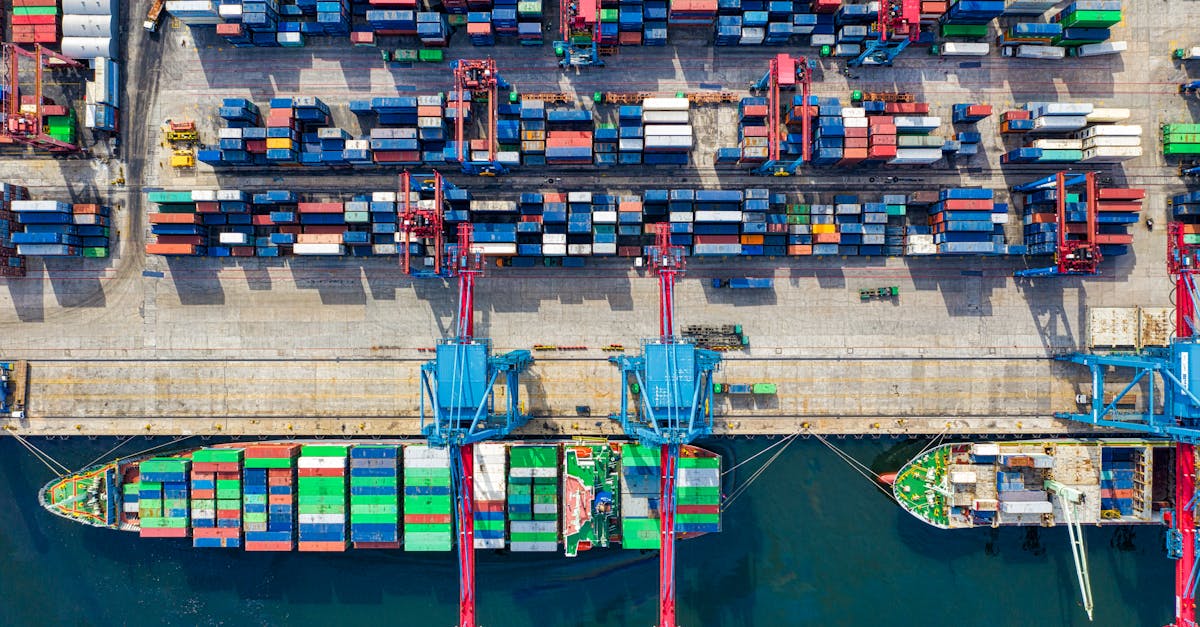

Navigating the complex waters of Middle East trade requires robust protection for your valuable cargo. With regional geopolitical tensions, varied regulatory frameworks, and challenging logistics routes, securing appropriate cargo insurance isn't just advisable—it's essential for your business continuity.

The Middle East's strategic position as a global trade hub connecting Europe, Asia, and Africa makes it a vital region for international commerce. Yet this same importance brings unique risks that standard insurance policies might not adequately cover. From political instability in certain areas to extreme climate conditions and maritime security concerns in key shipping lanes, you'll need specialized insurance solutions tailored to this dynamic marketplace.

Understanding Cargo Insurance in Middle East Trade

Cargo insurance in the Middle East operates within a complex framework of regional regulations, international standards, and unique risk factors. Navigating these complexities requires specialized knowledge of both insurance principles and regional particularities that impact trade flows across this strategically important area.

Common Risks in Middle Eastern Shipping Routes

Middle Eastern shipping routes face distinct hazards that heighten the importance of comprehensive cargo protection. The Strait of Hormuz and Suez Canal serve as critical chokepoints where approximately 30% of global maritime oil shipments pass, creating concentrated risk zones. Political tensions frequently impact these waterways, as evidenced by the 2021 Suez Canal blockage that disrupted global supply chains for weeks and caused estimated losses of $9.6 billion daily.

Maritime piracy continues to threaten vessels in specific areas like the Gulf of Aden and parts of the Red Sea, with over 25 reported incidents in 2022 alone. Extreme weather conditions, including sandstorms reducing visibility to less than 100 meters and summer temperatures exceeding 50°C (122°F), create operational challenges for cargo transportation and preservation, particularly for temperature-sensitive goods.

Regional security situations fluctuate rapidly, with conflicts or diplomatic tensions between neighboring states potentially leading to immediate shipping restrictions, vessel detainments, or cargo confiscations. These scenarios often fall under specialized policy clauses like war risk or political violence endorsements rather than standard coverage.

