Navigating the complex logistics landscape of the Middle East requires exceptional freight forwarding strategies. The region's unique geographical position connecting Europe, Asia, and Africa has transformed it into a crucial global trade hub, making success stories in this market particularly valuable for industry professionals.

In this article, you'll discover real-world case studies of freight forwarding companies that have mastered the Middle Eastern market. From overcoming regulatory challenges in Saudi Arabia to implementing cutting-edge tracking systems in the UAE, these examples demonstrate how innovation and regional expertise create logistical excellence. These success stories provide actionable insights you can apply to your own freight forwarding operations across this dynamic and rapidly evolving region.

The Growing Importance of Freight Forwarding in the Middle East

The Middle East freight forwarding sector has transformed dramatically over the past decade, evolving from a regional service industry to a global logistics powerhouse. This transformation stems from several economic and infrastructural developments that have positioned the region as a critical nexus in international supply chains.

Strategic Geographic Position

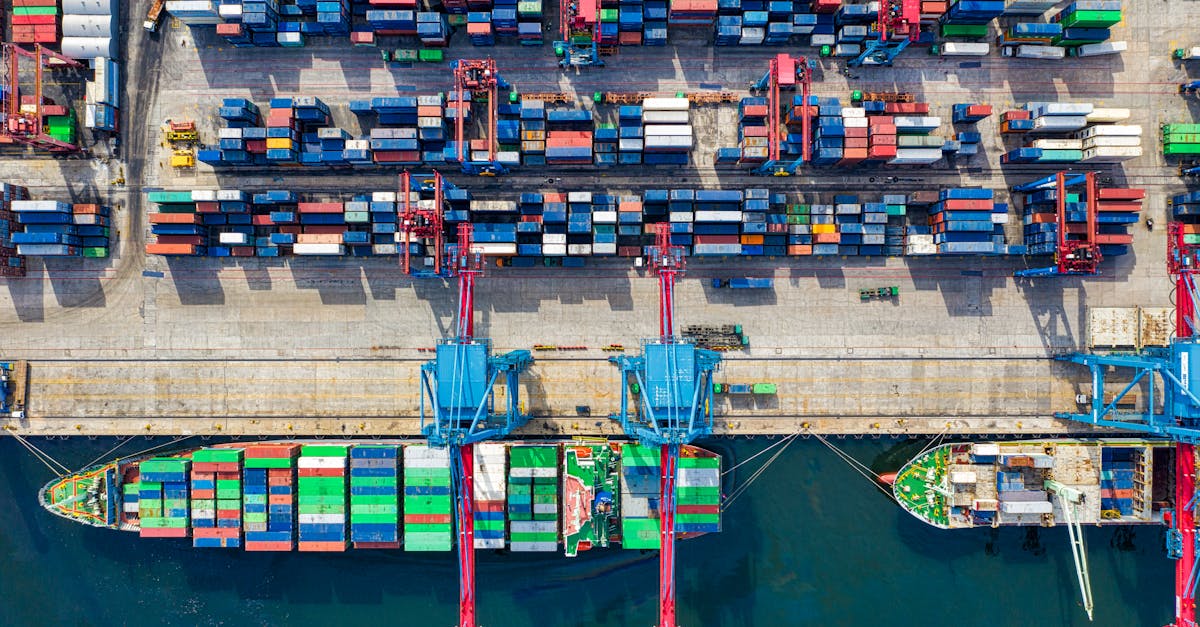

The Middle East's geographic advantage sits at the crossroads of Europe, Asia, and Africa, making it an ideal transit hub for global trade. Countries like the UAE, Saudi Arabia, and Qatar have capitalized on this position by developing sophisticated port infrastructure and air cargo facilities. Dubai's Jebel Ali Port, handling over 14.1 million TEUs annually, exemplifies how strategic location combined with world-class facilities drives freight forwarding success.

Economic Diversification Initiatives

Middle Eastern nations have aggressively pursued economic diversification beyond oil dependence, creating new opportunities for freight services. Saudi Arabia's Vision 2030 and the UAE's Economic Vision 2030 have specifically targeted logistics sector growth through:

- Reduced customs processing times from days to hours

- Streamlined documentation requirements across GCC countries

- Privatization of previously state-controlled logistics operations

- Zone-specific incentives for freight forwarders in special economic zones

These initiatives have attracted major international logistics players like DHL, Maersk, and Kuehne+Nagel to expand their Middle East operations significantly since 2018.

