTAs) or special trade arrangements. These certificates verify that products meet the specific rules of origin criteria outlined in these agreements. For example, under the United States-Mexico-Canada Agreement (USMCA), certain automotive products must contain 75% North American content to qualify for duty-free treatment. Exporters must complete forms like EUR.1 for EU trade partners, Form A for Generalized System of Preferences (GSP) beneficiaries, or agreement-specific certificates such as USMCA certification. The economic benefit of preferential COs is substantial - they can reduce duty payments by 5-35% depending on the product and agreement.

Non-Preferential Certificates of Origin

Non-Preferential Certificates of Origin serve as standard documentation of a product's origin without conferring any special tariff benefits. These certificates are typically issued by chambers of commerce and are used for products traded between countries without established trade agreements. They're essential for customs clearance, statistical purposes, and compliance with import regulations such as anti-dumping measures or import quotas. Common uses include meeting documentation requirements for letters of credit, satisfying country-specific import regulations, and providing transparency in global supply chains. Unlike preferential COs, these certificates focus solely on identifying where goods were produced or substantially transformed without applying complex rules of origin calculations or value-added requirements.

The Importance of Certificates of Origin in Global Commerce

Certificates of Origin (COs) serve as pivotal documents in international trade operations, functioning as the passport for goods crossing borders. These documents validate a product's economic nationality, directly influencing how shipments are processed and taxed at customs checkpoints worldwide.

Tariff Benefits and Trade Agreements

COs enable businesses to maximize financial advantages through preferential tariff rates established in trade agreements. When exporting products to countries with Free Trade Agreements (FTAs), properly documented origin certificates can reduce duty payments by 5-35% compared to standard rates. For example, automotive parts exported from Mexico to Canada under USMCA qualification may be eligible for zero duties instead of the standard 6% tariff. Major agreements like the EU-Japan Economic Partnership Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) offer significant duty reductions of up to 100% for qualifying goods with correct origin documentation. These savings transform into competitive pricing advantages and higher profit margins for exporters who maintain proper origin compliance programs.

Customs Clearance Facilitation

Properly prepared Certificates of Origin streamline the customs clearance process by providing verification of goods' provenance at international borders. Customs authorities prioritize shipments with complete and accurate origin documentation, often processing them 2-3 days faster than those with incomplete paperwork. Advanced electronic COs linked to customs systems in countries like Singapore, South Korea, and Australia enable nearly instantaneous verification, reducing clearance times by up to 80%. Without valid origin certificates, shipments face heightened scrutiny, including physical inspections that occur in approximately 28% of cases with documentation discrepancies. These inspections extend clearance times by 5-7 business days on average and increase holding costs by $150-300 per day in most major ports. The financial impact compounds with potential contractual penalties for delayed deliveries, making proper origin certification a critical element in maintaining efficient global supply chains.

How to Obtain a Certificate of Origin

Obtaining a Certificate of Origin involves gathering specific documentation and following a standardized application process. Companies engaged in international trade must familiarize themselves with these procedures to ensure their goods move smoothly through customs checkpoints worldwide.

Required Documentation

The documentation required for a Certificate of Origin application includes primary business identification and product-specific papers. You'll need to prepare your commercial invoice, packing list, and bill of lading or airway bill as supporting trade documents. Manufacturing records demonstrating where value-added processes occurred are essential, particularly for preferential certificates requiring specific regional content percentages. Companies must also provide a manufacturer's affidavit or supplier's declaration for goods incorporating components from multiple sources. For certain industries such as textiles, chemicals, or automotive parts, additional documentation like production process flowcharts or bills of materials may be necessary to verify compliance with origin rules.

Application Process

The Certificate of Origin application process varies based on the issuing authority and certificate type. You start by completing the appropriate CO form, which is available through chambers of commerce, trade associations, or electronic trade platforms. For non-preferential certificates, submit your completed application and supporting documentation to your local chamber of commerce, where processing typically takes 1-3 business days. Preferential certificates often require submission to customs authorities or designated government agencies, with processing times ranging from 3-10 business days depending on complexity. Electronic CO applications through platforms like eCertify or essCert streamline the process, reducing issuance time to 24-48 hours in many jurisdictions. After verification of your documentation, the authorized body issues your certificate with official stamps, signatures, or electronic validation to authenticate its legitimacy for international customs authorities.