Legal Requirements for Cargo Insurance in the Region

Cargo insurance requirements vary significantly across Middle Eastern countries, creating a patchwork of compliance challenges. The United Arab Emirates mandates minimum insurance coverage of 80% of cargo value for all imports and exports processed through its ports, enforced through customs documentation requirements. Saudi Arabia, through its Saudi Arabian Monetary Authority (SAMA), requires all commercial shipments to carry basic coverage against total loss, with additional regulations for specific commodity categories.

Gulf Cooperation Council (GCC) countries generally recognize internationally standardized Institute Cargo Clauses (A, B, and C), though local amendments and endorsements often apply. Egypt and Jordan have implemented stricter documentation requirements following regional instability, with customs authorities frequently requesting proof of comprehensive insurance before releasing shipments.

Sharia-compliant insurance (Takaful) represents an increasingly important segment of the cargo insurance market, growing at 15% annually across the region. These policies adhere to Islamic financial principles while providing coverage equivalent to conventional insurance but structured differently regarding premiums and claims processes.

Non-compliance with local insurance requirements commonly results in cargo delays, financial penalties ranging from $1,000-$10,000, and potential business license implications for repeated violations. Working with insurance providers experienced in Middle Eastern trade facilitates smoother compliance with these varied regional requirements.

Types of Cargo Insurance Policies Available

Cargo insurance policies for Middle East trade come in various forms, each designed to address specific risks along shipping routes through this strategic region. These specialized policies protect your goods against the unique hazards encountered in Middle Eastern commerce, from traditional marine perils to geopolitical risks.

Marine Cargo Insurance Options

Marine cargo insurance forms the foundation of shipment protection for Middle Eastern trade lanes. Open cover policies provide continuous protection for all your shipments under a single agreement, eliminating the need to negotiate terms for each voyage. Single shipment policies offer one-time coverage for occasional exporters or unique consignments. All-risk coverage protects against virtually all physical loss or damage except specifically excluded events, while named perils policies cover only those risks explicitly listed in the policy. For temperature-sensitive goods moving through the region's extreme climate, refrigerated cargo insurance includes coverage for breakdown of cooling equipment and temperature fluctuations. Containerized cargo policies address risks specific to goods shipped in containers through busy Middle Eastern ports like Jebel Ali and King Abdullah Port.

War and Political Risk Coverage

War and political risk insurance extends beyond standard cargo policies to protect shipments against Middle East-specific geopolitical threats. This coverage safeguards your goods against damage from war, civil unrest, rebellion, and government actions such as confiscation or nationalization. Strike clauses protect against losses resulting from labor disputes that frequently impact major shipping hubs. Embargo risk coverage compensates for financial losses when shipments are delayed due to sudden government restrictions. Detention coverage becomes crucial when authorities in countries like Iran or Yemen hold shipments for extended periods. SRCC (Strike, Riot, and Civil Commotion) endorsements provide additional protection against civil disturbances that can disrupt trade routes through politically sensitive areas like the Persian Gulf.

Terrorism and Piracy Insurance

Terrorism and piracy insurance addresses critical security threats prevalent in Middle Eastern shipping corridors. Anti-piracy coverage protects against hijacking attempts, particularly in high-risk areas near Somalia and the Gulf of Aden. Ransoms and extortion coverage reimburses payments made to secure the release of captured vessels and crew. Vessel detainment insurance compensates for business interruption when ships are seized by militant groups or hostile state actors. Cargo abandonment coverage provides financial protection when goods must be left behind due to security threats. K&R (Kidnap and Ransom) policies offer specialized protection for high-value shipments transiting through volatile areas of the Middle East, including emergency response services and crisis management expertise. Terrorism endorsements specifically cover damage resulting from politically motivated violent acts against your shipments in transit through regional hotspots.

Leading Insurance Providers in the Middle East Market

The Middle East cargo insurance market features a mix of established global insurers and specialized local providers. These companies offer tailored solutions addressing the region's unique shipping risks while navigating complex regulatory frameworks and providing essential protection for businesses engaged in international trade.

International Insurers with Regional Presence

Major global insurers have established strong footholds in Middle Eastern markets through strategic regional offices and partnerships. AIG maintains comprehensive operations across key Gulf markets, offering specialized cargo coverage that includes political risk protection vital for volatile shipping routes. Allianz SE operates extensive networks in UAE, Saudi Arabia, and Qatar, providing customized marine cargo policies with multilingual support and cross-border claim processing capabilities. Lloyd's of London, through its Dubai platform established in 2015, delivers specialized underwriting for high-value and unique cargo shipments throughout the region.