Technological Adoption in Regional Logistics

Middle Eastern freight forwarders have embraced digital transformation at remarkable speeds. The adoption of blockchain, IoT, and AI technologies has revolutionized traditional freight operations in the region. The Dubai Blockchain Strategy launched in 2016 has eliminated over 100 million paper documents annually in trade documentation, creating a fully digitized freight ecosystem that reduces processing times by 91% compared to traditional methods.

Shifting Trade Patterns Post-Pandemic

The COVID-19 pandemic reshaped global supply chains, with the Middle East emerging as a resilient alternative to traditional routes. E-commerce explosion in the region—growing at 28% annually since 2020—has created unprecedented demand for specialized freight forwarding services. Regional players like Aramex and Emirates Logistics have developed dedicated e-commerce fulfillment solutions that integrate seamlessly with last-mile delivery networks across previously challenging markets like Iraq and Lebanon.

Sustainability Focus in Regional Operations

Environmental concerns have gained prominence in Middle Eastern freight operations, with carbon footprint reduction becoming a competitive advantage. Saudi Arabian logistics firms have reduced CO2 emissions by an average of 17% since 2019 through fleet modernization and route optimization. The Green Shipping Initiative in Oman has established the first carbon-neutral shipping lanes in the Gulf, creating premium service offerings for environmentally conscious global shippers seeking sustainable transit options through the region.

Key Challenges in Middle East Logistics

The Middle East freight forwarding industry faces distinct operational hurdles despite its strategic advantages. These challenges require specialized approaches and deep regional understanding to overcome effectively.

Geopolitical Considerations

Geopolitical tensions significantly impact logistics operations across the Middle East. Regional conflicts in Yemen, Syria, and parts of Iraq create unpredictable shipping routes, forcing freight forwarders to implement dynamic route planning. Trade blockades, such as the Qatar diplomatic crisis (2017-2021), disrupted established supply chains and required companies to develop alternative transportation networks overnight. Ongoing maritime security concerns in the Strait of Hormuz affect approximately 21% of global oil shipments, compelling logistics providers to factor in additional security costs and insurance premiums. Successful freight forwarders like Aramex have addressed these challenges by establishing robust risk assessment protocols and maintaining flexible routing options across multiple countries to ensure business continuity during political disruptions.

Regulatory Complexities

The Middle East's regulatory landscape presents a patchwork of varying compliance requirements across different countries. Import documentation differs substantially between nations, with Saudi Arabia requiring 5-7 separate documents while the UAE has streamlined its process to 3-4 essential forms. customs clearance timelines range from 1-2 days in Dubai to 5-7 days in certain Iraqi ports, creating planning challenges for cross-regional shipments. Tariff structures change frequently, particularly in countries implementing economic diversification programs, requiring freight forwarders to maintain dedicated compliance teams. Foreign ownership restrictions in Kuwait and Oman limit operational models for international logistics companies, necessitating local partnerships. Advanced freight companies like Gulf Agency Company (GAC) have overcome these hurdles by developing country-specific operation manuals and implementing specialized digital platforms that automatically adjust documentation requirements based on shipment origin and destination, reducing clearance delays by up to 40%.

Case Study: DP World's Innovative Supply Chain Solutions

DP World has transformed Middle East freight forwarding through its cutting-edge logistics solutions and strategic infrastructure investments. This Dubai-based global port operator demonstrates how innovation and operational excellence create exceptional value in the competitive logistics landscape.

Jebel Ali Port Success Story

Jebel Ali Port represents one of DP World's most significant achievements in revolutionizing regional freight handling capabilities. As the largest man-made harbor in the world and the busiest port in the Middle East, it handles over 15 million TEUs (Twenty-foot Equivalent Units) annually. The port's strategic location connects East-West trade routes with 80+ weekly services linking 140 ports globally. Its integrated free zone offers businesses tax exemptions, full foreign ownership, and simplified customs procedures—creating a seamless ecosystem where goods move efficiently from port to market. Companies operating within this ecosystem report 35% reduction in supply chain costs and 25% faster delivery times compared to traditional logistics models.