Common Challenges With Certificates of Origin

Despite their critical importance in international trade, Certificates of Origin often present significant challenges for exporters and importers. These obstacles can disrupt supply chains, increase costs, and delay shipments if not properly managed.

Verification Issues

Certificate of Origin verification problems frequently derail shipment timelines and create costly delays. Customs authorities routinely flag documents with inconsistencies between the CO information and supporting documentation like commercial invoices or bills of lading. For example, discrepancies in product descriptions, HS codes, or quantities trigger additional verification steps, adding 3-5 business days to clearance times. Third-party verification requirements in countries like Brazil, Saudi Arabia, and Egypt further complicate the process, as these nations mandate authentication by their consulates or designated verification bodies. Additionally, electronic verification systems sometimes experience technical incompatibilities between different countries' platforms, creating digital bottlenecks that prevent smooth information exchange.

Compliance Requirements

Navigating compliance requirements for Certificates of Origin creates substantial administrative burdens for many exporters. Each trade agreement establishes unique rules of origin with specific regional value content thresholds—ranging from 35% under NAFTA successor USMCA to 60% under certain ASEAN agreements. Manufacturing changes, even minor supplier substitutions, can unexpectedly disqualify products from preferential treatment, potentially increasing duties by 5-25% overnight. Record-keeping mandates also pose challenges, with many jurisdictions requiring businesses to maintain origin documentation for 5-7 years after shipment and subject to audit. Companies operating across multiple trade agreements face particularly complex compliance landscapes, often needing specialized software or dedicated compliance teams to manage the varying requirements across different export markets.

Digital Certificates of Origin: The Future of Trade Documentation

Digital Certificates of Origin (eCOs) represent a transformative shift in how trade documentation is processed, verified, and managed across global supply chains. These electronic documents serve the same purpose as their paper counterparts but offer enhanced efficiency, security, and accessibility through digital technology integration.

How Digital Certificates Work

Digital Certificates of Origin operate through secure electronic platforms that connect exporters, importers, chambers of commerce, and customs authorities. The International Chamber of Commerce (ICC) reports that eCOs reduce processing time by 60-70% compared to paper documents. These systems incorporate digital signatures and blockchain technology to verify authenticity, creating tamper-proof records accessible to all authorized parties in the supply chain.

Electronic certificates use three core technologies:

- Digital signatures: Cryptographic validation tools that ensure document authenticity

- Blockchain registries: Immutable ledgers recording certificate issuance and changes

- API integration: Connection points with customs systems and trade platforms

Benefits for Exporters and Importers

Digital Certificates of Origin deliver substantial operational advantages for businesses engaged in international trade. Companies implementing eCOs report average processing cost reductions of 30-50% per certificate. The electronic format eliminates courier fees, reduces administrative labor, and minimizes error rates from 5% with paper certificates to less than 0.5% with digital versions.

Key benefits include:

- Accelerated processing time: Applications processed in minutes rather than days

- Error reduction: Automated validation checks prevent common documentation mistakes

- Enhanced traceability: Complete digital audit trails for compliance verification

- Remote accessibility: 24/7 access to apply for, receive, and share certificates

- Environmental impact: Elimination of paper consumption and transportation emissions

Global Implementation Status

The adoption of Digital Certificates of Origin varies significantly across regions and trade blocs. The Pan-Asian E-Commerce Alliance currently connects 13 Asian economies through a paperless trading system that processes over 75 million eCOs annually. The European Union's Single Window environment has integrated eCO capabilities in 19 member states, with full implementation planned by 2025.