Chubb's Middle East division specializes in energy sector cargo coverage, particularly relevant for oil shipments through the Strait of Hormuz. Their policies typically include enhanced security protocols and contingency planning for strategic shipments. Zurich Insurance offers dedicated trade credit solutions alongside traditional cargo coverage, protecting businesses against buyer insolvency and payment defaults—critical protections during periods of economic uncertainty.

Local Middle Eastern Insurance Companies

Regional insurers bring invaluable local market knowledge and regulatory expertise to cargo protection solutions. Abu Dhabi National Insurance Company (ADNIC) holds approximately 15% market share in UAE marine cargo coverage, offering Takaful-compliant options and specialized desert transport protection. Gulf Insurance Group, with operations across six countries including Kuwait and Bahrain, provides expedited claims processing through its regional network and customs documentation support services.

Qatar Insurance Company stands out with its specialized maritime risk assessment tools calibrated for Persian Gulf shipping routes and coverage extensions for transshipment at regional ports like Jebel Ali and Salalah. Saudi Arabia's Tawuniya offers comprehensive Islamic-compliant cargo insurance with dedicated risk engineers who conduct pre-shipment inspections for high-value goods. Oman Insurance Company provides tailored coverage for goods traveling through the Strait of Hormuz with enhanced piracy protection clauses and emergency response protocols.

These local insurers often maintain strategic partnerships with global reinsurance firms, combining international financial strength with essential regional expertise to address the Middle East's unique cargo transportation challenges.

Key Factors Affecting Insurance Premiums

Insurance premiums for cargo shipments in the Middle East are determined by multiple variables that reflect the unique risk profile of each transaction. Understanding these factors helps businesses anticipate costs and implement strategies to secure more favorable premium rates.

Country-Specific Risk Assessments

Country risk ratings significantly impact cargo insurance premiums in the Middle East. Insurers apply different premium multipliers based on political stability, security conditions, and regulatory environments in each country. For example, shipments to the UAE typically command lower premiums than those to Yemen or Iraq due to varying conflict levels and governance standards. Premium surcharges for high-risk destinations can range from 25-300% above standard rates, reflecting the increased likelihood of loss or damage.

Maritime chokepoint proximity also affects rating calculations. Vessels transiting near the Strait of Hormuz face premium surcharges of 10-30% during periods of heightened tension, while Suez Canal transit risks are factored differently following recent blockage incidents. Insurers regularly update country risk classifications based on real-time security intelligence, maritime incident reports, and geopolitical developments in the region.

Insurance underwriters also evaluate local port infrastructure quality and customs efficiency when determining rates. Ports with advanced container handling facilities, strict security protocols, and efficient clearance processes like Jebel Ali (Dubai) and Khalifa Port (Abu Dhabi) contribute to more favorable premium calculations compared to ports with documented handling deficiencies or security vulnerabilities.

Cargo Type and Value Considerations

Cargo characteristics fundamentally shape insurance premium calculations across Middle Eastern trade routes. High-value commodities such as electronics, pharmaceuticals, and luxury goods attract higher premium rates—typically 0.35-0.8% of declared value—compared to bulk commodities like grain or construction materials at 0.15-0.4%. This variance reflects both the increased theft risk and potential severity of financial loss.

Cargo sensitivity to environmental conditions triggers additional premium factors. Temperature-sensitive pharmaceuticals requiring uninterrupted cold chain management face premiums 40-60% higher than ambient products due to the catastrophic loss potential from temperature excursions. Similarly, fragile items like glassware or precision instruments command premium increases of 25-50% over more robust cargo types.

Dangerous goods classifications directly correlate with premium levels due to their specialized handling requirements and increased risk profiles. Hazardous materials falling under IMO classifications face structured premium increases:

| Hazard Class | Premium Increase Range |

|---|---|

| Class 1 (Explosives) | 100-300% |

| Class 3 (Flammable Liquids) | 50-100% |

| Class 6.1 (Toxic Substances) | 75-150% |

| Class 8 (Corrosives) | 40-80% |

Containerization methods also influence premium structures, with professionally packed FCL shipments receiving more favorable rates than mixed LCL cargo due to reduced handling exposure and theft risk. Insurers offer premium discounts of 10-20% for shipments utilizing certified high-security container seals and tracking systems that enhance cargo security throughout Middle Eastern transit routes.