Technology Integration Strategy

DP World's competitive edge stems from its comprehensive technology integration across operations. The company has invested $4 billion in digital transformation initiatives over the past five years, focusing on four key innovations:

- Blockchain implementation - DP World's TradeLens platform, developed in partnership with IBM, digitizes shipping documentation and creates transparent supply chains with 60% faster document processing.

- IoT sensors network - More than 50,000 connected devices throughout DP World facilities provide real-time cargo tracking, temperature monitoring, and condition reporting with 99.8% accuracy.

- AI-powered logistics planning - Their proprietary CARGOES platform optimizes container stacking, vessel berthing, and truck movements, reducing terminal waiting times by 70%.

- Automated port operations - At Jebel Ali Terminal 2, remote-controlled quay cranes and automated guided vehicles handle containers without human intervention, improving operational efficiency by 30% while reducing carbon emissions by 25%.

These technological investments have positioned DP World as a model for how traditional freight forwarding can evolve into intelligent, data-driven supply chain management—crucial for companies seeking competitive advantages in the Middle East logistics market.

Case Study: Aramex's Regional Expansion Model

Aramex has emerged as a standout success story in Middle Eastern logistics, transforming from a local operation to a global logistics provider with operations in over 65 countries. Their strategic approach to regional expansion has created a blueprint for logistics companies seeking growth in emerging markets.

Cross-Border Delivery Excellence

Aramex's cross-border delivery system revolutionized package movement throughout the MENA region. By establishing a centralized clearance hub in Bahrain with satellite operations in key markets like Saudi Arabia, UAE, and Egypt, Aramex reduced customs processing time by 43% between 2015-2020. Their proprietary "BorderLink" system connects directly with customs authorities in 12 regional countries, pre-clearing shipments before physical arrival. This integration enabled Aramex to process over 35 million cross-border shipments in 2022 alone, maintaining a 94.7% on-time delivery rate despite regional complexities. The company's cross-border excellence stems from their dual approach: investing in technology while simultaneously building relationships with regulatory authorities to streamline documentation requirements.

Last-Mile Delivery Optimization

Aramex tackled the Middle East's notoriously challenging last-mile delivery environment through innovative solutions tailored to local conditions. Their "SPOT" network - comprising over 3,000 neighborhood pickup points across 8 countries - solved the addressing system inadequacies common in rapidly developing urban centers. This network reduced failed delivery attempts by 62% since implementation in 2018. Aramex's mobile app utilizes dynamic geolocation instead of traditional addresses, allowing customers to share precise delivery locations through WhatsApp integration, a feature particularly valuable in areas lacking formal addressing systems. The company's fleet management platform optimizes routes based on real-time traffic conditions, driver expertise, and historical delivery patterns, cutting delivery times by 27% in dense urban areas like Cairo and Riyadh. Their data shows that 76% of regional e-commerce deliveries now reach customers within 48 hours, compared to industry averages of 72-96 hours.

Case Study: Agility Logistics' Specialized Services

Agility Logistics has established itself as a leading freight forwarder in the Middle East through its specialized service offerings. The company's tailored approach to industry-specific challenges has resulted in measurable success across different sectors.

Oil and Gas Sector Transportation

Agility Logistics' oil and gas transportation services showcase the company's expertise in handling complex industry requirements. Their dedicated Oil & Gas division manages over 500,000 metric tons of equipment annually across the Middle East, with a 99.7% on-time delivery rate. The company has developed specialized transportation solutions for critical equipment like drill bits, wellheads, and production chemicals, implementing custom-designed containers that reduce damage risk by 78% compared to standard shipping methods.

In Saudi Arabia, Agility partnered with Saudi Aramco to create a dedicated supply chain corridor between Dammam and key production sites, reducing transit times by 35% and lowering operational costs by $4.2 million annually. Their temperature-controlled transportation system maintains sensitive chemicals within ±0.5°C of required temperatures, even in extreme desert conditions where temperatures exceed 50°C.

Agility's digital tracking platform provides real-time visibility for oil and gas clients, with location updates every 15 minutes and immediate alerts for any deviations from planned routes or temperature fluctuations. This comprehensive approach has helped clients maintain production schedules during critical maintenance periods and expansion projects.