Leading digital certificate initiatives include:

- ICC Digital ATA Carnet: Electronic temporary import documentation system

- ASEAN Single Window: Regional platform connecting Southeast Asian nations

- African Continental Free Trade Area (AfCFTA): Developing continental eCO framework

Integration with Blockchain and AI

Next-generation Digital Certificates of Origin leverage blockchain technology and artificial intelligence to further enhance verification capabilities. IBM's TradeLens platform, developed with Maersk, has processed over 500 million shipping events with blockchain-verified documentation. These systems create immutable records that prevent certificate tampering and duplication.

AI integration enables:

- Automated rules of origin calculations: Systems that determine eligibility for preferential treatment

- Predictive compliance analysis: Identification of potential certification issues before submission

- Real-time verification: Instantaneous authentication of certificates at border crossings

- Data analytics: Pattern recognition to detect fraudulent documentation attempts

Digital Certificates of Origin represent a critical evolution in trade facilitation, reducing barriers through technology while maintaining the essential verification functions that underpin global commerce.

Best Practices for Managing Certificates of Origin

Establish a Systematic Documentation Process

A systematic documentation process forms the foundation of effective Certificate of Origin management. Create a centralized digital repository where all origin documentation, supporting evidence, and application templates are stored and easily accessible. Implement standardized naming conventions for files to ensure quick retrieval when customs authorities request verification. Develop detailed process maps for each export market, outlining the specific certificate requirements and steps for obtaining proper documentation. Companies like General Electric have reduced documentation errors by 45% by implementing standardized digital workflows for their origin certification processes.

Maintain Comprehensive Supplier Records

Comprehensive supplier records provide critical support for origin claims. Document your supply chain thoroughly by collecting manufacturer's affidavits, raw material origin statements, and production process descriptions from all suppliers. Update these records annually or whenever supplier relationships change to maintain accuracy. Create a supplier questionnaire that captures specific origin-relevant information, including manufacturing locations, HS codes for components, and value breakdown of materials. These detailed records serve as your defense during origin verification audits and simplify the certificate application process.

Leverage Technology Solutions

Technology solutions streamline Certificate of Origin management through automation and integration. Implement specialized trade compliance software that can automatically determine origin qualification based on bill of materials data and applicable trade rules. Connect your enterprise resource planning (ERP) system with certificate management platforms to ensure product specifications, supplier information, and manufacturing data flow seamlessly into certificate applications. Cloud-based solutions like Amber Road and Integration Point offer end-to-end management of origin documentation, reducing processing time by up to 75% and virtually eliminating repetitive data entry errors.

Conduct Regular Internal Audits

Regular internal audits verify the accuracy of your origin determination processes. Schedule quarterly reviews of your certificate management system, examining a sample of issued certificates against their supporting documentation. Create an audit checklist covering key compliance points such as correct product classification, accurate value calculations, and proper application of origin rules. Document discrepancies discovered during audits and implement corrective actions to prevent recurrence. These proactive assessments protect your company from penalties that can reach up to 20% of shipment value in some jurisdictions for origin documentation violations.

Invest in Staff Training

Staff training ensures your team understands the intricacies of origin determination and certification. Develop a comprehensive training program covering the fundamentals of rules of origin, documentation requirements, and verification procedures for different trade agreements. Conduct specialized workshops for employees directly involved in export documentation, focusing on practical application of origin rules to your specific product portfolio. Schedule regular refresher courses to keep staff updated on regulatory changes and new electronic certificate platforms. Companies that invest in regular training report 63% fewer certificate rejections at customs checkpoints compared to those without formalized training programs.

Create Clear Standard Operating Procedures (SOPs)

Clear standard operating procedures provide step-by-step guidance for certificate management. Develop detailed SOPs covering each aspect of the certification process, from initial origin determination to document retention after shipment. Include decision trees that help staff navigate complex origin scenarios based on product specifications and destination markets. Outline escalation procedures for handling unusual situations or customs challenges. These documented procedures ensure consistency across your organization and provide crucial continuity when experienced staff members leave or transfer to different roles.