Specialized Coverage for Middle East Trade Routes

Middle East trade routes require tailored insurance solutions that address the unique risks of this diverse region. Specialized coverage options protect shipments through strategic waterways and across land borders, accounting for both regional volatility and specific country requirements.

Gulf Cooperation Council (GCC) Trade Corridors

The GCC trade corridors represent some of the most economically significant shipping lanes in the Middle East, connecting Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman. Insurance providers offer specialized policies for these routes that cover:

- Intra-GCC transit protection that addresses the simplified customs procedures between member states while providing continuous coverage across multiple jurisdictions

- Oil and gas cargo endorsements specific to petrochemical products frequently transported through these corridors

- Enhanced coverage for free zone operations in major trading hubs like Jebel Ali in Dubai and Khalifa Port in Abu Dhabi

- Land transport extensions for road freight moving between GCC countries, covering border delays and inspection-related losses

Carriers operating exclusively within GCC corridors often benefit from 15-20% lower premiums compared to broader Middle East policies due to the region's relatively stable security environment and harmonized regulations. Many insurers offer specialized "GCC Transit Packages" that include coverage for transshipment at major ports like Dubai, Jeddah, and Dammam without additional declarations.

Mediterranean and Red Sea Shipping Lanes

Mediterranean and Red Sea shipping lanes connect Europe and Asia through vital waterways that present distinct insurance challenges. Specialized coverage for these routes typically includes:

- Suez Canal transit protection covering delays, canal authority fees, and potential rerouting costs in case of blockages

- Heightened piracy risk insurance for vessels navigating the southern Red Sea near the Bab el-Mandeb Strait

- War risk extensions with automatic reactivation clauses for vessels operating near conflict zones

- Port congestion coverage for major Mediterranean transshipment hubs like Port Said and Tangier Med

Insurance premiums for Red Sea routes have increased 25-40% since 2021 due to regional conflicts and security incidents. Many policies now include dedicated "Red Sea Clauses" that provide automatic coverage extensions for vessels forced to deviate from planned routes due to security threats. Specialized Mediterranean policies often feature broader temperature variation coverage, protecting cargo exposed to significant climate differences between northern and southern Mediterranean ports during transit.

Best Practices for Securing Optimal Coverage

Securing optimal cargo insurance for Middle East trade requires strategic planning and attention to detail. These best practices help you navigate the complex regional insurance landscape while ensuring comprehensive protection for your shipments.

Documentation Requirements for Claims

Proper documentation forms the foundation of successful cargo insurance claims in Middle Eastern markets. Insurance providers require complete shipping manifests, commercial invoices, packing lists, and bills of lading with clearly marked values for each claim submission. Photographs of cargo before shipment establish baseline conditions, while damage reports document specific losses when they occur.

For temperature-sensitive goods, maintain continuous temperature logs throughout transit, as these records prove critical during claims involving spoilage or degradation. Keep communication records with carriers and freight forwarders, as these exchanges often contain valuable timestamp information that validates your claim timeline. Many Middle Eastern insurers now accept digital documentation, but retain original copies of key documents for at least three years after shipment completion.

Regional documentation requirements differ significantly across Middle Eastern countries. Saudi Arabian authorities require Arabic translations of key shipping documents, while UAE insurers often request Certificate of Origin documentation even for minor claims. In countries like Egypt and Jordan, customs clearance documentation constitutes a mandatory component of any insurance claim submission.

Working with Specialized Brokers

Specialized insurance brokers deliver substantial value when securing cargo coverage for Middle Eastern trade routes. These brokers maintain relationships with multiple underwriters across the region, connecting you with insurers offering the most favorable terms for specific cargo types and destinations. Their market knowledge proves particularly valuable for challenging routes through areas like Yemen, Iraq, or passages near the Horn of Africa.

Regional brokers possess intimate knowledge of local regulatory environments, helping you navigate complex compliance requirements across different Middle Eastern jurisdictions. They understand specific documentation needs for countries like Saudi Arabia and Qatar, where insurance regulations emphasize Sharia compliance. Many specialized brokers maintain offices in key Middle Eastern trade hubs such as Dubai, Doha, and Riyadh, providing on-the-ground support during claims processing.