Project Cargo Handling

Agility's project cargo handling capabilities have established new benchmarks in the Middle East's logistics sector. The company specializes in moving oversized and heavy equipment, managing projects with individual components weighing up to 800 tons and measuring 100+ meters in length. Their project cargo division completed 37 major industrial installations across the UAE, Qatar, and Saudi Arabia in the past three years, with zero safety incidents.

For a major petrochemical plant in Jubail, Saudi Arabia, Agility orchestrated the transportation of 75 oversized reactor vessels from South Korea, coordinating specialized vessels, custom-built road transporters, and temporary infrastructure modifications. The project reduced expected completion time by 45 days, saving the client approximately $15 million in potential production delays.

Agility employs advanced 3D simulation software to pre-plan complex moves, identifying potential obstacles and creating detailed route surveys before equipment arrives. Their team of 150+ specialized project cargo engineers develops custom lifting and securing solutions for each project, addressing unique challenges posed by the Middle East's infrastructure and climate conditions.

The company maintains a dedicated fleet of multi-axle trailers, specialized cranes, and self-propelled modular transporters (SPMTs) specifically designed for the region's terrain. This equipment arsenal enabled Agility to successfully deliver six 150-ton gas turbines to a remote power plant in Oman's desert region, navigating 120 kilometers of unpaved roads and constructing temporary bridges over wadis.

Best Practices from Successful Middle East Freight Forwarders

The most successful freight forwarding companies in the Middle East share common operational strategies that drive their exceptional performance. These best practices offer valuable insights for logistics professionals looking to enhance their operations in this dynamic market.

Strategic Infrastructure Investments

Strategic infrastructure investments form the foundation of top-performing Middle East freight forwarders. Companies like DP World leverage their $4 billion infrastructure development program to create competitive advantages through purpose-built facilities. Leading firms strategically position warehouses and distribution centers near major transportation hubs, reducing transportation time by up to 40% and operational costs by 25-30%. They also establish regional consolidation centers in key markets such as Dubai, Riyadh, and Jeddah, enabling more efficient cross-border shipments and creating economies of scale. These investments extend to specialized storage facilities for temperature-sensitive goods, pharmaceuticals, and hazardous materials—essential capabilities in the region's diverse logistics landscape.

Digital Transformation Initiatives

Digital transformation initiatives distinguish market leaders from competitors in the Middle East freight forwarding sector. Top performers implement integrated transportation management systems (TMS) that connect all logistics functions, resulting in 35% improved operational efficiency and 28% cost reduction. Real-time tracking capabilities, powered by IoT sensors and GPS technology, provide customers with minute-by-minute shipment status updates across air, sea, and land transportation modes. Blockchain technology adoption streamlines documentation processes, reducing customs clearance times from days to hours and minimizing paperwork errors by 90%. Leading companies also leverage AI-driven analytics for route optimization, carrier selection, and demand forecasting, with Aramex's AI implementation reducing delivery times by 22% and fuel consumption by 15%. Customer-facing digital platforms, featuring self-service booking, real-time tracking, and automated documentation, have increased client satisfaction rates by up to 40% while reducing customer service inquiries by 60%.

Future Trends in Middle East Freight Forwarding

The Middle East freight forwarding industry is evolving rapidly, with emerging technologies and changing global trade patterns shaping its future. Several key trends are poised to transform logistics operations across the region in the coming years.

Digital Transformation and Technology Integration

Digital transformation is revolutionizing Middle East freight forwarding, with 78% of regional logistics companies increasing their technology investments since 2022. Advanced platforms now integrate document management, customs clearance, and shipment tracking into unified systems. Companies like Fetchr have implemented AI-powered predictive analytics that reduce delivery exceptions by 35% through anticipating potential delays before they occur.

Blockchain implementation is gaining traction across Gulf ports, with Abu Dhabi Ports' Maqta Gateway platform processing over 100,000 blockchain-verified transactions monthly. This technology reduces documentation processing time from days to minutes while virtually eliminating fraud risks.

Sustainable Logistics Solutions

Environmental sustainability has become a central focus in Middle East freight operations. Saudi Arabia's Green Logistics Initiative aims to reduce the sector's carbon emissions by 30% by 2030, while the UAE has committed $160 million to develop green logistics infrastructure.