Monitor Regulatory Changes

Regulatory changes impact origin requirements and certification processes in international trade. Subscribe to trade compliance newsletters, customs authority updates, and chamber of commerce bulletins to stay informed about evolving regulations. Assign specific team members to monitor changes in key export markets and report relevant updates to your compliance department. Create a regulatory change management process that evaluates the impact of new rules on your current certification procedures and implements necessary adjustments. This proactive monitoring prevents compliance gaps that could result in shipment delays or unexpected duty assessments.

Conclusion

Certificates of Origin are essential tools in your international trade toolkit not merely bureaucratic requirements. They serve as your products' passport opening doors to preferential tariff rates competitive advantages and expedited customs clearance.

As global commerce evolves digital Certificates of Origin are revolutionizing documentation processes reducing processing times by up to 70% while enhancing security and accessibility.

By implementing systematic documentation processes maintaining comprehensive records and leveraging technology solutions you'll navigate origin certification more efficiently. Your attention to CO compliance doesn't just avoid penalties and delays it creates strategic advantages that directly impact your bottom line.

In today's interconnected marketplace mastering Certificates of Origin isn't optional—it's a crucial component of successful international trade strategy.

Frequently Asked Questions

What is a Certificate of Origin (CO)?

A Certificate of Origin is an official document that verifies the economic nationality of products in international trade. It includes details about the exporter and importer, description of goods, country of manufacture, and official validations. This document is essential for determining applicable tariffs, duties, and eligibility for preferential treatment under trade agreements.

What's the difference between Preferential and Non-Preferential Certificates of Origin?

Preferential COs enable goods to qualify for reduced or zero tariff rates under Free Trade Agreements by verifying compliance with specific rules of origin. Non-Preferential COs serve as standard documentation of a product's origin without providing special tariff benefits, primarily used for customs clearance and regulatory compliance.

How do Certificates of Origin impact customs clearance?

Properly prepared COs streamline customs clearance by verifying goods' provenance. Shipments with complete documentation are typically processed 2-3 days faster than those with incomplete paperwork. Advanced electronic COs can enable nearly instantaneous verification, while shipments lacking valid certificates face heightened scrutiny, delays, and increased costs.

What documents are needed to obtain a Certificate of Origin?

Companies need business identification documents, commercial invoices, packing lists, and bills of lading. For preferential certificates, manufacturing records demonstrating value-added processes may be required. The specific requirements vary by issuing authority and certificate type.

What are Digital Certificates of Origin (eCOs)?

Digital Certificates of Origin are electronic versions of traditional COs that enhance efficiency, security, and accessibility through digital technology. They operate through secure platforms connecting all stakeholders, reducing processing time by 60-70% compared to paper documents, and utilize digital signatures and blockchain technology to ensure authenticity.

What benefits do eCOs offer exporters and importers?

eCOs provide accelerated processing times, significant cost reductions, error minimization, enhanced traceability, remote accessibility, and positive environmental impact. They streamline trade documentation processes and integrate with customs systems for faster clearance.

What challenges do companies face with Certificates of Origin?

Common challenges include verification issues where inconsistencies can lead to costly delays, complex compliance requirements with unique rules of origin varying by trade agreement, and substantial administrative burdens. These complexities often require specialized software or dedicated compliance teams to manage effectively.

What best practices should companies follow for managing Certificates of Origin?

Companies should implement systematic documentation processes, maintain comprehensive supplier records, leverage technology solutions, conduct regular internal audits, invest in staff training, create clear standard operating procedures, and monitor regulatory changes. These practices help streamline CO management and ensure compliance.

How much can proper Certificate of Origin documentation save in duties?

Properly documented COs can reduce duty payments by 5-35% through preferential tariff rates established in trade agreements. This translates into competitive pricing advantages and higher profit margins for exporters, making origin documentation a strategic business tool that significantly impacts a company's bottom line.

How is the global implementation of eCOs progressing?

Implementation varies globally, with initiatives like the Pan-Asian E-Commerce Alliance and the European Union's Single Window environment leading adoption. Next-generation eCOs are integrating blockchain and AI technologies to enhance verification capabilities, enable automated calculations, and provide real-time verification.