The best brokers conduct regular policy reviews, comparing your coverage against emerging regional risks and identifying potential gaps before problems arise. They analyze factors like sanctions compliance, which remains particularly complex in Middle Eastern trade due to frequently changing international restrictions. Select brokers who demonstrate experience with your specific cargo type and intended trade routes rather than general insurance knowledge alone.

Future Trends in Middle East Cargo Insurance

The Middle East cargo insurance landscape is evolving rapidly, driven by technological advancements, regulatory changes, and shifting geopolitical realities. These emerging trends are reshaping how businesses protect their shipments across this strategic trade region.

Impact of Regional Politics on Insurance Markets

Regional political developments are fundamentally reshaping the Middle East cargo insurance market. The Abraham Accords, normalizing relations between Israel and several Arab states, have opened new trade corridors that require fresh insurance frameworks. Insurance providers are developing specialized policies covering these emerging routes between Israel and the UAE, Bahrain, and Morocco, including transit protection through previously restricted territories.

Ongoing tensions in specific areas have created segmented risk zones, with premiums varying dramatically between stable and volatile regions. For example, shipments to Dubai typically command premiums 50-70% lower than similar cargo bound for conflict-affected areas. Many insurers now employ dynamic risk-based pricing models that adjust rates weekly based on political developments rather than traditional annual reviews.

The evolving sanctions landscape affecting Iran, Syria, and other countries has prompted insurers to integrate compliance technology that automatically flags potential sanctions violations. Major underwriters like Marsh and AIG have established dedicated Middle East political risk units that monitor developments daily and adjust policy terms accordingly.

Digital Transformation in Insurance Processing

Digital technologies are revolutionizing Middle East cargo insurance processing, creating efficiencies and enhancing risk management capabilities. Blockchain implementations are gaining traction, with platforms like TradeLens and CargoX enabling transparent documentation sharing between shippers, carriers, and insurers. The Dubai Multi Commodities Centre recently launched a blockchain-based insurance verification system that reduced processing times from days to minutes.

Automated underwriting systems using AI algorithms now analyze historical claims data, vessel information, and route analytics to generate instant quotes for straightforward shipments. Major regional insurers like Qatar Insurance Company have deployed these systems, reducing quote generation time by 85% while improving risk assessment accuracy.

Smart contracts with automated claims processing are eliminating paperwork and accelerating settlements. These contracts, triggered by predetermined conditions verified through IoT devices, are particularly valuable for temperature-sensitive pharmaceutical shipments crossing between Saudi Arabia and Egypt. Insurers including Zurich and Chubb have implemented IoT-enabled policies that offer premium discounts of 15-20% for shippers using approved tracking devices.

Marine cargo insurers operating in key Middle Eastern ports are increasingly integrating with port management systems for real-time risk assessment. The DP World Smart Insurance program at Jebel Ali Port connects insurance providers directly to cargo handling systems, enabling immediate notification of potential claims situations and preventative interventions.

Key Takeaways

- Middle East cargo trade faces unique risks including geopolitical tensions, maritime security concerns, extreme climate conditions, and varied regulatory frameworks across different countries.

- Standard cargo insurance options include marine cargo policies (open cover, single shipment, all-risk), specialized war and political risk coverage, and terrorism/piracy insurance tailored to regional threats.

- Insurance premiums are influenced by country-specific risk assessments, proximity to maritime chokepoints, cargo type/value, and the quality of port infrastructure across the region.

- Documentation requirements vary significantly between Middle Eastern countries, with some requiring Arabic translations, Certificates of Origin, or Sharia-compliant documentation for claims processing.

- Working with specialized brokers who understand local regulations and maintain relationships with regional insurers is crucial for securing optimal coverage for Middle East trade routes.

- The cargo insurance landscape is evolving through digital transformation (blockchain, IoT, smart contracts) and adapting to shifting regional politics, including new trade corridors opened by the Abraham Accords.

Conclusion

Navigating cargo insurance in the Middle East requires a tailored approach that accounts for the region's unique risk landscape. You'll need specialized coverage that addresses both standard shipping risks and region-specific challenges like political instability maritime chokepoints and extreme weather conditions.

Working with knowledgeable brokers who understand local regulations is essential for compliance and optimal coverage selection. The insurance market's evolution through technological innovations like blockchain and IoT-enabled policies offers new opportunities for more efficient risk management.

As trade corridors shift with geopolitical developments your insurance strategy should remain flexible. By selecting appropriate coverage options understanding premium factors and staying informed of market trends you'll protect your valuable cargo throughout its journey across this dynamic yet complex trade environment.