Leading companies are adopting:

- Electric delivery vehicles for last-mile operations

- Solar-powered warehousing facilities that reduce energy consumption by up to 40%

- Carbon offset programs for air and sea freight services

- Packaging optimization techniques that reduce material waste by 25-35%

Maersk's investment in biofuel-powered vessels operating from Jebel Ali Port demonstrates how sustainability initiatives are transforming regional shipping operations, reducing emissions by approximately 85% compared to traditional fuel options.

E-commerce Logistics Specialization

E-commerce growth is driving specialized freight forwarding services throughout the Middle East. Regional e-commerce is expanding at 25% annually, creating demand for cross-border solutions that bridge international markets with local delivery networks.

Specialized e-commerce logistics solutions now include:

- Micro-fulfillment centers in urban areas reducing delivery times to under 2 hours

- Customs clearance automation reducing processing delays for cross-border shipments

- Returns management systems streamlining the reverse logistics process

- Integration with major regional marketplaces like Noon and Amazon.ae

Gulf-based forwarders like Aramex have developed dedicated e-commerce divisions handling over 500,000 daily shipments during peak seasons, demonstrating the sector's rapid specialization in this growing segment.

Regional Trade Corridor Development

New trade corridors are reshaping freight movement across the Middle East. The UAE-Israel Abraham Accords have opened direct shipping lanes between Jebel Ali and Haifa ports, reducing transit times by 10-14 days compared to previous indirect routes.

Major developments include:

- The India-Middle East-Europe Economic Corridor reducing shipping times between Mumbai and Europe by approximately 40%

- Saudi Arabia's NEOM project creating advanced logistics zones along the Red Sea

- Oman's development of Duqm Port as an alternative to traditional Strait of Hormuz routes

- Enhanced rail connectivity through the GCC Railway Network connecting six Gulf states

These corridors are creating more resilient supply chains by offering multiple routing options and reducing dependence on traditional shipping lanes affected by regional tensions.

Autonomous and Robotics-Driven Operations

Automation is transforming warehousing and transportation across the Middle East logistics sector. DP World's Terminal 2 at Jebel Ali utilizes semi-automated crane systems that increase container handling efficiency by 30% while reducing labor costs.

Leading implementations include:

- Autonomous guided vehicles (AGVs) in major distribution centers

- Drone delivery services for remote locations and time-sensitive shipments

- Robotic process automation handling 65% of repetitive documentation tasks

- AI-powered route optimization reducing fuel consumption by up to 20%

The UAE's Autonomous Transportation Strategy aims to make 25% of all transportation autonomous by 2030, positioning the region at the forefront of logistics automation globally.

Key Takeaways

- The Middle East has become a strategic global trade hub connecting Europe, Asia, and Africa, with companies like DP World and Aramex demonstrating exceptional freight forwarding success through technology integration and specialized services.

- Successful freight forwarders overcome regional challenges including geopolitical tensions, regulatory complexities, and varied customs requirements by implementing flexible routing options, dedicated compliance teams, and country-specific operation manuals.

- Digital transformation drives competitive advantage in the region, with technologies like blockchain reducing documentation processing from days to minutes, IoT sensors enabling real-time tracking, and AI optimizing operations with up to 30% greater efficiency.

- Strategic infrastructure investments in facilities like Jebel Ali Port and specialized transportation solutions for industries such as oil and gas have enabled companies to reduce supply chain costs by up to 35% and improve delivery times by 25%.

- Future trends reshaping Middle East freight forwarding include sustainability initiatives like electric delivery vehicles and solar-powered warehousing, e-commerce logistics specialization, new regional trade corridors, and the increasing adoption of autonomous operations.

Conclusion

The dynamic Middle East freight forwarding landscape presents both remarkable opportunities and unique challenges. Through innovation adaptability and local expertise companies like DP World Aramex and Agility have established benchmarks for success in this crucial global hub.

You've seen how strategic infrastructure investments digital transformation and specialized industry knowledge create competitive advantages in this region. The continued evolution toward technology-driven sustainable logistics solutions signals an exciting future ahead.

As the Middle East further develops its position at the crossroads of global trade those who embrace these proven strategies will be well-positioned to capitalize on emerging opportunities. The region's transformation into a logistics powerhouse offers valuable lessons applicable to freight operations worldwide.